Credit: USDA ARS

Introduction

Mango (Mangifera Indica L.) is a member of the Anacardiaceae family and is native to the Indo-Burmese region in Southeast Asia. Mango can be grown in very diverse climatic conditions including tropical and subtropical regions. The largest mango producers in the world are India, Pakistan, Philippines, Mexico, and Thailand, respectively (Crane et. al. 2020). The United States has limited domestic mango production, with most of the commercial production taking place in California, Puerto Rico, Hawaii, and Florida (WIFSS 2016). The largest mango exporters to US markets are Mexico, Philippines, and Thailand.

Mangos were first successfully introduced in south Florida in 1889, when the USDA imported grafted trees from Bombay (Morton 1987). After World War II, the USDA was interested in significantly expanding Florida mango production. They invested in mango plantings and research conducted at the University of Florida and the University of Miami (Goldweber 1967). However, because of several factors such as poor marketing, quality issues, and foreign competition, the Florida mango industry never took off.

In Florida, commercial mango production takes place in the southern part of the state, specifically Miami-Dade, Lee, and Palm Beach Counties, where 2672 acres are dedicated to crop according to the 2017 agricultural census (USDA-NSS 2018). There are two major types of mangos grown in Florida, Indian, and Indochinese (Crane et. al. 2020). Florida’s mono-embryonic varieties are primarily derived from the Indian type, and the poly-embryonic varieties from Indochinese type (Mossler and Crane 2013). In Florida, the harvest season extends from May to September, and average yield for a mature tree (5 years and older) ranges from 220 to 330 pounds, depending on the cultivar, planting density, and cultural practices employed (Crane et. al. 2020).

Traditional commercial mango varieties grown in south Florida include ‘Tommy Atkins’, ‘Keitt’, ‘Palmer’, ‘Van Dyke’, and ‘Kent’. A diversity of mango cultivars has started to be grown on a small to moderate scale that address the green, home processed, and high quality unique-flavored fresh fruit markets. With an average planting density of 80 trees per acre, there are approximately 213,760 trees in south Florida. Based on the previous assumptions (average tree yield of 275 lb., and 213,760 trees), mango production in Florida may reach an estimated 58.8 million pounds annually. Growers reported an 85% average pack out rate and an average F.O.B. price (price leaving the packinghouse) of $0.41/pound. Therefore, the crop is estimated to be worth about $20.49 million. However, potential exists for this market to grow as internet sales have become a viable and potentially lucrative alternative to the traditional outlets.

Because of the growing interest in the profitability of alternative tropical fruit crops like mango, this publication provides an estimate of the costs and returns associated with an established mango orchard in south Florida. Information in this publication will be useful to current and future mango growers, wholesalers, and processors. The data for this analysis were collected through field interviews in 2017 with several growers and industry specialists, and thus the analysis covers a wide range of production practices. The growers interviewed operate small mango groves ranging from 3 to 6 acres. This publication is intended only as a guide to estimate the financial aspects of operating an established mango grove. Readers interested in specific information about the cultural practices of mango may want to consult Mango Growing in the Florida Home Landscape.

Main Assumptions

The estimates included in this analysis are based on a one-acre orchard (on a per-year basis). Because of the wide variability in cultural practices followed by the interviewed growers, we reported an average of their costs and returns for this analysis.

Orchard Layout — For this analysis, we assumed mango trees are planted 15-20 feet apart within rows and 27.5 feet between rows, resulting in a planting density of 80 trees per acre.

Yield —Assuming a planting density of 80 trees per acre, an average yield from a matured tree (5 years and older) of about 275 pounds, and a fruit pack-out rate of 85%, the average marketable yield would be about 18,700 pounds per acre per year.

Mango Prices — The average F.O.B. (Homestead) price for mango is estimated at $0.41 per pound. This value is the simple average of the prices that the growers interviewed received from the packing houses in 2017 after subtracting harvest and marketing costs.

Irrigation —Supplemental irrigations during very prolonged dry periods are beneficial to plant growth and crop yields (Crane et. al. 2020). Average irrigation expense, which is comprised of fuel or electricity cost, is estimated at $99/acre/year.

Fertilization — Fertilizer treatments for full-production trees (5 years or older) include applications of 6-6-6-2 percent fertilizer containing nitrogen, phosphate, potash, magnesium (N-P-K-Mg), soil drench applications of chelated iron, and minor element foliar sprays (Crane et. al. 2020). Average fertilization costs (materials only) are estimated at $415/acre/year.

Pest Management — There are no major diseases affecting mangoes in south Florida. There are some fungal diseases that may cause minor damage in mangoes, including powdery mildew (Oidium sp.), and anthracnose (Colletotrichum gloeosporioides). Weed management practices include herbicide applications, hand weeding, and mulching. Mangoes have relatively few insect pests, including several scale species such as pyriform scales and the Florida red scale (Crane et. al. 2020). Average agrochemical costs (materials only) are estimated to be $200/acre/year for fungicides, $122/acre/year for herbicides, and $110/acre/year for insecticides.

Labor Costs — These costs include the application of fertilizers, agrochemicals, and other cultural operations costs like irrigation, pruning, mowing, and other activities. Labor costs are estimated to be $400/acre/year.

Interest on Operating Capital — This cost is for borrowing money or the opportunity cost for using equity. In this analysis, we used a 5% interest rate, which would translate into the cost of interest on operating capital of $67/year.

Fixed Costs — These costs are incurred by the growers even if no fruit is produced. They include cash overhead, non-cash overhead, and other overhead costs. The cash overhead costs (e.g., insurance and taxes) are estimated to be $200 per acre; non-cash overhead costs (e.g., land rent) are estimated to be about $500 per acre. Although nearly all the south Florida growers own the land for the orchards they manage, we included the prevailing rental rate in south Florida to estimate the opportunity cost for the land occupied by the orchard. Other overhead costs (e.g., the depreciation of tractors, sprayers, and other machinery; electricity; and telephone, computer, and other office expenses) are estimated at $400 per acre.

Harvesting and Marketing Costs — The Florida mango season runs from May to September, but the main fruit-bearing period varies with the cultivar. For example, for the ‘Keitt’ cultivar, the harvest season is from August through September, and for the ‘Florigon’ cultivar, the harvest season is from May to July (Crane et. al. 2020). The cost for picking, packing, and marketing mango is estimated to be $667/acre/year.

Cost Analysis

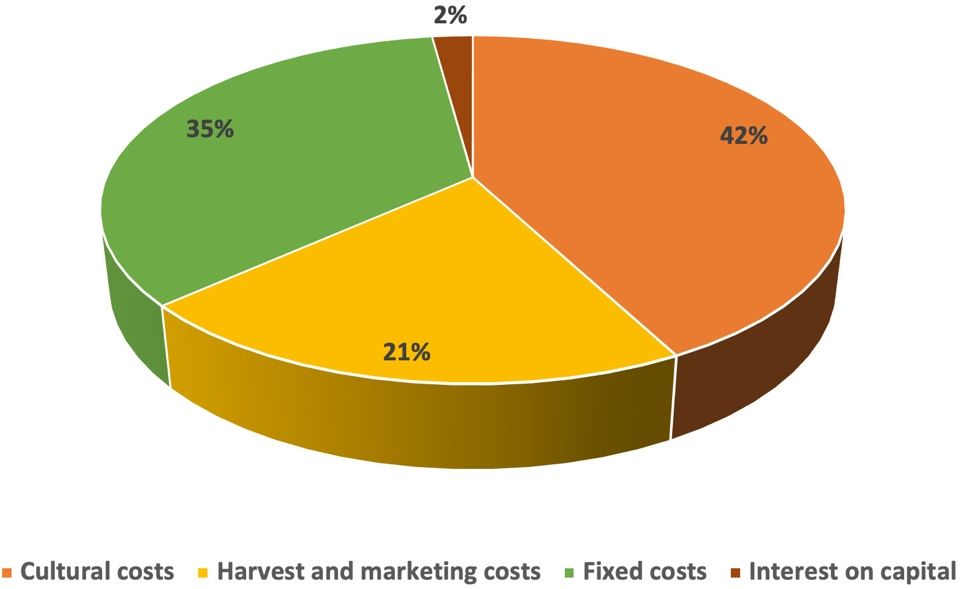

Figure 2 illustrates the share of each of the costs by category. Cultural costs (variable costs for hired labor, irrigation, fertilization, and pest control) are estimated to be 42% of the total cost; followed by fixed or overhead costs accounting for 35% of total cost; then harvest and marketing costs, which constitute 21% of the total cost; and finally interest on capital, which constitutes 2% of the total cost.

Credit: UF/IFAS

Cultural Costs — The major components of these costs are fertilizers (29%), labor (28%), fungicides (14%), and herbicides (9%). These costs are estimated to be $1,413 (about $0.08 per pound).

Fixed Costs — These costs, including the land rental rate, are estimated to be $1100/acre/year ($0.06/pound).

Harvest and Marketing Costs — These include costs associated with picking, packing, and marketing of the fruit. They represent 21% of the total production cost. Mangos are generally picked at maturity. The fruit is considered matured when the shoulders and the nose (the end of the fruit away from the stem) of the fruit broaden (fill out). Varieties that have color when ripe may have a slight blush of color development, or they may have begun to change color from green to yellow. Prior to this peel color break, the fruit is considered mature when the flesh near the seed changes color from white to yellow. (Crane et. al. 2020). Harvest and marketing costs are estimated to be $667/acre/year ($0.04/pound).

Returns and Profitability Analysis

Table 1 shows that the total cost to produce and market one acre of mango is estimated to be $3,180/acre/year ($0.17/pound). Based on an average marketable yield of 18,700 pounds/acre and an average F.O.B Homestead price (at the packinghouse) of $0.41/pound, the total receipt or gross revenue is estimated to be $7,667/acre/year.

Subtracting total variable costs (total cultural costs, interest on capital, and harvesting and marketing cost) from total revenue, we obtain a gross margin of $5,587/acre/year, or $0.30/pound. The gross margin provides a useful indicator of short-term profitability. A positive gross margin implies that all variable costs have been covered by the income generated and that additional funds remain to cover some or all fixed costs.

A negative gross margin implies that a business is not viable in the short term, and changes are required to continue operations. Many growers are only concerned with the gross margin. However, while the gross margin provides an indication of return for the grower, it does not include fixed costs and, hence, is not a true reflection of the long-term financial viability of the farm.

Net return is obtained by subtracting the fixed cost from the gross margin, and it is used to measure the long-term profitability of the farming operation. The data in table 1 show that the net return for an established mango orchard is $4,487/acre/year or $0.24/pound, which is an attractive net return compared to other tropical fruit crops in the area.

Table 1. Estimated annual return per acre from mango production in south Florida.

Sensitivity Analysis

Table 2 presents a sensitivity analysis based on gross margin (gross profit), which considers the short-term economic viability of a commercial mango operation. Under the best-case scenario, where both price and yield are assumed to increase by 10%, the gross margin would increase from $5,587/acre to $7,176/acre. Under the worst-case scenario, where both price and yield decrease by 10%, gross margin would decrease from $5,587/acre to $4,147/acre. Changes in yield (keeping the price constant) have a slightly larger impact on gross margin than price changes (keeping yield constant). A 5% increase in yield (base price, $0.41/pound) has a larger impact on gross margin than a 5% increase in the base price (base yield, 18,600 pound). The 5% increase in yield would create an increase in the gross margin of $383, while an increase in the base price would mean that the gross margin would increase by $374. As a reminder, fixed costs are not considered when estimating the gross margin (gross profit).

Table 2. Sensitivity analysis of gross margin per acre for mangos grown in south Florida.

Table 3 presents a similar analysis on the net returns per acre. Under the best-case scenario, where both price and yield are assumed to increase by 10%, net return would increase from $4,487/acre to $6,076/acre. Under the worst-case scenario, where both price and yield are assumed to decrease by 10%, net return would decrease from $4,487/acre to $3,047/acre. Other combinations of changes of prices and yields and their impact on net return per acre are shown in table 3. Yield and price changes can be interpreted in a similar manner to those presented in table 2.

Table 3. Sensitivity analysis of net returns per acre for mangos grown in south Florida.

Conclusions

The average net return obtained from an established mango grove in south Florida is about $4,487/acre, or $0.24/pound. The profitability of mangos in comparison to other cultivated crops makes this tropical fruit crop an attractive option. Some caution is needed because this analysis only considers the profitability of an established grove. We do not consider the cost of establishing a new mango grove, which includes land acquisition and development, planting costs, and amortized capital costs, keeping in mind that it will be 3 to 5 years before any appreciable crop is harvested (Crane et al. 2020). If the land-establishment and financing costs were to be incorporated in the analysis, then net return estimates would change substantially. Thus, caution is needed when using this analysis to make decisions on establishing a new orchard. Another important consideration is that any significant increases in production may lead to market saturation and downward pressure on prices.

Another consideration that mango growers need to recognize is that, although mangos are quite a profitable crop, they are also an alternate bearing crop. Additionally, some of the Florida’s commercial mango varieties are susceptible to anthracnose disease (Crane et. al. 2020). In order for south Florida orchards to remain productive and profitable, growers should replant mango orchards with anthracnose-resistant and high-yield cultivars like ‘Van Dyke’ and ‘Keitt’ when feasible to do so. UF/IFAS Extension also recommends that growers implement best management practices including fruit thinning and pruning, which help to offset the tendency of alternate bearing.

References

Crane, J. H., C. F. Balerdi and I. Maguire.2020. Mango Growing in the Florida Home Landscape.” HS2/MG216. EDIS 2006 (18). https://doi.org/10.32473/edis-mg216-2006

Goldweber, S. 1967. “Thoughts on the Florida Mango Industry.” Proceedings of the Florida State Horticultural Society. 80:384–387.

Morton, J. 1987. “Mango.” p. 221–239. In Fruits of warm climates. Miami, FL. https://www.hort.purdue.edu/newcrop/morton/mango_ars.html

Mossler, M., and J. H. Crane. 2009. “Florida Crop/Pest Management Profile: Mango.” CIR1401/PI052. EDIS 2009 (10) https://doi.org/10.32473/edis-pi052-2009

United States Department of Agriculture - National Agricultural Statistics Service (USDA-NASS). 2018. 2017 Census - State Data. Florida Table 37. https://www.nass.usda.gov/Publications/AgCensus/2017/Full_Report/Volume_1,_Chapter_1_State_Level/Florida/st12_1_0037_0037.pdf

Western Institute for Food Safety and Security (WIFSS) University of California-Davis. 2016. Mangoes. https://www.wifss.ucdavis.edu/wp-content/uploads/2016/10/Mangos_PDF.pdf