Introduction

The United States is the world's largest producer of blueberries, with Michigan being the top producing state. In 2014, US blueberry production was estimated at 576 million pounds. That year, Michigan growers produced 99 million pounds of blueberries, while Florida's growers produced 20 million pounds of fruit (USDA/NASS 2015a). Nationwide, Florida's blueberry production represented only 3.54% of total US production and 9% of total US value. The relatively higher value of Florida production is due to the advantage of producing the first crop of domestic blueberries each calendar year, which means growers obtain higher prices during the early market window (Williamson et al. 2015). In fact, the average price received by growers in Florida during the last three years was 2.5 times that of the US average (USDA/NASS 2015b).

Credit: USDA

The Florida blueberry industry has experienced significant growth in recent years. The number of harvested acres increased from 2,600 in 2007 to 4,300 in 2014, representing a 65% increase (USDA/NASS 2015a). Factors such as increased consumer demand for blueberries and citrus growers looking for alternative crops due to the devastating effect of Huanglongbing (HLB; citrus greening) help to explain the rapid increase in blueberry acreage in Florida.

The southern highbush blueberry is an interspecific hybrid that is primarily grown in Florida, Georgia, and southern California. It is well adapted to Florida's mild winter climate, ripens earlier than other cultivars when market prices are highest, and is most suitable for fresh fruit markets (Williamson et al. 2015).

This article, which summarizes the establishment and production costs, as well as the potential profitability of a southern highbush blueberry orchard in Florida, is organized as follows. First, we present a blueberry enterprise budget. Second, we provide estimates of potential revenue and undiscounted cash flows for different combinations of prices and yields. Third, we analyze the investment in a blueberry operation by computing the Net Present Value (NPV) for different discount rates. This information is relevant to current and potential Florida blueberry growers.

Assumptions

Readers are reminded that this economic analysis is based on a number of assumptions, particularly regarding yields, prices and, revenue. We use a combination of production scenarios to generate a range of possible outcomes.

The assumptions used for the economic analysis include the following:

- The land is already owned and any required buildings are onsite.

- Calculations for investment and fixed costs of machinery and irrigation assume a 20-acre operation.

- Plant spacing is 2.5 by 9 feet, resulting in 1,936 plants per acre.

- The time horizon for the analysis is 10 years.

- Production costs are assumed to be constant for years 3 through 10.

- It is assumed that it takes four years for the plants to reach full production.

- Three different yield scenarios are analyzed. In scenarios 1, 2, and 3, the maximum marketable berries are 6, 7, and 8 thousand pounds per acre, respectively, in years 4 through 7 (Table 1).

- Yield is reduced 3% annually after year 7.

- Plant mortality rate is 3% annually, with dead plants replaced every year.

- The assumed packout is 95%.

- The brokerage fee is 8% of market price and includes cost of cooling and handling.

- An interest rate of 5% is applied to obtain the interest on variable costs and capital investment.

- Overhead and management are computed as 10% of the total variable costs.

There are also a few caveats worth noting. First, the quotes for chemicals in our calculations are based on retail prices obtained from vendors, but growers, depending on the size of their operation, may receive up to a 20% discount for volume. Second, the actual investment in machinery and irrigation depends on whether growers start a new operation or whether the equipment is already available to them; for this budget, all equipment was assumed to be new and prices were obtained from machinery dealers. Third, the cultural practices used to build the enterprise budget are based on a combination of recommendations from UF/IFAS Extension personnel and the experience of blueberry growers who provided feedback for this budget.

Estimated Capital Investment, Establishment, and Maintenance Costs Per Acre

Costs are typically divided into variable (or operating) and fixed (or ownership) costs. Variable costs depend on the level of production and arise from the actual operation of the enterprise; they include costs of land preparation, planting, fertilization, weed control, and pest and disease control. Fixed costs are independent of the level of production and arise from owning fixed inputs such as machinery, buildings, or land. For example, fixed costs include asset depreciation, interest, insurance, and taxes.

The required initial investment in machinery for a blueberry operation is $5,488 per acre, and the annual fixed costs associated with the operation are $981 per acre (Table 2). The initial investment in irrigation is $14,110 per acre, and the corresponding annual fixed costs per acre are $1,634 (Table 3). Thus, the total investment in machinery and irrigation required to establish a blueberry operation in Florida is $19,598 per acre. Table 3 also shows that the costs associated with repairs and maintenance for the irrigation system is $304.

Tables 4 through 6 show the estimated establishment and maintenance costs per acre for the 10-year horizon. The budget for the first year includes the cost of land preparation at $5,013 and solid-set planting at $4,840 per acre, respectively. For the first year, total variable costs are $12,458 per acre, and fixed costs are $4,111 per acre. Thus, total variable and fixed costs are $16,568 per acre for year one (Table 4).

For the second year, variable costs are $4,977 per acre, and fixed costs are $3,363 per acre. Fixed costs associated with irrigation account for approximately 49% of the total fixed costs per acre. Also, in the second year, variable and fixed costs combined are $8,340 per acre year (Table 5). Starting in year two, plants start bearing fruit, initiating the costs of harvesting, marketing, and brokerage.

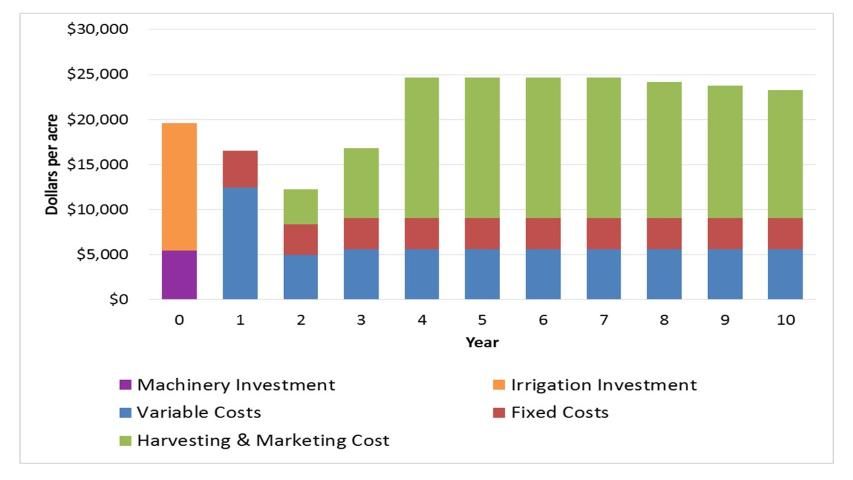

Variable costs for the third year are $5,603 per acre, and fixed costs are $3,425 per acre. Hence, total production cost for year three is $9,028 per acre (Table 6). As mentioned above, annual production costs are assumed to be constant for years 3 through 10. In contrast, the costs of harvesting, marketing, and brokerage change from year 2 onwards due to varying yield and price levels. Figure 1 illustrates variable, fixed, harvesting, and marketing costs for the 10-year horizon under scenario 3, which is the scenario with the highest assumed yield and highest harvesting and marketing costs.

Harvesting and marketing costs are assumed to be $1.00 and $0.05 per pound harvested, respectively. Additionally, there is a charge of $0.85 per marketable pound for custom packing. Cooling, handling, and brokerage are also dependent on yield and price. Therefore, all such costs are computed separately for the different yield scenarios and price levels (Tables 7 through 9). Due to varying maximum yields in years 4 through 7 across all scenarios, harvesting and marketing costs can be as low as $11,732 per acre for scenario 1, and as high as $15,642 per acre for scenario 3. Brokerage costs in years 4 through 7, under the different scenarios, vary from $1,776 to $3,136 per acre (Tables 7 through 9).

Estimated Revenue and Cash Flows

The market prices used for the analysis were obtained by combining USDA/NASS data with feedback from Florida blueberry growers. The underlying assumption is that those prices represent the averages throughout the investment period. Thus, we compute revenue for the following price levels: $3.70, $4.00, $4.30, $4.60, and $4.90 per pound. Tables 10 through 12 show revenue for yield scenarios 1, 2, and 3, respectively. For years 2 and 3, all scenarios attain the same level of revenue for the corresponding prices because yield is assumed to be the same across the scenarios. Therefore, the lowest (highest) level of revenue during years 2 and 3 is $7,400 ($19,600) per acre, which is obtained by multiplying the lowest (highest) price level of $3.70 ($4.90) per pound and yield of 2,000 (4,000) pounds per acre. Revenue varies with different yield scenarios in years 4 through 7, and is estimated to be $22,200; $25,900; and $29,600 per acre in scenarios 1, 2 and 3, respectively, for the lowest price level of $3.70 per pound. In contrast, revenue is estimated to be $29,400; $34,300; and $39,200 per acre in scenarios 1, 2 and 3, respectively, for the highest price level of $4.90 per pound. In terms of production, years 4 through 7 present the highest yields and, consequently, the highest revenues from production. However, in year 10, we also included the revenue from the salvage value of machinery and irrigation equipment.

Production of a perennial crop like blueberries typically requires a number of years before the annual value of production is greater than the annual costs. Therefore, growers endure a few years with negative cash flows. Table 13 shows the undiscounted annual cash flows per acre for yield scenarios 1, 2, and 3 at the different price levels. For all three scenarios, when price is $3.70 per pound, cash flows are positive starting in year 4, whereas when price is $4.00 per pound or higher, cash flows are positive starting in year 3. The lowest undiscounted annual cash flow at year 10 occurs under scenario 1, with $3.70 per pound price at $9,223 per acre. The highest cash flow at year 10 occurs under scenario 3, with the highest price of $4.90 per pound, totaling $19,928 per acre cash flow.

Table 14 shows the undiscounted cumulative cash flows per acre for yield scenarios 1, 2, and 3 at the different price levels. Under yield scenario 1, the cumulative undiscounted cash flow in year 10 is positive starting at a price level of $4.30 per pound, and is $9,642 per acre. Under yield scenario 2, the cumulative undiscounted cash flow in year 10 is positive starting at a price level of $4.00 per pound, and is $8,456 per acre. Under yield scenario 3, the undiscounted cumulative cash flow in year 10 is positive starting at the lowest price level of $3.70 per pound, and is $3,502 per acre. Under our assumptions, the earliest a grower will receive a positive undiscounted cumulative cash flow in year 6 under the combinations of price at $4.60 per pound combined with yield scenario 3 or price at $4.90 per pound combined with scenarios 2 or 3.

Investment Analysis

To analyze the profitability of the investment in southern highbush blueberries in Florida, we combined the initial cost of investment, the annual net cash flows (receipts minus expenses), and the discount rates to compute the Net Present Value (NPV). We obtained the NPV by summing the discounted cash flows for each year. Typically, when the NPV is positive, the investment is profitable and should be accepted. Conversely, when the NPV is negative, the investment is unprofitable and should not be accepted.

Table 15 summarizes the NPV per acre for different interest rates and price levels under each yield scenario. Under yield scenario 1, the NPV is negative for all prices when the discount rate is 15%. With discount rates of 10% and 5%, the NPV under yield scenario 1 starts being positive when prices are $4.90 and $4.60, respectively. Under yield scenario 2, with a discount rate of 10% (5%), the NPV is $4,526 ($6,929) when the price is $4.90 ($4.30) per pound. Under yield scenario 2, with a discount rate of 15%, the NPV is $1,938 per acre when the price is $4.90 per pound. Under yield scenario 3, with a discount rate of 5%, the NPV is $4,462 per acre when the price is $4.00 per pound. Under yield scenario 3, with a 10% (15%) discount rate, the NPV is $3,487 ($8,798) per acre when the price level is $4.30 ($4.90) per pound.

Conclusions

In this article, we provide a summary of the enterprise budget developed for highbush blueberry production in Florida. The budget represents a typical or average operation and serves as an economic benchmark for growers. An enterprise budget is useful in providing estimates of expenses, and when combined with market prices it can also provide potential estimates of revenue and profit for a crop. Such information should be useful to current and potential blueberry growers for their decision-making processes.

We found the initial investment required for a blueberry operation in Florida to be $19,598 per acre; the expense in land preparation and planting alone in year one is $9,853. Variable and fixed costs in years 2 through 10 range from $8,340 to $9,028 per acre. As an example of profitability, we found that when using a 10% discount rate, an operation yielding 6,000 (8,000) pounds of marketable berries per acre during its most productive years starts obtaining a positive NPV when the average price is $4.90 ($4.30) per pound.

References

USDA/NASS. 2015a. Noncitrus fruits and nuts 2014 summary. Washington, DC: United States Department of Agriculture, National Agricultural Statistics Service (USDA/NASS).

USDA/NASS. 2015b. Quick statistics. Washington, DC: United States Department of Agriculture, National Agricultural Statistics Service (USDA/NASS).

Williamson, J. G., J. W. Olmstead, and P. M. Lyrene. 2015. Florida's Commercial Blueberry Industry. AC031. Gainesville: University of Florida Institute of Food and Agricultural Sciences. https://edis.ifas.ufl.edu/ac031

Acknowledgements

We are grateful to the growers, agriculture consultants, and agricultural equipment, chemical and fertilizer supply stores that provided us feedback.

Description of blueberry yield scenarios 1, 2, and 3 for the 10-year investment horizon of a 20-acre operation of southern highbush blueberry in Florida. The three scenarios include total marketable yield of 6, 7, and 8 thousand pounds per acre respectively, in years 4 through 7, with yield reduced 3% annually after year 7 for each scenario.

Estimated annual fixed machinery costs for establishment of a 20-acre operation in Florida.

Estimated solid set plus drip irrigation systems costs for establishment of a 20-acre operation in Florida.

First year estimated establishment and maintenance cost per acre of a 20-acre operation in Florida.

Second year estimated establishment and maintenance cost per acre of a 20-acre operation in Florida

Third to tenth year estimated establishment and maintenance cost per acre of a 20-acre operation in Florida

Yield scenario 1: estimated total marketable yield, harvesting and marketing cost, and brokerage cost per acre for a 10-year horizon of a 20-acre operation in Florida. Yield scenario 1 simulates a total marketable yield of 6 thousand pounds per acre in years 4 through 7, with yield reduced 3% annually after year 7.

Yield scenario 2: estimated total marketable yield, harvesting and marketing cost, and brokerage cost per acre for a 10-year horizon of a 20-acre operation in Florida. Yield scenario 2 simulates a total marketable yield of 7 thousand pounds per acre in years 4 through 7, with yield reduced 3% annually after year 7.

Yield scenario 3: estimated total marketable yield, harvesting and marketing cost, and brokerage cost per acre for a 10-year horizon of a 20-acre operation in Florida. Yield scenario 3 simulates a total marketable yield of 8 thousand pounds per acre in years 4 through 7, with yield reduced 3% annually after year 7.

Yield scenario 1: estimated revenue per acre for different market price levels for a 10-year horizon of a 20-acre operation in Florida. Yield scenario 1 simulates a total marketable yield of 6 thousand pounds per acre in years 4 through 7, with yield reduced 3% annually after year 7.

Yield scenario 2: estimated revenue per acre for different market price levels for a 10-year horizon of a 20-acre operation in Florida. Yield scenario 2 simulates a total marketable yield of 7 thousand pounds per acre in years 4 through 7, with yield reduced 3% annually after year 7.

Yield scenario 3: estimated revenue per acre for different market price levels for a 10-year horizon of a 20-acre operation in Florida. Yield scenario 3 simulates a total marketable yield of 8 thousand pounds per acre in years 4 through 7, with yield reduced 3% annually after year 7.

Undiscounted annual cash flows per acre for different prices (dollars per pound) by yield scenariosa for a 10-year horizon of a 20-acre operation in Florida

Undiscounted cumulative annual cash flows per acre for different prices (dollars per pound) by yield scenariosa for a 10-year horizon of a 20-acre operation in Florida