Introduction

Credit: USDA

Guava (Psidium guajava L.), a member of the Myrtaceae family, is a small single- or multi-trunked evergreen tree native to the American tropics. The fruit is very diverse and may be sweet to highly acidic in flavor. The fruit may exhibit a strong to mild aroma and possess a thick or a thin skin depending on the cultivar (Morton 1987; Mossler and Crane 2009).

Guava is cultivated in subtropical and tropical climates throughout the world and is adapted to a wide range of climatic conditions (from humid to dry). India and Mexico are the leading global guava producers. Mexico is the main fresh guava exporter to the United States, supplying the fruit year-round to major US markets (USDA-AMS 2017).

Guava, first introduced to Florida from Cuba in 1847, quickly became naturalized throughout central and south Florida (Popenoe 1920). US domestic production occurs primarily in Hawaii, Puerto Rico, and Florida (Crane and Balerdi 2016). Guava is also cultivated on a smaller scale in California and Texas. In Florida, the cultivated guava area is about 200 acres, with over 95% of the acreage in Miami-Dade County.

Pink and white (characterized by the color of their pulp/flesh) are the two main types of guava cultivated in Florida. Generally, pink guava is consumed after it ripens, and white guava is consumed at an immature stage when nearly full-sized but hard (like an apple) (Crane and Balerdi 2016). The major pink guava cultivars in Florida were selected by a local guava producer and are proprietary; a minor variety named 'Homestead' was developed from the breeding program at the University of Florida's Tropical Research and Education Center (Crane and Balerdi 2016). In Florida, the main guava harvest season occurs from August to October, followed by a smaller harvest from February to March (Mossler and Crane 2009). In addition, guava trees may be induced to produce off-season fruit at nearly any time of the year through pruning and nutrient and water management.

A mature guava tree (5 years or older) yields 50 to 80 pounds of fruit per year, depending on tree size, cultivar, prevailing climatic conditions, and cultural practices (Crane and Balerdi 2016). Considering a planting density of 150 trees per acre for pink guava and yield from a mature tree of 65 pounds per year, average pink guava yield per acre is 9,750 pounds. Estimating an 82% fruit packout rate, the pink guava marketable yield for Florida is about 8,000 pounds per acre, or 1.60 million pounds per year (200 acres×8,000 pounds/acre). Assuming an average "free on board" (FOB) Homestead price (i.e., the price at the packinghouse) of $2.00 per pound, the crop is worth about $3.20 million at the packinghouse level.

Given the growing interest in the profitability of alternative minor tropical fruit crops, this publication presents the estimated costs and returns associated with the operation of an established pink guava grove in south Florida. The information presented was collected through field interviews with growers and industry specialists; it reflects a wide diversity of production techniques in small guava orchards (1 to 3 acres). The information presented is intended only as a reference to estimate the financial requirements of operating an established pink guava grove. Readers interested in specific information regarding guava cultural practices may want to consult HS4, Guava Growing in the Florida Home Landscape (edis.ifas.ufl.edu/mg045), or their local UF/IFAS Extension agent.

Main Assumptions

The annual budget and cost of production are based on a one-acre grove. Because of the varied types of cultural practices adopted, only the averages of the costs and return values are used for the present analysis. Given that tropical fruit growers in south Florida own the land, a prevailing market land rent of $500/acre/year was taken into consideration to factor in the opportunity cost of the land.

Grove Layout—Guavas planted 20 to 25 feet between-rows and 10 to 20 feet in-rows, resulting in a tree density ranging from 87 to 217 trees per acre (Mossler and Crane 2009). The present analysis considers a density of 150 trees/acre.

Yields—Assuming a planting density of 150 trees/acre, an average yield from a mature guava tree of 65 pounds/year, and an 82% fruit packing rate, marketable yield is estimated at 8,000 pounds/acre/year.

Guava Prices—The average FOB (Homestead) pink guava price (price at the packinghouse) is estimated at $2.00/pound; this is the average price growers received from the packinghouses in 2016.

Irrigation—Mature guava trees require adequate watering during prolonged dry periods for optimum crop yields, and irrigation is crucial from bloom through fruit development (Crane and Balerdi 2016). Average irrigation expenses, including fuel or electricity costs are estimated at $200/acre/year.

Fertilization—Fertilizer treatments for mature trees include applications of 6-6-6-2 or similar fertilizer materials (nitrogen, phosphate, potash, and magnesium); soil drench applications of chelated iron; and nutritional foliar sprays (zinc and manganese and other minor elements) (Crane and Balerdi 2016). Average fertilization costs (materials only) are estimated at $550/acre/year.

Pest Management—Guava trees are attacked by several insect pests. The pests of economic importance include the Caribbean fruit fly (Anastrepha suspensa) and guava white fly (Metaleurodicus cardini).

Weed-management practices include herbicide applications, hand-weeding, and mulching. There are no serious guava diseases in south Florida. Diseases that may cause some damage include red alga (Cephaleuros virescens) and anthracnose (Colletotrichum gloeosporioides), which may be identified from the vigorous spread of reddish spots on leaves (Crane and Balerdi 2016). Average agrochemical costs (materials only) are insecticides $450/acre/year, herbicides $450/acre/year, and fungicides $400/acre/year.

Labor Costs—These include application costs for agricultural inputs (e.g., fertilizers and agrochemicals) and the costs incurred for various cultural operations (e.g., irrigation, pruning, and mowing). Labor costs are estimated at $650/acre/year.

Interest on Capital—This is the cost of borrowing money or the opportunity cost for using equity. A rate of 5% was considered in the given analysis. Interest on capital is estimated at $135/acre.

Fixed Costs—These are the costs that are incurred regardless of the level of production. They include cash overhead costs (e.g., insurance and taxes), non-cash overhead costs (e.g., land rent), and other overhead costs (e.g., machinery use, electricity, and telephone, computer, and other miscellaneous office expenses). Total fixed costs are estimated at $1,300/acre/year.

Harvesting and Marketing Costs—We assume that Florida guava are harvested twice per year: a major harvest from August to October and a minor harvest from February to March, depending on the cultivar (Mossler and Crane 2009). Because the fruit may be easily bruised during harvest, fruit picking (hand-harvesting) is a time-consuming activity. The cost for picking, packing, and marketing guava is estimated at $2,800/acre/year.

Table 1 shows the per-acre expenses and returns associated with a full-production pink guava grove.

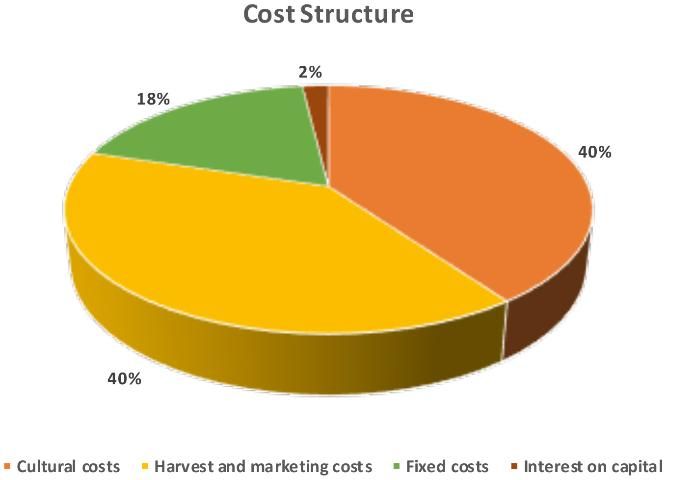

Production Costs (or variable costs)—Production costs are estimated at $2,835 ($0.35 per pound), representing 40% of the total cost. The major components from the production costs include hired labor (23%), fertilizers (19%), herbicides (16%), and insecticides (16%).

Fixed Costs—These include cash overhead costs of $200 (insurance and taxes); a non-cash overhead cost of $500/acre (the opportunity cost of the land); and other overhead costs of $800 (machinery use, electricity, and telephone, computer, and other miscellaneous office expenses). Total fixed costs are estimated at $1,300/acre/year ($0.16/pound), representing 18% of the total cost.

Harvesting and Marketing Costs—Harvesting and marketing costs are estimated at $2,800/acre/year ($0.35/pound), representing 40% of the total cost. Pink guava is usually harvested when the peel changes color from light green to slightly yellow (Crane and Balerdi 2016).

Figure 2 illustrates the magnitude of the costs by category and their respective share of the total cost. Harvest and marketing costs, along with production costs (variable costs for hired labor, irrigation, fertilization, and pest control), are the major cost drivers, accounting for 40% each of the total cost, followed by fixed (overhead) costs at 18% of the total cost, and interest on capital at 2% of the total cost.

Returns and Profitability Analysis

The information provided in Table 1 shows that the total cost to produce and market one acre of pink guava is estimated at $6,935/acre/year ($0.87/pound). Based on an average marketable yield of 8,000 pounds/acre and an average FOB Homestead price (at the packinghouse) of $2.00/pound, the total receipt or gross revenue is $16,000/acre/year.

Subtracting total variable cost (total production cost plus harvesting and marketing cost) from total revenue, we obtain a gross margin of $10,365/acre/year ($1.30/pound). The gross margin provides a useful indicator of short-term profitability. A positive gross margin indicates that all variable expenses have been covered by the income generated, while a negative gross margin implies that a business is not covering its operational costs in the short term, and changes are needed to continue operating. Given that the gross margin does not include fixed costs, it is not a true indicator of the viability of the business in the long term.

Net return is obtained by subtracting the fixed costs from the gross margin; it provides a more realistic indicator of the long-term profitability of the farming operation. Table 1 shows a net return for a pink guava grove of $9,065/acre/year ($1.13/pound).

Sensitivity Analysis

Table 2 presents an analysis based on the gross margin (gross profit), which considers the short-term viability of a pink guava grove. Under the best-case scenario, where both price and yield are assumed to increase by 10%, gross margin per acre would increase from $10,365/acre to $13,725/acre. Under the worst-case scenario, where both price and yield decrease by 10%, gross margin per acre would decrease from $10,365/acre to $7,325/acre. Price changes (keeping the production constant) have an impact on gross margin similar to that of quantity changes (keeping the price constant). It can be observed that a 5% increase in the base price (base yield of 8,000 pounds) has an impact on gross margin ($800 more) equal to the impact of a 5% increase in yield (base price of $2.00/pound) ($800 more). It must be noted that the gross margin estimates do not consider the fixed overhead costs.

Table 3 presents a similar analysis based on the net returns to a grower per acre. Under the best-case scenario, in which both price and yield are assumed to increase by 10%, net return per acre would increase from $9,065/acre to $12,425/acre. Under the worst-case scenario, where both price and yield decrease by 10%, net return per acre would decrease from $9,065/acre to $6,025/acre. Other combinations of changes of prices and yields and their impact on the net return per acre are shown in Table 3. The information presented in Table 3 can be interpreted in a similar manner to that presented in Table 2. However, it should be noted that at the industry level, a noticeable increase in production usually results in a decrease in the price received by the growers.

Conclusions

The average net return obtained from an established pink guava grove in south Florida is $9,065/acre ($1.13/pound), which makes pink guava an interesting option in the region. The information presented in this document is based on an established grove. We have not quantified the financial requirements for establishing a new guava grove, which include land acquisition and development, planting costs, amortized capital costs, etc.

The outlook for guava demand seems favorable given the increase in US ethnic populations, particularly Asians and Hispanics, who are familiar with the fruit. Conversely, overproduction of guava may result in market saturation, which would lead to lower profitability or some growers leaving the industry. Therefore, caution is advised regarding the establishment of a new guava grove. According to south Florida guava growers, fruit fly management remains an ongoing concern for the industry. Pink guava producers primarily control fruit flies with insecticides. At the same time, the potential threat posed by fruit flies also helps protect domestic producers from foreign markets due to strict import requirements (Karst 2011).

References

Crane, J., and C. Balerdi. 2016. Guava growing in the Florida home landscape. HS-4. Gainesville: University of Florida Institute of Food and Agricultural Sciences. https://edis.ifas.ufl.edu/mg045

Karst, T. 2011. "U.S. Allowing Irradiated Guava Imports." The Packer. http://www.thepacker.com/fruit-vegetable-news/crops-markets/us_allowing_irradiated_guava_imports_122053224.html

Morton, J. 1987. Guava. https://www.hort.purdue.edu/newcrop/morton/guava.html

Mossler, M., and J. Crane. 2009. “Florida Crop Pest Management Profile: Papaya: CIR1402 PI053, Rev. 11 2009.” EDIS 2009 (10). Gainesville, FL. https://doi.org/10.32473/edis-pi053-2009

Popenoe, W. 1920. Manual of Tropical and Subtropical Fruits. New York: MacMillan.

USDA-AMS. 2017. Terminal Market Price. https://www.marketnews.usda.gov/mnp/fv-report-config-step1?type=termPrice