Introduction

Papaya is produced in about 60 countries, with the vast majority being grown in developing economies. There are two main types of papaya cultivated: small-sized (aka Hawaiian papayas) and large-sized (aka Mexican papayas). Among the small-sized papayas, the Solo-type is the most widely known; it originated in Barbados and was later taken to Hawaii, where it became one of the flagship export products from Hawaii, and thus the title "Hawaiian" papayas. Maradol is the best known papaya cultivar among the large-sized (Mexican) papayas; it originated in Cuba as the result of a long breeding process. Because of its special taste, this particular cultivar was rapidly adopted in many regions.

Global papaya production reached 11.22 million (M) metric tonnes (t) in 2010, with an annualized growth rate of about 5 percent since 2000. Production in 2010 was 7.26 percent higher than the previous year and 63.67 percent above the 2000 crop. Asia is the leading papaya producing region, accounting for 52.55 percent of the world production during the 2008–2010 period, followed by South America (23.09%), Africa (13.16%), Central America and the Caribbean (10.94%), North America (0.14%), and Oceania (0.13%) (FAOSTAT 2012). The main papaya producing countries are India, Brazil, Indonesia, Nigeria, and Mexico. The top two producing countries accounted for more than 55 percent of global papaya production during 2008–2010.

Gaining in popularity worldwide, papaya is now ranked as the third most traded tropical fruit (excluding bananas), behind mangoes and pineapples. In volume, world exports of fresh papayas exceeded 279,000 t in 2009, with a market value of $197 million. Despite a long-term upward trend in exports, papaya has a low export ratio, with less than 3 percent of global papaya production traded internationally, compared to 25 percent and 11 percent for bananas and apples, respectively.

Global imports of papayas reached an estimated 268,476 t in 2009. The United States is by far the largest papaya importer, absorbing more than half of the global imports between 2007 and 2009 (FAOSTAT 2012). Other significant importers are Singapore, Canada, the Netherlands, and the United Kingdom. Together these four countries account for an additional 21 percent of total global imports.

The United States is not considered a major papaya producer although there is the potential to increase production. Total papaya production in the United States is close to 14,000 t annually. However, with per capita consumption of the fruit on the upswing and recent advances in the development of papaya cultivars tolerant to the Papaya Ring Spot Virus (PRSV), many growers in South Florida are taking a second look at the prospect of producing papaya for the domestic market.

The objective of this article is to provide information on domestic trends in the production and trade of fresh papaya in the United States. An overview of the current and future trends of domestic production and trade is presented herewith. Also included is a price analysis at the wholesale level for representative markets on the US East and West Coasts.

US Papaya Market

Production

As mentioned earlier, the United States is not considered a major producer of papaya. Between 2008 and 2010, US papaya production averaged 14,393 t per year. This production level is less than 0.13 percent of the global production, and ranks the United States as 57th among the global producers (FAOSTAT 2012). US papaya production is concentrated in the Hawaiian Islands; other areas of papaya cultivation include California, Florida, and Texas. Papaya production in Hawaii peaked in 1985 at about 2,650 harvested acres; since then, production has declined at an annual rate of 2.6 percent, down to 1,350 acres in 2010 (USDA/ERS 2011). The decline in papaya production in Hawaii is due to several factors, including high input and labor costs, and low crop returns. As noted earlier, Hawaii produces mainly the small-sized Solo-type papayas. The most important Solo-type cultivars grown commercially in Hawaii include Kapoho, Sunrise, SunUp, and Rainbow. A more detailed description of the different papaya cultivars is presented in Table 1. Kapoho and Sunrise are not genetically modified (GM) cultivars, while Rainbow and SunUp are GM cultivars. The vast majority of papayas grown in Hawaii are of the GM-type. In terms of acreage distribution, GM cultivars, such as Rainbow (77%) and SunUp and other non-disclosed varieties (5%), account for 82 percent of the total. Non-GM cultivars, such as Kapoho (9 %) and Sunrise (9 %), account for just 18 percent of the total area (USDA/NASS 2009). The shift to GM papaya cultivars was the result of the introduction of the PRSV disease into the main growing areas during the 1970s. In the 1990s, this disease threatened to wipe out Hawaii's papaya industry completely. The GM papaya cultivars played a significant role in saving the Hawaiian papaya industry from devastation by the PRSV disease.

Papaya production in the continental United States is restricted to specific regions in the states of California, Florida, and Texas. In California, winter temperatures in the San Joaquin Valley restrict the growing season from February to November. The shortened season only provides sufficient time for the fruit to reach one-half to two-thirds of their normal size at maturity. These non-mature or green papayas are typically used for cooking and are popular with Burmese, Mexican, Japanese, and Laotian consumers (Warnert 2004). In Texas, there are a few commercial plantings of papaya in the lower Rio Grande Valley that rarely survive more than a few years because of freezing temperatures (Sauls 2012).

South Florida offers the best potential for commercial crop production in the continental United States. Unlike California and Texas, papaya can be grown year-round in South Florida, as the region's subtropical climate is suitable for the crop. Both mature and immature papayas are produced in Florida, with most of the production located in Miami–Dade County. After peaking at close to 500 acres in the early 1970s, Florida's production area is now only about 300 acres (Balerdi 2012). The decline in Florida papaya production is due in large part to increased competition from other countries, such as Mexico, higher production costs (unit costs), and the lack of PRSV-tolerant cultivars. At present, GM papaya cultivars that are resistant to the PRSV disease have had limited commercial production worldwide. After following formal regulatory procedures and notifications, the USDA/APHIS and FDA, in 2009, deregulated the genetically engineered X17-2 (GMO line) papaya developed by the University of Florida. Additional data are being generated to the US Environmental Protection Agency (EPA) to further support the University of Florida's petition to the EPA. The University of Florida is continuing to evaluate and develop four new papaya lines (all with the X17-2 background) of the Solo- and Maradol-type papayas suitable for production in South Florida. It is expected that these new papaya cultivars could be released to the public in 2015 or 2017. The availability of Solo-type cultivars tolerant to the PRSV and adaptable to South Florida conditions will help to revitalize and further diversify agricultural production in South Florida and increase the local farm income.

Import and Export Trade

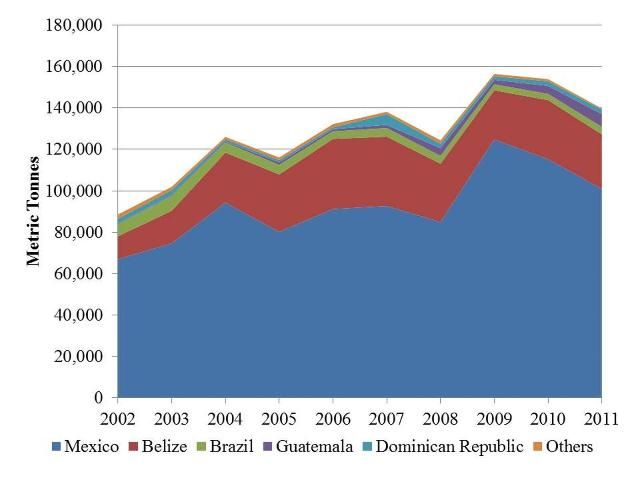

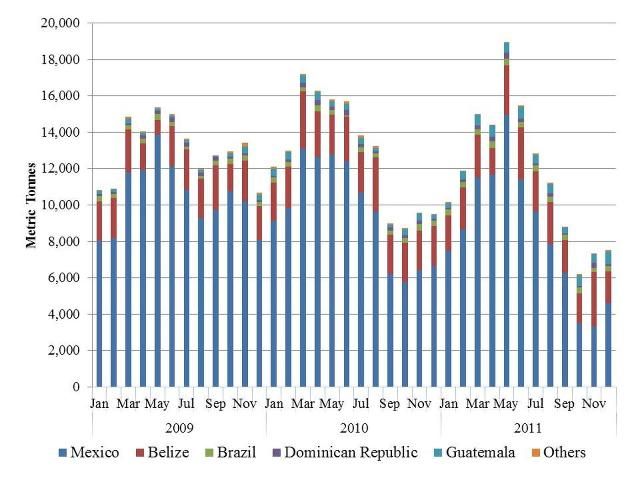

As noted earlier, the United States is the largest papaya importer, absorbing more than half of the global imports between 2007 and 2009 (FAOSTAT 2012). US total papaya imports (fresh and frozen) increased from 89,912 t in 2002 to 144,566 t in 2011. The vast majority (more than 98%) of papaya imports are sold as fresh fruit. US imports of fresh papaya have trended upwards from 88,256 t in 2002 to 144,566 t in 2011, representing an annual growth rate of about 6.75 percent (Figure 1). The main papaya suppliers to the US market are Mexico, Belize, Guatemala, Brazil, and the Dominican Republic, respectively. Mexico is by far the largest supplier, accounting for about 75.7 percent of the market during 2009–2011, followed by Belize (17.5%), Guatemala (2.7%), Brazil (2.1%), the Dominican Republic (1.4%), and others (0.6%). While fresh papayas are imported year-round, the peak of the importing season occurs from March to June, when approximately 42 percent of the total imports are sold (Figure 2) and prices are usually at their lowest. The main papaya cultivars imported by the United States, in order of importance, are Maradol, Solo, and Tainung. Maradol-type papayas are produced in Mexico, Guatemala, Belize, and the Dominican Republic. Solo-type papayas are grown in Brazil and the Dominican Republic. Tainung-type papayas are cultivated in Mexico, Guatemala, Belize, and Ecuador. The value of the US fresh papaya import market in 2011 was estimated at $68.3 million, down from the $87 million imported the previous year. The reduction was due mainly to problems with supplies coming from Mexico and is unlikely to become the trend.

Credit: USDA/FAS (2012)

Credit: USDA/FAS (2012)

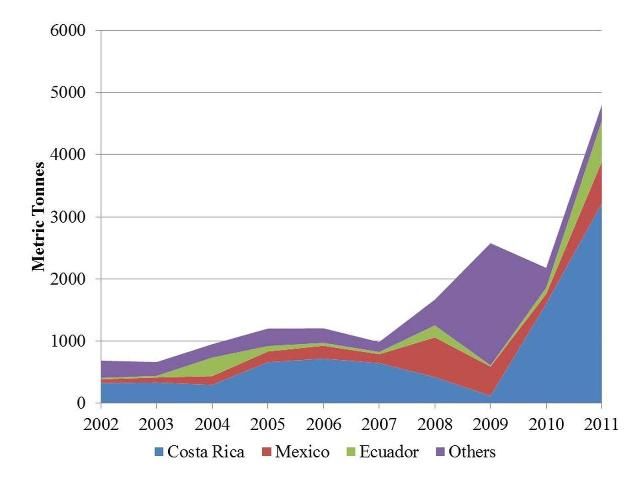

US imports of frozen papaya grew steadily at an annual rate of 24.31 percent from 686 t in 2002 to 2,187 t in 2010 before soaring in 2011 to reach 4,800 t, an increase of almost 120 percent over the previous year (Figure 3). The main suppliers of frozen papaya to the US market are Costa Rica, Mexico, and Ecuador, respectively. US imports of frozen papaya in 2011 were valued at $2.6 million. Frozen papaya products are used for smoothies, toppings, salads, and snacks.

Credit: USDA/FAS (2012)

The main papaya marketers in the United States include Dole, Brooks Tropicals, HLB Specialties, Agromod, and Calavo Growers. Dole markets a variety of fresh and processed papayas; Brooks Tropicals markets the Maradol-type papayas called Caribbean Red and Caribbean Sunrise from Belize; HLB Specialties supplies mainly Golden and Formosa-type papayas from Brazil, Guatemala, and Mexico; Agromod specializes in Maradol-type papayas imported from Mexico; and Calavo Growers sells mainly Solo-type papayas from the United States.

In August 2011, the US Animal and Plant Health Inspection Service (APHIS) gave approval for imports of papayas from Malaysia based on certain conditions. US imports of fresh fruit are subject to the application of one or more designated phytosanitary measures to mitigate the pest introduction risk. In the case of papayas from Malaysia, they must be irradiated, as described in Part 305 of Section 9 of the US Code of Federal Regulations, with an absorbed dose of 400 grays (Gy), to receive clearance for exports to the United States (The Packer 2011). Malaysia is the fourth largest papaya exporter; in 2009, the country exported 24,301 t of the fruit, with an estimated value of $7.7 million (FAOSTAT 2012).

While not ranked among the top ten papaya producers, the United States is an important exporter of papayas, including re-exports of the fruit. In 2011, US papaya exports totaled 3,982 t, which was down from 4,895 t exported in 2002, reflecting a tightening of supplies in the domestic market (USDA/FAS 2012). Correspondingly, the value of US exports fell from $10.7 million in 2002 to $7.2 million in 2011 as a consequence of reduced export volume.

Hawaii leads the US papaya export market, contributing on average more than 95 percent of the US papaya exports. Most of the Hawaiian exports are of the GM Rainbow and non-GM Kapoho and Sunrise cultivars. The United States exports fresh papaya mainly to Canada, Japan, and Hong Kong, respectively. Between 2009 and 2011, Canada, as the largest buyer of US papayas, had an export share of 73.7 percent, followed by Japan (11.43%), Hong Kong (5.16%), and other countries (9.67%) (USDA/FAS 2012).

After the Rainbow cultivar was released to Hawaiian growers in 1998, consumers in the international market became increasingly concerned about the potential health effects of GM papayas. As a result of the controversy, Japan, the top export market for Hawaiian papaya, denied market access for the Hawaiian GM fruit. After a long review process, the Japanese government finally approved the commercial importation of the GM Rainbow papaya from the United States in 2011. The reopened market in Japan now gives Hawaiian GM papaya producers the opportunity to regain their share of the market lost to the non-GM papayas from the Philippines (USDA/FAS GAIN 2011).

Consumption

Papaya is considered one of the most economically important and nutritious fruits; it is rich in antioxidants (carotenes, vitamin C, and flavonoids), the B vitamins (folate and pantothenic acid), minerals (potassium and magnesium), and fiber (Mahattanatawee et al. 2006; USDA/ARS 2012). These nutrients promote a healthy cardiovascular system and provide protection against colon and prostate cancer (Jian, Lee, and Binns 2007).

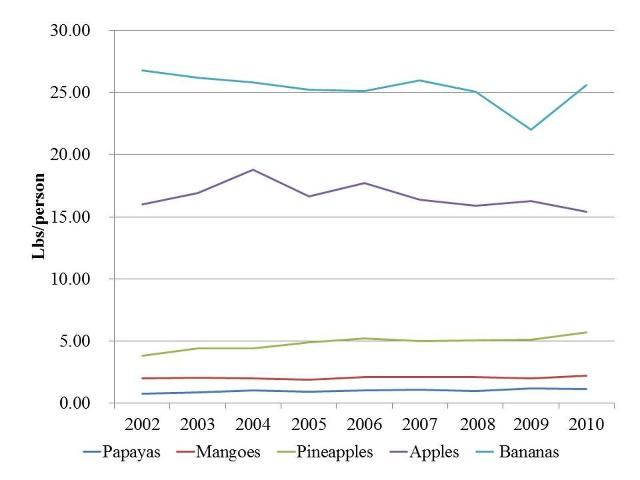

Figure 4 shows the trend in US per capita consumption of selected fruits during 2002–2010. Per capita consumption of papaya has been steadily increasing, from 0.79 pounds in 2002 to 1.16 pounds in 2010, growing at an annual rate of 4.5 percent (USDA/ERS 2012). In 2010, papaya consumption in the United States was still low compared to other tropical fruits such as mango (2.2 lb/person) and pineapple (5.7 lb/person). The gap in per capita consumption is even wider when compared to bananas (25.6 lb/person) and temperate fruits such as apples (15.4 lb/person) (USDA/ERS 2012).

Credit: USDA/ERS (2012)

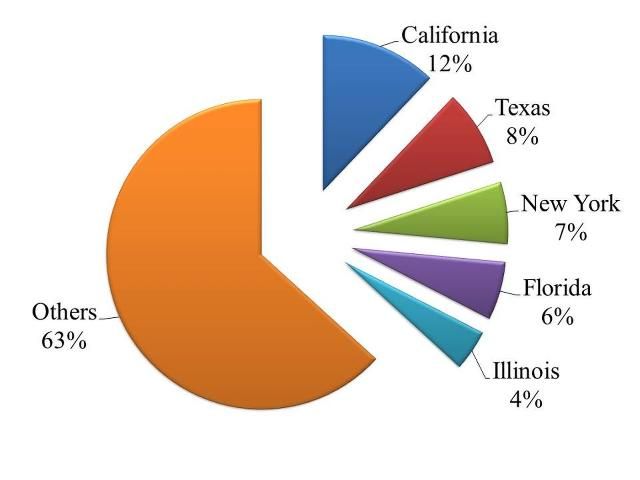

California, Texas, New York, Florida, and Illinois are the leading US states in papaya consumption (Figure 5). These five states account for 36.8 percent of the total quantity of papayas consumed in the United States in 2009 (US Food Market Estimator 2012). California has the highest share value of total US consumption of the fruit at 6,750 Mt, or 12.1 percent, followed by Texas (4,415 t; 7.9%), New York (3,564 t; 6.4%), Florida (3,371 t; 6.1%), and Illinois (2,373 t; 4.3%).

Credit: US Food Market Estimator (2012)

In Florida, papaya consumption is much higher in counties with large urban areas (Table 2). Miami–Dade County leads papaya consumption in Florida at 13.08 percent, which is not surprising since Miami is home to one of the largest Hispanic populations in the United States. Other Florida counties with a high share value in total papaya consumption are Broward (9.64%), Palm Beach (6.94%), Hillsborough (6.43%), and Orange (5.84%) (US Food Market Estimator 2012).

Wholesale Price Analysis

To provide a broader coverage of the wholesale prices for fresh papaya, Miami and New York City are chosen as representative markets on the US East Coast, while Los Angeles and San Francisco are chosen as representative markets on the US West Coast. Papaya packaging varies according to the origin; thus Brazilian papayas are sold in 7.71-lb (3.5 kg) boxes, Solo-type papayas are sold in 10-lb cartons, Maradol-type papayas are mostly sold as 35-lb cartons, and Green-cooking-type papayas are sold in 40-lb cartons. In order to make meaningful comparisons, the following analysis focuses on per pound (lb) wholesale prices.

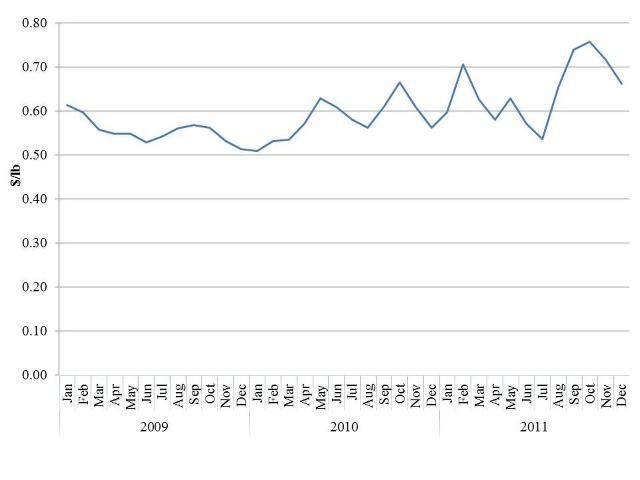

Figure 6 shows the 2009–2011 monthly wholesale prices for Maradol-type papayas on the Miami East Coast market, with prices ranging between $0.50/lb and $0.76/lb, and averaging $0.60/lb. Shipments of Maradol-type papaya arrive year-round, with papayas from other countries being shipped seasonally by land or sea. For most of 2009, wholesale prices decreased due to increased supplies from Mexico. The third quarter of 2011 saw a considerable spike in papaya prices. This was due to the Salmonella outbreak linked to papayas from Mexico, with the consequences that imports from that country were curtailed severely.

Credit: USDA/AMS (2012)

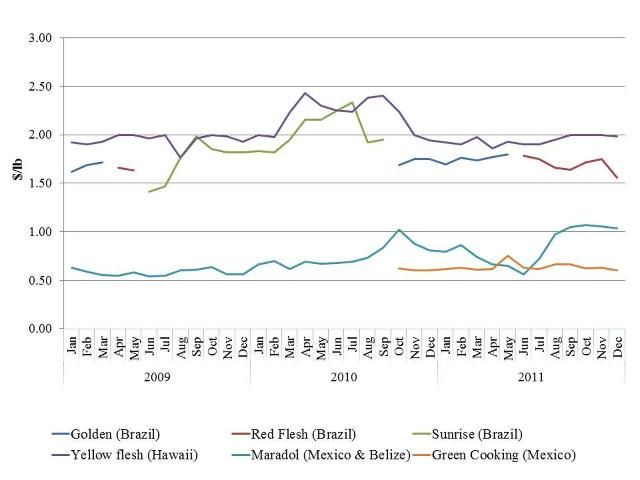

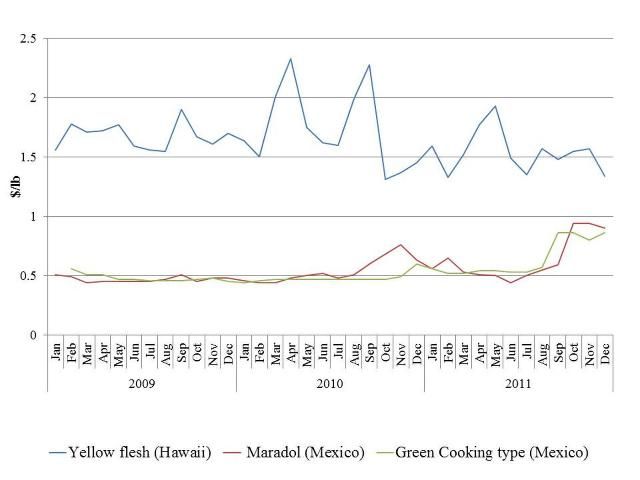

The New York City (NYC) East Coast wholesale market offers on a regular basis Maradol-type and Solo-type papayas from Brazil and Hawaii, and since October 2010, it also offers the Green-cooking-type papaya. Figure 7 shows the 2009–2011 monthly wholesale prices for each of the types of papaya. Between 2009 and 2011, prices for Maradol-type papaya varied widely, from $0.60/lb to $1.07/lb. Because Solo-type papayas are considered to be of a better quality and sweeter than Maradol-type papayas, they sell at higher prices. Solo-type (Golden, Red Flesh, and Sunrise) papaya from Brazil are shipped to the NYC market year-round, with 2009–2011 prices fluctuating between $1.41/lb and $2.33/lb. In addition, because Solo-type (Yellow Flesh) papayas from Hawaii are considered a premium product of higher quality than papayas from other countries, they sell for even higher prices (USDA/AMS 2012).

Credit: USDA/AMS (2012)

As illustrated in Figure 7, Solo-type papayas from Hawaii command the highest prices on the NYC market. During the years 2009–2011, the average price for papayas from Hawaii was $2.03/lb, reflecting a higher premium over the Brazilian Golden, Red Flesh, and Sunrise. Another reason that Solo-type papayas command higher prices is because they are shipped by air, whereas Maradol-type papayas are shipped by sea. Green-cooking-type papayas sold on the NYC market come mainly from Honduras, the Dominican Republic, and Florida. Wholesale prices of Green-cooking-type papayas have remained relatively stable at about $0.60/lb since their introduction to the NYC market in 2010.

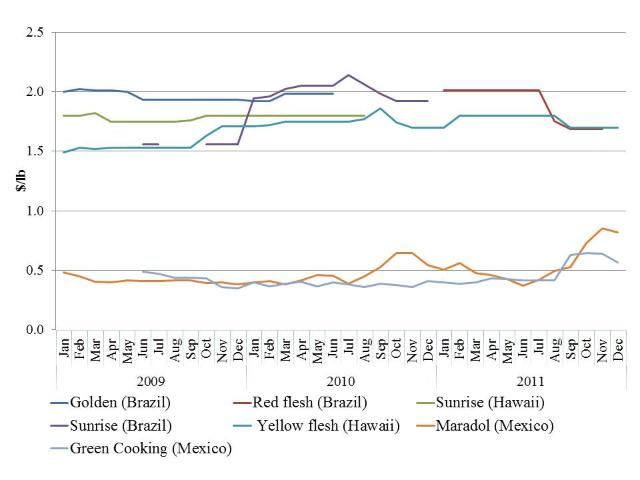

The wholesale papaya market in Los Angeles is the most active on the US West Coast when considering the number of cultivars marketed. In 2009 and 2010, Brazil mainly exported the Solo-type cultivars Golden and Sunrise to Los Angeles, but since 2011, Brazil only exports the Solo-type cultivar Red Flesh to the Los Angeles market (Figure 8). While it was available on the Los Angeles market, the Brazilian Golden papaya was the most expensive cultivar, with an average price of $2.00/lb. The non-GM Sunrise papaya from Hawaii was available until August 2010, with an average price of $1.80/lb. Prices of Maradol-type papayas from Mexico remained close to $0.50/lb until August 2011, when prices started to increase substantially due to a Salmonella outbreak linked to Mexican papayas that limited supply availability in the US market. Green-cooking-type papayas from Mexico have been supplied on a regular basis since June 2009, with prices increasing from $0.40/lb in 2009 to $0.64/lb in 2011.

Credit: USDA/AMS (2012)

The main papaya cultivars sold on the San Francisco West Coast wholesale market are the Solo-type Yellow Flesh from Hawaii, and the Maradol-type and Green-cooking-type from Mexico (Figure 9). Among all the markets analyzed, prices for Solo-type papayas in San Francisco exhibited the most erratic pattern, from a high of $2.33/lb in 2010 to a low of $1.34/lb in 2011. In contrast, the Maradol-type and Green-cooking-type varieties have exhibited a fairly stable price behavior, with average prices of $0.55/lb and $0.53/lb for Maradol-type and Green-cooking-type, respectively.

Credit: USDA/AMS (2012)

A discussion of the prices for fresh papaya at the retail level is not possible at this time, as the Agricultural Marketing Service (USDA/AMS) does not currently collect this information.

Market Outlook

The United States will probably continue to be the largest papaya importer, especially since the second largest papaya importer, Singapore, accounted for just 8.3 percent of the total imports during 2007–2009 (FAOSTAT 2012). While Solo-type papayas will continue to command premium prices in the US market due to limited supplies and higher shipping costs, Maradol-type papayas will be cheaper due to ample supplies and lower shipping.

Our analysis indicates that there are regional differences with respect to US consumer perception regarding fresh papayas. On the US West Coast, specifically in the Los Angeles market, Brazilian papayas command higher prices over Hawaiian papayas because most of the Hawaiian papaya production is of the GM type. In sharp contrast, US East Coast papaya consumers in New York City are willing to pay more for the GM Solo-type cultivars from Hawaii than for the non-GM cultivars from Brazil although both Solo-type papayas are available year-round. It should be noted that US regulations do not require labeling to disclose GM content in fresh or processed food products, which may explain the Hawaiian GM premium over the non-GM papayas in the NYC market. Labeling regulations may change in 2012 if the California Right-to-Know Genetically Engineered Food Act passes (this Act would require mandatory labeling for GM food products and food ingredients).

As our analysis indicates, the United States is not a major producer of papayas, but it could become a contender if Solo-type PRVS resistant varieties are approved. Florida could become a major supplier of Solo-type papayas to the domestic NYC East Coast market since the state would be able to take advantage of cheaper transportation costs, compared to Hawaii and Brazil. Mexico will continue to dominate the Maradol-type papaya market.

References

FAOSTAT. 2012. Crops Production Data. https://www.fao.org/faostat/en/#data/QCL

FAOSTAT. 2012. Detailed Trade Data. https://www.fao.org/faostat/en/#data/TCL

Hawaii Papaya Industry Association (HPIA). 2012. Papaya Information: Choices to the Consumer. (No longer available online.)

Jian, L., A. Lee, and C. Binns. 2007. Tea and lycopene protect against prostate cancer. Asia Pacific Journal of Clinical Nutrition 16 (Supplement 1):453–457.

Mahattanatawee, K., J.A. Manthey, G. Luzio, S.T. Talcott, K. Goodner, and E.A. Baldwin. 2006. Total antioxidant activity and fiber content of select Florida-grown tropical fruits. Journal of Agricultural and Food Chemistry 54:7355–7363. https://doi.org/10.1021/jf060566s

Melissa's. 2012. Products: Papaya. (No longer available online.)

Melissa's. 2012. Products: Papaya. https://www.melissas.com/products/tai-nung-papaya

Sauls, J.W. 2012. Home Fruit Production: Papaya. AgriLife Extension, Texas A&M University, College Station, TX. (No longer available online.)

The Packer. 2011. USDA Approves Malaysian Papayas for Import in the United States. (No longer available online.)

Union Growers of Brazilian Papaya (UGBP). 2010. Papaya Golden. (No longer available online.)

US Food Market Estimator. 2012. (No longer available online.)

USDA/AMS. 2012. Fruit & Vegetables Market News. United States Department of Agriculture, Agricultural Marketing Service, Washington, D.C. (No longer available online.)

USDA/ARS/NAL. 2012. National Agricultural Library, Nutrient Data Lab, United States Department of Agriculture, Agricultural Research Service, Washington, D.C. https://www.nal.usda.gov/

USDA/ERS. 2012. Fruit and Tree Nut Yearbook: Fruit Per-Capita Consumption (F-41). United States Department of Agriculture, Economic Research Service, Washington, D.C. https://www.ers.usda.gov/data-products/fruit-and-tree-nuts-data/fruit-and-tree-nuts-yearbook-tables/

USDA/ERS. 2012. Fruit and Tree Nuts Yearbook: Papaya (B-23). United States Department of Agriculture, Economic Research Service, Washington, D.C. https://view.officeapps.live.com/op/view.aspx?src=https%3A%2F%2Fwww.ers.usda.gov%2Fwebdocs%2FDataFiles%2F54499%2FFruitYearbookNoncitrusFruit_BTables.xlsx%3Fv%3D7858.3&wdOrigin=BROWSELINK [11 November 2022].

USDA/FAS. 2012. Global Agricultural Trade System. United States Department of Agriculture, Foreign Agricultural Service, Washington, D.C. https://apps.fas.usda.gov/gats/default.aspx

USDA/NASS. 2009. Hawaii Fruits and Nuts: Papaya. United States Department of Agriculture, National Agricultural Statistics Service, Washington, D.C. https://www.nass.usda.gov/Statistics_by_State/Hawaii/Publications/Fruits_and_Nuts/index.php

Warnert, J.E. 2004. Conventionally bred papaya still possible, even in California. California Agriculture 58(2):74. ttps://109429-conventionally-bred-papaya-still-possible-even-in-california