Credit: Jehangir Bhadha, Mark Clark, Michael Andreu, Yuchuan Fan, Tara Wade, and Young Gu Her, UF/IFAS

Infographic Text

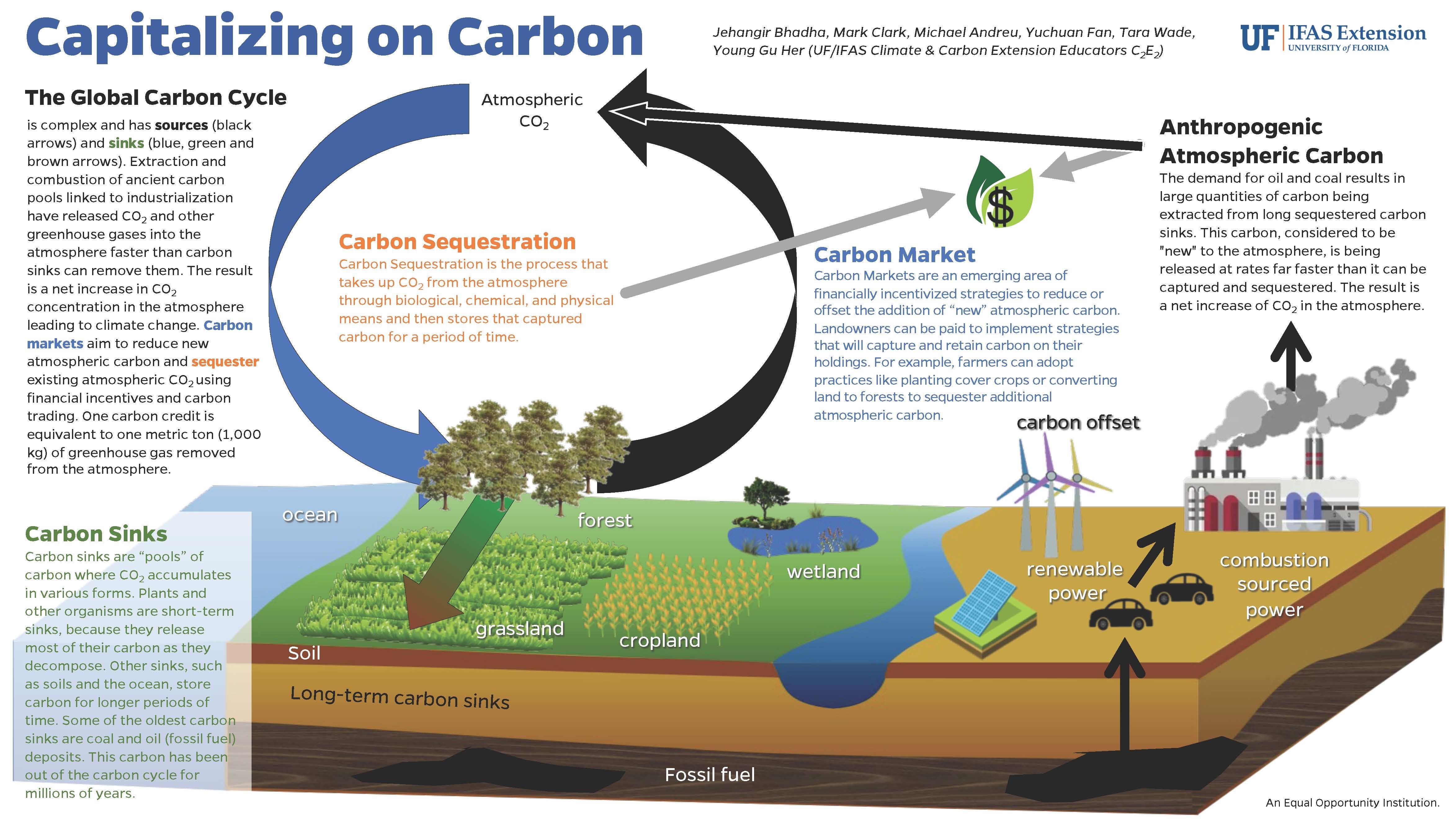

The Global Carbon Cycle is very complex. It has sources (orange and black arrows) and sinks (blue, green, and brown arrows). Extraction and combustion of ancient carbon pools linked to industrialization have released CO2 and other greenhouse gases into the atmosphere faster than carbon sinks can remove them. The result is a net increase in CO2 concentration in the atmosphere leading to climate change. Carbon markets aim to reduce new atmospheric carbon and sequester existing atmospheric CO2 using financial incentives and carbon trading. One carbon credit is equivalent to one metric ton (1,000 kg) of greenhouse gas removed from the atmosphere.

Carbon Sinks

Carbon sinks are “pools” of carbon where CO2 accumulates in various forms. Plants and other organisms are short-term sinks because they release most of their carbon as they decompose. Other sinks, such as soils and the ocean, store carbon for longer periods. Coal and oil (fossil fuel) deposits are some of the oldest carbon sinks. Fossil fuel has been out of the carbon cycle for millions of years.

Carbon Sequestration

Carbon sequestration is the process that takes up CO2 from the atmosphere through biological, chemical, and physical means and then stores that captured carbon for a period of time.

Carbon Market

Carbon markets are an emerging area of financially incentivized strategies to reduce or offset the addition of “new” atmospheric carbon. Landowners can implement strategies that will capture and retain additional carbon on their holdings and get paid for it. For example, farmers can adopt practices such as planting cover crops or converting land to forests to sequester additional atmospheric carbon.

Anthropogenic Atmospheric Carbon

The demand for oil and coal results in extraction of large quantities of carbon from long-sequestered carbon sinks. This carbon, considered to be "new" to the atmosphere, is being released far more quickly than it can be captured and sequestered. The result is a net increase of CO2 in the atmosphere.