Introduction

The United States is the world's third largest producer of peaches, behind China and the European Union. In 2015, bearing acres of peaches in the United States were estimated at 99,790, which yielded 1.7 billion pounds of fruit. The top US peach-producing state is California, accounting for approximately 70% of the domestic production, followed by South Carolina, Georgia, and New Jersey (USDA-NASS 2016).

While the Florida peach industry is small, it has experienced significant growth in recent years. The number of harvested acres increased from 1,231 in 2012 to 3,000 in 2014 (USDA-NASS 2016; Olmstead and Morgan 2013). The devastating effect of Huanglongbing (HLB; citrus greening) across Florida citrus groves may partly explain the increase in peach acreage; some citrus growers have found peaches to be a suitable alternative crop.

One of the main advantages of growing peaches in Florida is that growers can typically obtain higher prices for their fruit from March through early May. The reason behind the higher prices is that the state's peach producers have the advantage of producing the first domestic peaches each calendar year.

This article summarizes the establishment and production costs as well as the potential profitability of a peach orchard in Florida. It includes an enterprise budget, estimates of potential revenue and undiscounted cash flows for different combinations of prices and yields, and an investment analysis. The information in this article should be relevant to both current and potential Florida peach growers.

Assumptions

This economic analysis is based on a number of assumptions regarding peach yields, prices, and revenue. We use a combination of production scenarios to generate a range of possible outcomes. The assumptions used for the economic analysis include the following:

- The land is already owned and any required buildings are at the site.

- Calculations for the investment and fixed costs of most machinery and irrigation assume a 100-acre operation, which is divided into two groves of 50 acres each. These two groves are assumed to be located close to each other, allowing for sharing of machinery.

- The irrigation system is planned for 50 acres, so each grove has its own structure.

- There is an initial investment in a micro-sprinkler fertigation and frost-protection system using one green jet (16 GPH) for every plant. In addition, there is one irrigation zone with the corresponding calculations based on the scheduling of 16 acre-inches per year. The calculations related to frost protection assume three frost events during which irrigation water is run for 12 hours continuously at each event, totaling 36 pumping hours for frost protection.

- Plant spacing is 14 feet between trees by 20 feet between rows, resulting in 156 plants per acre.

- Plant mortality rate is 5% annually, with dead plants being replaced every year.

- The time horizon for the analysis is 15 years.

- Fruit production starts in year 2. It takes 4 years for the plants to reach full production. Yield is held constant from year 4 through 15 (Table 1).

- Three different yield scenarios are analyzed. In scenarios 1, 2, and 3, the maximum marketable fruit yields are 5.6, 6.5, and 7.3 thousand pounds per acre, respectively, in years 4 through 15.

- The season-average packout is assumed at 84% (Table 2).

- The season-average FOB packing house price is $1.88 per pound (Table 2).

- Harvesting and hauling cost is $0.25 per pound of fruit harvested. The harvesting/hauling charge includes containers, bins, and bin trailers needed for harvesting.

- Marketing cost comprises a packing charge of $0.50 per pound and a brokerage fee of 6% of gross sales. The packing charge includes custom package and packing operation costs.

- The management charge is assumed to be $75 per acre.

There are also a few caveats worth noting. First, the quotes for chemicals in this budget are based on retail prices obtained from vendors. However, depending on the size of their operations, growers may receive a discount for volume. Second, the actual investment in machinery and irrigation depends on whether growers start a new operation or whether the equipment is already available to them (for this budget, all equipment is assumed to be new, with prices obtained from machinery dealers and irrigation-supply companies). Third, the cultural practices used to build the enterprise budget are based on a combination of recommendations from UF/IFAS Extension personnel and the experience of peach growers who provided feedback through personal communication.

Estimated Capital Investment, Establishment, Maintenance, and Harvesting and Marketing Costs

Costs are typically divided into variable (or operating) and fixed (or ownership) costs. Variable costs depend on the level of production and arise from the actual operation of the enterprise; they include costs of land preparation, planting, fertilization, weed control, and pest and disease management. Fixed costs are independent of the level of production and arise from owning fixed inputs such as machinery, buildings, or land; they include asset depreciation, interest, insurance, taxes, etc.

To establish a 100-acre peach operation, it was estimated that $1,865 per acre would be needed as initial investment on machinery and equipment (Table 3), and the irrigation and frost protection system would require an investment of $4,592 per acre (Table 4). Thus, the total investment in machinery and irrigation is $6,457 per acre. Tables 3 and 4 also show the annual fixed costs (e.g., depreciation, interest, tax, and insurance costs) associated with machinery ($336 per acre) and with irrigation ($526 per acre). In addition, the annual variable costs associated with machinery and equipment are $75 per acre (Table 3), and those associated with the irrigation system are $1,406 per acre (Table 4).

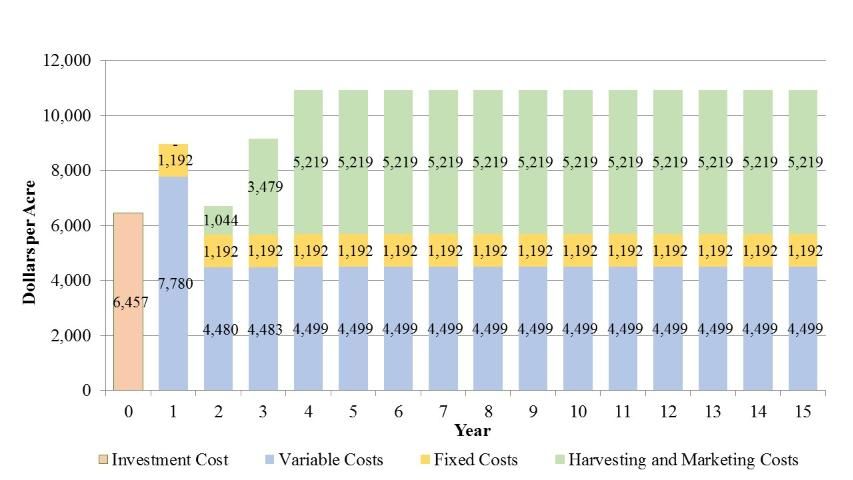

Tables 5 through 8 show the estimated establishment and maintenance costs per acre for the 15-year investment horizon. In the first year, total variable costs are $7,780 per acre, which includes soil amendments, herbicides, insecticides, fungicides, solid set planting, hired labor, and other costs such as repairs and fuel (Table 5). The budget also includes $1,192 per acre in fixed costs. Thus, total variable and fixed costs are $8,972 per acre for year 1.

In the second year, variable and fixed costs are estimated at $4,480 and $1,192 per acre, respectively. Thus, total variable and fixed costs in year 2 are $5,673 per acre (Table 6). In year 2, plants start bearing fruit, so total annual costs per acre include harvesting and marketing (i.e., packing and brokerage) costs. However, packing and brokerage costs are dependent on yield and price, so we calculate them separately in Tables 9 through 11. Variable and fixed costs in year 3 are $4,483 and $1,192 per acre, respectively. Hence, the total cultural cost for year 3 is $5,675 per acre (Table 7). Annual production costs are assumed to be constant for years 4 through 15. During this period, variable costs are estimated at $4,500 per acre, whereas fixed costs are $1,192 per acre, for a total of $5,692 per acre (Table 8).

Figure 1 shows initial, variable, fixed, and harvesting and packing costs for the 15-year investment horizon under yield scenario 2, which is the intermediate yield scenario that assumes a production of 6.5 thousand pounds per acre in years 4 through 15. Harvesting and packing costs are assumed to be $0.25 per pound harvested and $0.50 per pound of marketable fruit, respectively. Brokerage costs are price dependent at 6% of gross sales, so they are computed separately for each yield scenario and price level (Tables 9 through 11). Brokerage costs in years 4 through 15 range from $460 to $1,036 per acre annually across the different price scenarios (Tables 9 through 11).

Estimated Revenue and Cash Flow

The market prices used for the analysis were $1.38, $1.63, $1.88, $2.13, and $2.38 per pound based on prices obtained through feedback from Florida peach growers. The underlying assumption is that those prices represent the averages throughout the investment period. Tables 12 through 14 show the estimated revenue by combining the different price levels with yield scenarios 1, 2, and 3, respectively.

Fruit production starts in year 2, with revenue as low as $1,532 or as high as $3,455 per acre, depending on the yield-price combination. In year 3, the lowest (highest) level of revenue is $5,107 ($11,515) per acre, which is obtained by multiplying the lowest (highest) price level of $1.38 ($2.38) per pound and yield of 3,698 (4,836) pounds per acre. Revenue in years 4 through 15 is estimated at $7,661; $9,013; and $10,019 per acre in scenarios 1, 2, and 3, respectively, using the lowest price level of $1.38 per pound. In contrast, revenue is estimated to be $13,208; $15,538; and $17,273 per acre in scenarios 1, 2, and 3, respectively, using the highest price level of $2.38 per pound. In terms of production, years 4 through 15 present the highest yields and, consequently, the highest revenues from production. Cash flows in year 15 also include the revenue from the salvage value of machinery and irrigation equipment.

Production of a perennial crop like peaches typically requires a number of years before the annual value of production is greater than the annual costs. Therefore, growers endure a few years with negative cash flows. Table 15 shows the undiscounted annual cash flows per acre for yield scenarios 1, 2, and 3 at the different price levels. For all three scenarios, when price is $1.38 per pound, cash flows are negative for all years. When the price is $1.63 per pound, the cash flow is positive in year 15 for scenario 2, and starting in year 4 for scenario 3. At a price level of $1.88, cash flows are positive starting in year 4 for all three scenarios. At a price level of $2.13, cash flows are positive starting in year 4 for scenario 1 and in year 3 for scenarios 2 and 3. At a price level of $2.38, cash flows are positive starting in year 3 for all three scenarios.

Table 16 shows the undiscounted cumulative cash flows per acre for yield scenarios 1, 2, and 3 at the different price levels. Under yield scenarios 1 and 2, the cumulative undiscounted cash flow in year 15 is positive at a price of $2.13 per pound or higher. Under yield scenario 3, the undiscounted cumulative cash flow in year 15 is positive at the price of $1.88 per pound or higher.

Investment Analysis

To analyze the profitability of the investment in peaches in Florida, the initial cost of investment was combined with the annual net cash flows (receipts minus expenses), and the discount rates to compute the Net Present Value (NPV). The NPV was obtained by summing the discounted cash flows for each year. Typically, when the NPV is positive, the investment is profitable and should be accepted. Conversely, when the NPV is negative, the investment is unprofitable and should not be accepted.

Table 17 summarizes the NPV per acre for different interest rates and price levels under each yield scenario. Under yield scenario 1, the NPV is negative for all prices when the discount rate is 10% or 15%. With a discount rate of 5%, the NPV under yield scenario 1 is positive when price is $2.38 per pound. Under yield scenario 2, when using a discount rate of 5%, the NPV is positive when the price is $2.13 per pound or higher. Under yield scenario 2, when using a discount rate of 10% and 15%, the NPV is positive at the price level of $2.38 per pound. Under yield scenario 3, when using a discount rate of 5% or 10%, the NPV is positive when the price is $2.13 per pound or higher. When using a 15% discount rate, the NPV is positive under scenario 3 when price is at $2.38 per pound.

Conclusions

This article provides a summary of the enterprise budget developed for peach production in Florida. The budget represents an average operation and serves as an economic benchmark for growers. It is useful in providing estimates of expenses. When combined with market prices, it provides potential estimates of revenue and profit for a crop. Such information should be useful to current and potential peach growers for their decision-making processes.

Our findings show the initial investment required for a peach operation in Florida to be $6,457 per acre; the expense in land preparation and planting in year 1 is $2,541 per acre. Variable and fixed costs in years 2 through 15 average $5,680 per acre. As an example of profitability, when using a 10% discount rate, an operation yielding 6,525 pounds of marketable fruit per acre during its most productive years obtains a positive NPV when the average price is $2.38 per pound.

References

Olmstead, M., and K. Morgan. 2013. Orchard Establishment Budget for Peaches and Nectarines in Florida. HS1223. Gainesville: University of Florida Institute of Food and Agricultural Sciences. https://ufdc.ufl.edu/IR00009572/00001

United States Department of Agriculture, National Agricultural Statistics Service (USDA/NASS). 2016. Quick Statistics. Washington, DC (October).

Description of peach yield scenarios 1, 2, and 3 for the 15-year investment horizon of a 100-acre operation of peaches in Florida. The three scenarios include total marketable yield of 5.6, 6.5, and 7.3 thousand pounds per acre, respectively, in years 4 through 15.

Description of the calculation to obtain base packout rate and season-average base price for peaches grown in Florida, based on the within-season variation of volume harvested, packout rate, and price by month of the harvest season. Base rates are weighted averages by volume harvested.

Estimated annual fixed machinery costs for establishment for a 100-acre peach operation in Florida.

Estimated annual fixed and variable costs for establishment and maintenance of an irrigation and frost-protection system for a 100-acre peach operation in Florida.

First-year estimated establishment and maintenance cost per acre of a 100-acre peach operation in Florida.

Second-year estimated establishment and maintenance cost per acre of a 100-acre peach operation in Florida.

Third-year estimated establishment and maintenance cost per acre of a 100-acre peach operation in Florida.

Fourth-year to fifteenth-year estimated establishment and maintenance cost per acre of a 100-acre peach operation in Florida.

Estimated total marketable yield, harvesting and hauling costs, and marketing costs per acre for a 15-year horizon of a 100-acre peach operation in Florida for yield scenario 1 (assumes a total marketable yield of 5.6 thousand pounds per acre in years 4 through 15).

Estimated total marketable yield, harvesting and hauling costs, and marketing costs per acre for a 15-year horizon of a 100-acre peach operation in Florida for yield scenario 2 (assumes a total marketable yield of 6.5 thousand pounds per acre in years 4 through 15).

Estimated total marketable yield, harvesting and hauling costs, and marketing costs per acre for a 15-year horizon of a 100-acre peach operation in Florida for yield scenario 3 (assumes a total marketable yield of 7.3 thousand pounds per acre in years 4 through 15).

Estimated revenue per acre for different market price levels for a 15-year horizon of a 100-acre peach operation in Florida for yield scenario 1 (assumes a total marketable yield of 5.6 thousand pounds per acre in years 4 through 15).

Estimated revenue per acre for different market price levels for a 15-year horizon of a 100-acre peach operation in Florida for yield scenario 2 (assumes a total marketable yield of 6.5 thousand pounds per acre in years 4 through 15).

Estimated revenue per acre for different market price levels for a 15-year horizon of a 100-acre peach operation in Florida for yield scenario 3 (assumes a total marketable yield of 7.3 thousand pounds per acre in years 4 through 15).

Undiscounted annual cash flows per acre for different prices (dollars per pound) by yield scenarioa for a 15-year horizon of a 100-acre peach operation in Florida.

Undiscounted cumulative annual cash flows per acre for different prices (dollars per pound) by yield scenarioa for a 15-year horizon of a 100-acre peach operation in Florida.