Introduction

Peaches are among the most commonly produced fruits in the United States, with annual production levels around 806,600 tons (United States Department of Agriculture, 2016); that's the weight of seven jumbo jets. New cultivars have been developed in recent decades to allow for the fruit to be grown in Florida (United States Department of Agriculture, 2010). While peach production has increased in Florida, overall consumer demand has not increased at the same rate (Bradley & House, 2017). For the Florida peach industry to remain viable, producers and marketers must understand what consumers value and desire when purchasing peaches. Understanding consumer awareness, perceptions, and preferences regarding Florida peaches is important to the future of the industry. If consumer demand for Florida peaches improves, the opportunities for growers to market their Florida peach crop will also improve.

This document addresses consumers' perceptions of Florida peaches, purchasing motivations and barriers, preferred packaging options and opportunities, purchasing locations, and knowledge of peach health benefits. Recommendations for peach growers and marketers are provided at the end of this document.

Credit: UF/IFAS

Data Sources

The data in this document is from an online survey conducted in 2016 that gathered results from 519 Florida peach purchasers, 1,020 national peach purchasers, and 522 non-purchasers (Harders, Rumble, Bradley, House, Anderson, & Stofer, 2016). Participants who claimed to have purchased fresh peaches in the last 12 months were categorized as purchasers.

Table 1 displays the most commonly reported demographic profile of respondents. The respondents in all three groups (Florida purchasers, national purchasers, and non-purchasers) were predominately female and Caucasian. Most respondents in all groups reported a yearly household income of between $35,000 and $74,999. The groups differed in age. Nearly half of all Florida purchasers were between the ages of 20 and 39, while more than 40% of national purchasers and non-purchasers were between the ages of 60 and 79.

Reasons Consumers Do or Do Not Purchase Florida Peaches

Many motivations exist for purchasing specific foods (Produce for Better Health Foundation [PBHF], 2015). Identifying barriers to the purchase of Florida peaches may allow for the development of new methods to encourage Florida peach consumption.

Seasonality

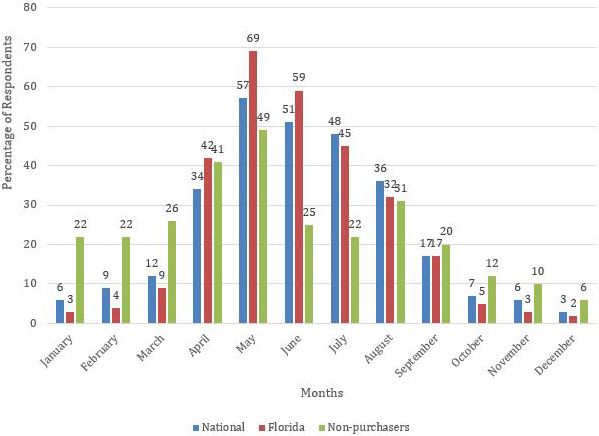

In this study, the most frequently selected reason for purchasing peaches was because they were in season. Half of all respondents stated the lack of availability of fresh peaches was why they did not purchase peaches more often. However, only about a quarter of people claimed to know when Florida peaches were in season. Even fewer could identify the correct mid-March through mid-May Florida growing season. Most people thought the growing season was similar to Georgia, South Carolina, and California's summer peach season. Nearly one-third of participants reported not purchasing peaches when they are out of season.

The following graph identifies when purchasers and non-purchasers believe Florida peaches are in season (Figure 2).

Credit: UF/IFAS

In-Store Motivations

Respondents commonly made purchases when peaches were on sale or when peaches caught their eye. Less than two-fifths of people claimed fresh peaches were part of their typical grocery purchases and a perfect snack. Therefore, in-store promotions could be very effective at increasing Florida peach purchases. Common reasons for avoiding peaches when shopping (in addition to seasonality) were price and the competition from other fresh fruits. This trend was especially strong among those who had not purchased peaches in the past year. Only 11% of non-purchasers claimed they avoided peaches because they did not like them, which shows potential for increasing the purchaser population. Some commonly cited reasons for not purchasing fresh peaches were: preference for other fresh fruits (38%), price of peaches (29%), purchasing canned peaches instead (17%), and low quality of peaches (17%).

Uncertainty/Novelty

Individuals who had not purchased peaches in the past 12 months were more likely to believe Florida peaches were of low quality and from large farms. When asked about attitudes toward peaches grown in Florida, purchasers were moderately more positive in their views than non-purchasers. Additionally, when rating the physical qualities of Florida peaches, the Florida population was more aware of the smaller size of Florida peaches than the national population. However, many people who took the survey did not know Florida peaches tend to be smaller than those produced in other states.

Peach Packaging

The packaging of products affects their convenience and quality. While a pre-assembled box of peaches may be convenient, individual selection allows a consumer to choose each peach based on an in-store evaluation (Yeh et al., 2008). More than two-thirds of respondents preferred to self-select their peaches and pay for a total weight of the product, making it the most appealing purchasing option.

Purchasing Location

Over 80% of all purchasers buy at least some of their peaches from a supermarket. Bulk food stores, retail stores, and farmers markets were each selected by one-third of respondents as peach purchasing locations. Purchasers most strongly identified farmers markets to have locally grown peaches.

Florida peach production fluctuations have made it difficult to market peaches to larger, more horizontally integrated businesses, such as Publix and Walmart. Respondents in this survey identified farmers markets, U-pick operations, and roadside stands as having peaches that were available, high-quality, locally grown, and affordable. While at a purchasing location, individuals (including nearly half of those who do not currently purchase peaches) desired to sample Florida peaches.

Where peaches are grown is also important to purchasers. 56% percent of national purchasers and 59% of Florida purchasers claim to look for a sticker to see where the peaches were grown. Additionally, 39% of all purchasers claim to purchase peaches based on where they were grown.

Awareness of Health Benefits

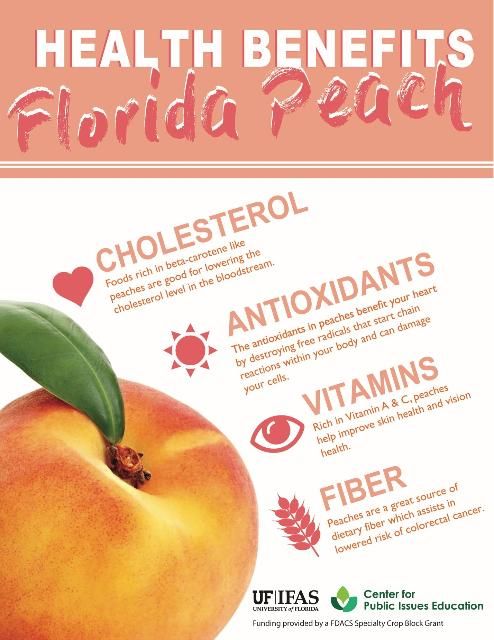

When quizzed on health benefits of peaches, respondents knew the least about how few calories were in a peach, peaches' ability to help prevent cancer, and the nutrients found in peaches. Most respondents knew that peaches are a source of fiber. However, few knew that peaches are a good source of vitamin C.

Recommendations

Based on our findings, the following recommendations for peach growers and marketers are provided:

Promote purchases

- Increase awareness of the Florida peach season by including point of purchase signage to catch shoppers' eyes. The signage should indicate the growing location and will be helpful for consumers who believe peaches are out of season at that time.

- Focus on promoting the Florida peach season as different from other domestic seasons.

- Including the phrase "in season" when advertising in store, on television, in print, or through other media channels.

- Develop and distribute display and handling recommendations for retail stores to ensure the quality of Florida peaches is high at the point of purchase.

Get the most out of packaging

- Exploring various approaches to pre-packaging Florida peaches may create a higher demand for the product on a snack or novelty level. A pre-assembled packaging style, such as that done with Cutie oranges, Rockit apples, or Tasti-Lee tomatoes, should be explored.

- Continue to offer self-selection, by-the-pound purchases.

Capitalize on purchasing and growing location

- Use labels to appeal to customers who desire peaches that are grown either locally or in the US. Inclusion of the Fresh from Florida logo should be considered.

- Utilize multiple marketing channels to sell peaches, such as farmers markets, U-Pick sales, and roadside stands.

- Provide peach tasting opportunities at the point of purchase.

Communicate key attributes and health benefits

- In advertisements, focus on key attributes, such as the smaller size and sweet flavor of Florida peaches.

- Highlight health benefits when advertising Florida peaches.

For more information about consumers' perceptions and awareness of peaches, as well as recommendations for marketing Florida peaches, please visit http://www.piecenter.com/issues/food/local-food/.

To help facilitate the awareness of Florida peaches and the Florida peach season, we have created the following promotional materials. Use these materials in your communications about Florida peaches.

References

Bradley, T., & House, L. (2017). Strategic marketing plan for the Florida peach industry (16/17 - 02a). Retrieved from University of Florida/IFAS Center for Public Issues Education website: http://www.piecenter.com/wp-content/uploads/2015/09/PeachMarketingPlanFinal.pdf

Harders, K., Rumble, J., Bradley, T., House, L., Anderson, S., Stofer, K. (2016). Consumer purchasing survey (17-02). Retrieved from http://www.piecenter.com/wp-content/uploads/2015/09/Peach-Report_FINAL.pdf

Produce for Better Health Foundation. (2015). State of the plate: 2015 study of America's consumption of fruit and vegetables. Retrieved from Produce for Better Health Foundation website: http://www.pbhfoundation.org/pdfs/about/res/pbh_res/State_of_the_Plate_2015_WEB_Bookmarked.pdf

United States Department of Agriculture. (2010). Local food systems concepts, impacts, and issues (97). Retrieved from USDA Economic Research Service website: https://www.ers.usda.gov/webdocs/publications/46393/7054_err97_1_.pdf

United States Department of Agriculture. (2016). (1936–3737). Retrieved from USDA National Agricultural Statistics Service website: https://downloads.usda.library.cornell.edu/usda-esmis/files/tm70mv177/0v8381155/df65v8708/CropProd-08-12-2016.pdf

Yeh, M., Ickes, S. B., Lowenstein, L. M., Shuval, K., Ammerman, A. S., Farris, R., & Katz, D. L. (2008). Understanding barriers and facilitators of fruit and vegetable consumption among a diverse multi-ethnic population in the USA. Health Promotion International, 23(1), 42–51. doi:10.1093/heapro/dam044