Introduction

The organic food industry is one of the fastest growing sectors of US agriculture. Consumer demand for organic food has continued to grow at a steady pace of 20% or more annually since the 1990s. About 73% of conventional grocery stores and 100% of natural food stores carry organic products, accounting for approximately 2.5% of total food sales in the United States (Organic Trade Association 2006). The demand for organic produce is increasing faster than supply, resulting in expanding trade gaps between imports and exports (Willer and Yussefi 2008). The organic sector of the US agricultural system is demanding increased attention from producers, retailers, consumers, and policy makers interested in environmental and health issues within the food system.

Credit: linetic/iStock/Thinkstock.com

Organic sales are growing at a rate similar to the national market of 20% a year (Dimitri and Green 2003). Organic fresh market produce is sold in 73% of the conventional markets, including regional and national chains (Dimitri and Green 2003). Conventional markets in Florida source organic fruits and vegetables from as far away as California (Blumenthal 2007). For many operators of small, diversified, family-owned farms, the income generated from sales of certified organic products contributes to financial security (Hodges, Rahmani, and Stevens 2013).

In addition to growing demand for organic products, Florida organic producers clearly have stated a need for additional information on organic production. Organic production programs led by UF/IFAS faculty at field days and workshops attract attendees statewide. These growers and other industry stakeholders have expressed a need for Internet accessibility as well as printed publications on organic production topics specific to Florida conditions.

The objective of this document is to deliver a reliable overview of the organic industry in Florida. This information includes the definition of organic and the standards required for organic certification. It also provides a summary of the current situation and trends affecting Florida organic producers by identifying the structure of organic farming in Florida, organic processors in Florida, the environmental impacts on organic production, and direct market outlets for organic products. This document concludes with a discussion of the major market outlets for organic products, and the advantages and disadvantages of each outlet.

Organics—Defined

For a food to qualify as organic, it must meet the standards of the United States Department of Agriculture's (USDA) National Organic Program standards, which were first implemented in 2002. Organic food is defined by the production practices that cannot be used. According to the USDA/AMS (2019; https://www.ams.usda.gov/about-ams/programs-offices/national-organic-program), organic foods are produced without using most conventional pesticides, synthetic fertilizers, or sewage sludge, and these foods are processed without using ionizing radiation. Production of organic foods must be free from genetically modified organisms. Organic poultry, eggs, meat, and dairy products must come from animals that were given no antibiotics or growth hormones.

In addition, a public or private organization must verify whether a certified organic grower or processor meets or exceeds the defined organic standards (USDA/AMS 2019). These standards include:

Prior to certification, the land must be free of prohibited substances for three years.

A certifying agency annually inspects farm/processor operations.

Farmers and processors must keep detailed records of organic practices.

All farmers and handlers are required to maintain a written organic management plan.

When farmers have complied with these standards, they can label their products as having met organic standards in Florida using the Quality Certification Services Label (http://www.qcsinfo.org).

Florida Organic Farms

Florida's population is expected to reach 25 million by the year 2025. With decreasing available farmland, agricultural land prices have increased by 50%–88% across the state (Reynolds 2006). In 2014, there were more than 47,000 commercial farms (organic and non-organic) in Florida (USDA/NASS 2014).

US census data from 2002 and informally validated data using a Florida Organic Growers and Consumers (FOG) survey instrument estimated Florida organic acreage at 12,000 acres, with sales at $4 million in 2002 (Austin and Chase 2003).

While a number of larger organic operations and numerous small farms have entered the market in Florida since 2002, the number of certified organic farming operations in this state remains small. The lack of volume output from certified farms, along with the global import market, puts Florida organic farmers at a disadvantage. Because large buyers import agricultural products from regions around the world, Florida organic farmers need to work together to become more competitive in indirect markets.

Structure of Florida Organic Farms

According to the Florida Organic Farms (FOG) 2002 Survey of Certified Organic Agriculture in Florida, certified Florida organic growers reported sales increases of 21% between 2001 and 2002, which is consistent with the national organic growth rate. However, specific sales ranged from a decrease in sales of 77% to an increase of 459% over that period (Austin and Chase 2003). Most growers' sales were in local and Florida-based markets. The most common business organization for growers was sole proprietorship (63.5% of all grower respondents), followed by corporations (29.2%) and partnerships (7.3%). The Florida Organic Farms website is http://www.foginfo.org/.

The FOG survey reports a diverse array of crops and a wide range of acreage under production. These crops include vegetables, sprouts, citrus, hay, microgreens, pasture, blueberries, tropical fruits, chestnuts, herbs, and edible flowers (Austin and Chase 2003). Acreage under production varies, ranging from 1 acre to 52 acres. The average size is 15 acres. In addition to their primary crop, most growers cultivate and produce a number of secondary crops, including conventional crops.

Table 1 is a summary of the crops produced by farmers and the acreage in crop production. The number one category in production is vegetables (almost 25% of total acreage), followed by non-citrus fruits and citrus fruits. Most farmers grow multiple organic crops, with organic vegetables as the primary crop (38%).

Organic Processors in Florida

Organic processors are certified organic operators that handle, package, and process organic agricultural products (Austin and Chase 2003). Most organic processors (67%) in Florida are corporations that are involved in processing organic juices. All organic processors are certified organic operators, but only 16% of all certified organic operators in Florida are organic processors (Austin and Chase 2003). In 2002, processors reported total sales of $4.9 million, a 53.5% growth since 2001. Sales for organic processors were mainly in national and international markets, accounting for 89% of total sales.

Environmental Impacts

The increasing population in Florida stimulates development throughout the state, which affects natural resources and contributes to environmental degradation. Organic farming could help ease the environmental pressure on Florida's ecosystems by promoting natural food production. Restrictions on using pesticides and herbicides promote diverse populations of plants, insects, and other animals (Macilwain 2004). Organic production uses less energy and produces minimal wastes compared to conventional farming. A study at Washington State University found that energy consumed by machinery, labor, and production control to grow organic apples is 7% more energy efficient than conventional apple production (Macilwain 2004). Studies also found that organic farms generate less carbon dioxide and, in theory, produce less nitrous oxide that is associated with acid rain (Macilwain 2004). The key environmental goal of organic farming is the long-term sustainability of the system.

There are opportunities associated with safe environmental practices and organic production that Florida producers could use to their advantage. One important aspect is utilizing these benefits to favorably position products in markets. Other aspects include knowledge of Florida's ecological terrain and adjusting production practices to suit land type.

Table 2 compares the different land types, precipitation, soil type/drainage, and temperature range for Florida, California, Colorado, Illinois, and New York. Because each region differs in conditions and land types, what works for one region may not work for another region. Chris Bell (2008) founder of InterNatural Marketing, an organic marketer in Lake Worth, Florida, said that one issue affecting organic production in Florida is humidity. Disease pressure is a much larger problem in humid climates and in climates that are not subject to freezing temperatures. To optimize organic production, Florida organic producers must learn how to utilize and make the most of their land. Organic production is dependent on crop rotation. Small, diversified farms in particular must undertake considerable planning to make the most efficient use of their land.

Market Outlets for Florida Organic Produce

Marketing decisions have a direct and substantial impact on the success or failure of organic producers. These decisions include determining the most marketable varieties to produce and deciding how to deliver high quality fruits and vegetables to consumers at a profit (Sustainable Production Systems 2002). To be effective, marketing alternatives must be considered before production takes place. Organic producers in Florida have several marketing alternatives. Each alternative has unique characteristics that can be beneficial to different types of producers.

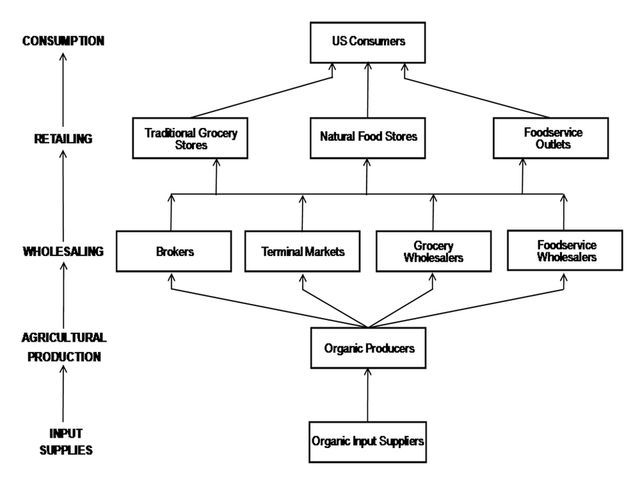

Organic producers have two classifications of marketing channels to consider—direct markets and indirect markets. Knowing the advantages and disadvantages of each allows producers to make wiser decisions for their companies. Direct markets are based on one-on-one interactions between producers and consumers. For example, organic producers could sell products directly to consumers, with no middlemen being involved. Types of direct markets include farmers markets, roadside stands, pick-your-own operations, and Community Supported Agriculture (CSA) partnerships. Indirect markets are based on market intermediaries that connect producers with consumers. Types of indirect markets include brokers, terminal market firms, and retail outlets (grocery and foodservice operations). The primary channels for organic products at this time are direct markets, but indirect outlets help organic producers reach more consumers (Sustainable Production Systems 2002).

Direct Market Outlets

There are many advantages and disadvantages associated with direct markets. This approach normally benefits both producers and consumers because producers receive larger profits while consumers save money by purchasing premium organic products at competitive prices. Furthermore, it encourages bonding within communities and strengthens relationships by providing social settings for interaction between producers and consumers. It gives producers the opportunity to educate customers about organic foods and helps cultivate long-term relationships between with producers and consumers.

Opportunities in direct marketing to receive higher net returns also have disadvantages. More time, effort, and knowledge are required from producers to produce organic foods. In addition, it is essential for producers to develop positive customer relations skills in dealing with a wide range of customers. Establishing a positive image and goodwill with customers should be a top priority for producers using direct marketing.

Farmers' Markets

The most popular form of direct market outlets are farmers markets where a designated place is established for local organic producers to congregate to sell their products directly to consumers. Farmers' markets provide consumers a reliable source of organic products on a seasonal basis throughout Florida. These markets afford organic producers the opportunity to work together to increase profits and to facilitate growth in the industry. Members share costs for insurance, advertising, and marketing. The main challenge for farmers is that minimal stall rentals are on an annual basis versus a time-limited basis.

Roadside Stands

Roadside stands are direct market outlets that involve producers setting up businesses by a major roadway to sell organic products directly to consumers. Roadside stands offer producers flexibility in operation hours and can be used to dispose of extra volume. Challenges that roadside stands face are establishing and retaining customers along with providing consistent quality and availability of goods.

Pick-Your-Own Operations

Pick-your-own operations are direct market outlets that let consumers harvest (hand pick) their fruits and vegetables straight from the farm. This type of channel encourages agri-tourism, which creates more value for farmlands and increases profits. To be successful, producers should provide a variety of high quality produce and invest in advertising and promotions to attract consumers. Challenges for this type of operation include accident liability, advertising costs, and customer supervision to prevent damage to plants or property. Operators of pick-your-own operations should take extra measures to ensure customer safety. Properties need to be consumer-friendly, including adequate parking and accessibility. Rules for using the property should be posted onsite for customers.

Community Supported Agriculture

A relatively new and growing trend in direct sales is Community Supported Agriculture (CSA), a socioeconomic model of cooperative partnership and broadly adopted by US producers during the early 1990s. Many of Florida's CSAs are listed on the Local Harvest website (http://www.localharvest.org). Largely based on trust and mutual support, producers sell annual memberships, or shares of their products, based on their seasonal harvestable yield projections. One share is typically enough food to feed a family of four. Customers receive their portions of the harvest weekly at designated drop-off locations and times. The producers benefit by receiving a cash flow at the beginning of the season when funds for production costs (e.g., seeds, fertilizer, labor, etc.) are critical. This enables many small, diversified farms to stay in business. Consumers benefit by receiving a diverse array of fresh fruits and vegetables along with other products, such as honey, throughout the season.

Indirect Markets

When choosing an indirect market (e.g., brokers, terminal market firms, and retail outlets), the most important factors to consider are consumers' needs and requirements, and organic producers' abilities to meet consumers' needs and requirements (Sustainable Production Systems 2002). It is important for organic producers to pay close attention to product varieties, grades, quantity, and packaging demanded by consumers, as the requirements of indirect markets vary. With the rising global demand for organic foods, utilizing indirect marketing channels with the capacity of reaching multiple markets may provide new financial opportunities for organic farming operations. Using indirect markets for sending products abroad means meeting the organic standards set by the receiving countries and providing evidence of organic certification, so it is important to select a certifying agency with experience in international markets. Figure 1 is an example of a flow chart for indirect markets.

Brokers

Organic producers sometimes utilize brokers that specialize in organic products, such as InterNatural Marketing (http://www.internaturalmarketing.com/home.html) and Global Organic Specialty Source, Inc. (http://www.globalorganics.ws/). Brokers are individuals or firms that connect sellers with buyers by negotiating sales contracts for the parties involved. They usually do not take title or possession of the products and are not responsible if contracts between sellers and buyers fail. While brokers provide professional sales services and they have access to large numbers of buyers, they require a large volume of products, and their fees are directly associated with product volume. Responsibilities of product delivery and quality still fall on producers.

Terminal Markets

Terminal markets are hubs of buying, selling, and distributing fruit, vegetables, and herbs and are usually located in large metropolitan areas. Producers can utilize terminal markets to sell large volumes of organic products to wholesalers and local chain stores. These buyers then redistribute products to local markets. Examples of terminal markets in Florida include the Pompano State Farmers' Market, the Miami Produce Center, and the Jacksonville Produce Terminal.

Unfavorable aspects of terminal markets include the need for consistency of high quality and timely delivery of a large volume of products, and less control of the market situation.

Retail Outlets

Retail outlets comprise another portion of the indirect market. One type of retail outlet in Florida is the organic-themed retail operations that sell directly to consumers through small, independent grocery stores or via large, grocery chains such as Whole Foods, Inc. and Greenwise (Publix). The most accessible grocery markets are the small independent grocery stores. Another type of retail outlet is foodservice operations that allow producers to sell directly to restaurants or through foodservice distributors such as FreshPoint (http://www.freshpoint.com/). Retail outlets often require frequent deliveries of a variety of products. Quality and packaging requirements, prices, and delivery times are flexible. To succeed in this market, producers must interact with their buyers on a daily basis and reduce delivery costs in the process (Sustainable Production Systems 2002). Retail outlets that process organic food products in any way, including washing, cutting, and/or repackaging, must obtain organic certification.

Conclusion

Sales of organic products in the United States have been increasing, and economists project that this trend will continue to increase. To secure a position in the organic food market, producers must find ways to innovate and deliver quality products. Understanding the trends affecting the Florida organic food market will help producers make strategic plans based on market conditions and producer abilities. Farm production and inputs are dependent on the structure of organic farm and processor operations, the type of products produced, and the environment. Knowing which markets to target, and when and how to target them, will optimize production and profits in the organic foods segment.

References

Austin, J. and R. Chase. 2003. 2002 Survey of certified organic agriculture in Florida. Gainesville, FL: Florida Certified Organic Growers and Consumers, Inc.

Bell, C. 2007. President of InterNatural Marketing. Personal communication. Lake Worth, FL: InterNatural Marketing. https://www.internaturalmarketing.com/

Blumenthal, M. 2007. President of Global Organic. Personal communication. Sarasota, FL: Global Organic. https://www.global-organics.com/index.php.

Dimitri, C. and C. Green. 2002. Recent growth patterns in the U.S. Organic foods market. Agriculture Information Bulletin No. AIB777. Washington, DC: United States Department of Agriculture, Economic Research Service. https://www.ers.usda.gov/publications/pub-details/?pubid=42456

Duram, L. (2006). "Organic farmers in the US: opportunities, realities and barriers." Crop Management 10:1094.

Hodges, A., M. Rahmani, and T. Stevens. 2013. Economic Contributions of Agriculture, Natural Resources, and Related Food Industries in Florida in 2012. FE954. Gainesville: University of Florida Institute of Food and Agricultural Sciences. https://edis.ifas.ufl.edu/fe954

Kortbech-Olesen, R. 2002. The United States market for organic food and beverages. Geneva: World Trade Organization.

Macilwain, C. 2004. "Organic FAQs (Is organic farming better for the environment?)." Nature Journal 428:796-798. http://www.nature.com/nature/journal/v428/n6985/full/428796a.html

Organic Trade Association. 2006. OTA's 2006 manufacturer survey. Greenfield, MA: Organic Trade Association. http://www.ota.com/pics/documents/short%20overview%20MMS.pdf

Quality Certification Services (2006). QCS website. http://www.qcsinfo.org/

Reynolds, J.E. 2006. Strong Nonagricultural Demand Keeps Agricultural Land Values Increasing (2005). FE625. Gainesville: University of Florida Institute of Food and Agricultural Sciences. https://edis.ifas.ufl.edu/FE625

Sustainable Production Systems. 2019. Marketing alternatives for Texas organic fruit and vegetable growers. College Station, TX: Texas A&M Cooperative Extension, Texas A&M University. https://aggie-horticulture.tamu.edu/vegetable/guides/guide-to-marketing-organic-produce/marketing-alternatives/

USDA/AMS. 2019. National Organic Program. Washington, DC: United States Department of Agriculture, Agricultural Marketing Service, National Organic Program. https://www.ams.usda.gov/about-ams/programs-offices/national-organic-program

USDA/NASS. 2015. Florida state agriculture overview – 2014. Washington, DC: United States Department of Agriculture, National Agricultural Statistics. http://www.nass.usda.gov/Quick_Stats/Ag_Overview/stateOverview.php?state=FLORIDA

Willer, H. and M. Yussefi. 2008. The world of organic agriculture: statistics and emerging trends 2007. Bonn, Germany: International Federation of Organic Agriculture Movements (IFOAM).