If you want to buy a house, you will have to talk to a bank or other lending agency. That shouldn't be scary. Banks want to lend money for housing because people who borrow money to buy a home pay interest for using their money. The interest on many home loans is what keeps banks in business. However, banks do want to know if you are a good risk. That is, if you receive money from their bank, can they be sure you will pay it back? Banks don't have to ask you a lot of embarrassing questions to find out if you have always paid your debts on time. Usually, they will look to a credit bureau, also known as a credit reporting agency (CRA), for answers on your credit history. The Fair Credit Reporting Act requires credit bureaus to furnish correct and complete information to businesses to use in evaluating your applications for credit, renting a home, utilities, insurance, or a job.

Credit: Ryan McVay

What is a credit bureau?

Credit bureaus are for-profit companies with no government affiliation that collect credit information about how well people handle their credit. When you apply for a credit card, a company can pay a credit bureau to provide a credit report. The report answers such questions as "Has this person paid bills on time?" and "What debts does this person currently owe and to whom?"

Today, there are three major credit bureaus in the United States—Equifax, TransUnion, and Experian.

What does a credit bureau know about a person?

Your file from a credit bureau will include how you manage your debts, as well as other related information. Unpaid bills, repossessions, tax liens, bankruptcies, and judgments may also be included in your record. Generally, legitimate adverse credit information stays on your credit report for seven years with certain exceptions (for instance, bankruptcy information can be reported for 10 years).

Does a credit bureau have a file on you?

If you have ever used a major credit card or purchased a car, you probably have a record at a credit bureau. Your credit history allows creditors to check your payment habits before they give you credit. If you have ever asked for a loan and have been turned down, you have a right to know why. Under federal law, you're entitled to a free credit report if a company takes adverse action against you, such as denying your application for credit, insurance, or employment, and you request your report within 60 days of receiving notice of the action. The notice will give you the name, address, and phone number of the consumer reporting company that supplied the information about you. If you contact the credit bureau after 60 days, you may be charged a fee.

Can you find out what is in your credit file?

You are always entitled to learn what is in your credit file, even if you have not been turned down for credit. Each credit bureau is required to provide you with a free copy of your credit report, at your request, once every 12 months.

To order your free annual report from one or all of the credit bureaus, visit www.annualcreditreport.com, call 1-877-322-8228, or complete the Annual Credit Report Request Form (https://www.consumer.ftc.gov/sites/www.consumer.ftc.gov/files/articles/pdf/pdf-0093-annual-report-request-form.pdf) and mail it to: Annual Credit Report Request Service, PO Box 105283, Atlanta, GA 30348-5283. It is generally recommended that you obtain your credit report from one credit bureau each quarter. This way you can monitor your credit report throughout the year for free.

Is your credit report okay?

If you are planning to buy a house, you should check your credit report several months before applying for a loan. This provides you with time to examine your credit report for inaccuracies. Your credit report cannot be changed, but you are entitled to have incomplete or inaccurate information corrected without charge. For example, the credit report might show that you were late in making payments but failed to show that you have now made up your payments. This means that the credit bureau would have to add information to show that your payments are now current. If you are behind on making debt payments, your credit report may become more acceptable if you talk to the lender and start to make regular payments.

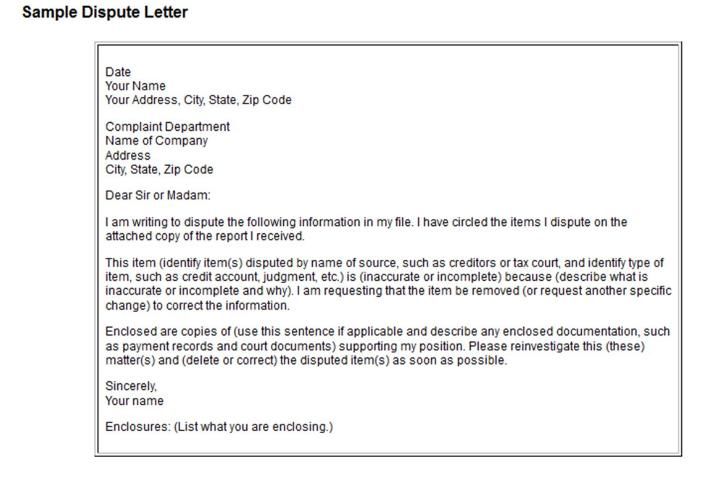

The credit bureau must disclose the contents of your credit file at your request. Check to see if the information reported on you is accurate and complete. Under the Fair Credit Reporting Act, you have the right to dispute the completeness or accuracy of any information in your report. If you need to dispute information in your report, it helps to tell the credit bureau, in writing, why you think the information is not correct. Unless your dispute is frivolous or irrelevant, the credit bureau must then investigate the matter. The credit bureau must correct any information that it finds is not reported accurately. Information that cannot be verified must be deleted. If you disagree with the results of the credit bureau's investigation, you may file a brief dispute statement explaining your side of the story. At your request, the credit bureau will note your dispute in future credit bureau reports. You will find the contact information for the respective credit bureau on your credit report. See Figure 2 for a sample dispute letter.

Credit: Federal Trade Commission

Be aware that when negative information in your report is accurate, that information will only be removed over time. Credit bureaus are permitted by law to report bankruptcies for 10 years and other negative information for 7 years. There is nothing that you (or anyone else) can do to require a credit bureau to remove accurate information from your credit file until the reporting period has expired. Do not be misled by ads aimed at people with bad credit histories, judgments, or bankruptcies. Promises to repair or clean up a bad credit history can almost never be kept.

For more information on managing your credit, see the You and Your Credit series of EDIS publications at https://edis.ifas.ufl.edu/entity/topic/series_you_and_your_credit.

References

Facts for Consumers, Bureau of Consumer Protection, Federal Trade Commission. Retrieved June 2022 from https://consumer.ftc.gov/articles/free-credit-reports