Background

As of the end of April, 2020, 42 states and at least 316 million people in the United States have been urged to stay home for nearly a month (NYT 2020) to prevent the spread of COVID-19. The pandemic has shocked the food supply chain from both the consumption and production sides. Challenges on the supply side include a shortage of labor and disruptions to the logistics network. On the consumption side, consumers' demand for some food items has spiked, largely due to consumers panic buying essential items for consumption at home and a sudden shift away from the food-service sector (Hobbs 2020).

Consumers are impacted in many different ways during the pandemic. They may go grocery shopping with the intent to buy, only to find items not in stock. Some may face new budget constraints due to lost jobs or working fewer hours. Orange juice, long believed by consumers to help them stay healthy, has become one of the main food and beverage products that consumers have turned to during the pandemic. Dollar sales of orange juice at grocery stores rose 50.7% for the 4-week period ending April 11 compared to the same 4-week period last year, according to a monthly Nielsen topline (FDOC 2020). The futures price for frozen concentrated orange juice surged 24% since mid-March in response to consumers' changed purchasing behaviors, making orange juice one of the best-performing commodities in the first quarter of 2020 (WSJ 2020).

This is a big turn for the OJ industry, which had experienced a steady decline in sales over the past decade for many reasons, including the changes in consumer preferences and breakfast habits, decline in juice availability, and reduced consumer awareness (Heng et al. 2019). The recent surge in OJ sales indicates that consumers are returning to the market or increasing their purchases of orange juice. The boost in sales during a pandemic is not surprising given OJ has a reputation as a healthy beverage with vitamin C and other nutrients that support a healthy immune system. A more critical question for the industry is whether the increase in purchases will be sustained when consumer behavior reaches a "new normal" following the pandemic. For the industry to plan for the long run, it is important to understand the demand drivers responsible for the surge in purchases during the pandemic, notably who is buying more orange juice and what factors might influence their decisions.

Using data from a monthly consumer survey, we present recent findings regarding consumers' responses to the COVID-19 outbreak in terms of OJ purchases. This study provides an initial look at the consumers who have contributed to the surge in OJ sales, as well as the reasons why their purchases of orange juice have changed or stayed the same. Such findings are expected to help the industry understand the impacts of the pandemic and develop marketing plans to sustain the purchases beyond the short run.

Methods and Data

The University of Florida's Florida Agricultural Marketing Research Center (UF/FAMRC) has conducted a monthly tracker to measure orange juice consumption patterns. The tracker provides a sample of 500 respondents monthly representing the US population and targets respondents who are primary grocery shoppers in the households at least 18 years of age. The survey collects various information including buying behavior and perceptions, household demographics, and preferences and attitudes towards orange juice. To measure the impacts of the COVID-19 pandemic on OJ purchases, we included new survey questions in the most recently launched tracker in early April. The results from this tracker provide an initial view of the current OJ demand in response to the pandemic.

Results

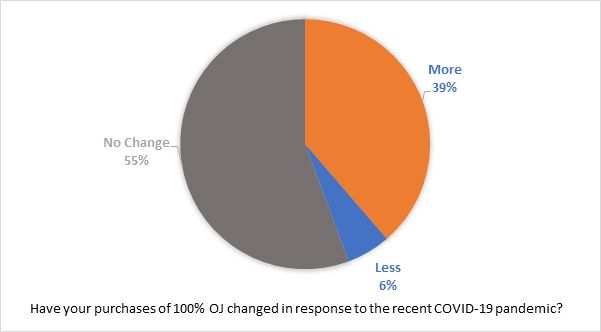

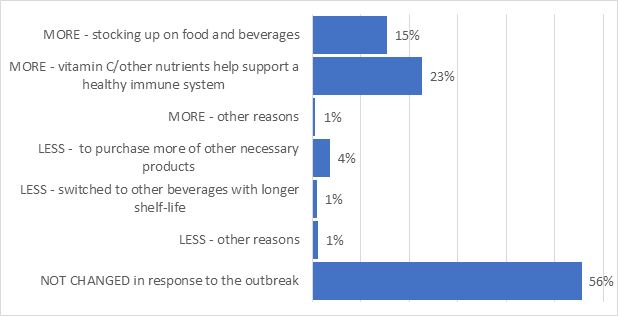

A total sample of 512 responses were collected in the April wave of the tracker. Respondents answered questions including their purchases in the past month (in March). Regarding the impacts of the COVID-19 pandemic, we asked respondents to indicate whether their purchases of orange juice changed in response to the COVID-19 outbreak. About 55% of the respondents in the sample indicated that their OJ purchases had not changed due to the outbreak, nearly 40% indicated that they purchased more OJ, and about 6% indicated that they purchased less OJ (Figure 1). When asked about the reasons why their purchases have changed, 15% of the respondents explained that they purchased more OJ because they were stocking up on food and beverages, 23% indicated that they purchased more because OJ has vitamin C and other nutrients that help support a healthy immune system, while 4% indicated that they purchased less OJ because they were stocking up on other essential items (Figure 2). Some respondents also mentioned that they purchased less because OJ was out of stock at their shopping locations. It is common for people to consume OJ during the flu/cold season because it has vitamin C and nutrients that help support the immune system. While COVID-19 is not the flu, it is not surprising to see consumers become more cautious about what they eat and choose foods they believe may help them stay strong during a pandemic.

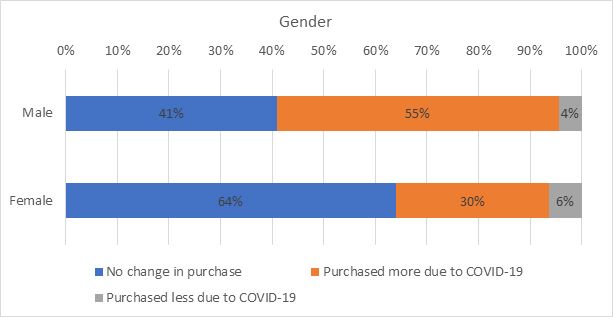

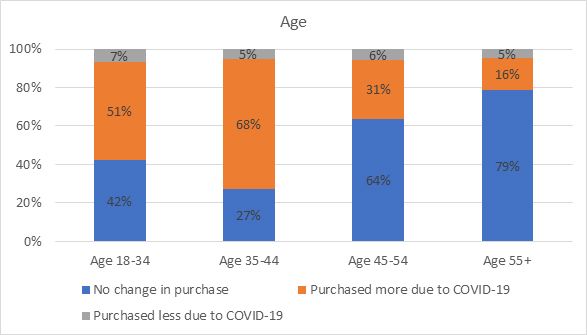

We found consumers' responses to COVID-19 varied by demographics. For example, the results show that male shoppers (55%) were more likely to purchase more OJ in response to the pandemic compared to female shoppers (30%) (Figure 3). Younger consumers (under age 45) were more likely to purchase more OJ, while older consumers were more likely to maintain their current purchase level (Figure 4). The age group 35–44 had the highest share (68%) of respondents who had indicated they purchased more OJ due to the outbreak compared to other age groups, while only 16% of respondents who were 55 and above indicated that they had purchased more OJ due to concern about COVID-19.

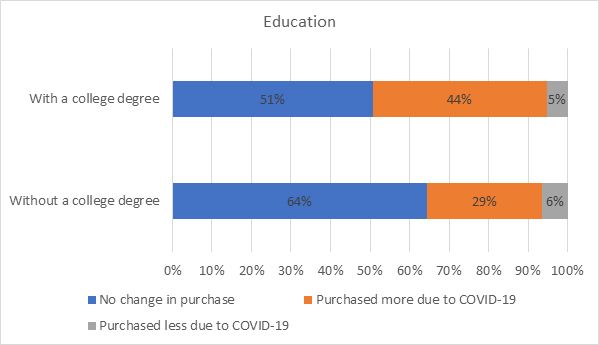

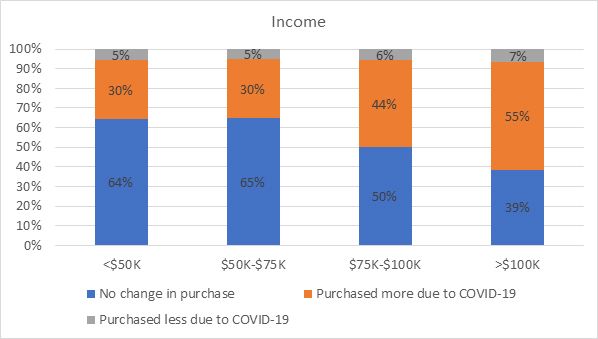

Differences in purchases due to concerns about COVID-19 impacts are also seen across education and income levels. Nearly half, 44%, of respondents with a college degree or higher indicated that they had purchased more OJ due to concerns over the outbreak, while only 29% of respondents without a college degree indicated they purchased more OJ. Households with higher income levels ($75K or greater) had a higher share of respondents who indicated they increased OJ purchases compared to households with incomes less than $75,000. As the pandemic continues, the income effect could become more pronounced due to the increase in the job losses and salary decreases resulting from nationwide lockdown, which might have a long-run effect on food demand.

Interestingly, shoppers who are male, younger, with a college degree, and with a higher household income, have been reporting a higher market penetration according to our database. The outbreak of COVID-19 has pushed these active consumers' demand even higher.

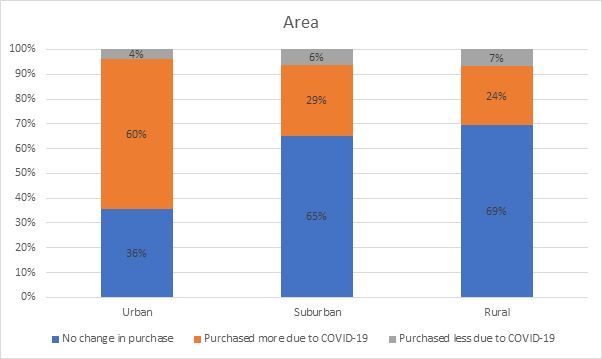

Moreover, consumers' responses to the pandemic are different across population densities. Respondents who self-identified as urban residents were more likely to purchase more OJ in response to COVID-19 concerns, with 60% indicating they purchased more OJ in the past month (Figure 7). At the same time, increased OJ purchases due to concerns about COVID-19 represented about 30% of suburban residents and 24% of rural residents, while nearly 70% indicated that they had maintained their current level of OJ purchases.

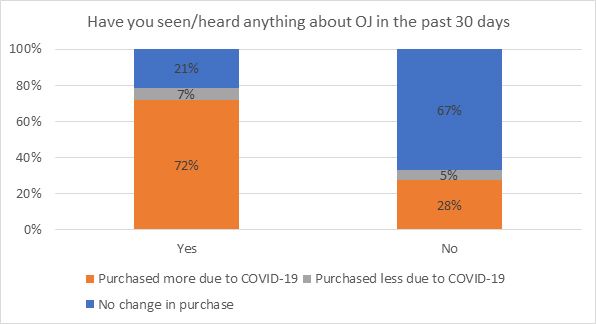

One interesting observation is that whether consumers had seen media about OJ made a difference in their purchase decisions during the pandemic. The share of total respondents (about 24%) who indicated that they had seen/heard/read something about OJ in the past month did not change significantly from previous periods. The top media sources for receiving OJ information identified by respondents included TV (66%), social media (46%), in-store display (31%), and newspapers (30%). The share of respondents who were aware of OJ information was comparable to previous seasons. However, being aware of something about OJ made a difference in consumers' purchase behavior during the pandemic. Among respondents who indicated that they had seen/heard/read something about OJ, 72% purchased more OJ, whereas only 28% of respondents who were not aware of anything about OJ made more purchases of OJ due to COVID-19. Such results indicate that information about OJ could help boost demand, suggesting it would be important for the industry to reach out to consumers, especially during such an abnormal period. At the same time, the share of consumers purchasing OJ due to concerns about COVID-19 even though they had not indicated seeing media about OJ provides insight into consumer awareness of OJ that predates the pandemic.

Conclusion

The COVID-19 pandemic has challenged the food supply chain in the United States. The pandemic has changed consumers' lifestyles in many ways: online shopping for groceries has soared; people are switching from food service to meals prepared and consumed at home, and people are trying to eat healthful foods on a limited budget. The surge in OJ sales during the period can be attributed to both panic buying and consumers seeking nutritious food. It sends a positive signal to the industry that consumers are willing to buy more OJ because it has the nutrients people are looking for. However, it is important for the industry to find ways to keep consumers drinking OJ once the pandemic is past.

Using a monthly consumer survey, we confirmed that about 30% of consumers have purchased more OJ, mostly because they were stocking up food and beverages or they recognized OJ has nutrients that support the immune system. Moreover, we found that shoppers who are male, younger than 45 years old, with higher levels of education and income, or living in an urban area are more likely to increase OJ purchases in response to the COVID-19 pandemic. Many of these consumers who increased their purchases were buying OJ before the pandemic, indicating the surge in sales could be largely attributed to active consumers. Results also revealed that consumers' awareness of OJ information from media sources is important for enhancing demand, even though the awareness level was not different from previous periods. Therefore, increasing consumers' awareness could be a key factor attracting new consumers to the market.

In the long run, the industry needs to closely monitor whether and how consumers' shopping and diet habits return to pre-COVID-19 patterns. Additionally, we may not have seen all the impacts yet. Job losses and salary decreases may cause consumers to become more price sensitive and limit what they purchase. For the orange juice industry, the COVID-19 pandemic has brought an opportunity. With more people consuming OJ than before, there is the chance to remind consumers of the benefits of drinking OJ, which have been found to be the key drivers for consumers to stay active in the market (Heng et al. 2019).

References

Florida Department of Citrus. 2020. Nielsen Retail Sales OJ, GJ, and OJ/GJ Beverages. https://app.box.com/embed/s/xkc7lolerh/file/657493456179?showItemFeedActions=true&showParentPath=true

Heng, Y., R. Ward, L. House, and M. Zansler. 2019. "Assessing key factors influencing orange juice demand in the current US market." Agribusiness 35 (4): 501–515.

Hobbs, J. 2020. "Food supply chains during the COVID-19 pandemic." Canadian Journal of Agricultural Economics https://doi.org/10.1111/cjag.12237.

The New York Times. 2020. "See which states and cities have told residents to stay at home." https://www.nytimes.com/interactive/2020/us/coronavirus-stay-at-home-order.html

The Wall Street Journal. 2020. "Grocery-store rush spurs big gains in sleepy orange juice futures." https://www.wsj.com/articles/grocery-store-rush-spurs-big-gains-in-sleepy-orange-juice-futures-11585652402