Introduction

The purpose of this study is to present practical enterprise budgets and help growers to determine how the particular crop they are growing influences profitability. If growers need to reduce costs and increase profitability, which cost component should they primarily focus on? Will switching to a different production practice be economically feasible? This information will help growers to determine which crops are relatively profitable to grow. Such information has been so far neglected in enterprise budgeting analysis for ornamental production. By comparing and aggregating a set of crops similar to those in our study, growers can identify their operational efficiency. Additionally, sensitivity analysis provides applications to risk situations associated with price and input costs. Growers can make necessary modifications to reflect their own situations and determine if adoption of alternative pest management practices is economically feasible. With increasing environmental concerns related to pesticides and consumer demand for sustainable products, it is important for growers to be forward-thinking and prepared to meet these challenges. Relevant stakeholders including Extension agents should understand the production cost structure and production decisions while developing educational programs with more relevant research recommendations.

Background

The United States is one of the world’s largest producers of floriculture crops and nursery plants. According to the Floriculture Crops 2018 Summary report (USDA NASS 2019), the total wholesale value for all growers with $10,000 or more in sales is estimated to be $4.63 billion in 2018, with California and Florida as the two leading states accounting for almost half of the value. The combined wholesale value of all bedding and garden plants is $2.16 billion, making it the largest plant category among all reported plant categories. The wholesale value for potted herbaceous perennials totaled $708 million in 2018, up 24% from 2015 and representing 33% of the total bedding and garden wholesale value.

According to the National Green Industry Survey (2019), the share of herbaceous perennials accounted for 8.0% of the total industry sales, ranking the second top plant category next to annual bedding plants (12.4%). Nonetheless, the industry has experienced continuously declining revenues in recent years due to considerable consolidation within the industry, increased price competition, and relatively weak consumer demand (Madigan 2018). Thus, it is important for floriculture crop growers to maintain low-cost and competitive production practices. While inquiring about the importance of various factors that affected competitiveness and performance, Khachatryan et al. (2020) reported that “cost of production” was the highest-rated factor with an average rating of 2.9 on a 4-point rating scale (4 representing “very important,” 3 representing “important,” 2 representing “minor importance,” and 1 representing “not important”).

The total production area of greenhouse operations (including glass, rigid plastic, and film plastic greenhouses) was estimated to be 423,013,000 sq. ft. in 2018, accounting for almost half of the total area of covered production (USDA NASS 2019). This study focused on greenhouse production of perennial crops not only because of its importance to the ornamental horticulture industry (i.e., providing out-of-season plant products), but also because of the high level of risk (e.g., large investment, yield and demand uncertainty) involved in greenhouse production. Greenhouse production is more capital-intensive than producing the same crop in the open field.

To estimate the cost of greenhouse production for perennial plants and help growers to determine the way that the crop they are growing influences profitability, ten representative perennial plants (Table 1) were selected based on their sales values (USDA NASS 2014). Due to high levels of risks involved in greenhouse production, this enterprise budgeting incorporated sensitivity analysis to account for risk situations associated with changes in price and input costs. Uncertainty in prices could be caused by supply or demand shock due to extreme weather conditions or outbreak of a widespread crop disease. Due to our primary interest in consideration of alternative production practices related to pest management, the uncertainty in input cost was represented by changes in pesticide and chemical costs and changes in labor costs, which can be caused by switching to alternative pest management practices, or substitution between labor and intensive management of chemicals. Material costs are also important input cost items and represent a large share of production costs, but they are not the main focus of this study.

Methods

Partial Budgeting Analysis Assumptions

Farm enterprise budgets remain the primary approach used by Extension professionals and growers to gauge the profitability of farm business operations. A traditional enterprise budget contains all the revenue and cost associated with a single enterprise involving both fixed and variable cost. In contrast, partial budgeting is a commonly used economic tool to show the effect of changes in production operations and assess economic profitability of an alternative production practice. By the definition of partial budgeting analysis, upfront fixed investment costs that are unchanged (such as land lease/purchase, greenhouse construction costs, or machinery) were suppressed. Even though the initial investment in assets was assumed away in this partial analysis, investment cost was partially captured in the overhead costs due to the importance of capital investment in an enterprise budget (see more details in the “Overhead Costs” section). The supporting assumptions were based on USDA survey data combined with knowledge and experience of agricultural economists, Extension horticulturalists, and ornamental plant producers.

This analysis considered a representative grower operating an existing greenhouse of 20,000 square feet (about 0.46 acre) designated for the production of a single perennial crop. The finished plant size of 1-gallon containers is considered to reflect the actual products available in retail outlets. Therefore, the representative grower was assumed to start with 50,000 plants for a finished size of 1-gallon containers (Table 1). Fisher et al. (2014) considered an example of 100,000 square feet to produce 250,000 one-gallon plants, but they did not specify whether the 250,000 one-gallon plants in their analysis were one single crop or multiple crops. The cost of growing media is calculated based on the finished container sizes (Fisher 2014). Growth period is then specified for each of the 10 crops (Dole and Wilkins 1999). Growth period is used to calculate fertilizer and chemical usage and associated costs (Hinson et al. 2008). Due to variations in production practices within the green industry, individual growers may have different production schedules depending on whether they start from seed germination or different stages of propagation or transplants. Considering the shrinkage rate across all plant types was about 8% (Fisher et al. 2014), we assumed a 10% shrinkage rate to account for the proportion of total production loss when calculating sales revenue. The shrinkage rate partially captures yield uncertainty, which is not explicitly modeled in this analysis. In sensitivity analysis, yield is held constant to indicate that any switch of pest management practices will need to produce the same amount of yield to be comparable.

Direct Costs

Eight detailed items were considered to capture the direct operating costs of a greenhouse operation. The cost categories included seeds and plants, pots and containers, growth media, fertilizer, insecticides, fungicides, other chemical controls, and tags. Unit costs for materials were adopted from several published sources and individual interviews with growers. For example, unit prices for pots and containers and tags were adopted from a New Jersey greenhouse production analysis (Rutgers New Jersey Agricultural Experiment Station Farm Management 2008). The cost of growing media was assumed to be $2.00 per cubic foot (Fisher et al. 2014; Stathacos and White 1981; UMass Extension Greenhouse Crops & Floriculture Program 2003). The prices for insecticides and other chemicals were based on retail prices obtained from vendors, but individual growers may receive discounts depending on the size of their transaction/operation (i.e., bulk discounts). Details on calculating each cost component are presented in Table 2 using hostas (1-gallon) as an example. All other perennial plants follow the same structure. Table 3 summarizes the total direct cost for the 10 selected plants.

Labor Costs

Specialty crop production is labor intensive, and another large portion of production cost is associated with labor. Zahniser et al. (2012) estimated that labor expenses accounted for about 40% of the total variable costs for specialty crops production. According to the Bureau of Labor Statistics, the mean wage for green industry in Florida was $10.38 in 2016 (NAICS Classification Code 45-2092, Farmworkers and Laborers, Crop, Nursery, and Greenhouse). Hinson et al. (2008) utilized the wage rates of $9.60 and $15.30 to distinguish unskilled labor and skilled labor (e.g., tractor operators). In this analysis, labor costs were calculated based on three broad categories: unskilled labor, pest control labor, and skilled managerial labor with hourly wage rates set at $9.60, $12.00, and $15.00, respectively.

Overhead Costs

The third biggest category in greenhouse production is overhead costs. This study broke overhead costs into two major components: heating and fuel, and other overhead costs, which include depreciation, interest, taxes, insurance, repair and maintenance, truck and equipment, and other cash expenses. Heating and fuel costs were calculated based on the production area of 20,000 square feet throughout the production period for each perennial plant, and thus vary only across different growth periods. Heating and fuel costs may vary depending on the location of the greenhouse, but the analysis of this variation is beyond the scope of the present study.

Economic Performance Indicators

The market prices used for calculating sales revenues for the 10 perennial plants were based on combined information of USDA NASS data and wholesale prices received by growers. Gross margin, net income (profit), and profit margin are calculated for a representative grower to provide baseline performance scenarios in the industry using the following formulas:

Gross Margin = (Total Sales – Total Direct Costs) / Total Sales,

Net Income = Total Sales – Total Costs,

Profit Margin = Net Income / Total Sales,

where Total Sales is given by unit price × the number of plants × (1 – the shrinkage rate).

Gross margin measures the percentage of revenue that exceeds daily operating costs. Therefore, as an indicator of profitability, the higher the gross margin is, the more efficient a given operation is in generating profit from operating costs involved in production. Based on this definition, it is worth noting that the gross margin indicator may slightly overestimate the profitability as labor costs are separated as a standalone category. In general, production labor (e.g., unskilled labor) is typically considered as a direct cost. In addition, increases in total sales and revenue do not necessarily translate into increased profitability. It is necessary to introduce net income (in absolute dollar amount) and net profit margin to measure profitability.

Results

Cost Summary and Economic Performance

Table 3 summarizes the total direct costs and per unit cost for the selected 10 perennial plants. Chrysanthemums, Nepeta, and Agastache had the lowest direct cost among the selected 10 perennial plants. Total direct cost of producing the three perennial plants is less than $46,000 (equivalent to a direct cost of $1.00 per unit). On the high-cost end, total direct costs of producing hostas and coral bells are $109,000 and $124,000, respectively (equivalent to a direct cost of $2.40 and $2.80 per unit, respectively).

In terms of detailed cost categories, material costs, including seeds and plants, containers, and growing media, represented the largest portion of the total direct costs followed by tags and expenses on fertilizer. Material costs accounted for 60% to 90% for perennial plants (Table 3). Particularly, perennial plants such as hostas, daylilies, coral bells, and Echinacea had relatively high material costs; more than 80% of the total direct costs went to materials for these plants. Agrichemical costs in general are small-cost items. For example, insecticides alone only account for about 2% for perennial plants. Our calculations indicated that growers may face tradeoffs among material costs (e.g., seed costs and growing media) and fertilizer and chemical input costs depending on their decisions on the starting stages of plants. For instance, production from seed germination may significantly reduce cost on seeds compared with production from seedling plugs; however, this decision may increase costs for growing media as well as fertilizer and chemical control due to a longer growth period.

Table 3 summarizes detailed labor costs. Labor cost varied significantly among perennial plants. For example, total labor costs for Rudbeckia were as high as $66,115 and as low as $16,536 for hostas and coral bells. Regardless of plant type, expenses for unskilled labor (e.g., picking and cutting) accounted for more than 70% of total labor costs. The combined expenses for semiskilled (e.g., pest control) and skilled labor (e.g., managerial) accounted for 20% to 30% of the total labor costs.

As shown in Table 5, heating and fuel costs generally accounted for about 30% of the overhead costs. Other overhead costs (i.e., expenses related to depreciation, interest, taxes, insurance, repairs and maintenance, truck and equipment, and other cash expenses) comprised 70% of the overhead costs. Given that heating and fuel usage and other overhead costs were allocated across square footage and growth periods, we typically observed that plants with longer growing periods had higher overhead costs.

Table 6 summarizes economic performance indicators. Even though perennial plants in general have slightly higher production costs, all three economic indicators suggested that all perennial plants generated positive economic returns. By simply looking at the gross margin, one may have an impression that the decision of which specific crop to grow may not be very important. However, high gross margins may not necessarily lead to high profit margins once labor costs are included because specialty crop production is labor-intensive. A cross-comparison between gross margin and profit margin reveals more information on crop profitability. For example, among the top five perennial plants (that have the largest sales values), Salvia and coral bells had relatively high gross margins, but relatively low profit margins. Thus, they were not as profitable as chrysanthemums and daylilies. By looking at gross margin only, one might think hostas were not as profitable as Salvia or Dianthus. It is not surprising to see that the top three revenue-generating plants (i.e., chrysanthemums, hostas, and daylilies) have relatively high profit margins. In fact, producing Rudbeckia and Dianthus led to extremely low profits and profit margins. Even though profit margins take into consideration all related production costs and are a more reliable predictor for economic performance and profitability, our analysis indicated that looking at multiple indicators is more informative for growers when selecting crops. Profitability varied significantly in perennial plant production, which may be due to additional pest pressures and longer growth periods. It is recommended to maintain a gross margin of 30%–40% and a profit margin of 10%–15% to be sustainable in the industry.

Sensitivity Analysis

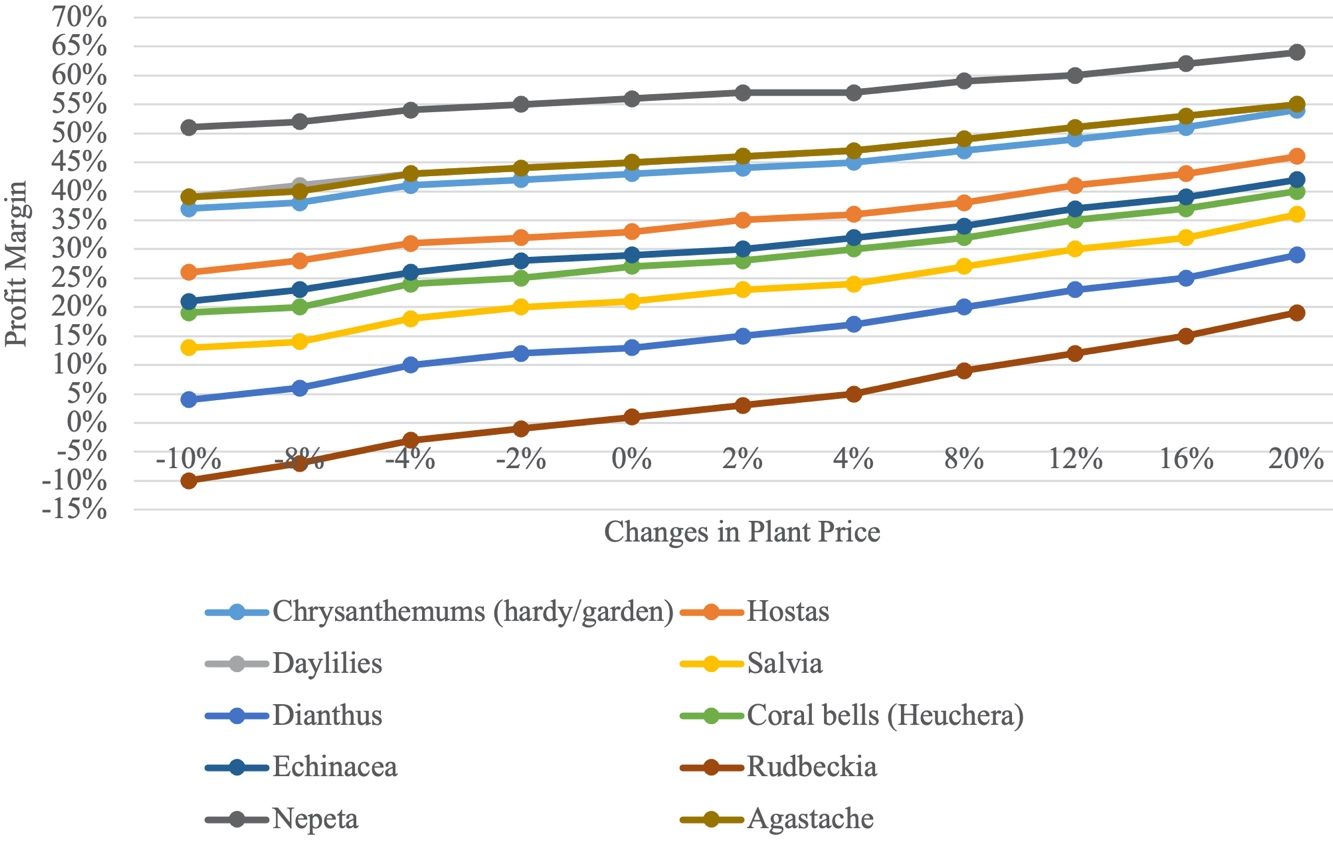

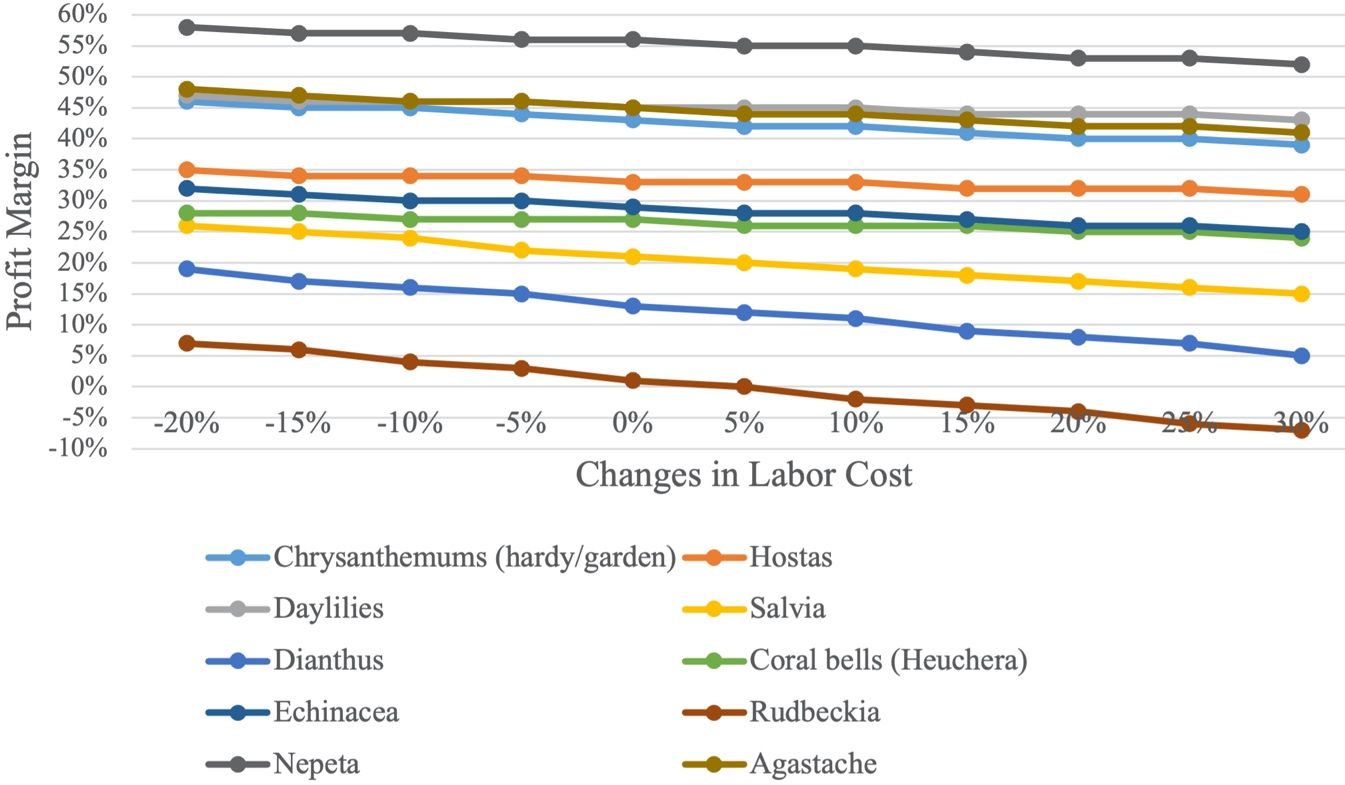

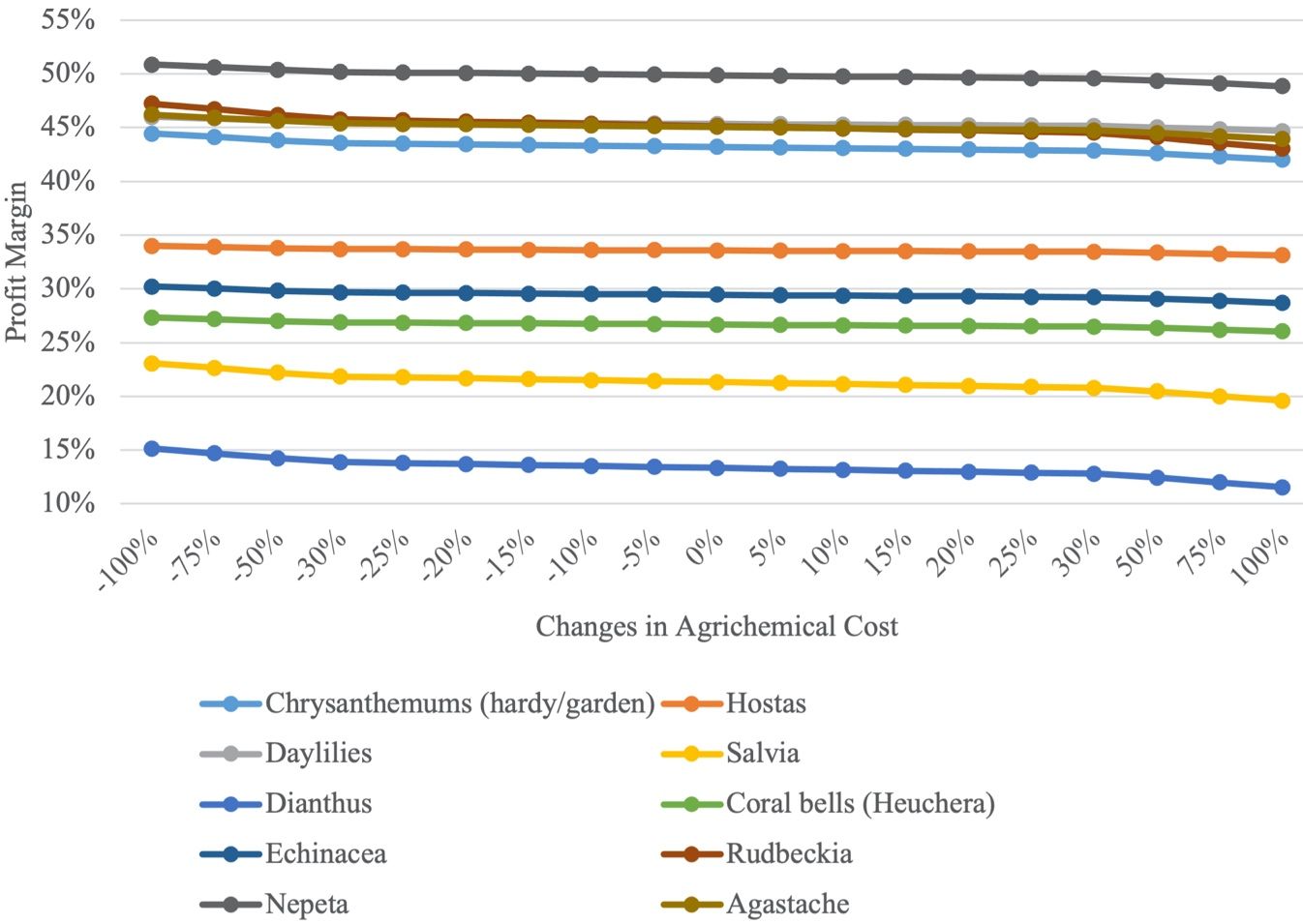

Sensitivity analysis is one way to assess uncertainty when building enterprise budgets. This study considers three uncertainty scenarios. Table 7 and Figure 1 demonstrate the effect of price uncertainty. The scenario was set to be unbalanced between -10% and +20%, as we anticipated a price premium due to consumer valuation for sustainable products or production practices (Khachatryan et al. 2017; Rihn et al. 2016). In response to increased attention to policies related to pollinator health (Gemmill-Herren 2016) and consumer valuation for pollinator-friendly labels (Khachatryan et al. 2017), we considered profit margin scenarios related to cost changes induced by alternative production practices, such as pesticide-free or neonicotinoid-free practices. Research on production costs of organic and conventional production systems showed that production costs for organic products tend to be higher than (Brumfield and Brennan 1996; Butler 2002; Takele et al. 2007) or similar to conventional products (Dalton et al. 2005; Dalton et al. 2008). Therefore, the scenario for changes in labor costs in Table 8 and Figure 2 was also set to be unbalanced (-20% to +30%). Table 9 and Figure 3 demonstrated the profit margins with percentage change in chemical controls ranging from -100% to +100%. This calculation simulates two possible production regimes that greenhouse growers could adopt, depending on their risk perceptions, financial capabilities, equipment, and infrastructure: either switch to a completely chemical-free program, or intensively substitute neonicotinoid insecticides with other chemical controls.

Credit: UF/IFAS

Credit: UF/IFAS

Credit: UF/IFAS

A cross-comparison of the three uncertainty scenarios indicates that price is the most important determinant of profit margins. A slight increase or decrease in price and labor could significantly affect greenhouse growers’ profitability. Profit margins were not significantly affected by changes in agrichemical inputs due to their small share in total production costs. This finding is consistent with the findings of Fisher et al. (2014), who also indicated that lowering cost in pesticides or fertilizers alone has little impact on profitability. The combined effect of chemical and labor inputs induced by a switch of chemical use or pest management practices has a more profound impact on profitability and profit margins. Therefore, we recommend that growers emphasize labor item shifts and associated changes in costs when considering potential cost savings. Additionally, some plants are less resistant to potential risks. Profit margins for some perennial plants such as Rudbeckia, Salvia, and Dianthus were sensitive to cost changes compared to others.

There are also a few considerations to keep in mind when interpreting profit margin figures and other economic performance indicators. The initial upfront investment was not included in this analysis, and it was only partially accounted for in the overhead cost category, resulting in an overestimation of profit margins for each individual plant. Nonetheless, not fully accounting for investment cost does not affect the validity of comparing profitability across different perennial plants and overall consideration of crop mix.

Conclusions

This report summarized a partial enterprise budget for 10 perennial plants. The budget represented a typical operation of a 20,000 square foot greenhouse and serves as an economic benchmark for growers with comparable size and operation characteristics. By knowing the costs in the production process, producers can focus on cost reduction in specific areas and maintain low-cost and competitive production practices (e.g., “lean processing”). While producing a set of ornamental crops rather than a single crop is more common in the green industry, enterprise budget estimates for each individual crop are still useful in identifying which crop(s) might be more profitable. Depending on the size of the operation, as well as the combination of crops produced, production costs might vary significantly among growers.

Considering an average grower operating a greenhouse with a production area of 100,000 square feet producing a crop mix of five perennial crops, a straightforward application of our analysis is to aggregate a few different combinations of crops from our list. Based on our analysis, a grower producing the top five profitable crops (i.e., chrysanthemums, hostas, daylilies, Nepeta, and Agastache) would be much more profitable than a grower producing a combination of the five least profitable crops (Salvia, Dianthus, coral bells, Echinacea, and Rudbeckia). This simple aggregation may have ignored some efficiency gains due to economies of scale. Nonetheless, adding up similar crops or crops with similar growth periods in our list may still provide some useful information to growers as a benchmark case. By providing estimates of revenue and expenses for each perennial crop, this analysis can assist growers in reducing costs in specific areas and in selecting an appropriate combination of crops to maximize profits. This method can be easily generalized to estimate the production costs of other perennial plants in different greenhouse sizes.

In addition, our sensitivity analysis of cost scenarios simulated different production regimes that greenhouse growers could adopt. With increasing environmental concerns related to pesticides and consumer demand for sustainable products, it is important for growers to be forward-thinking and prepared to meet these challenges.

References

Brumfield, R. G., and M. F. Brennan. 1996. Crop Rotational Budgets for Three Cropping Systems in the Northeastern United States. Rutgers New Jersey Agricultural Experiment Station.

Butler, L. J. 2002. “Survey quantifies cost of organic milk production in California.” California Agriculture 56(202): 157–162.

Dalton, T. J., L. A. Bragg, R. Kersbergen, R. Parsons, G. Rogers, D. Kauppila, and A. Wang. 2005. Cost and Returns to Organic Dairy Farming in Maine and Vermont for 2004. Orono, ME: University of Maine Department of Resource Economics and Policy Staff Paper #555.

Dalton, T. J., R. Parsons, R. Kersbergen, G. Rogers, D. Kauppila, L. McCrory, L. A. Bragg, and Q. Wang. 2008. A Comparative Analysis of Organic Dairy Farms in Maine and Vermont: Farm Financial Information from 2004–2006. Orono, ME: University of Maine, Maine Agricultural and Forest Experiment Station Bulletin 851.

Dole, J. M., and H. F. Wilkins. 2005. Floriculture: Principles and Species. Upper Saddle River, NJ: Prentice-Hall, Inc., Simon & Schuster/A Viacom Company.

Fisher, P., A. Hodges, B. Swanekamp, and C. Hall. 2014. The New Economics of Greenhouse Production. Floriculture Research Alliance.

Gemmill-Herren, B. (ed.) 2016. Pollination Services to Agriculture: Sustaining and Enhancing a Key Ecosystem Service. Oxon and New York, Routledge.

Hinson, R. A., A. Owings, J. Black, and R. Harkess. 2008. Enterprise Budgets for Ornamental Crops in Plant Hardiness Zones 8 and 9. Working Paper Series #2008-14. Baton Rouge, LA: Department of Agricultural Economics and Agribusiness, Louisiana State University AGCenter.

Khachatryan, H., A. Hodges, C. Hall, and M. Palma. 2020. Production and Marketing Practices and Trade Flows in the United States Green Industry, 2018. Southern Cooperative Series Bulletin #421 (May, 2020).

Khachatryan, H., A. L. Rihn, B. Campbell, C. Yue, C. Hall, and B. Behe. 2016. “Visual attention to eco-labels predicts consumer preferences for pollinator friendly plants.” Sustainability 9:1743–1756.

Madigan, J. 2018. Plant & Flower Growing in the US. IBISWorld Industry Report 11142.

Nebraska Extension at University of Nebraska—Lincoln. 2016. Neonicotinoid Insecticides – Pollinators, Plants and Your Garden. Accessed January 16, 2020. https://extension.unl.edu/statewide/cass/Neonictinoid%20Insecticides%20-%20Pollinators%2C%20Plants%20and%20Your%20Garden%20...%20August%2012%2C%202018.pdf

Rihn, A. L., H. Khachatryan, B. Campbell, C. Hall, and B. Behe. 2016. “Consumer Preferences for Organic Production Methods and Origin Promotions on Ornamental Plants: Evidence from Eye-Tracking Experiments.” Agricultural Economics 47:599–608.

Rutgers New Jersey Agricultural Experiment Station Farm Management. 2008. “Greenhouse Costs of Production Budgets.” Accessed January 20, 2023. https://farmmgmt.rutgers.edu

Stathacos, C. J., and G. B. White. 1981. An Economic Analysis of New York Greenhouse Enterprises. Ithaca, NY: Department of Agricultural Economics, Cornell University. Accessed November 18, 2020.

Takele, E., B. Faber, M. Gaskell, G. Nigatu, and I. Sharabeen. 2007. Sample Costs to Establish and Produce Organic Blueberries in the Coastal Region of Southern California, San Luis Obispo, Santa Barbara, and Ventura Counties, 2007. University of California Cooperative Extension.

UMass Extension Greenhouse Crops & Floriculture Program, the Center for Agriculture, Food and the Environment, University of Massachusetts Amherst. 2003. “Calculating Costs for Growing Media.” Accessed October 7, 2019. https://ag.umass.edu/greenhouse-floriculture/fact-sheets/calculating-costs-for-growing-media

USDA NASS. 2015. Census of Horticultural Specialties (2014). Washington, D.C.: United States Department of Agriculture, National Agricultural Statistics Service (USDA/NASS).

USDA NASS. 2019. Floriculture Crops 2018 Summary. Washington, D.C.: United States Department of Agriculture, National Agricultural Statistics Service (USDA/NASS).

Zahniser, S., T. Hertz, P. Dixon, and M. Rimmer. 2012. The Potential Impact of Changes in Immigration Policy on U.S. Agriculture and the Market for Hired Farm Labor: A Simulation Analysis. ERR-135. Washington, D.C.: United States Department of Agriculture, Economic Research Service (USDA-ERS).

Table 1. Fertilizer and chemicals usage for selected greenhouse-grown perennial plants.

Table 2. An example cost structure for hostas (1-gallon).

Table 3. Total direct cost for selected greenhouse-grown perennial plants.

Table 4. Labor cost for selected greenhouse-grown perennial plants.

Table 5. Overhead costs associated with selected greenhouse-grown perennial plants.

Table 6. Economic performance indicators for selected greenhouse-grown perennial crops.

Table 7. Profit margin scenarios with uncertainty in prices.

Table 8. Profit margin scenarios with uncertainty in labor cost.

Table 9. Profit margin sensitivity analysis: Uncertainty in agrichemical costs scenario.