Introduction

Consumer demand is increasing for local products (Yue et al. 2011). Local products are often preferred over products from greater distances due to perceptions of superior quality, along with the idea that local products benefit personal health, the local community, and the environment (Campbell et al. 2014; Costanigro et al. 2011). In many states, publicly funded marketing programs are used to promote the consumption of local products (Onken and Bernard 2010). The Florida Department of Agriculture and Consumer Services (FDACS) has partnered with the Florida Nursery, Growers, and Landscape Association to include horticulture plants in the state's Fresh from Florida campaign (Drotleff 2014). Within the Florida food industry, the Fresh from Florida campaign is associated with better quality and freshness (Rumble and Roper 2015). Additionally, consumers associate the Fresh from Florida logo with the Florida lifestyle (Rumble and Roper 2015). Although the impact of the Fresh from Florida campaign on consumer preferences for food products has been studied, little research has been conducted on consumer preferences for horticultural plants designated as Fresh from Florida. This report provides an overview of Florida consumer perceptions of the Fresh from Florida campaign with regards to horticultural plants and makes recommendations to the nursery and greenhouse industry on the best ways of benefiting from the campaign program. Understanding consumer perceptions and using the promotional materials of the program to reach consumers can help reduce economic risks for supply-chain members (growers, wholesalers, marketers, and retailers) and improve their returns on investment.

Credit: Fresh from Florida

Methodology and Statistics

The data for this study were collected by surveying Florida horticulture plant consumers in June and July of 2014. A total of 301 people participated in the study, with 84% from Orlando and 16% from Gainesville. The average household size was two to three people, with most participants having completed some college. The average annual household income was between $41,000 and $50,000.

Results

Perceptions of Fresh from Florida

In this survey, 83% of respondents recalled noticing Fresh from Florida logos on ornamental plants in retail garden centers. The majority of the surveyed consumers (62%) believed 100% of the product needed to be produced in Florida for it to be designated as Fresh from Florida and be eligible for participation in the program. In fact, only 51% of the product must originate in Florida (FDACS 2015).

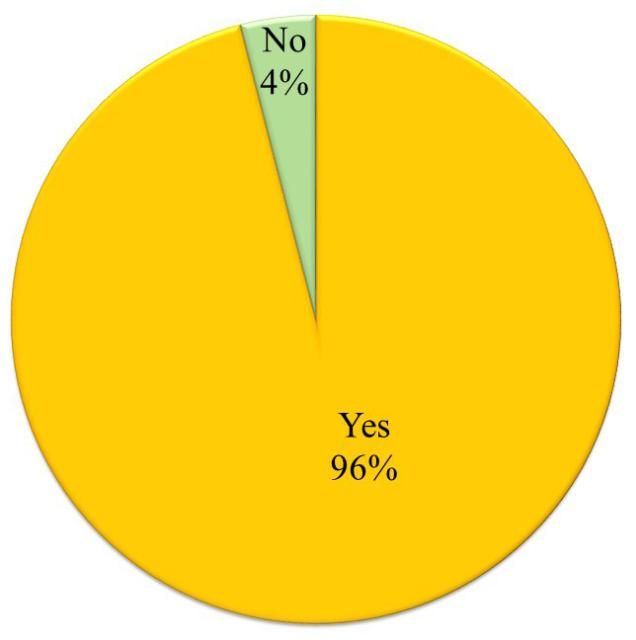

Ninety-six percent of consumers consider Fresh from Florida ornamental plants to be local (Figure 1); it is imperative to understand consumer perceptions of local plants and how those perceptions affect consumer purchasing behavior. A better understanding of consumer perceptions of "local" provides opportunities to design relevant marketing materials highlighting the perceived benefits of buying local products. For instance, consumers have indicated that food quality is an important trait (Rumble and Roper 2015); if this is true for ornamental plants, retailers can use in-store promotions, as well as national mass marketing, to emphasize the high quality of horticultural plants produced in the state of Florida (Rumble and Roper 2015). Quality-assurance programs (i.e., guarantees) could also be implemented to indicate that producers and retailers stand behind their products.

Consumer Perceptions of Local Products

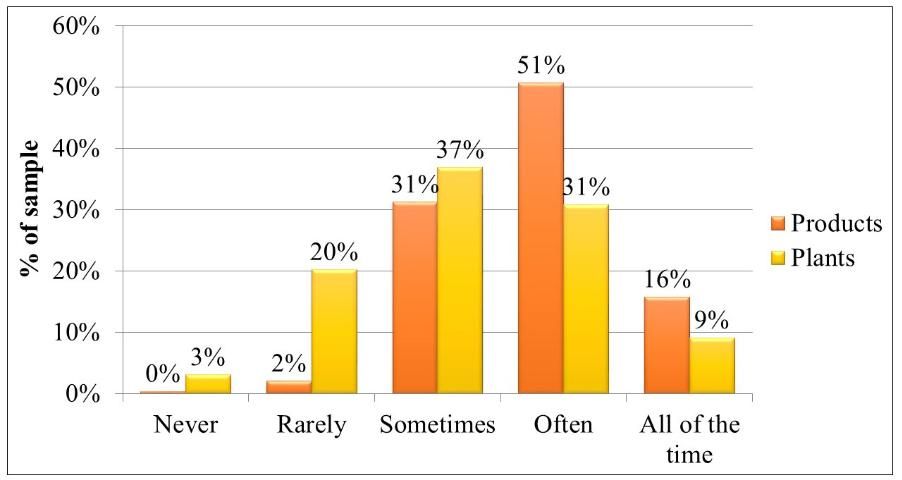

Of the respondents, 70% defined local products as those being grown within their county of residence and neighboring counties. Regarding purchasing behavior (Figure 2), 51% of the respondents reported purchasing local products often, followed by sometimes (31%), and all of the time (16%). When considering local ornamental plant purchases (Figure 2), 37% reported purchasing local plants sometimes, followed by often (31%), and rarely (20%).

Consumer Perceptions of Local Plants

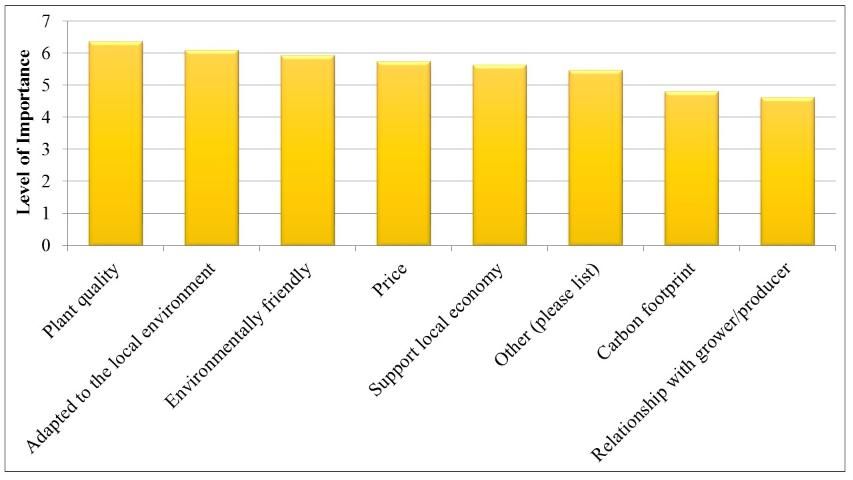

To determine the importance of local plant traits, consumers were asked about the importance of plant attributes when purchasing local ornamental plants. The most important reported attribute was plant quality (Figure 3). Consumers were also interested in environmentally friendly, lower-priced plants. The Other category included the following attributes: native, lifespan, light tolerance, reputation of producer, wildlife benefit, non-invasive, size, personal experience, look, color, water use, growth stage, and breeding (Figure 3). Consumers were also asked about the importance of local ornamental plant benefits. Local community benefit (job creation, money/local economy) was rated as the most important, followed by product safety, product quality, and lower carbon footprint (Figure 3).

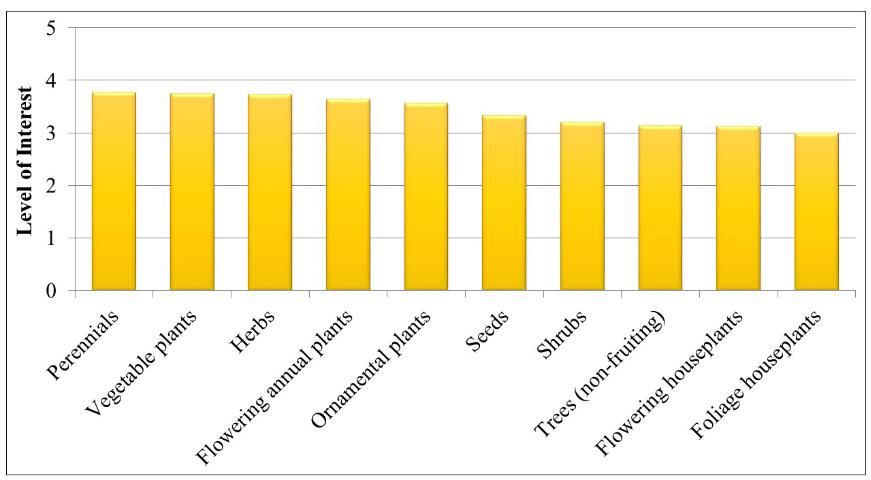

Respondents indicated that they would be interested in all types of horticulture plants produced locally (Figure 4). Local plants that held the most interest for consumers were local perennials, vegetable plants, herbs, flowering annuals, and ornamental plants. These results are not surprising because these types of plants are typically grown outdoors, and locally grown plants are acclimated to the local environment (Curtis and Cowee 2010).

Recommendations to the Industry

The majority of Florida consumers consider Fresh from Florida horticulture plants local. Supply-chain members (growers, marketers, and retailers) can use consumers' positive perception of local plants to increase sales through mass media promotions of the Fresh from Florida logo. Mass media promotions could establish a connection between the logo and the Florida lifestyle (Rumble and Roper 2015).

Because plant quality was the most important attribute, retailers could use in-store promotions and quality assurance programs (e.g., guarantees) to differentiate the quality of horticultural plants from Florida versus other locations. In-store promotions (i.e., signs and labels) could inform consumers about how purchasing Fresh from Florida plants is good for the state economy (i.e., jobs and money). Retailers could promote the suitability of local plants for gardening in Florida (Curtis and Cowee 2010).

Regardless of plant type, consumers exhibited interest in purchasing Fresh from Florida horticulture plants. To maximize consumer interest in local ornamental plants, growers and retailers must increase their participation in the Fresh from Florida promotion campaign. Greater participation will lead to increased product availability and brand awareness. Consumers will benefit from being able to purchase local Fresh from Florida products, and growers and retailers will benefit from increased sales of local horticulture plants.

References

Campbell, B., H. Khachatryan, B.K. Behe, J.H. Dennis, and C.R. Hall. 2014. U.S. and Canadian consumer perceptions of local and organic terminology. International Food and Agribusiness Management Review 17:21–40.

Costanigro, M., D. Thilmany McFadden, S. Kroll, and G. Nurse G. 2011. An in-store valuation of local and organic apples: The role of social desirability. Agribusiness An International Journal 27:465–477.

Curtis, K.R., and M.W. Cowee. 2010. Are homeowners willing to pay for origin-certified plants in water-conserving residential landscaping? Journal of Agricultural and Resource Economics 35(1):118–132.

Drotleff, L. 2014. FNGLA Partners With "Fresh from Florida" Marking Program. Greenhouse Grower. https://www.greenhousegrower.com/management/fngla-partners-with-fresh-from-florida-marketing-program/

FDACS. 2015. Join Fresh from Florida. Florida Department of Agriculture and Consumer Services, Tallahassee, FL.

Onken, K.A., and J.C. Bernard. 2010. Catching the "local" bug: A look at state agricultural marketing programs. Choices 25. http://www.choicesmagazine.org/UserFiles/file/article_112.pdf

Rumble, J.N., and C.G. Roper. 2015. Talking local: Florida Consumers Fresh from Florida Perceptions. WC181. Gainesville: University of Florida Institute of Food and Agricultural Sciences. https://edis.ifas.ufl.edu/wc181

Yue, C., J.H. Dennis, B.K. Behe, C.R. Hall, B. Campbell, and R.G. Lopez. 2011. Investigating consumer preference for organic, local, or sustainable plants. HortScience 46:610–615.