Introduction

The citrus industry is a key contributor to the Florida economy. While Florida used to be the top citrus-producing state in the United States, Huanglongbing disease (HLB, more commonly referred to as citrus greening), a disease affecting and eventually killing citrus trees, has driven substantial acreage losses, which significantly reduced Florida’s citrus production in the past decade. Florida is still the largest producer of orange juice in the United States, although producers are facing great challenges in the domestic market. Recently, increasing amounts of orange juice imports have heightened challenges faced by the Florida orange juice industry. Higher production costs driven by efforts to combat citrus greening, and decreased production yield make it difficult for Florida growers to compete with imports. The share of Florida orange juice in the domestic market has decreased from nearly 90% during the 2010–11 season to less than 50% in the 2018–19 season (Florida Department of Citrus 2021). Meanwhile, the demand for orange juice over this period has decreased mostly because of changes in consumers’ preferences and breakfast habits (Heng et al. 2019). While sales of orange juice in the US have spiked during the first several months of the COVID pandemic, the spike in demand may not prove sustainable when the pandemic is past (Heng et al. 2020).

There is currently no cure for citrus greening, but both the Florida Department of Citrus (FDOC)and major citrus brands are making efforts to maintain or increase the demand fororange juice while waiting for the Florida supply to resume in the future. Generic advertising has been used to increase demand in a product category, and previous studies have shown that the generic advertising funded by the Florida Department of Citrus has effectively enhanced the demand for Florida orange juice (Brown and Lee 1997; Heng et al. 2019). Generic advertising and promotion activities conducted by the FDOC are funded under checkoff programs, which collect taxes from Florida growers and processors. However, as Florida growers have struggled with the HLB and losses of fruit, it has become difficult for growers to stay in the orange juice business and pay the checkoff taxes. Reflecting the struggle of local producers, the box taxes received by FDOC have decreased from 23 cents per box before 2015 to 7 cents per box in 2020. The decreases in per-box checkoff revenues, coupled with declining production volumes, have diminished the budget for advertising and promotion substantially over this period. To maintain an effective marketing agenda, some have questioned whether Florida growers should pursue a federal program which would require all orange juice growers and processors in the United States, to pay taxes to continue marketing orange juice. However, a federal program needs to promote orange juice in general instead of Florida orange juice. Many Florida producers worry that pursuing a federal program would weaken the “Florida” image in orange juice products and benefit consumption of orange juice generally, which would boost imported orange juice along with Florida’s orange juice. Therefore, it is essential for the industry to understand whether maintaining the “Florida” image associated with orange juice creates value in consumers’ perceptions. This study aims to provide the Florida citrus industry with timely information on the value of the “Florida” brand on orange juice products.

Consumer Survey

The University of Florida’s Florida Agricultural Marketing Research Center (UF/FAMRC) has designed and launched a national survey to understand consumers’ preferences and perceptions of orange juice and its ingredient origins. The survey targeted respondents who were at least 18 years old and the primary grocery shopper in the household. The survey aimed to collect information on respondents’ purchasing experiences, perceptions, and preferences about origins of orange juice, as well as social demographics.

Results

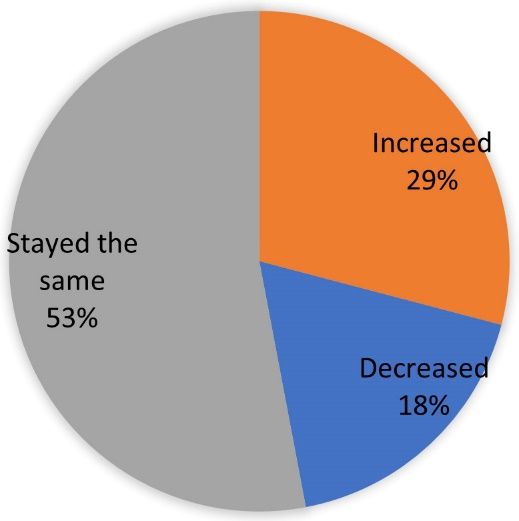

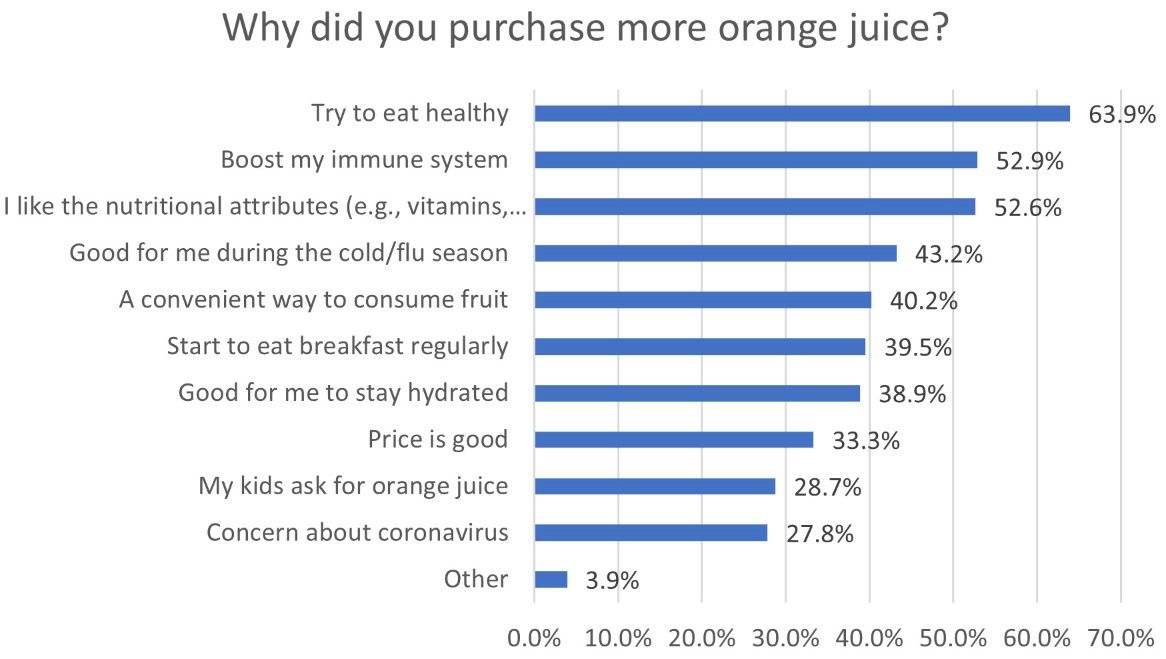

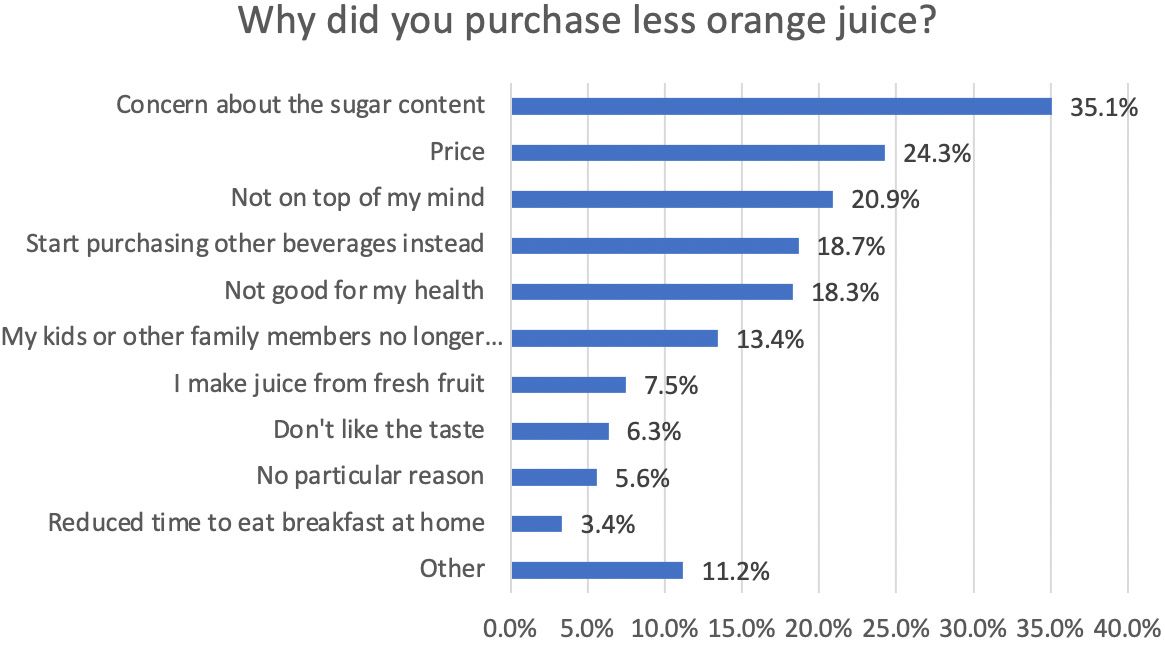

The survey was conducted in July 2020, and a final sample of 1,495 responses was collected. The sample demographics were comparable to the US population based on the recent American Community Survey 2019 (United States Census Bureau 2020). In the sample, 52.2% of the respondents reported that they purchased orange juice in the past 30 days. Since the survey was distributed during the first year of the pandemic and consumers’ buying behaviors could have been influenced (Heng et al. 2020), survey participants were asked about their orange juice purchases compared to the previous year. As shown in Figure 1, 53% of the respondents reported that their orange juice purchases stayed the same, 29% reported their orange juice purchases increased, and 18% reported their orange juice purchases decreased compared to the previous year. The top reasons for buying more orange juice include “Try to eat healthy,” “Boost my immune system,” and “I like the nutritional attributes” (see Figure 2). The top reasons for buying less orange juice include “Concern about the sugar content,” “Price,” and “Not on top of my mind” (see Figure 3). Overall, more respondents increased than decreased their orange juice purchases, with the key reason being “stay healthy.” Approximately 27.8% of the respondents who increased orange juice purchases reported that concern about coronavirus was one reason to buy more. While the pandemic might have changed consumers’ purchases of orange juice, there is no reason to expect this to change their preferences related to the origins of orange juice.

Credit: undefined

When asked about the key factors that went into their decision to purchase orange juice, respondents most often selected taste (50%), price (42%), and nutritional benefits (30%). About 20% of the respondents indicated that the origin of oranges used in the orange juice was one of the top factors considered in their orange juice purchase decision.

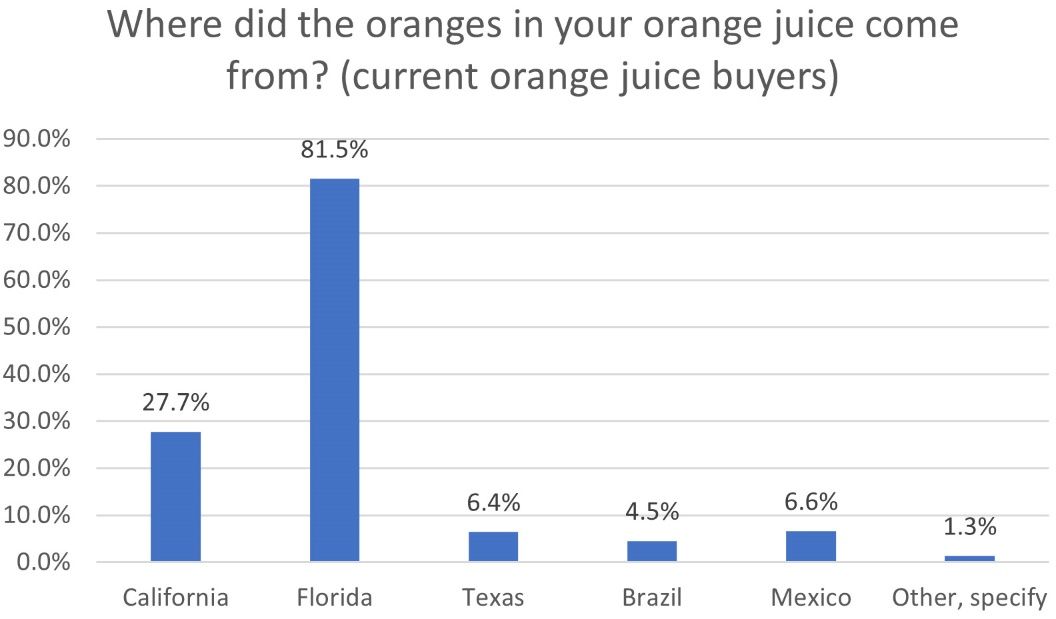

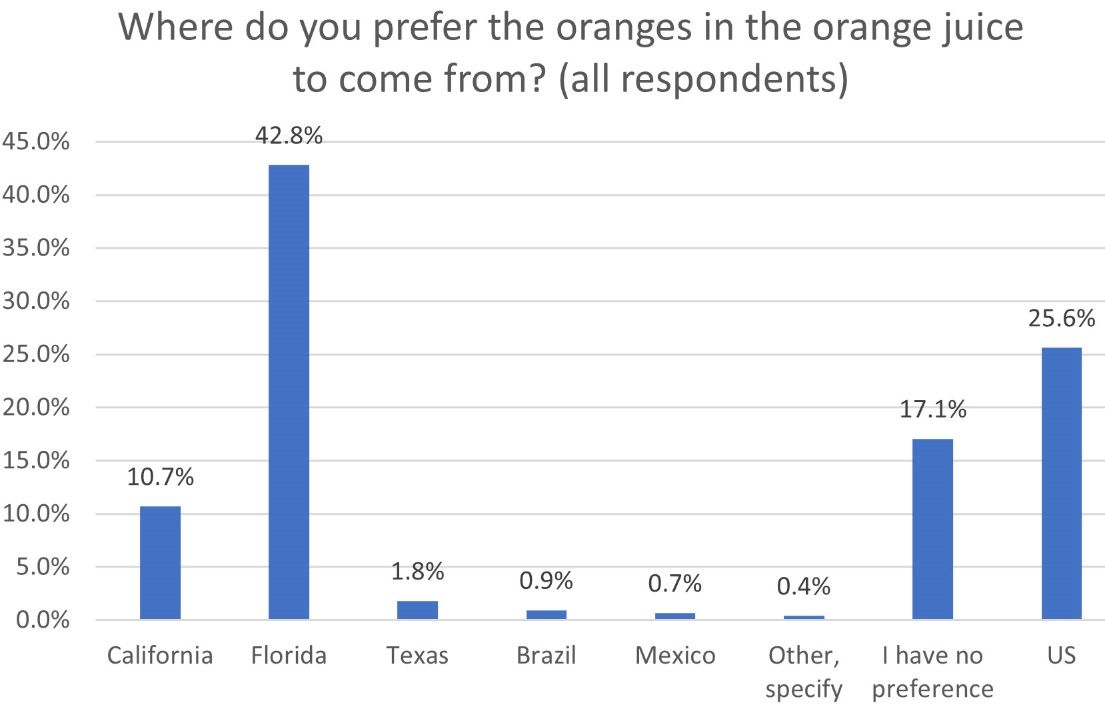

Among respondents who purchased orange juice in the past 30 days (52.2% of the sample), nearly 60% stated that they knew where the oranges in their orange juice came from, and over 80% believed the oranges in their orange juice came from Florida (Figure 4). When we asked all respondents about their preferences regarding the origins of oranges in the orange juice they purchased, 42.8% stated a preference for Florida, followed by the United States (25.6%), and no preference (17.1%) (see Figure 5). Results show that respondents show a much stronger preference for Florida orange juice over orange juice from other origins.

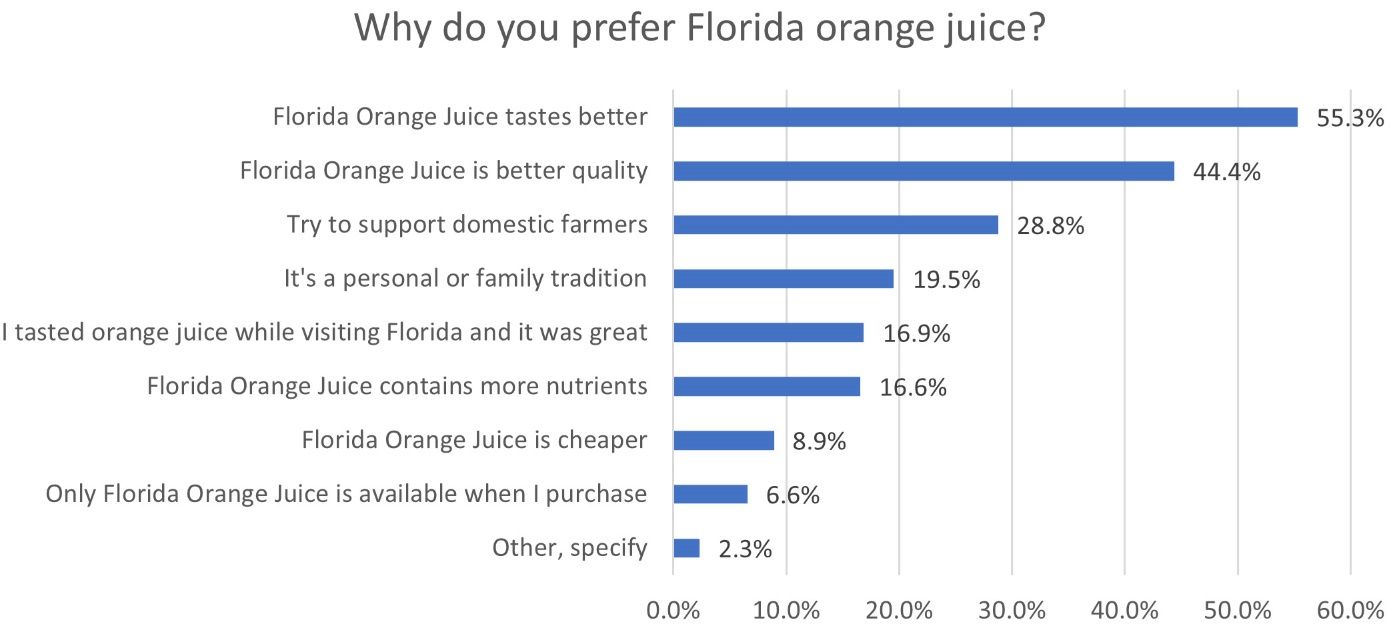

We further asked respondents who stated a preference for Florida orange juice why they preferred Florida (Figure 6). The top selections include “Florida orange juice tastes better,” “Florida orange juice is better quality,” and “Try to support domestic farmers.” Also, nearly 20% of respondents indicated that drinking Florida orange juice is a personal or family tradition. Overall, respondents held a superior perception of orange juice from Florida relative to orange juice from other origins.

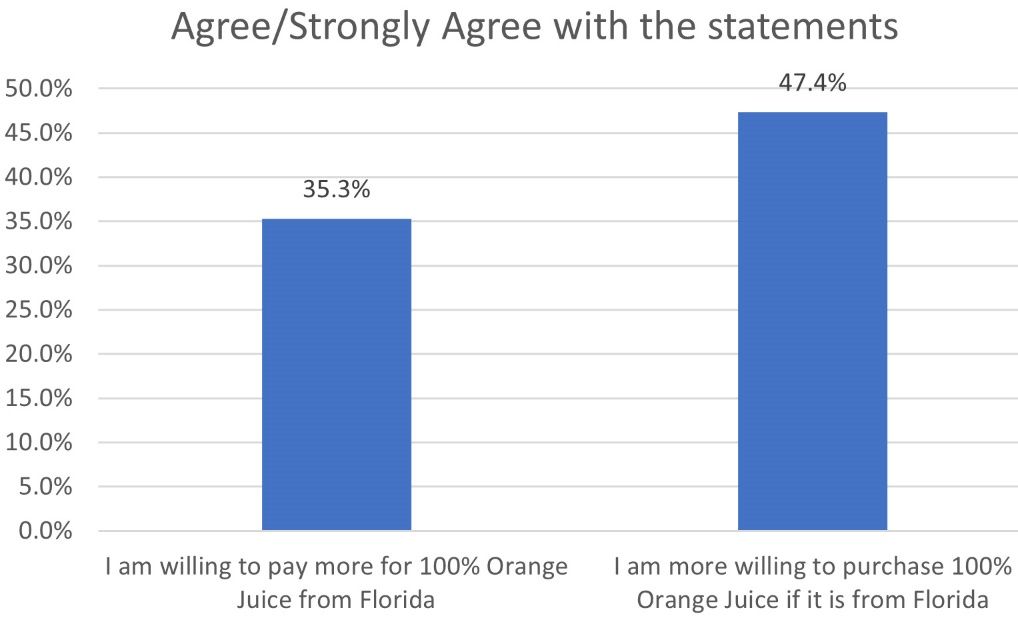

We also asked respondents questions about their willingness-to-buy and willingness-to-pay for Florida orange juice. For each statement, respondents were asked to select from 1 to 7 based on their agreement with the statement (where 1 was strongly disagree and 7 was strongly agree). We found that 47.4% of all the respondents strongly agreed (selected points 6 or 7 on the scale) that “I am more willing to purchase 100% orange juice if it is from Florida,” and 35.3% of all the respondents strongly agreed that “I am willing to pay more for 100% orange juice from Florida.” In addition, about 35.5% of respondents strongly agreed that “It is not acceptable if Florida orange juice is no longer available.”

Summary

The Florida citrus industry has faced many challenges in recent years. The reduced domestic supply due to citrus greening disease and competition from imports have put great pressure on Florida citrus producers. High production costs have placed Florida growers in a disadvantaged spot. It is essential for the industry and Florida growers to understand whether consumers have a superior perception of Florida-produced orange juice and value Florida orange juice more than orange juice produced in other states or countries.

In this study, we designed and launched a national survey to collect a representative sample of orange juice consumers. We found that Florida is the most preferred origin of oranges in orange juice, mostly for perceived better taste and quality, as well as to support domestic farmers. For current orange juice buyers, over 80% of respondents believed the oranges in their orange juice came from Florida, whereas the Florida share of the total orange juice available in the US market was just 56.3% in the 2019–20 season (Florida Department of Citrus 2021). Such results indicate the importance of informing people about the origin of their orange juice purchases, so Florida producers would benefit from these preferences indicated in this survey. Moreover, nearly half of all the respondents indicated that they are more willing to buy orange juice if it is from Florida, and about 35.3% of respondents are willing to pay more for orange juice if it is from Florida.

In summary, this study confirms that consumers have a superior perception of orange juice produced in Florida, and this perception could lead to higher rates of willingness-to-buy and willingness-to-pay for Florida orange juice. However, the orange juice products from Florida need to be clearly designated to benefit from this preference. Our results provide evidence for the value of the “Florida” product designation, and we suggest that the Florida industry and FDOC maintain and enhance the positive image of “Florida” in their marketing strategies to build upon identified consumers’ perceptions and preferences.

References

Florida Department of Citrus. 2021. Citrus Reference Book. Accessed on July 15, 2021. https://www.floridacitrus.org/grower/economic-market-resources/economic-reports/

Frown, M. G., and J. Y. Lee. 1997. “Incorporating Generic and Brand Advertising Effects in the Rotterdam Demand System.” International Journal of Advertising, 16 (3): 211–220.

Heng, Y., R. W. Ward, L. A. House, and M. Zansler. 2019. “Assessing Key Factors Influencing Orange Juice Demand in the Current US Market.” Agribusiness: An International Journal 35 (4): 501–515.

Heng, Y., M. Zansler, and L. House. 2020. “Orange Juice Consumers’ Response to the Covid-19 Pandemic.” FE1082. EDIS 2020 (4): 4. https://doi.org/10.32473/edis-fe1082-2020

United States Census Bureau. 2020. American Community Survey 2019. Accessed on July 15, 2021. https://data.census.gov/cedsci/table?d=ACS%201-Year%20Estimates%20Data%20Profiles&tid=ACSDP1Y2019.DP05