Introduction

According to the Foreign Agricultural Service/USDA (2016), worldwide consumption of fresh grapefruit has grown from 4.2 million metric tons (MT) in 2010/11 to 5.2 million MT in 2014/15. The increase in consumption is mostly attributed to China, which is also the largest producer, therefore doesn't impact the international market to a large degree. (The numbers reported by the FAS do not distinguish grapefruit and pomelo, but generally the production and consumption in China are attributed to pomelo, while the production and consumption in other countries are attributed to grapefruit.) Estimated grapefruit consumption in China was 3.8 million MT in 2014/15, followed by the European Union (EU) with 435,000 MT. Consumption in many other countries shrunk between 2010/11 and 2014/15. For example, consumption of grapefruit in Japan, a major importer of grapefruit, shrunk 40%, while consumption in the United States and Canada decreased by approximately 16% and 10%, respectively. Many factors are pressuring grapefruit consumption, such as price, changes in consumer preferences, and competition from other fruit categories. Particularly, the reported interaction effect of grapefruit with certain medications, such as cholesterol drugs, may prevent the older population from consuming the fruit, while the younger generation may prefer grab-and-go fruits and sweeter taste.

On the production side, there have also been major changes. In the United States, the production of grapefruit declined nearly 30% in 2015/16 compared to 2010/11 (USDA/FAS 2016). This decrease is largely attributed to decreases in acreage and citrus greening disease, particularly in Florida, the largest producer of grapefruit in the United States. In 2014/15, production of Florida grapefruit was 548,000 tons, a decline of nearly 35% compared to 2010/11 (Florida Department of Agriculture and Consumer Services [FDACS] 2016). Other major producers include Mexico and South Africa, each with approximately 400,000 MT in 2014/15.

Regarding trade, the major grapefruit exporters include the United States, South Africa, and Turkey. The EU is the largest importer of grapefruit, followed by Russia and Japan (USDA/FAS 2016). The United States exports fresh grapefruit to Japan, the EU, Canada, and most recently, South Korea. Within the United States, Florida is the major exporting state, accounting for 72% of US exports in 2014 (FDACS 2015). However, export trends for US grapefruit have been changing. Due to the shrinking domestic market and weakened local currency, US grapefruit exports to Japan and the EU have decreased 65% and 35%, respectively. However, South Korea has become a fast growing market for the US citrus. This study aims to provide an overview of the grapefruit market in South Korea and evaluate the potential of this market for Florida fresh grapefruit producers using a consumer survey.

Fresh Fruit Market in South Korea

South Korea ranked eleventh by nominal gross domestic product (GDP) in the world in 2015, with 1,393 billion dollars. The growing buying power leads to consumers' interests in food quality and diet diversity, reflecting consumers' demand for health food. South Korea produces various vegetables and fruits, and the value of fresh vegetable and fruit accounts for nearly one third of the total agricultural output value in this country. However, majority of Korea's fruit productions were limited to apple, pear, grape, peach, tangerine and persimmon. Moreover, domestic producers no longer fully satisfy Korean consumers' growing demand and taste changes, and the annual per capita consumption of fruits increased from 41.8kg in 1990 to 63.2kg in 2013. Fruit imports have increased from $320 million in 1995 to $1,680 million in 2014 (Korea Rural Economic Institute 2015).

South Korea has been reducing import barriers and importing fruits to meet consumers' growing demands. Fruit imports have increased from $825 million in 2000 to $1,640 million in 2014 (Korea International Trade Association, 2016). The United States has been a major exporter of agricultural products to South Korea for decades. South Korea was the sixth largest US importer in 2015, with $6.01 billion in agricultural purchases (USDA/ERS, 2016). South Korea imports various fruits from the United States, including oranges, grapefruit, lemons, grapes, and sweet cherries. Although the harvest season for many fruits is the same in the United States as South Korea's, US producers are finding markets in South Korea because of the quality and relative low costs.

Grapefruit Market in South Korea

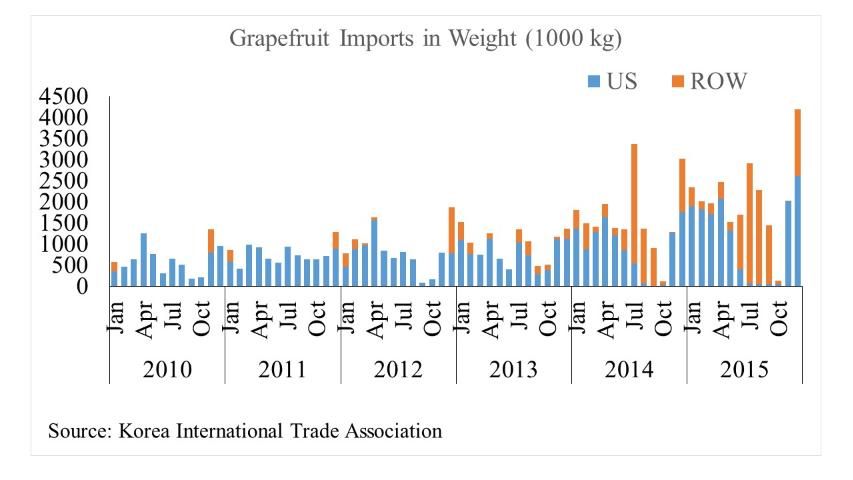

South Korea first imported grapefruit from the United States in 1988, with imports peaking in 1989. For the decade that followed, South Korean imports of US grapefruit declined because of a misinterpreted laboratory test on grapefruit for Alar, a chemical with a potential for causing cancer. Even though the mistake was corrected, it took time for consumers perception of US grapefruit to improve. Grapefruit imports eventually increased, reaching a historical record of 19,491 MT in 2014. As the increasing trend continued in 2015, the share of imports from the rest of the world also began to increase, from 10% in 2010 to 43% in 2015. Monthly grapefruit imports from the United States and rest of the world between 2010 and 2015 are shown in Figure 1.

South Korean consumers have shown an interest in grapefruit both due to its low calories/sugar content and high vitamin C content. There is a trend of demand shifting from lemons to grapefruit because of grapefruit's less sour taste and competitive price compared to lemons. The beverage industry and restaurants have developed various products with grapefruit, such as grapefruit beer and ice cream in summer and grapefruit "chuang" in winter.

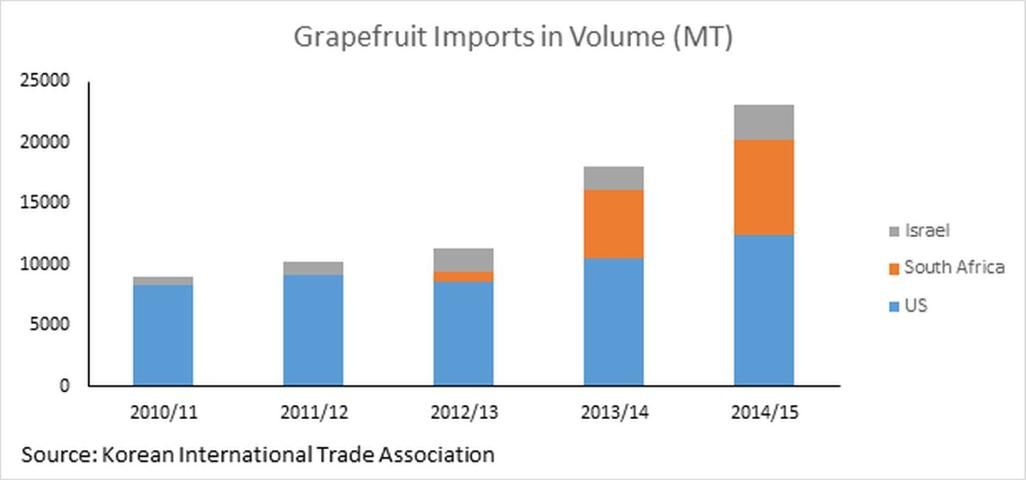

South Korea imported 23,087 MT grapefruit in 2014/15, and the imports are expected to increase to 25,000 MT in 2015/16. During 2010–2014, exports of Florida grapefruit to South Korea increased 50% (Florida Department of Agriculture and Consumer Services, 2015). Figure 2 shows that current major grapefruit exporters to South Korea are the United States and South Africa, accounting for 54% and 34% of market shares in 2014/15 season, respectively.

South Korea imports fresh grapefruit from Florida from October to March, from California from April to June, and from South Africa from May to September. While the harvest season in South Africa is different from other exporters, US fresh grapefruit is competing head-to-head with red grapefruit from Israel, in particular, a variety Star Ruby, which is usually called "Sweetie". Grapefruit imports from South Africa and Israel have increased dramatically since 2012/13 to meet the increasing demand, whereas the rate of imports from the United States is increasing, but at a relatively slower rate. US grapefruit accounted for over 80% of South Korean imports until 2013, but decreased to 56% in 2014. One reason is that the import price of US grapefruit is still higher than grapefruit imported from Israel and South Africa. According to the Korea-United States Free Trade Agreement (FTA), which was implemented on March 15, 2012, the 30% tariff rate on US grapefruit will be reduced to zero in five equal annual installments. As a result, the price of US grapefruit is expected to decline in the future and help US grapefruit gain back the market share gradually.

Korea Grapefruit Consumer Survey

As expanding consumption in the Korean market will benefit Florida grapefruit producers and exporters, the Florida Department of Citrus has recently focused on export promotions in South Korea. As part of the monitoring of this program, a national online survey was conducted in May 2015 regarding Korean consumer behavior and trends related to grapefruit consumption, as well as perception of US grapefruit. The targeted consumers in the survey were female shoppers, over 20 years of age and responsible for household food purchases. The survey consisted of questions regarding purchase decisions, shopping behavior, consumption frequency and habits, as well as the perceptions of grapefruit. A validation question was used to ensure the quality of the responses to the survey (Jones, House, and Gao, 2015). Demographic information, including age, education, marital status, and employment were also collected and are reported in Table 1.

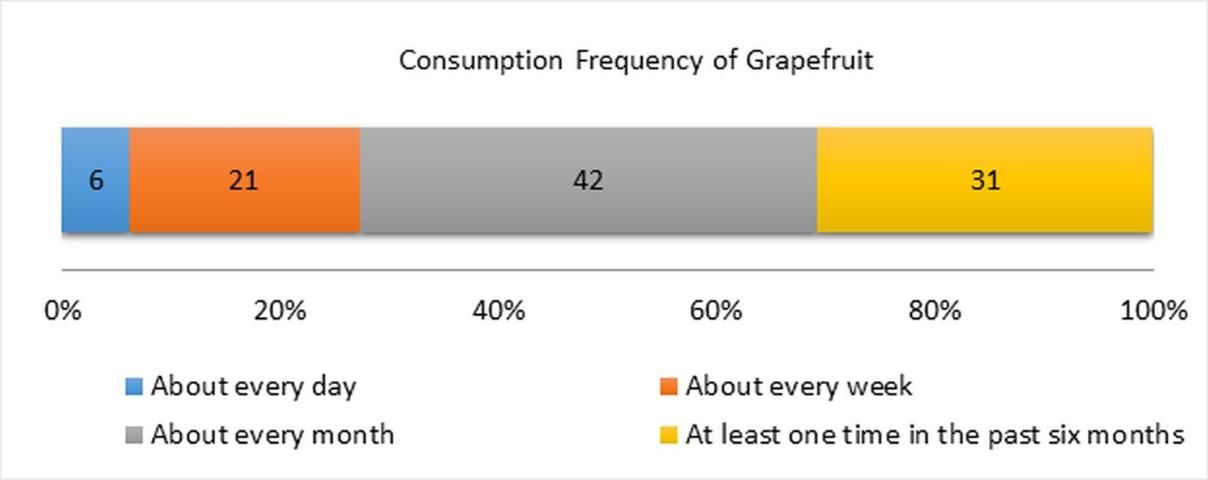

A sample of 992 respondents was collected. Within the sample, about 26% of respondents reported that they have purchased grapefruit in the last six months (defined as active consumers). Of these active consumers, nearly 70% consumed grapefruit at least once per month (Figure 3). The top reasons for grapefruit consumers to purchase more grapefruit include eating grapefruit regularly (47%) and trying to eat healthier (46%). The top three factors that influence consumers' purchases are freshness (67%), good value (60%). and sweetness (50%). Over 67% of respondents who have purchased or intend to purchase grapefruit associated vitamin C/immune system support with grapefruit.

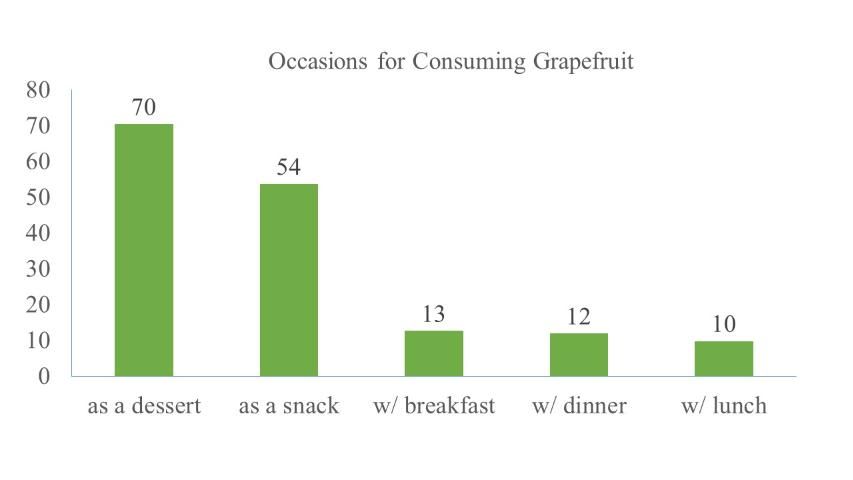

The most popular occasions to consume grapefruit in South Korea is as a dessert and as a snack (Figure 4). Of respondents who purchased or intend to purchase grapefruit, 70% eat or would eat grapefruit as a dessert, and over half of them eat or would eat grapefruit as a snack.

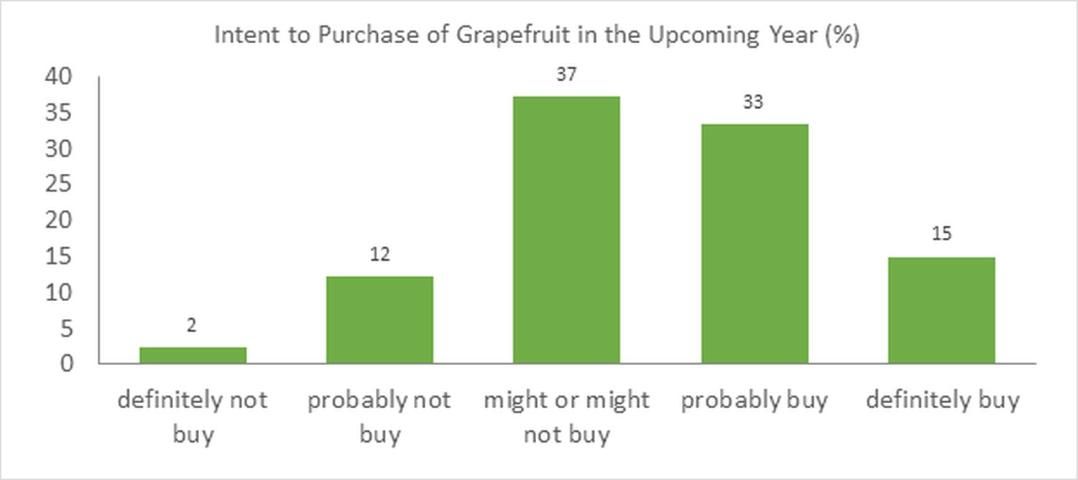

About 42% and 40% of respondents were aware that California and Florida produce grapefruit, 37% of grapefruit consumers indicated that they believe California was the source of their purchased grapefruit, and 35% indicated that Florida was their source of purchased grapefruit. Nearly half of the total respondents indicated that they will definitely or probably buy grapefruit in the upcoming year (Figure 5). Of the respondents who have purchased or intend to purchase grapefruit, 67% indicate they will definitely or probably buy Florida grapefruit in the upcoming year. Respondents indicate that the major factor that would increase purchases of Florida grapefruit are price promotions (50%), better quality (48%), and better taste (43%).

Unlike traditional markets where consumers tend to be older, the survey shows that Korean active grapefruit consumers consist of younger respondents. Table 1 shows the distribution of respondents by age and consumer type. The upper section compares grapefruit consumers and non-grapefruit consumers, where grapefruit consumers are defined as consumers who either purchased grapefruit in the past six months (active consumers) or those who did not purchase in the past six months but purchased in the past two years (lapsed consumers), and non-grapefruit consumers are defined as consumers who did not purchase grapefruit in the last two years. The bottom section compares the active grapefruit consumers and lapsed grapefruit consumers. T-tests are used to test for the age differences between two types of consumers. Results show that a larger proportion of senior consumers (age 50 and above) have consumed grapefruit in the past two years, but consumers of age 30–39 are significantly more likely to be active consumers. Such results indicate that senior consumers are likely to stop purchasing grapefruit, while younger consumers are likely to continue purchasing grapefruit in the current Korea market.

Summary

The Korean grapefruit market has been increasing in recent years and is expected to keep growing. The United States has dominated the Korean grapefruit market but is facing fierce competition from other suppliers with lower import prices and different harvest seasons. According to a survey conducted with consumers in South Korea, grapefruit is perceived as a healthy diet food and providing vitamin C/supporting immune system. The United States is recognized as the top grower of grapefruit and the source of purchased grapefruit. Price and quality are key factors that influence consumers' grapefruit purchase and with the implementation of Korea-United States Free Trade Agreement (which will gradually phase out the 30% grapefruit tariff on US grapefruit), prices for US grapefruit in South Korea are expected to decrease. However, the price will be also influenced by production of the US grapefruit, which is likely to continue declining in the near future as the industry battles citrus greening.

Korean grapefruit consumers tend to be younger compared to traditional markets and usually consume grapefruit in drinks and desserts. As many older consumers are leaving the market because of the concern about the interaction effect between grapefruit and medication, the larger proportion of younger consumers in South Korea provides a potential market for grapefruit producers, and a market to learn from to see if the increase in consumption among young consumers can be replicated in other parts of the world.

References

Florida Department of Agriculture and Consumer Services. 2015. "Fresh From Florida How to Export to Asia" Available at: https://www.fdacs.gov/content/download/62184/file/How_to_Export_to_Asia.pdf.

Florida Department of Agriculture and Consumer Services. 2016. "Florida Citrus Statistics 2014-2015" Available at: https://www.nass.usda.gov/Statistics_by_State/Florida/Publications/Citrus/Citrus_Statistics/2014-15/fcs1415.pdf.

Jones, M., L. House, and Z. Gao. 2015. "Respondent Screening and SARP: Testing Quarantining Methods for Better Data Quality in Web Panel Surveys." Public Opinion Quarterly, 79(3):687-709.

Korea International Trade Association. 2016. "K-Statistics-By Commodity-All Countries" Available at: http://www.kita.org/kStat/byCom_AllCount.do.

Korea Rural Economic Institute, 2015. "Agriculture in Korea" Available at: https://www.krei.re.kr/DATA/portlet-repositories/agri/files/1448584031908.pdf.

USDA-ERS. 2016. "Top 15 U.S. Agricultural Export Destinations, by calendar year, U.S. value." Available at: https://www.ers.usda.gov/data-products/foreign-agricultural-trade-of-the-united-states-fatus/calendar-year/.

USDA-FAS. 2016. "Citrus: World Markets and Trade" Available at: https://downloads.usda.library.cornell.edu/usda-esmis/files/w66343603/t148fh542/xp68kg78r/citruswm-07-20-2016.pdf