Introduction

Florida is the largest supplier of winter strawberries in the United States and the second largest overall after California. The farm-gate value of Florida strawberries is approximately US$400 million and the total economic contribution of the industry is estimated at about US$1 billion. Even so, over the last few years, the Florida strawberry industry has faced many challenges. In 2012, Florida production was down by 20% compared to the previous year. The record level of imports of strawberries from Mexico deeply depressed the market, causing a market crash at the peak season of the Florida production. Decreased revenues coupled with increased production costs have caused significant losses to the Florida industry.

Besides international competition, the Florida strawberry industry is also facing increased regulation and labor shortages. All these challenges are creating great uncertainty for the industry. In this article, we investigate Florida growers' perceptions of various threats and challenges and discuss those threats that should be dealt with as high priority.

A Comprehensive Industry Survey

In cooperation with the Florida Strawberry Growers Association (FSGA), we conducted a comprehensive industry survey in 2013 to gather information on the 2011/12 production season. A 41-question survey instrument was mailed to Florida strawberry growers to collect information on major challenges, market outlook, impact of immigration/labor policies, compliance costs, production costs, priority traits for breeding, protected culture, and disease-control practices. The first section of the survey asked questions such as what challenges growers are facing, where the industry is going, and whether growers are expanding or downsizing their strawberry operations. The survey also contained questions about grower and farm characteristics. We mailed out questionnaires to over 100 growers and followed up with field interviews. We received 32 completed surveys, representing a response rate of about 30%. The strawberry acreage reported by survey respondents accounted for over 60% of the total Florida strawberry acreage.

Threats and Challenges

Growers were asked to rank the top three challenges to the industry from a list provided to them in the questionnaire. Below is a summary of the growers' responses.

Mexican Competition. Fresh strawberry imports to the United Ststes reached a record 351 million pounds in 2012, almost exclusively from Mexico (99.7%). The amount of imported strawberries doubled between 2003 and 2009 and doubled again between 2009 and 2012. In 2009, the imported Mexican strawberries market share was 20% less than the market share for Florida, but was twice as large as the Florida market share in 2012. The large import volume from Mexico has depressed the market price and squeezed the market share and profit margin of Florida strawberries. The situation may worsen in the coming years because Mexico is pursuing further expansion of its production capacity.

Government regulation and compliance requirements. Growers are facing various regulations and compliance requirements on different aspects of production and the environment. The rules and standards growers must comply with include worker protection standards (WPS), labor wages, housing, water management, fumigant management, and food safety. Many of these rules are designed to protect the workers, consumers, and the environment. However, complying with these requirements has made it operationally more demanding to do business and has increased growers' cost burden.

Labor shortages. The immigration and labor policies are causing tremendous pressure on the industry in terms of both cost and labor supply. Strawberry growers rely on migrant workers, most of whom hail from Mexico, to harvest their crops. Tougher US immigration laws and improved economic opportunities in Mexico have decreased the migrant labor supply in Florida. Labor shortages may worsen in the future as the pool of migrant workers continues to shrink.

Volatile prices. Strawberry fruit development is characterized by an uneven distribution of strawberry yield over the production season, which, in conjunction with the highly perishable nature of the product, often results in large price fluctuations in the market (Mackenzie and Chandler 2009).

Weather risk or uncertainty. Strawberry yield is very sensitive to weather conditions as ambient temperature and rainfall determine the intensity of all physiological processes. Climate change is posing increased risks for strawberry production. Extreme weather, such as unusually high and low temperatures, could cause significant losses for growers.

Fumigation and pest and disease control. For many years, strawberry growers relied on methyl bromide for pest and disease control. Methyl bromide, which is a powerful fumigant to control diseases, weeds, insects, and nematodes, is banned in the United States because it depletes the ozone layer of the upper atmosphere. The methyl bromide ban has caused a technological shock for the industry. Alternatives currently being used are generally less effective and tend to provide inconsistent control (Olson and Santos 2012).

Variable quality of fruit. Significant quality variations cause loss of marketable yield and/or reduce prices, leading to loss in revenues.

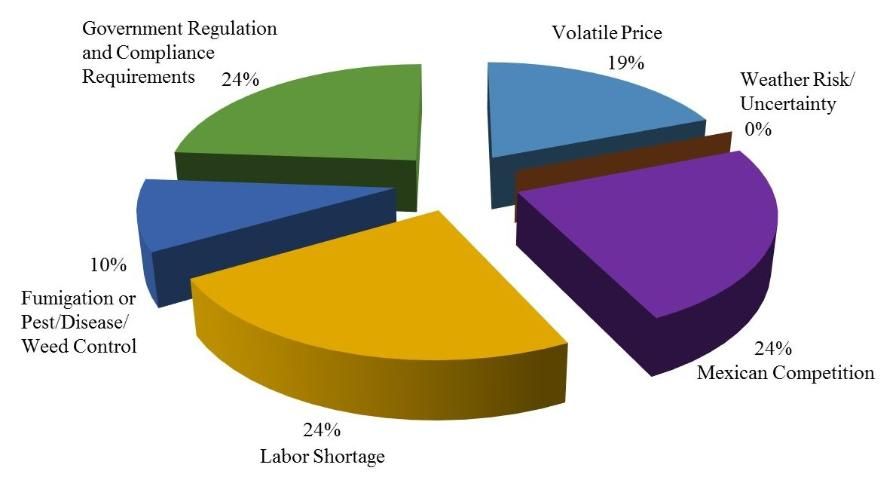

We also asked growers to indicate other threats and challenges not listed in the questionnaire. Figures 1 through 3 present the survey results on challenges to the Florida strawberry industry. Figure 1 shows that 24% of growers cited Mexican competition as the most serious challenge, another 24% cited labor shortages and regulation as the most serious, 19% cited volatile market prices, and 10% cited fumigation/pest control. No growers considered weather risk as the most serious issue.

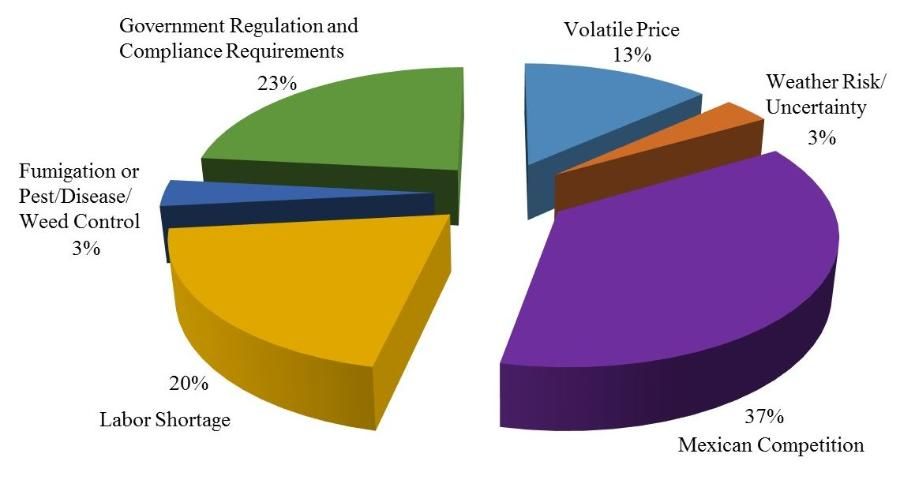

Figure 2 presents the issues growers ranked as the second most serious challenge. It shows that 37%, 23%, 20%, and 13% of growers selected Mexican competition, regulation, labor shortages, and volatile market, respectively, as the second most serious challenge. Weather risk and fumigation issues were only sporadically mentioned by growers.

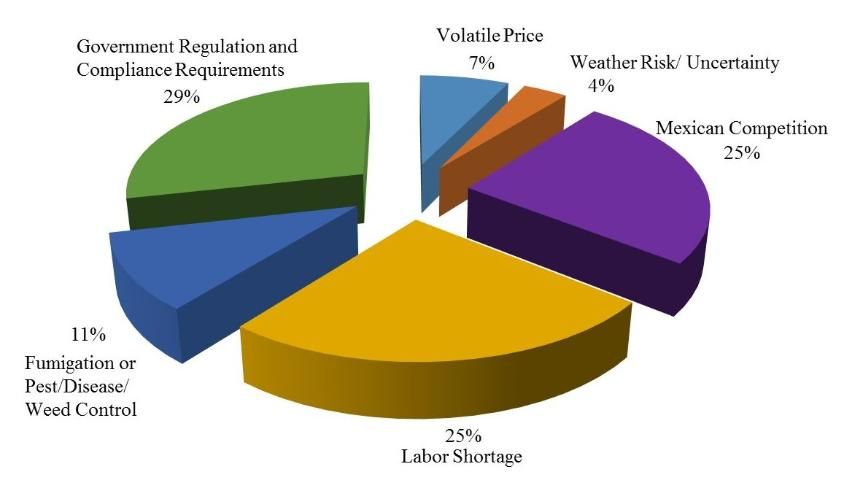

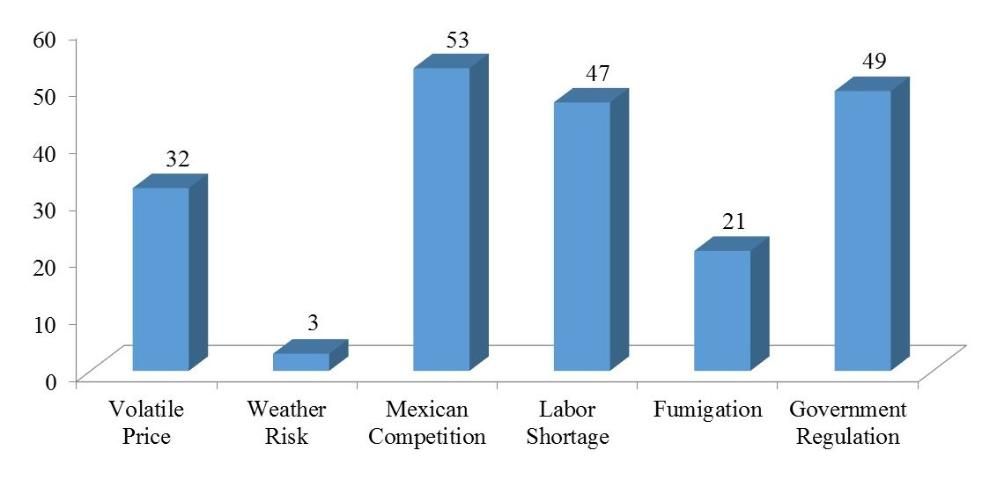

As for the third most serious challenge, 29% of growers selected government regulation and compliance requirements, while 25% of growers chose labor shortage and Mexican competition (Figure 3). We further summarized the rankings in Figure 4. We assigned 3 points for the number one challenge, 2 points for the number two challenge, and 1 point for the number three challenge, and then added up all the points for each listed challenge. Overall, growers considered Mexican competition as the most serious challenge, followed by government regulation and labor shortage. It is worth noting that the competitive advantage of Mexican strawberries mainly lies in their low labor cost and that many of the government regulations relate to labor. It seems labor is at the heart of all the major challenges.

Conclusions

Mexico's strawberry industry has been rapidly expanding in recent years, ranking as the number one challenge to the Florida industry. Its strawberry acreage jumped dramatically from 15,500 acres in 2010 to 25,100 acres in 2013. Its total production is estimated at over 600 million pounds, roughly three times higher than that of Florida. US imports of strawberries increased by 44% in 2012, to a record 351 million pounds, almost exclusively from Mexico (99.7%). In that same year, the United States became a net importer of strawberries for the first time. The volume imported was approximately two times the total Florida production, creating tremendous pressure on the Florida industry. In addition, labor shortages and increasingly restrictive regulations are making it more challenging and costly to grow strawberries in Florida. Given these various challenges, the majority of Florida growers are extremely concerned about the sustainability of the industry.

References

MacKenzie, S.J., and C.K. Chandler. 2009. A method to predict weekly strawberry fruit yields from extended season production systems. Agronomy Journal 101(2):278-287.

Olson, S.M., and B. Santos. 2012. Vegetable Production Handbook for Florida. Lincolnshire, IL: Vance Publishing Corporation.