Introduction

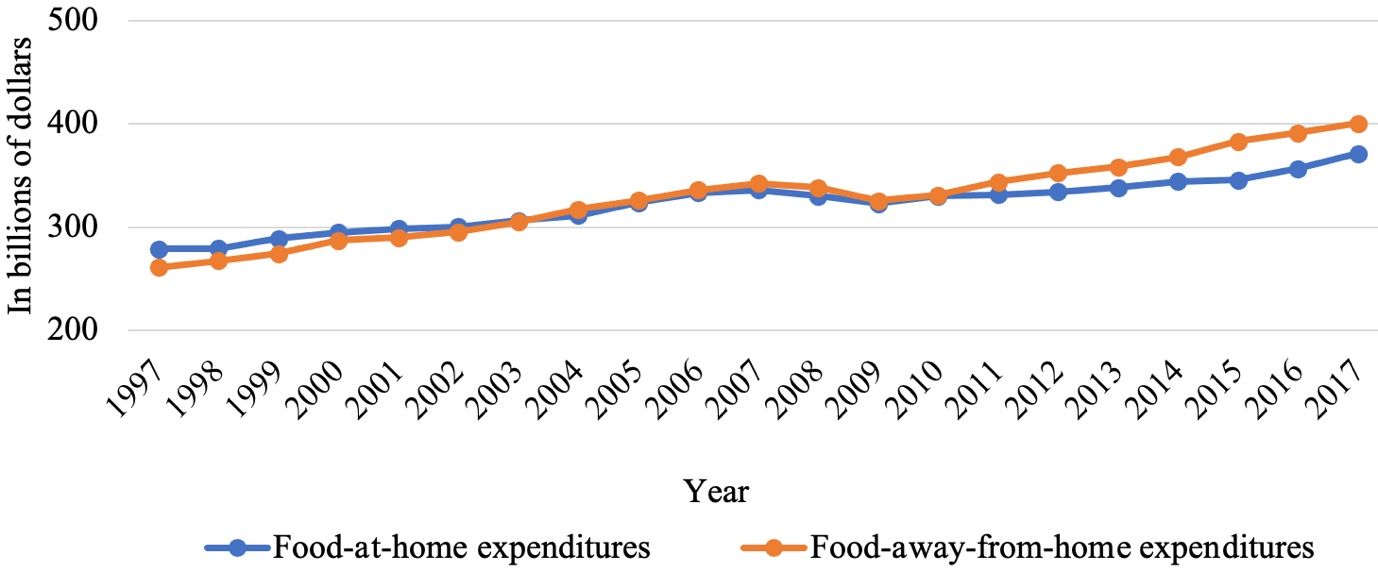

The US Department of Agriculture (USDA) data on food expenditures show that US consumers spent approximately 10% of their disposable income on food, and 46% of the total food expenditures were devoted to food-at-home consumption in 2017 (Figure 1). In 2010, expenditures on food-away-from-home (e.g., full- and quick-service restaurants) were higher than expenditures on food-at-home (e.g., grocery stores and other food retail stores) for the first time (see Food Expenditure Series—https://www.ers.usda.gov/data-products/food-expenditure-series/documentation/—for definitions of FAH and FAFH). This trend continued through 2017. The principal actors that drove this phenomenon were food shoppers. Targeting primary food shoppers, this study aims to provide an overview of food shopping patterns and consumer behavior. To track consumer trends and evaluate the landscape of the food market on a year-to-year basis with consistent measures, this study provides an analysis of 2017 consumer data and serves as the baseline for future yearly analyses.

Credit: Food Expenditure Series, USDA-ERS, https://www.ers.usda.gov/data-products/food-expenditure-series/

Data and Methods

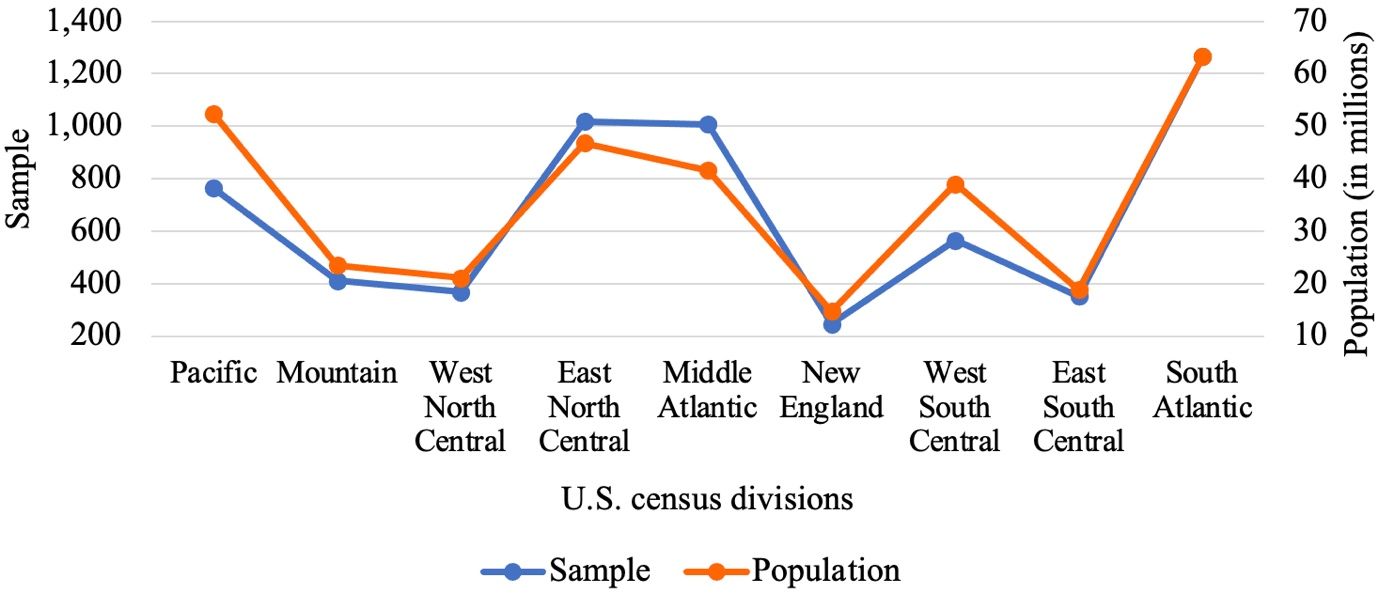

To investigate consumer perspectives about food and beverage consumption in a timely manner, the Florida Agricultural Market Research Center in the Food and Resource Economics Department at the University of Florida developed and maintains a monthly consumer tracker to collect consumer data nationwide (support to the monthly consumer tracker is provided by the Florida Department of Citrus). Through an online survey platform, the consumer tracker collects approximately 500 valid responses from primary grocery shoppers in the United States each month. The participants are randomly drawn from a demographically and geographically balanced panel to represent the US population as well as screened to meet the criteria of being a primary grocery shopper, being above 18 years of age, and being from a household with an income level above $25,000. Therefore, this sample represented the profile of US food shoppers rather than the US population. To control for data quality, the consumer tracker used two screeners to verify whether participants were carefully reading questions (Jones et al. 2015). Because the data collection occurred at the beginning of each month on data for the prior month, this study focuses on data collected from February 2017 to January 2018, covering January 2017 to December 2017. After excluding observations with missing values and identical values in questions about food-related attitudes, the final sample size was 5,993. The distribution of the sample among US census divisions was similar to the geographical population distribution in 2017 (Figure 2).

Credit: Survey data calculated by authors; and US population by divisions in 2017 (US Census Bureau, https://data.census.gov/cedsci/)

Consumer Demographics

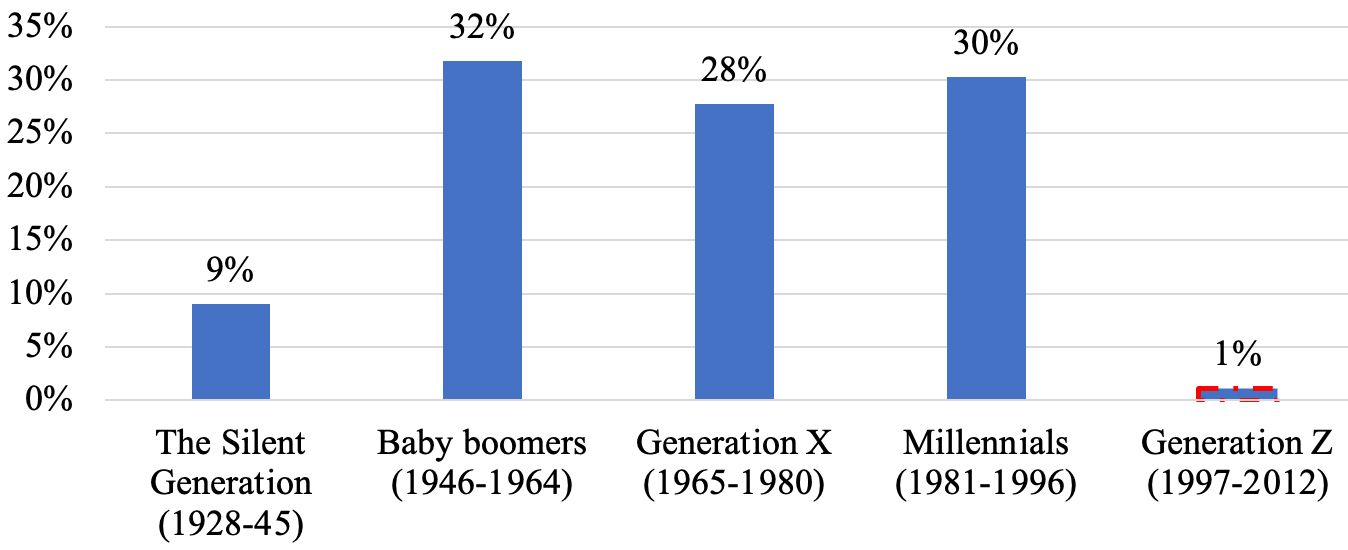

Primary food shoppers are defined as consumers who either are primarily responsible for or share responsibility of food shopping tasks in the household. The majority of the sample were women (67%), college-educated (66%), and with a household income above $50,000 (66%). Respondents were from medium-sized families with 2.7 household members, with 13% and 15% of the respondents having pre-school and school-aged children, respectively. With respect to generations, baby boomers (born between 1946 to1964), generation X (born betwen1965 to 1980), and millennials (born between 1981 to 1996) made up 90% of the sample (Figure 3). This percentage was higher than that in the United States census (63%) because this study focused on primary food shoppers above 18 years of age. It is worth noting that generation Z’s share in this sample was fairly low but was expected to grow as more Gen Zs became eligible for this consumer survey, which only targeted consumers above 18 years of age. Data on Gen Z in this study are presented as a reference point for the future but did not include Gen Z as a part of food shopper trends analyses. In the following sections, Gen Z’s data are presented with dash outlines.

Credit: Survey data calculated by authors

Grocery Spending

In a typical week in 2017, an average consumer/household’s grocery expenditure was $137. Specifically, high-income, middle-income, and lower-income households spent $181, $139, and $106 on groceries on a weekly basis. Once the data were adjusted for household size, average weekly food expenditures (i.e., per capita) was $55.

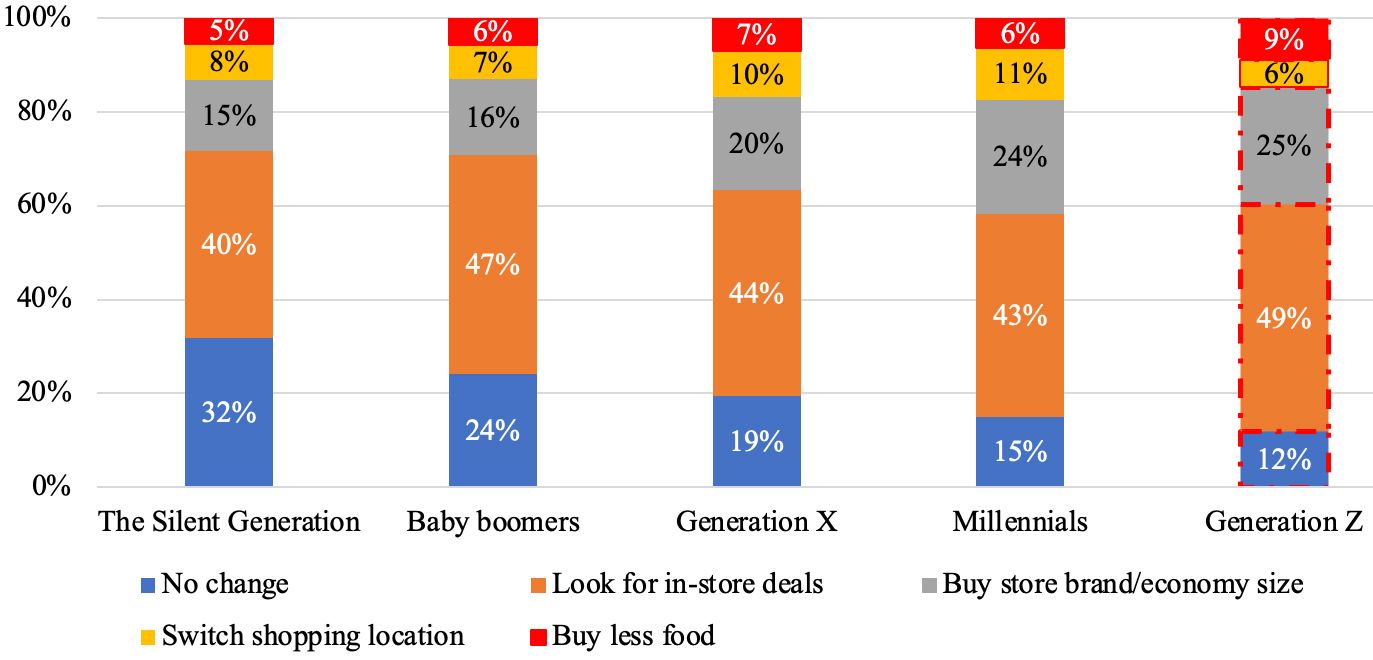

As price cue is important to consumers’ food-related behavior, consumers responded to food price increases differently. For instance, as shown in Figure 4, when facing noticeable food price increases, the dominant coping strategy for all generations is to look for in-store deals. However, the senior generations (i.e., the silent generation and baby boomers) were less likely to change their shopping behaviors, whereas the young generations (i.e., millennials and generation Z) were more likely to switch to store-branded products or larger economy sizes.

Credit: Survey data calculated by authors

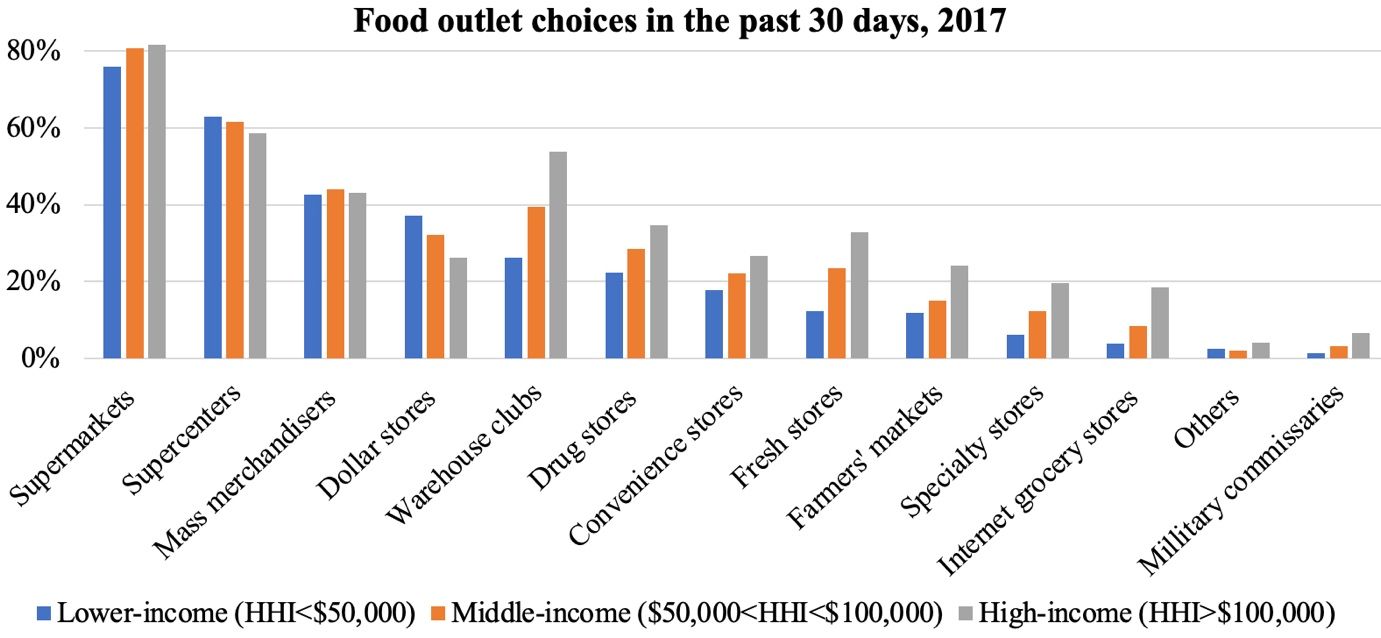

Food Shopping Outlets

Understanding consumers’ food outlet choices will help to better identify marketing opportunities and more efficiently develop strategies promoting healthy eating. From the list of food outlet formats (supermarkets or grocery stores, supercenters, mass merchandisers, warehouse clubs, dollar stores, drug stores, fresh stores, convenience stores, farmers’ markets, specialty stores, internet grocery stores, military commissaries, and others), respondents were asked to select all formats of food outlets that they had visited in the past 30 days. In 2017, an average consumer visited 3.7 different formats of food outlets on a monthly basis. Further, lower-income (household income between $25,000 and $50,000), middle-income (household income between $50,000 and $100,000), and high-income consumers (household income above $100,000) visited 3.2, 3.7, and 4.3 food outlets, respectively. As illustrated in Figure 5, supermarkets (grocery stores), supercenters, and mass merchandisers were the most popular formats patronized by more than 40%–80% of the consumers. Compared to middle- and lower-income consumers, high-income consumers were more interested in warehouse clubs, limited-assortment stores (e.g., drug stores and fresh stores), and high-end stores (e.g., fresh and specialty stores).

Credit: Survey data calculated by authors

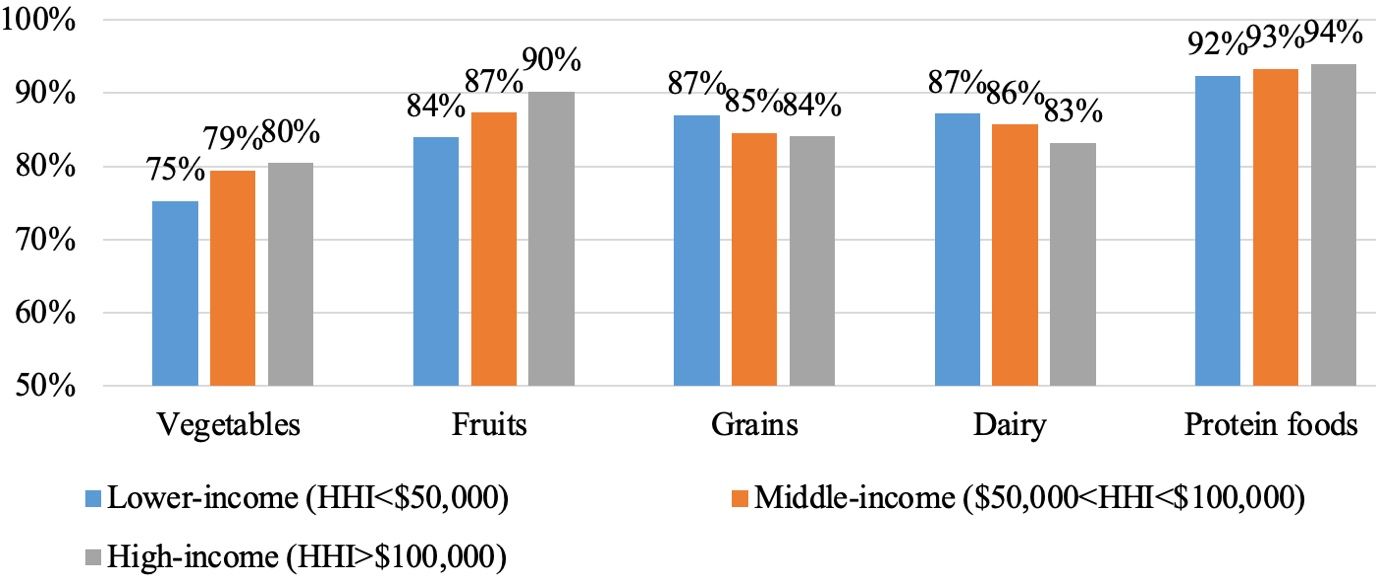

Food and Beverage Purchase Patterns

On average, food shoppers indicated having breakfast 23 days in a typical month and more than two-thirds indicated they tried to eat a healthy breakfast. The data below focus on 10 common food categories from five food groups: vegetables, fruits, grains, protein foods, and dairy. Note that this study focused only on animal protein. Plant-based proteins such as legumes, nuts, seeds, and soy products were added to the consumer tracker in November 2020. Results show that protein foods (93%) were the most purchased, and vegetables (78%) were the least purchased food groups. In addition, cross-tabulation analyses (chi-square tests) showed a significant relationship between household income level and purchases of the food groups (i.e., vegetables, fruits, grains, and dairy) (p<0.05). Specifically, high-income households were more likely to purchase vegetables and fruits (Figure 6).

Credit: Survey data calculated by authors

In addition, a dietary diversity index was calculated, which is the total count of food categories presented in the survey, including grains, fresh fruits, beef, pork, poultry, eggs, seafood, fresh vegetables, dairy, and fruit juice. In a typical month in 2017, an average household’s dietary diversity count was 7.0, indicating that an average household purchased 7.0 out of 10 food categories.

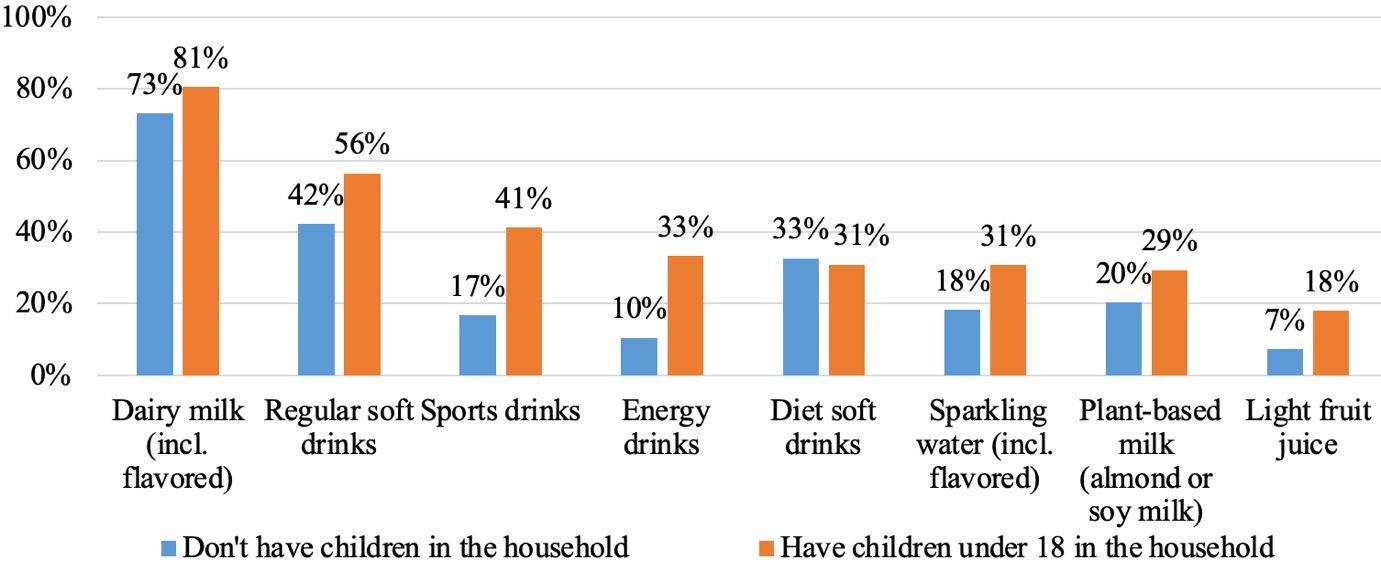

Food shoppers’ beverage purchases in the past 30 days are shown in Figure 7. Dairy milk, regular soft drinks, and diet soft drinks were the most popular among consumers in 2017. Beverage Marketing Corporation (2016) revealed that the market has seen a steadily broadening array of beverage categories in the past decades. These data add details to the changing landscape of the beverage market, in that households with young children were more likely to purchase a variety of beverages. Having young children at home significantly differentiated (p<0.01) beverage purchases for all categories considered except for diet soft drinks. For instance, families with young children were approximately three times more interested in energy drinks and sports drinks.

Credit: Survey data calculated by authors

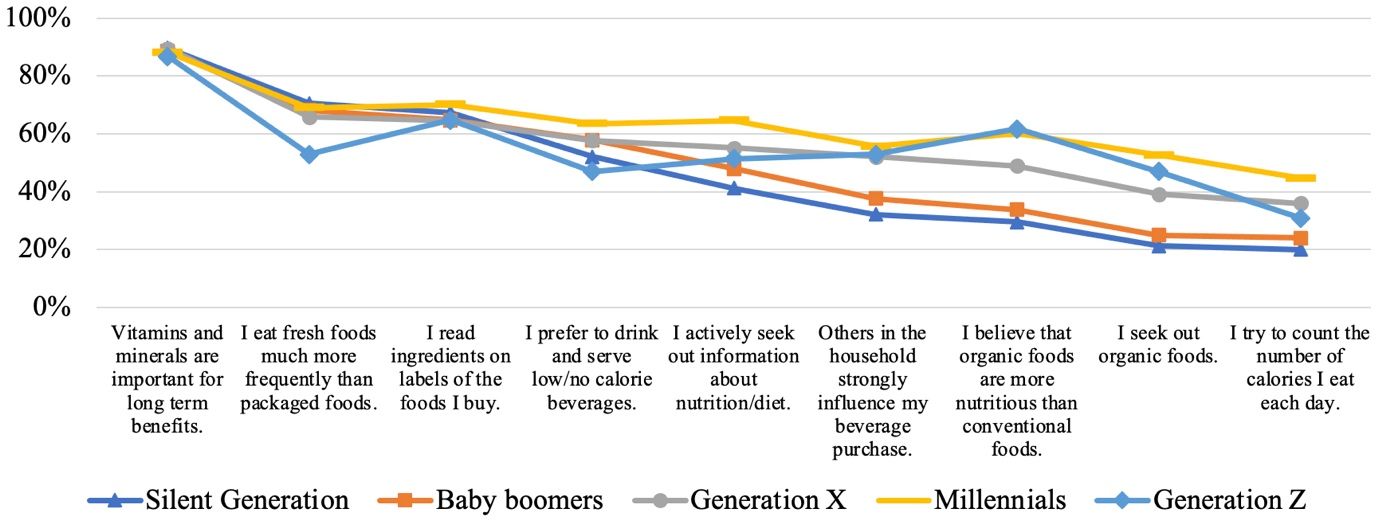

General Food Attitudes and Nutrition Perceptions

To elucidate consumer opinions about food, respondents were asked to indicate how much they agreed or disagreed with nine food-related statements. The statement with the highest level of agreement was that vitamins and minerals are important for long-term health benefits (Figure 8). More than two-thirds of respondents reported consuming fresh foods more than packaged foods and reading ingredient labels, while a relatively smaller portion of consumers (about 54%) actively sought out nutrition and diet information. More than half preferred low-calorie beverages, and about a third tried to count calorie intake daily. More than a third of consumers reported seeking out organic foods; among them, 86% believed that organic food is more nutritious than conventional food. Finally, household members’ preferences influenced the food shoppers’ purchase decisions in about half of the cases.

In addition, consumer food attitudes varied across generations. A pattern emerged, showing that the lower the overall agreement with the food attitudes listed in Figure 8, the larger the generational difference. Millennials were most likely to agree with several food attitude statements, implying the highest level of involvement in managing caloric intake, searching for food-related information, and seeking out organic foods. Comparatively, senior generations held a lower level of agreement with these food attitudes, especially the ones regarding organic foods and calorie counting. This gives rise to the research question concerning whether food attitudes change over the course of life or depend on the food environment and culture that are specific to a generation.

Credit: Survey data calculated by authors

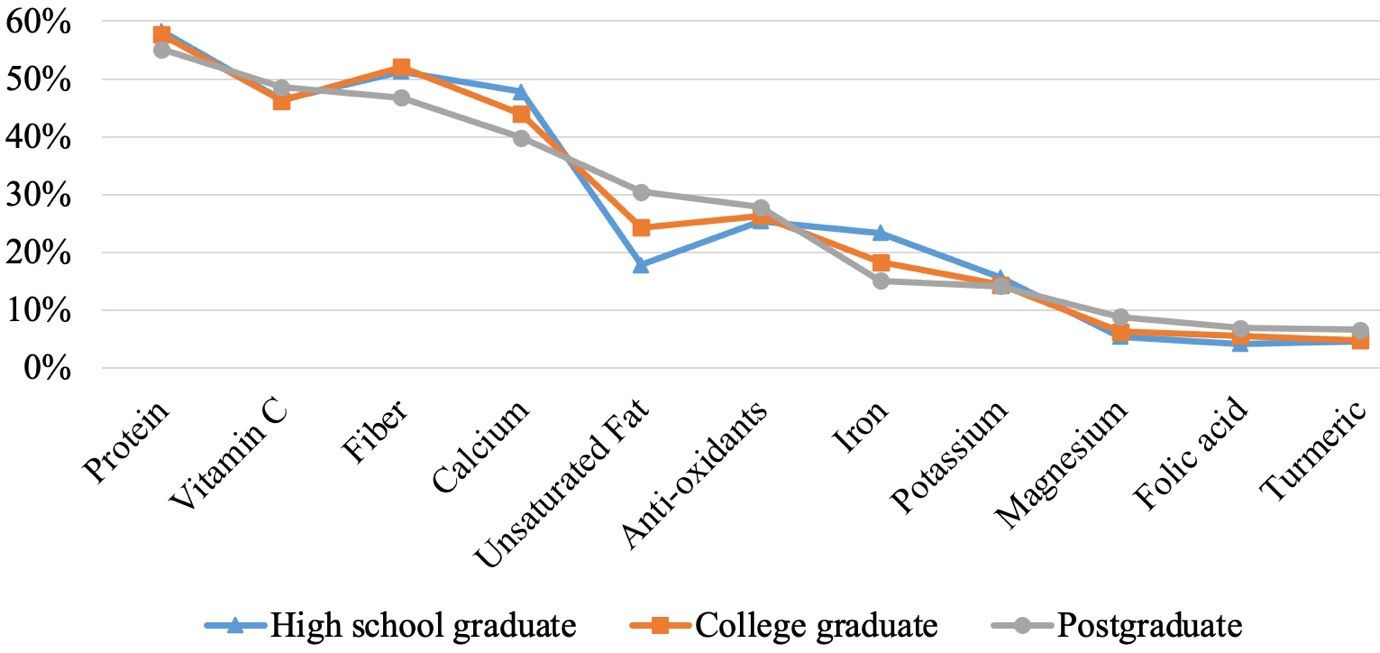

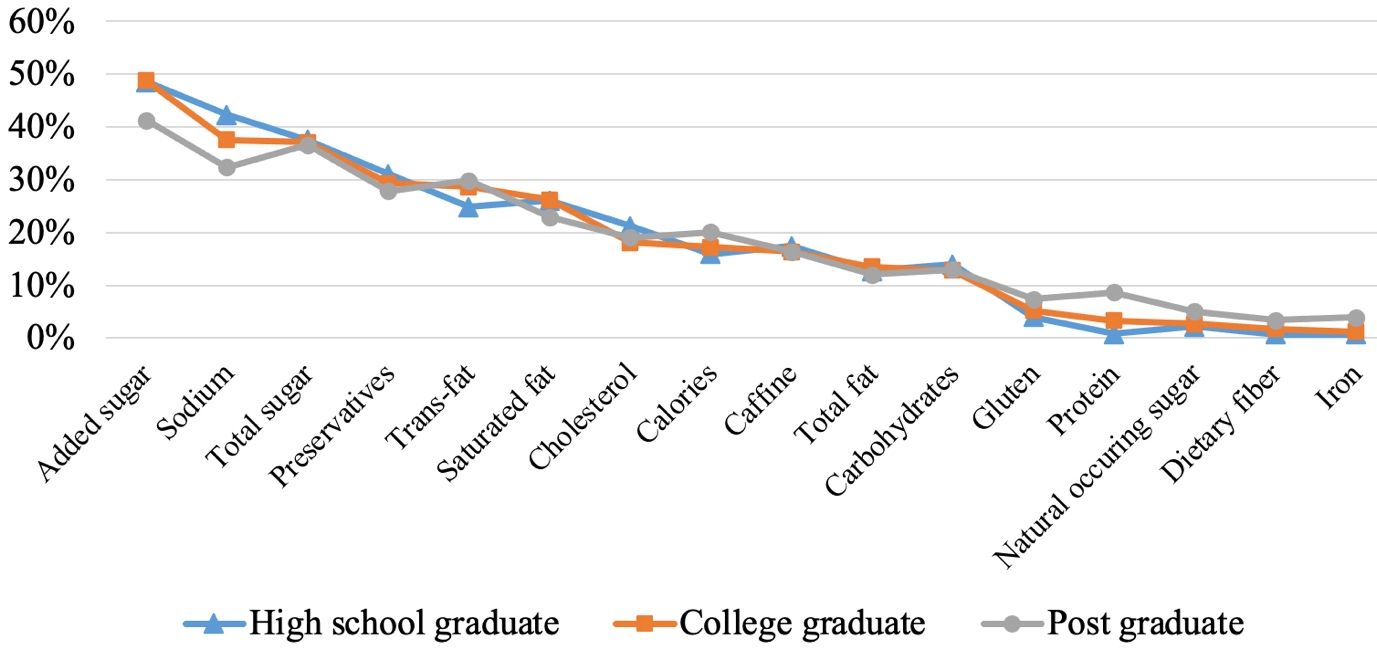

Overall, more than a third of consumers selected protein, vitamin C, fiber, and calcium as the nutritional characteristics they most wanted to include in their regular diets (Figure 9). The selections of several other nutrients (i.e., folic acid, magnesium, calcium, fiber, unsaturated fat, turmeric, and iron) varied over educational attainment levels. For example, consumers with a postgraduate degree had the strongest preference (30%) for unsaturated fat to be included in their diet, compared to high school graduates, where only 18% indicated wanting to include unsaturated fat in their diet. When asked about beverage characteristics that consumers considered to be the worst for health, added sugar, sodium, total sugar, and preservatives (Figure 10) were highly selected. Similarly, consumer evaluation of characteristics bad for health also varied across education levels (e.g., added sugar, natural sugar, transfat, gluten, and sodium). For instance, consumers with a higher level of educational attainment were less likely to rate sodium as the worst for health.

Credit: Survey data calculated by authors

Credit: Survey data calculated by authors

Conclusion

This study provides an overview of US food shoppers in 2017 and serves as a benchmark for analyzing consumer trends in the future. A nationwide sample of 5,993 adults, all primary food shoppers in the United States, was obtained in 2017 to learn about food-related perspectives and trends. Consumers tended to visit different food outlet formats to fill their shopping baskets, with an average expenditure of $137 per week. While traditional supermarkets (grocery stores) and supercenters are the dominant food shopping venues, the use of non-traditional stores to supplement food shopping varies depending on household income levels. Higher income households are more likely to use high-end store formats (e.g., fresh stores), warehouse clubs featuring large-quantity purchases, and internet grocery stores, while lower-income households are more likely to use dollar stores and supercenters. Consumer responses to food price increases vary by generation. For example, millennials are the most likely to adopt cost-saving measures (e.g., look for deals and use store brands) to offset a noticeable price increase. Generational differences are also observed in consumers’ food-related attitudes. Compared to the silent generation and baby boomers, millennials are more likely to count calories, seek out organic foods, and search for nutrition information. In addition, several demographic characteristics differentiate food and beverage consumption patterns and nutrition perceptions. For example, households with young children are more likely to consume sports drinks and energy drinks. Lastly, educational attainment level differentiates consumers’ nutrition perceptions. Higher education is associated with a greater likelihood of rating unsaturated fat as “good” and a lower likelihood of rating sodium as “bad.”

References

Beverage Marketing Corporation. 2016. The shifting beverage landscape. Retrieved from https://www.beveragemarketing.com/docs/ibdea-2016.pdf. Accessed on November 10, 2020.

Jones, M. S., L. A. House, and Z. Gao. 2015. Respondent Screening and Revealed Preference Axioms: Testing Quarantining Methods for Enhanced Data Quality in Web Panel Surveys. Public Opinion Quarterly. 79 (3): 687–709. https://doi.org/10.1093/poq/nfv015

United States Census Bureau. 2022. Current versus Constant (or Real) Dollars. https://www.census.gov/topics/income-poverty/income/guidance/current-vs-constant-dollars.html#:~:text=Constant%2Ddollar%20value%20(also%20called,series%20reported%20in%20dollar%20terms. Accessed on August 25, 2022.