The purpose of this document is to provide a framework and provisional values to estimate the costs and returns of hemp production for fiber and seed for commercial producers in Florida. The primary objective is to illustrate the infrastructure, labor, and input costs associated with a hemp cropping system for the production of fiber, seed, or both related to the potential returns from sales of raw materials.

Credit: Zachary Brym, UF/IFAS Tropical Research and Education Center

Introduction

Hemp is Cannabis sativa L. (<0.3% 9-tetrahydrocannabinol) grown commercially for fiber, seed, and flower. Some of the processing applications for fiber hemp include clothing, shoes, paper, industrial textiles, biocomposite plastics, and various building materials (i.e., concrete, insulation mats, fiber boards). These processing options are distinguished by two primary types of fiber produced by hemp: the strong and long external “bast” fiber, or the short and abundant interior “hurd” fiber (Kaur et al. 2021). Hemp-derived fibers have been appealing for industrial applications, with companies such as car manufacturers incorporating hemp bioplastics into their models in door panels, cup holders, and dashboard panels (Karche 2019). Hemp seeds are botanically a fruit called an achene. Although commonly referred to as a grain, they are classified as an oil seed with notably high-quality oil content. Oil extracted from hemp seeds is different from cannabinoid extracts in its source and composition. The use of hemp seed as a grain-like food dates back thousands of years and is still present in traditional and modern foods. Hemp fiber for materials and seeds for consumption may drive production for a modern hemp market.

Many factors should be considered before establishing a hemp planting, such as permit application, access to seed, land preparation, crop management, harvest operations, and proximity to a processing outlet. When developing an agricultural enterprise, producers must allocate time and resources wisely to achieve quality production and financial viability. When developing a crop production system or modifying an existing one, budgets can be used to make cost-effective decisions (Morgan et al. 2021).

This document is a guide for evaluating the cost of establishing a hemp system for fiber or seed production. The development of a site- and operation-specific budget can assist producers in arriving at a sound economic judgment for an individual farming enterprise. The input costs provided in these budgets are influenced by a variety of factors and should be modified whenever possible to reflect a producer’s actual operation and pricing. Broadly, factors affecting the budget accuracy include location within Florida, cropping system design, market dynamics (demand and supply), input suppliers, and outlet buyer.

The purpose of this publication is to provide information to current and potential hemp growers, wholesalers, and processors, especially those exploring the economic viability of hemp as an alternative crop. Specific information on hemp markets can be found in Ask IFAS publication FE1116 (“Is a viable hemp industry in Florida’s future?”).

Main Assumptions

Production costs and revenues used in this annual budget are based on a one-acre planting. Because of variability in producers' current management practices, costs and returns are estimated for a representative condition reflecting an average from the authors’ investigations. Given the fact that growers in Florida generally do not own the land, a rental estimate of $300/acre/year is taken to factor in for the opportunity cost of the land. We used an average land rental price for the state of Florida. Rental prices in north Florida are likely lower than rates in south Florida. Table 1 shows the total estimated annual costs and returns incurred while operating a one-acre hemp cropping sysyem for fiber and/or seed production.

Table 1 estimates the expected revenue of growing and harvesting industrial hemp for fiber and seed production in Florida. Table 2 estimates the costs of growing and harvesting industrial hemp for fiber and seed production in Florida. This should be used as a tool to estimate actual costs and returns. This is not representative of any specific farm.

Table 1. Estimated revenue of growing and harvesting industrial hemp for fiber and seed.

Table 2. Estimated costs of growing and harvesting industrial hemp for fiber and seed.

- Planting layout: Based on the information collected, in Florida, the seeding density for hemp fiber production is 0.7–1 million live seed per acre; for seed production, the seeding density is 0.25–0.4 million live seed per acre.

- Yields: Based on the information collected, the average bast fiber yield per acre is about 20% of dry matter per plant for dry-retted straw. The average marketable yield is 4,000 pounds of dry straw fiber yield and 1,000 pounds of hemp seed per acre. Dual-purpose crops that yield both fiber and seed have been considered with both yields; both are included in the budget for reference.

- Hemp fiber and seed price: The estimated average price of dry straw fiber yield in Florida is $0.10/pound and the price for hemp seed is $0.70/pound (University of Kentucky College of Agriculture 2019).

- Operating costs: The total operating cost is $1,029.56 and is divided into the following categories: irrigation, fertilization, labor costs, and interest in capital.

- Irrigation: Average irrigation expense reflects a well pump ($161.25) for a total of $161.25/acre/year.

- Fertilization: Fertilizer costs include applications of N-P-K (nitrogen, phosphate, potash). Fertilization costs (materials only) are estimated at $117.30/acre/year.

- Labor costs: These include application costs for agricultural inputs (fertilizers) and costs incurred for implementing other cultural practices (land preparation, planting, harvest, and postharvest). Labor costs (hired labor only) are estimated at $386.86/acre/year.

- Interest in capital: This is the cost of borrowing money or the opportunity cost for using equity. A rate of 6.00% was considered in the given analysis. Interest on operating capital is estimated at $67.87/acre/year.

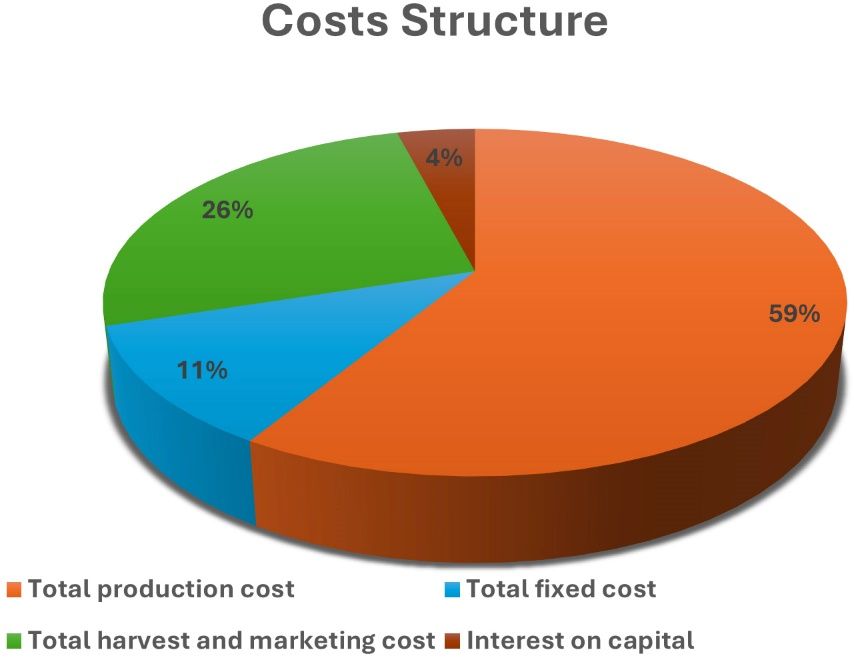

- Harvesting and marketing costs: Harvesting and marketing costs represent 26% of the total cost.

- Variable costs: Variable costs are the operating costs plus the harvesting and marketing costs. These amount to $1,202.98/acre/year, representing 59% of the total costs. The major component is hired labor (56%). These costs are directly related to production.

- Fixed costs: These constitute the indirect costs that are incurred regardless of the level of production. They include cash overhead costs (e.g., insurance and taxes), non-cash overhead costs (e.g., land rent), and other overhead costs (e.g., machinery use, electricity, telephone, computer, and other miscellaneous office expenses). Total fixed costs are estimated at $416.71/acre/year and represent 11% of the total costs.

Variable costs (costs for hired labor, irrigation, fertilization, pollination, and pest control) account for 59% of the total cost. Harvest and marketing costs are 26% of the total cost. Fixed or overhead costs constitute 11% of the total cost. Finally, interest on capital represents 4% of the total cost (Figure 2).

Credit: Andres Bejarano Loor

Returns and Profitability Analysis

The total cost to produce and market one acre of hemp for fiber and seed is estimated at $1,619.69/acre/year. Based on an average marketable yield of 4,000 pounds dry straw fiber yield/acre and the average estimated price of $0.10/pound, revenue for fiber yield is $400/acre/year. Based on the average marketable yield of 1,000 pounds hemp seed/acre and the average estimated price of $0.70/pound for hemp seed, total receipts for hemp seed would be $700/acre/year. Total revenue for fiber and seed would be $1,100/acre/year.

Subtracting total variable cost (operating cost plus harvesting and marketing cost) from total revenue, we estimate a gross return of -$102.98/acre/year and a gross margin of -9.4% (-$102.94/$1,100). The gross margin provides a useful indicator of short-term profitability by indicating how much of each dollar goes to operating expenses or variable costs and how much is retained by the owner. A positive gross return implies that all variable costs are covered by the income generated and those additional funds can be utilized to cover some or all the remaining fixed costs. A negative gross profit implies that a business is not viable in the short term, and changes are needed to continue operating.

Many growers are only concerned with the gross margin. However, while the gross margin provides an indication of return to the grower, it does not include fixed costs and, hence, is not a true indicator of the long-term feasibility of the business. Calculations of both net return and gross profit are necessary to measure profitability and sustainability.

Net return is obtained by subtracting the fixed costs from the gross margin and is used to measure the long-term profitability of the farming operation. Table 1 shows a net return of -$519.69/acre/year.

Sensitivity Analysis

We developed a dual-purpose budget to evaluate the potential for producing fiber, seed, or both (“dual”). As presented in Table 2, the net return for dual production is negative. Tables 3 and 4 provide a sensitivity analysis focused solely on fiber production, while Tables 5 and 6 present the analysis for seed production only. This comprehensive approach allows us to assess the financial viability of each production type individually.

Table 3 presents a sensitivity analysis of the gross margin of hemp production for fiber. The analysis considers the short-term economic viability of a hemp planting for fiber based on variable yield and price. Under the best-case scenario, where the price increases 20% and yields are assumed to increase by 10%, gross margin would increase from -$37/acre to $883/acre. Under the worst-case scenario, where the price is the base and the yields decrease by 10%, gross margin would decrease from -$37/acre to -$77/acre. Price changes (keeping the production constant) have the same level of impact on gross margin as yield changes (keeping the price constant).

Table 3. Sensitivity analysis of the annual per-acre gross margin of hemp production for fiber yield in Florida with negative values in orange.

Table 4 presents a similar analysis based on annual net returns per acre that includes the total cost for fiber production alone. Under the best-case scenario, where the price increases by 20% and the yield is assumed to increase by 10%, net return would increase from -$189/acre to $731/acre. Under the worst-case scenario, where the price is the base and the yield decreases by 10%, net return results in losses of $229/acre. Other combinations of prices and yields and their impacts on net return are also shown in Table 4.

Table 4. Sensitivity analysis of per-acre annual net returns of hemp production for fiber yield in Florida with negative values in orange.

Table 5 presents a sensitivity analysis of the gross margin of hemp production for seed. Under the best-case scenario, where both price and yield are assumed to increase by 10%, gross margin would increase from -$62/acre to $85/acre. Under the worst-case scenario, where both price and yield decrease by 10%, gross margin would decrease from -$62/acre to -$195/acre. Price changes (keeping the production constant) have the same level of impact on gross margin as yield changes (keeping the price constant).

Table 5. Sensitivity analysis of the annual per-acre gross margin of hemp production for hemp seed in Florida with negative values in orange.

Table 6 presents the sensitivity analysis of net returns for hemp seed. Under the best-case scenario, where both price and yield are assumed to increase by 10%, net return would increase from -$375/acre to -$228/acre. Under the worst-case scenario, where both price and yield decrease by 10%, net return results in a loss of -$508/acre. The information presented in Tables 4 and 6 can be interpreted in a similar manner. However, it should be considered that at a broader industry level any significant increase in production would decrease the price received by the growers.

Table 6. Sensitivity analysis of per-acre annual net returns of hemp production for hemp seed in Florida with negative values in orange.

Conclusions

The estimated net return of a fiber and seed hemp production system in Florida is approximately -$519.69/acre. This return makes this crop not an attractive crop. In addition, UF/IFAS does not recommend plant species with high invasive potential in Florida’s natural areas, including hemp (https://assessment.ifas.ufl.edu/assessments/).

The multiple uses and potential markets for fiber have retained interest for some producers. In the case for fiber and seed markets, the market should have enough production to motivate processing facilities. Hemp fiber has many applications in the industrial sector including paper, textiles, biodegradable plastics, health food, and fuel. It is stronger than jute and linen fiber (Hart 2020). Additionally, it is ideal for making ropes, twine, cables, carpets, sail cloth, canvas, and ship cordage (Crini 2019).

The primary barrier to producing hemp for fiber and seed production in Florida is the low net return. To improve profitability, the best option is to focus on maximizing fiber production, as it offers a more favorable return compared to dual-purpose or seed-only production. To minimize the loss in the first production cycle, it is recommended to start with a small planting. If you are new in the industry, starting with a small planting will help you to become more experienced in managing your cultivar and adapting the processes to your specific needs.

References

Crini, G., E. Lichtfouse, G. Chanet, and N. Morin-Crini. 2020. “Applications of Hemp in Textiles, Paper Industry, Insulation and Building Materials, Horticulture, Animal Nutrition, Food and Beverages, Nutraceuticals, Cosmetics and Hygiene, Medicine, Agrochemistry, Energy Production and Environment: A Review.” Environmental Chemistry Letters 18 (2020): 1451–1476. https://doi.org/10.1007/s10311-020-01029-2

Hart, C. 2020. “The Opportunities and Challenges with Hemp.” Integrated Crop Management. https://crops.extension.iastate.edu/cropnews/2020/03/opportunities-and-challenges-hemp

Karche, T. 2019. “The Application of Hemp (Cannabis sativa L.) for a Green Economy: A Review.” Turkish Journal of Botany 43 (6): 710–723. https://doi.org/10.3906/bot-1907-15

Kaur, N., L. K. Sharma, C. Kelly-Begazo, M. Tancig, and Z. Brym. 2021. “Uses of Raw Products Obtained from Hemp: Fiber, Seeds, and Cannabinoids: SS-AGR-458/AG459, 9/2021.” EDIS 2021 (5). https://doi.org/10.32473/edis-ag459-2021

Morgan, K. L., T. Wade, K. Athearn, C. Prevatt, A. Singerman, E. Evans, T. Blare, H. Khachatryan, and Z. Guan. 2022. “An Introduction to Florida Commodity Enterprise Budgets: An Extension Tool to Improve Farm Financial Planning: FE1109, 12/2021.” EDIS 2021 (6). https://doi.org/10.32473/edis-fe1109-2021

Purdue University Hemp Project. 2015. "Hemp Production.” https://ag.purdue.edu/hemp-project/production/index.html

University of Kentucky College of Agriculture. 2019. “Industrial Hemp Budgets.” https://hemp.ca.uky.edu/marketing-economics