Estate planning has to do with living, not just with decisions about who inherits property. An estate plan is a pattern, a guide, or a master method for working toward financial security and the family's future welfare. To be most effective, estate planning should involve all members of the family.

The objectives of estate planning will differ among families because of varying circumstances, such as differences in assets, value judgments, personal desires, and number of children. Consider the following purposes for estate planning, but be aware that they do not apply to all estates:

-

To promote the financial security of you and your family during your working and retirement years.

A properly executed estate plan should help you arrange your financial affairs to provide an adequate income for you, your spouse or partner, and your family during your working years; for you and your spouse when you retire; and, finally, for the ultimate transfer of your property to your heirs or other intended recipients. To achieve this may involve some changes in your current money management, changes in your current business or investment programs, and possibly changes in your life insurance setup.

2. To minimize federal estate taxes, state inheritance taxes, and probate and settlement costs.

An estate plan will provide the means for reducing a possible large loss of assets in your estate through federal estate taxes. This tax is levied by the federal government on the estate itself before your heirs receive their portions. Because of size, however, not all estates are subject to a federal estate tax. On the other hand, more and more individuals have accumulated sufficient assets that will be subject to this tax unless proper planning is done. Federal estate tax laws may change. It is important to revisit your estate plan periodically to be certain that you are minimizing your tax liability.

3. To insure equitable treatment of your children.

Planning will enable you to treat all of your children fairly, but not necessarily equally. Some may have already received special gifts from you, such as money for their college education or an investment in some enterprise, such as a farm or a business. Thus, you may wish to compensate the other children who have not yet received any substantial funds from you. Also, you may wish to compensate individuals who have made or are now making special personal contributions to you and your spouse or partner. Children with special needs may require special provisions in the estate plan.

4. To anticipate and satisfy the need for cash in settling your estate.

Settlement of an estate always involves some costs. These include payment of the debts incurred by and for the person who has died; unpaid federal and state income taxes and local property taxes as of the time of death; potential federal estate taxes and administrative or probate expenses (such as fees for an attorney, personal representative or administrator, and court costs). Many times the immediate financial drain after a death may be severe. Unless steps have been taken to provide available cash (the proceeds from a life insurance policy or some other assets that can be readily converted into cash), it may be necessary for the executor of your estate to borrow the necessary funds. This can lead to additional costs of settling the estate. In the case of a business person's or a farmer's estate, it might even be necessary to sell some of the land or other assets that should have been kept intact.

5. To inform your heirs about your plans.

Although it is highly desirable for all heirs to have some information about what your estate plan contains, it is especially important for those who will be operating a family business. Knowing your plan will help them in making their own plans; accordingly, any future transfer of property can be made more smoothly and many problems arising from a change of ownership can be avoided. Understandably, we are often reluctant to discuss money matters with our children and other potential heirs. We may still consider them as we did when they were babies depending on us for many of their decisions.

Potential heirs are often reluctant to raise the matter of what you may have in mind for them. This can be a sensitive subject, and they do not want you to think they are anxious for their portion of your estate. Nevertheless, if the desires and goals of both you and your children are to be fulfilled, you cannot indefinitely postpone a discussion of mutual financial matters.

6. To aid in transfer of the family business.

The operator of a business may have special needs for estate planning. When transferring a family business, it may be wise to start the orderly transfer of assets prior to death. A well-designed estate plan can help sort through these issues. For example, there may be a problem of equitable treatment of the surviving spouse and the children if it is decided to keep the business in the family and ultimately transfer ownership to one or more of the children who are best suited to take over its operation.

Who Needs an Estate Plan?

Everyone, regardless of age or net worth, needs an estate plan. A good estate plan assures the economic and legal consequences you desire. It can save thousands of dollars if your estate is large enough to be subject to federal estate taxes.

There may be an even greater need to plan a small estate. Careful arrangement of your affairs is essential to make the best of what you own. Planning your estate will help you to provide as much income as possible during retirement and/or contribute to the financial security for your surviving spouse or partner and minor children in case of your early death.

This does not mean that a family with a moderate amount of assets should take the same steps as the family with considerable wealth. Naturally, if a family's accumulated assets are larger and more complex, the arrangements connected with them are usually more involved. For most families, however, a workable plan is not a highly complicated affair, nor is it so simple that you should try to go it alone without professional help or advice.

Who Should Plan the Estate?

Each family needs to decide on definite objectives, keeping in mind the needs and aspirations of every member. The beginning family thinks more in terms of building an estate. The growing family often has a different set of goals geared to expanding interests and needs. The older family may need to focus its major attention on retirement arrangements and the disposal of property.

Seek Professional Help

Various written statements, called "legal instruments," are necessary in estate planning. Because few of us are familiar with legal jargon, many of us need legal assistance in planning our estates. Using an online estate planning kit may seem convenient but could lead to unnecessary wasting of assets if contesting lawsuits result. Remember: When these legal instruments are being interpreted, you won't be there to explain what was intended. Additionally, probate laws vary by state, and many online estate planning kits do not address the variations in law. Furthermore, the online kit may contain out-of-date information and forms.

Depending on the size of your estate, you may need to assemble a team of industry professionals to work with you when you are creating your estate plan. A financial planner may be the best-qualified person to help with an estate plan by looking at the "big picture." The financial planner considers everything when formulating the plan and often brings in specialists to help implement the plan. The financial planner may need to consult with the family's life insurance agent, attorney, and representative of the bank or trust company, as these persons can help balance finances for both protection and income.

If the family doesn't make the necessary plans and arrangements, the estate will be settled according to the law of the state of residence.

Information to Gather

Before your financial planner can be of service in helping develop your financial plan, including your estate plan, you will need to assemble the following basic information about you, your spouse, and your property:

A. Your Property and Your Present Financial Situation

The information pertaining to your financial situation includes the following: a) the property that you own outright and in which you have an interest; b) your present income from all sources; and c) anticipated income. Because of its importance, this information should be in writing and in a systematic form. It should be as complete and accurate as possible.

Basically, property is anything that you own. There are two kinds of property, real property and personal property. Real property, or real estate, can best be defined as land, buildings, and any property that is closely and permanently affixed to the land. The two classes of personal property are tangibles (such as household goods, livestock, and automobiles) and intangibles (such as bonds, common stock shares, life insurance policies, and bank accounts).

The general types of ownership in real property are fee simple, life estate, and various interests in remainder. In fee simple, the person designated essentially has the exclusive use of and the sole right to dispose of the realty by deed or other instrument of transfer. A life estate entitles a person to the use and benefits of the property only for a lifetime. This person is known as the life tenant and cannot dispose of the property. Individual rights cease upon their death. The person to whom the property then passes is the remainder person. Co-ownership, or joint ownership, means that two or more persons own the same property at the same time.

When you compile your list of assets, indicate how the title of each is held — whether it is in your name alone or jointly owned with your spouse or someone else.

In case of assets for which you are still making payments (such as your farm, home, automobile, etc.), state the mortgage terms or current payment plan. Also, you will need to furnish your attorney with a copy of your current will if you have one.

B. Personal Information

Under this heading write information about yourself, including your date of birth, birth certificate (where kept), birthplace, Social Security number, and place of employment (if not self-employed). Give the same type of information about your spouse or partner. Also, include facts on your marital status (when and where married), and list any previous marriages and when and how each terminated. List your heirs and other intended beneficiaries; the names and ages of your children, including adopted children; if any of your children are dead, list the names of their children; names of your parents, if living; names of your brothers and sisters, if living; and names of the children of any deceased brothers and sisters.

C. What You Seek to Accomplish with Your Estate Plan

As previously mentioned, estate planning includes the arrangement of your affairs to provide a satisfactory living for you and your family during your working and retirement years and for survivor(s) after your death. What you seek to accomplish with your plan should represent the desires of you and your spouse in harmony with the goals of your children.

If you have accumulated sufficient assets, you may want to start disposing of some of them in the form of gifts while you are living. One purpose might be to avert future death taxes on a portion of your estate; or you might wish to aid one or more of your children in some project, such as the beginning of an ownership interest in your business; or to make gifts to some charity or institution. If you make gifts during your lifetime, you can observe and evaluate the ability of the recipients to handle money. This might influence your decision on how you choose to provide for them in your will.

Some of your other purposes have likely already been mentioned and do not need repeating here. Obviously, the purposes that you desire for your plan will be influenced greatly by the present net worth of your estate and what its potential worth may be between now and some future time, such as at the time of your death.

As part of what you seek to accomplish by your estate plan, you will need to list your intentions regarding the disposal of the items in your estate. You will need to list the names of those persons or institutions (e.g., your church) whom you wish to remember. This might include specific amounts of money or certain properties (such as your business or property), or those bequests might be in the form of percentages of your net estate. You may wish to designate the recipients of such items as your jewelry, silverware, books, and other personal things; and to whom the residue of your estate is to go (the remaining portion of your estate after debts, expenses, taxes, and specific bequests have been taken out).

Means or Tools Used in Estate Planning

With the information you have given about yourself and your spouse, your attorney will be able to help you evaluate your situation and to make some recommendations on how to carry out your wishes. In helping you prepare your estate plan, your attorney and your other consultants will likely make use of several means or "tools." The selection of the particular tools, of course, will be made on the basis of your situation and the goals or purposes that you have indicated.

Social Security Survivor Benefits: More than nine out of every 10 of the regularly employed men and women in the United States are covered by Social Security and may receive its benefits. This source of income is particularly helpful for older adults and for families in which the breadwinner dies, leaving children under 18.

Life Insurance: Life insurance is a contract for payment of a specified amount of money upon death of the insured. The major purpose of life insurance is to give protection to the insured's family in the event of his or her death. It should not be thought of as a tool for providing for retirement unless it has an annuity provision.

Life insurance is often used in estate planning to provide cash at the time of death to pay debts, claims against the estate, and taxes. Used in this way, adequate insurance can prevent forced sale of property to meet costs in settling the estate.

Annuities: An annuity is a type of retirement income in which an insurance company contracts to pay a person a fixed amount of money at specified intervals during his or her lifetime.

Gifts: These may include cash, real estate, life insurance securities, annuities, etc.

Certain legalities concerning exceptions, exemptions, and exclusions must be understood. A competent lawyer can help in long-range planning and maximum tax savings. However, it would not be advisable to make gifts just to save taxes. After all, when property is given away, it is gone and the family cannot recall it if it is needed later.

Trusts: A trust is created by the grantor (you) when you transfer legal title of property to a trust usually named after the grantor and dated (for example, The Jones Family Trust dated February 4, 2002). A trustee, either you or someone that you name, manages the property and administers the trust for the benefit of beneficiaries that you have identified. These beneficiaries are usually family members, such as your wife, children, or elderly dependents. Corporate trustees are often used in larger estates. They have the advantage of professional asset managers to make decisions and investments and to handle claims. Trusts are also of particular advantage to family members who do not like to handle business affairs or do not feel they can make wise investments. Here again, a lawyer's services are necessary.

Stocks and Bonds: Stocks are stockholder shares in a corporation, entitling individuals to dividends and other rights of ownership. A bond is a certificate of debt issued by a government or corporation guaranteeing payment plus interest at a specified future date.

These should not be overlooked in estate planning. It does require considerable time, effort, and skill to study the market and decide which stocks and bonds to buy. There is a certain amount of risk involved, but dealing with stocks and bonds can be a fascinating and rewarding experience.

Ownership of Property: A retired person must have a place to live. Rent or mortgage payments may be a heavy burden for a retired person whose income has been reduced. If possible, every homeowner should make it a goal to have their home paid for in full before retirement.

The following methods of ownership should be considered in estate planning:

-

Sole Ownership: If a person owns property solely in his or her own name, it becomes a part of that person's estate at the time of death.

-

Joint Ownership: There are two types of joint ownership, tenancy in common and joint tenancy with the right of survivorship. Tenancy in common is the type of joint ownership frequently used that means each tenant in common owns a certain undivided interest in goods or property. Their shares in the property do need to be equal, nor do the owners need to be related. Each owner has the right to dispose of his/her share in the personal property without the consent of the others. Tenancy in common is often not the most desirable form of joint ownership, especially for husbands and wives. Joint tenancy with right of survivorship is a more practical way for a husband and wife to hold the family home, bonds, and bank account. The right of survivorship is the important qualification in this form of ownership, and it means that if one of the owners dies, the survivor(s) becomes the owner of the whole property. Joint tenancy with right of survivorship simplifies the administration of an estate. That is, it passes directly to the beneficiary and does not go through probate. However, before making such an arrangement, discuss with a lawyer the advantages and disadvantages of such an ownership in your situation.

In any instrument involving joint ownership, carefully check the wording to make sure it means what you really want it to. If you intend to create a joint bank account with right of survivorship, you should make certain that the words "payable to survivor," or their equivalent, appear on the form furnished by the bank. If such a form is not available, be sure these words appear in the instrument you sign. If you intend to create an account without survivorship (tenancy in common), the deposit needs only to be made in the names of the depositors, connected with the word "and."

In a survivorship deed to real estate, suitable wording is "John R. and/or Mary L. Smith, and the survivor thereof." In case of the death of either party, the title then becomes vested in the survivor.

Wills

Virtually all comprehensive estate plans have a will as their cornerstones. Thus, the importance of a correctly planned and executed will cannot be overemphasized.

The court distributes your property according to state laws if you die intestate (without a will). State law, in effect, writes a will for you. The court names the executor of your estate. This might be a member of your family or a close associate, but it could also be someone completely unknown to you.

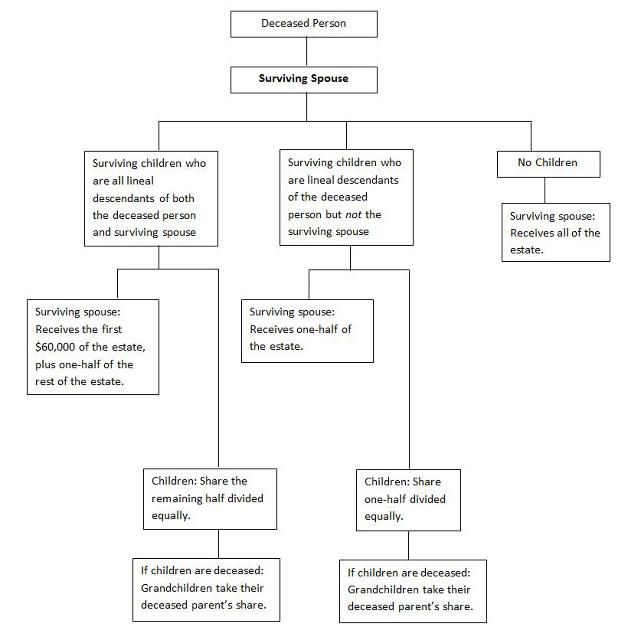

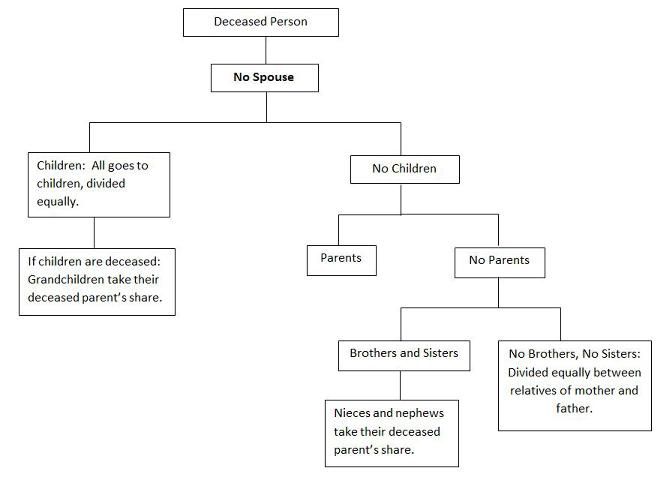

The following figures outline the distribution based on your family situation if you die intestate (without a will) in Florida.

This division of property according to state law may not suit you. In fact, difficulties involved in dividing a farm or business without destroying its efficiency as a productive unit might show that the only reasonable solution would be to sell and divide the proceeds among the heirs. Thus, the farm or business might be sold out of the family. An estate plan based on good legal advice, including a will, could avoid this situation.

Another example: If you own farm property and your daughter lives in the city while your son remains on the farm, you would probably prefer that your son receive the farm. Other assets could be used to equalize the distribution between the children. This could be set up by a properly executed will. However, one must recognize the effects of inflation on the value of assets and provide for this in balancing the distribution. It might be more equitable if amounts were given as percentages of the net value.

Making Separate Wills

Even though property is held jointly or a beneficiary is named in a contract, both the husband and the wife should make wills. If both die at the same time, having separate wills will allow you to name the guardians for minor children and list the persons to inherit your property.

Six Ways to Transfer Property

There are six ways of transferring property that can help in estate planning:

-

By gifting property that you will NOT need during your lifetime.

-

By a will, a legal document, in which the owner designates the disposal of property.

-

By joint ownership of property that automatically passes to the survivors.

-

By contract, such as life insurance policies, annuities, trusts, or pension plans. (In these cases, beneficiaries are usually named in the contract.)

-

By a living trust that becomes irrevocable at your death. When the trust is set up, specific instructions are defined for the distribution of the trust's assets.

-

By state law (in the absence of a will), which specifies how an estate is to be divided among heirs according to their relationship to the deceased.

Through estate planning, taxes and fees can be kept at a minimum, which keeps as much of the estate as possible intact for survivors. Taxes to be considered include state inheritance, federal estate, and federal gift taxes.

Summary

These are the four steps to estate planning:

-

Decide what you want to achieve and what you're worth.

-

Select competent financial and legal advisors.

-

Arrange for the best use and disposal of your assets.

-

Review the plan periodically to keep it up-to-date.

Disclaimer

This publication is not intended to be a substitute for legal advice. Rather, it is designed to create an awareness of the need for estate planning and to help families become better acquainted with some of the devices involved. Further changes in laws cannot be predicted, and statements in this publication are based solely upon the laws in force on the date of publication.