Abstract

Increasing foreign competition and disease pressure has made many Floridan growers question the viability of traditional commodity crops such as tomatoes, citrus, and avocados. Industrial hemp might be an attractive alternative for these growers, given that the Agriculture Improvement Act of 2018 known as the 2018 Farm Bill permitted its production. The Florida legislature has followed several other states in approving permits in 2020 to allow the production of industrial hemp. While early markets for cannabidiol (CBD) oil and other industrial hemp products were promising in the first years of production, the market prices started to decline dramatically in 2020 with many growers unable to sell all their product. For the hemp industry to flourish, better coordination is needed between regulators, processors, financial institutions, research and Extension services, and the retail sector to build confidence and harmonize policies and procedures. Such actions will lower transaction costs along the supply chain and ensure that growers, hemp related enterprises, and consumers can benefit from this emerging market. In this article, we examine the hemp value chain with a focus on opportunities in the Florida market.

Key words: alternative crops, value chain development, market development, specialty crops

Introduction

Florida growers have faced many difficulties over the past few decades that have impacted their ability to remain profitable growing some of their mainstay crops. Debilitating diseases such as greening and laurel wilt have raised questions about the future of citrus and avocado (Farnsworth et al. 2014; Mosquera et al. 2015) production in the state. Disease challenges have been further complicated from intense international competition for products such as tomatoes (Biswas et al. 2017). Because of these realities, the Florida agricultural industry has been seeking alternative crops that could prove profitable for its growers. As a multi-purpose crop, hemp has emerged as an opportunity for farmers in the United States and Florida that find themselves looking for a profitable alternative to other crops (Sterns 2019), yet cultivation and market challenges have been prominent over the early development of the hemp industry.

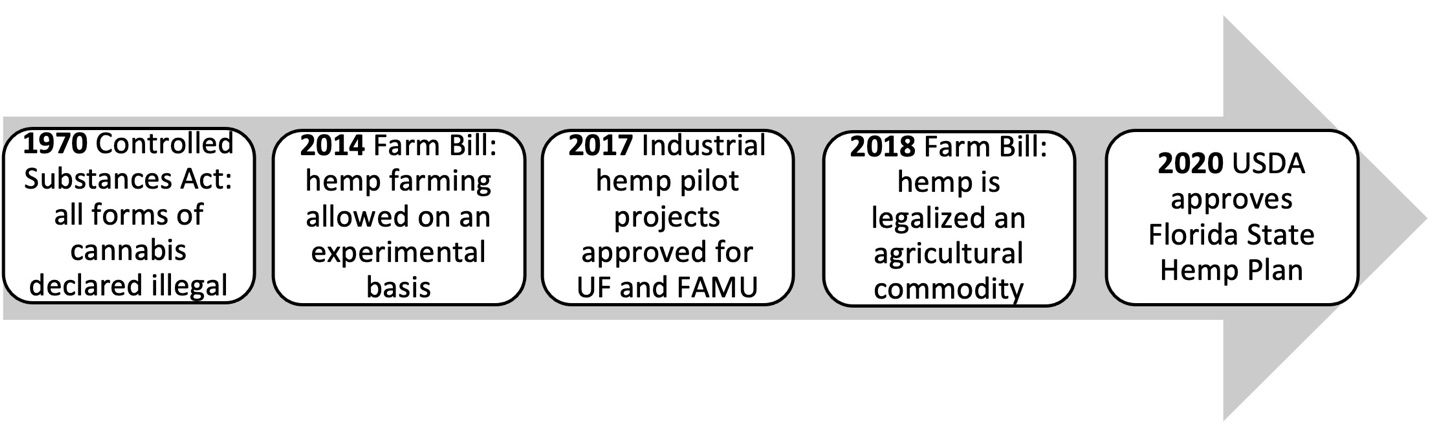

Hemp has made a resurgence in the United States after being reintroduced after decades of prohibition beginning in 1970, as part of the Controlled Substances Act. It had once been an important crop to US growers until market declines early 1900s and later regulations in 1937 under the Marihuana Tax Act (CBP 2019) As of 2018, the market for hemp-derived products has generated over a billion dollars in sales in the United States, prompting hemp cultivation in the country to expand rapidly (Hemp Benchmarks 2020). Currently there are 49 states that have enacted hemp legislation, each with hopes of becoming the industry leader in the country. In this paper, we examine opportunities for Florida growers and enterprises interested in hemp cultivation and processing in Florida to take advantage of a new market. This article provides useful information for stakeholders including growers, private industry, Extension professionals, service providers, and policy makers interested in supporting the emerging Florida hemp industry.

Regulations in Florida

The 2018 federal Farm Bill removed hemp from the list of controlled substances and legalized the plant as an agricultural commodity. The regulatory framework for hemp cultivation, the US Domestic Hemp Production Program, was released almost a year later, and the final rule became effective on March 22, 2021 (USDA 2021). States must submit their cultivation plans for the approval of the United States Department of Agriculture (USDA). For states with no USDA-approved plan, the rule provides a federal plan for them to follow. In the case of Florida, a state plan was approved in April 2020. Some key provisions as of Dec 2021 included: growers in the state are required to plant certified seed or approved seed/cultivars from the University of Florida (UF) and Florida Agricultural and Mechanical University (FAMU) pilot project; they are subject to annual inspections; and they must have an environmental containment plan for every location where hemp is planted (Figure 1). While the FDA has declared that it is illegal to market CBD in food or label it as a dietary supplement, several states, including Florida, do not prohibit these products. In Florida, hemp extract, including cannabidiol (CBD), that is intended for human consumption is permitted if it meets labeling requirements that provide transparency to consumers (FDACS 2021c).

Credit: undefined

Multitude of Hemp Products

One of the interesting features of hemp is that different parts of the plant have economic value and can be processed for different uses including food and industrial applications. Hemp seed and hemp seed oil has found a place in consumer food markets. Both products are in demand by consumers interested in foods with the potential to reduce the risk of disease. The ratio of omega-6 fatty acid linoleic acid (LA) to omega-3 fatty acid α-linolenic acid (ALA) found in hempseed is between 2:1 and 3:1, which is deemed ideal for a healthy diet. Much higher ratios, typically between 20:1 and 30:1, are recommended for patients with chronic diseases such as coronary artery disease, hypertension, diabetes, and cancer (Pierce and Rodriguez-Leyva 2010). According to Pierce and Rodriguez-Leyva (2010), hempseed has “almost as much protein as soybean and is also rich in Vitamin E and minerals.” Antunović et al. (2019) suggest that the nutritive properties of hemp seed and its derivatives (hemp seed oil, hemp seed cake) could also be used for animal feed “as a valuable source of crude protein and essential fat”. Outside of the food industry, hemp seed oil can be manufactured into a wide variety of other goods such as body care products, cosmetics, solvents, inks, and fuel products, just to name a few.

Some of the more common applications for fiber include clothing, shoes, paper, industrial textiles, and various building materials (i.e., concrete, insulation mats, fiber boards). The latest innovation for hemp fiber involves its manufacture into bio-composites. This novelty has been appealing to the automotive industry, with companies such as car manufacturers incorporating hemp bioplastics into their models in applications such as door panels, cup-holders, and dashboard panels (Karche 2019). The use of hemp bio-composites in the automobile industry is indicative of their potential to replace an abundance of conventional plastic items in the future.

Perhaps the most lucrative industry for hemp early on involved the production of floral material or biomass that contain cannabinoids such as cannabidiol (CBD), cannabigerol (CBG) and cannabinol (CBN). Currently, the most popular cannabinoid is CBD, a non-psychoactive compound believed by some to treat several health conditions, including, among others, anxiety, stress, insomnia, and inflammation. However, there is limited scientific research to validate those claims (Johnson 2019). The one drug containing CBD that has passed the rigorous review process of the Food and Drug Administration (FDA) was Epidiolex. It was approved in 2018 and treats two rare, severe forms of epilepsy (FDA 2018). Regardless of the scarcity of studies backing CBD usage for a broad range of conditions, hemp-derived CBD extract is currently sold in tinctures, creams, capsules, foods, beverages, and smokable flower. Smokable hemp is only legal in six states, including Florida, where it is legal for home consumption but cannot be smoked in public (Smith 2020). CBG and CBN are other non-psychoactive compounds found in cannabis that are also marketed as hemp-derived extracts. However, there is even less information surrounding CBG and CBN usage, and these compounds are less abundant in commercial hemp varieties.

Production in Florida

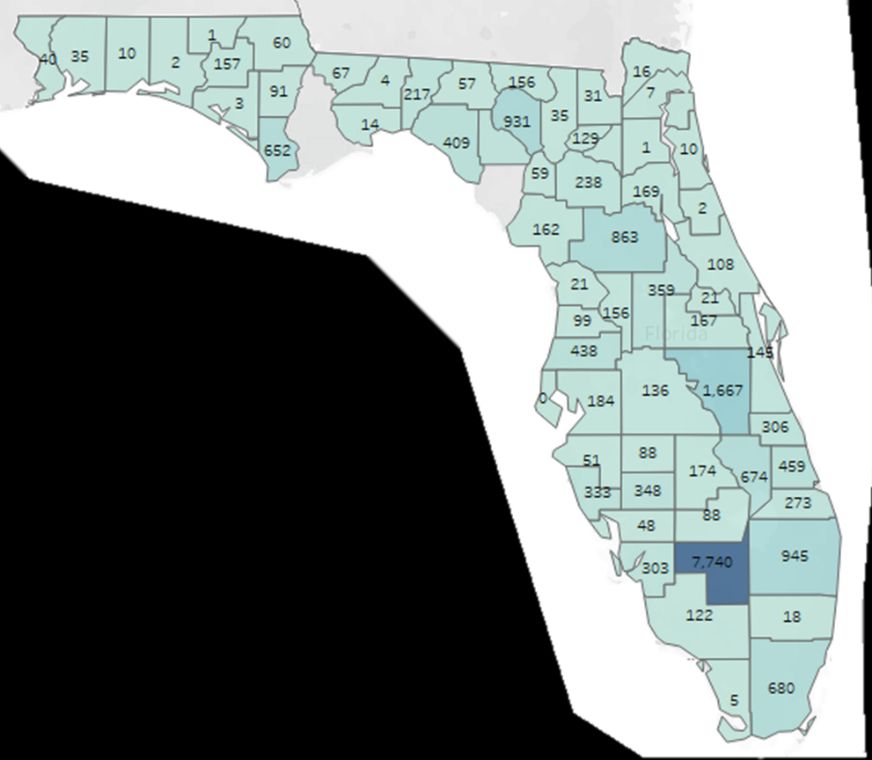

Florida, which is among the states that commenced their first growing season in 2020, reported over 18,191 licensed acres dispersed among 736 growers in December 2021 (Figure 2). During the 2020 growing season, the top counties in terms of licensed acreage were Hendry (7,740 acres), Osceola (1,670 acres) and Palm Beach (950 acres) (FDACS 2021a). (Refer to https://edis.ifas.ufl.edu/publication/AG453 for detailed information on licensed hemp acreage in Florida.) There are 19 hemp retailers located throughout the state (FDACS 2021b). Some initial measures that Florida has adopted to limit barriers to development of the industry are having no cultivation permit fee and no limit to the number of cultivation permits allowed. To meet compliance requirements, growers still need to pass a background check, which includes the collection of fingerprints and costs around $80. They also must have a harvest testing contract, which can run from between $250 and $500 (FDACS 2021a). The relatively low cost of qualifying to participate in the industry provides Florida an advantage over other states where production is constrained by limited permits and to registration/renewal fees that typically charge per acre. Additionally, the cost for a retail, wholesale, and hemp extract processing permit in Florida is relatively low at $650 per year. To put that in perspective, the Georgia Department of Agriculture charges any hemp processor in the state an initial processor permit fee of $25,000 and an annual renewal fee of $10,000 (Miller & Martin PLLC 2020).

Credit: undefined

Challenges to further expansion

For industrial hemp to be a profitable industry in Florida, several economic challenges need to be addressed. The state of Florida must work together with the federal government and other state governments to harmonize regulations so that industrial hemp products can be sold across the country with similar rules. The United States Food and Drug Administration (FDA) needs to create specific rules on the dosage of CBD oil acceptable to treat different ailments. Further investment and support are needed to develop hemp varieties that are suitable to Florida’s climate and that do not pass the 0.3% threshold of tetrahydrocannabinol (THC) (the chemical responsible for inducing psychotropic effects) at marketable harvest time as restricted by the United States Drug Enforcement Agency (DEA) for industrial hemp.

Other challenges will need to be overcome before hemp can be viable in Florida. Financial services, insurance, and credit agencies will need to support investment in the industry. Many financial institutions are reluctant to invest in hemp production and processing because of the unclear legal status of industrial hemp, particularly for CBD oil (Davies 2021). Some financial institutions have even been reluctant to provide growers of hemp with bank accounts. These institutions report concern about the lack of clarity in the legality of industrial hemp production and whether they need to submit suspicious activity reports (SARs) under the Bank Secrecy Act. However, the Federal Reserve in December 2020 clarified that financial institutions no longer needed to submit SARs for activities related to industrial hemp (Federal Reserve 2020). The lack of financial analysis on the potential profitability of hemp has dampened interest in this sector in supporting the industrial hemp value chain.

Likely the biggest challenge faced by industrial hemp growers is the lack of investment in building supply chains and markets for the various products. In fact, Whitney Economics (2020) reported that 65% of producers that participated in their national survey in 2019 did not have a buyer for their crops. Developing these markets is further limited by the lack of information, research, and infrastructure to support growers and processors to take advantage of opportunities. Very little investment has been made to analyze the profitability of hemp production and consumer demand for these products.

The future of industrial hemp in Florida

Several states, including Colorado, Kentucky, and Oregon, immediately began to create a hemp industry after the passage of the 2014 Farm Bill (Vote Hemp 2019). These states have accumulated years of experience leading to the development of hemp varieties suited for their climates. Florida, on the other hand, did not begin developing an industrial hemp industry until 2017, when it authorized hemp pilot projects in two land-grant universities, UF and FAMU. Even with the later start, the Florida Department of Agriculture and Consumer Services (FDAC) has been vocal about its support for the hemp industry. Commissioner Nikki Fried said that, “By working closely with our farmers, processors, retailers, and consumers, Florida’s state hemp program will become a model for the nation, will set a gold standard for this emerging industry, and will create billions in economic opportunity for Florida” (CBS Miami 2020). A director of cannabis was appointed by Commissioner Fried to develop the infrastructure needed for this industry, bringing experience from her previous work in Tennessee’s hemp pilot program. Florida has positioned itself as a leader in the regulatory space with several similarities and common developments arising between the Florida and Federal hemp program rules.

While Florida was not one of the first states to cultivate hemp under the new legislation, it could still develop a successful hemp industry. States like Florida that have more recently decided to implement industrial hemp programs must establish effective policies having observed the experiences of other states. The Florida agricultural sector and those public and private actors that support it need to advance the development of markets for hemp-related products in order for hemp to become profitable.One example of market development for industrial hemp is the effort by FDACS’s Fresh from Florida program, established to promote agricultural products produced in Florida, which now includes hemp. It is offering growers the option of marketing their products with a “Made with Florida Hemp” logo. Additionally, Florida needs to work with neighboring states and the federal government not only to harmonize regulations but also to encourage official rules to be set for the use of industrial hemp products.Defining official regulations in this way will provide clarity regarding what activities can be undertaken, which would also provide assurances to the financial sector. Finally, those interested in having a profitable hemp industry in Florida need to invest efforts to develop varieties and best management practices that are best suited to Florida’s climate and to determine under what circumstances hemp can be a viable alternative for Florida growers.

References

Antunović, Z., Ž. Klir, and J. Novoselec. 2019. “An Overview on the Use of Hemp (Cannabis sativa L.) in Animal Nutrition.” Poljoprivreda 25 (2): 52–61 https://doaj.org/article/959928bc961f4835be86191d9de7c4dc

Biswas, T., Z. Guan, and F. Wu. 2017. Mexican Competition and Trade Policy. TOMATO PROCEEDINGS, 30.

CBS 4 Miami. 2020. “‘Florida’s Hemp Industry Officially Begins Now’: State Can Now Accept Applications to Grow Industrial Hemp.” Available at https://cutt.ly/yWAMWlC

Customs and Border Patrol (CBP). 2019. “Did You Know... Marijuana Was Once a Legal Cross-Border Import?” Available at https://www.cbp.gov/about/history/did-you-know/marijuana

Davies, S. 2021. “Farm Credit, USDA Actions on Lending Have Hemp Industry Concerned.” Agri-Pulse. https://www.agri-pulse.com/articles/16276-farm-credit-usda-actions-on-lending-have-hemp-industry-concerned

Farnsworth, D., K. A. Grogan, A. H. van Bruggen, and C. B. Moss. 2014. “The Potential Economic Cost and Response to Greening in Florida Citrus.” Choices Magazine 29(3).

Federal Reserve. 2020. “Agencies clarify requirements for providing financial services to hemp-related businesses.” Available at https://www.federalreserve.gov/newsevents/pressreleases/bcreg20191203a.htm

Florida Department of Agriculture and Consumer Services (FDACS). 2021a. “Hemp Cultivation Licensing.” Available at https://www.fdacs.gov/Cannabis-Hemp/Hemp-CBD-in-Florida/Hemp-Cultivation-Licensing

Florida Department of Agriculture and Consumer Services (FDACS). 2021b. “Hemp Food Establishment Permit.” Available at https://www.fdacs.gov/Business-Services/Food/Food-Establishments/Hemp-Food-Establishment-Permit

Florida Department of Agriculture and Consumer Services (FDACS). 2021c. “Notice: 25001670.” Available at https://www.flrules.org/Gateway/View_notice.asp?id=25001670

Hemp Benchmarks Editors. 2020. “2020 CBD Biomass Production Estimate.” Available at https://cutt.ly/KWAMhav

Johnson, R. 2019. “Hemp-Derived Cannabidiol (CBD) and Related Hemp Extracts.” Available at https://fas.org/sgp/crs/misc/IF10391.pdf

Karche, T. 2019. “The Application of Hemp (Cannabis sativa L.) for a Green Economy: A Review.” Turkish Journal of Botany 43 (6): 710–723.

Miller and Martin PLLC. 2020. “Georgia Begins Accepting Hemp Processor Permit Applications.” Available at https://www.millermartin.com/in-depth/blog/georgia-begins-accepting-hemp-processor-permit-applications/

Mosquera, M., E. A. Evans, and R. Ploetz. 2015. “Assessing the Profitability of Avocado Production in South Florida in the Presence of Laurel Wilt.” Theoretical Economics Letters 5 (02): 343. Available at: https://www.scirp.org/journal/PaperInformation.aspx?PaperID=56018

Pierce, G., and D. Rodriguez-Leyva. 2010. “The Cardiac and Haemostatic Effects of Dietary Hempseed.” Nutrition and Metabolism 7:32 Available at https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2868018/

Smith, H. 2019. “Is it legal to smoke hemp where I live?” Green Unicorn Farms. Available at https://greenunicornfarms.com/blog/hemp-legalities-by-state/

Sterns, J. A. 2019. “Is the emerging US hemp industry yet another boom–bust market for US farmers?” Choices Magazine 34 (3): 1–8.

Vote Hemp. 2019. U.S. Hemp license report. Available at https://www.votehemp.com/u-s-hemp-crop-report/

Whitney Economics. 2019. Whitney Economics Releases Results of U.S. Hemp Industry Survey: Survey Says Hemp Industry is Poised to Become the Fourth Major U.S. Crop and a Foundation to American Agriculture. Press release, November 19 2019. https://www.businesswire.com/news/home/20191119005089/en/Whitney-Economics-Releases-Results-of-U.S.-Hemp-Industry-Survey