The purpose of this document is to provide a framework and provisional values to estimate costs and returns of hemp flower production for commercial producers in Florida. The primary objective for hemp flower producers is to consider the infrastructure, labor, and input costs associated with a hemp cropping system for flower production related to the potential returns from sales of cannabidiol (CBD) oil. CBD is currently the most popular cannabinoid for hemp. CBD is a non-psychoactive compound demonstrated to treat epilepsy, muscle spasms, and pain perception (World Health Organization 2018). Hemp-derived cannabinoid extracts and CBD isolate are currently sold in tinctures, creams, oils, capsules, foods, beverages, patches, and vapes. According to the World Health Organization (2018), “There is no evidence of public health related problems associated with the use of pure CBD.”

Credit: Andres Bejarano Loor, UF/IFAS Tropical Research and Education Center

Introduction

Hemp is Cannabis sativa L. (<0.3% 9-tetrahydrocannabinol, or “delta-9”-THC) grown commercially for fiber, seed, and flower. Hemp flower is harvested for the high concentration of cannabinoid and terpenes in and around the unpollinated flower (marketed commercially for fresh smokable flower or various extracts of floral material) that both include CBD and sometimes the psychoactive THC at levels below the legal threshold.

The one drug containing CBD that has passed the rigorous review process of the Food and Drug Administration (FDA) was Epidiolex. It was approved in 2018 and treats two rare, severe forms of epilepsy (FDA 2018). Regardless of the scarcity of rigorous studies with evidence in support of CBD usage for various conditions, hemp-derived products are widely available. Smokable hemp is legal in six states, including Florida, for private consumption but not in public (Smith 2020).

Many factors should be considered before establishing a hemp planting. When competing in today’s market, producers must wisely allocate their time and money resources to maintain their financial viability and produce the highest-quality work. When establishing a hemp operation in Florida or modifying an existing one, budgets can be used to make cost-effective decisions. This document is a guide for evaluating the cost of establishing a hemp planting for flower production.

The creation of a budget can assist farmers in reaching an economic judgment and business decision for an individual farming enterprise. The input costs provided in these budgets are influenced by a variety of factors. These may include location within Florida, market dynamics (demand and offer), and the suppliers (Morgan et al. 2021). The information in this publication will be useful to current and potential hemp growers, wholesalers, and processors, especially those exploring the economic viability of hemp as an alternative crop. Specific information on hemp markets can be found in Ask IFAS publication #FE116 (“Is a viable hemp industry in Florida’s future?”).

Main Assumptions

Production costs and revenues used in this annual budget are based on a one-acre planting. Because of the variety of cultural practices adopted by growers, average costs and returns are average for this analysis. Given the fact growers in Florida generally own the land, a rental estimate of $300/acre/year is taken to factor in for the opportunity cost of the land. We used an average land rental price for the state of Florida. Rental prices are likely lower in north Florida and much higher in south Florida. Table 1 shows the total estimated annual costs and returns incurred while operating a one-acre hemp for CBD orchard. These costs, returns, and production data were obtained directly from growers.

Table 1. Estimated annual revenue and costs of growing and harvesting industrial hemp for CBD-rich flower.

Table 1 lists estimated costs and returns of growing and harvesting industrial hemp for CBD in Florida. This can be used as a guide to estimate actual costs and returns, as it is not representative of any specific farm.

Planting layout: Based on the information collected, in Florida, the density for a hemp field is 1,600–3,500 plants per acre for photoperiod-sensitive cultivars and 10,000–20,000 plants per acre for day-neutral cultivars. The budget is specific to photoperiod sensitive cultivars.

Yields: Based on the information collected from growers, average yield per acre is about 10% CBD per dry matter per plant. Of the 1,600 plants, 95% are harvested for a total of 1,520 plants. Thus, the average marketable yield is 15,200 pounds %CBD/acre. In terms of CBD oil extract an acre at 15,200 pounds %CBD/acre would yield 152 pounds of CBD oil extract.

CBD oil price: The average estimated Florida price of CBD is $1.00 per % of CBD oil (Oregon State University 2021).

Operating costs: These costs amount to $10,909/acre/year, representing 66% of the total costs. The major component is hired labor (34.7%).

Irrigation: Average irrigation expenses comprised drip tape ($432) and pump ($161.25) for a total of $593.25/acre/year.

Fertilization: Fertilizer costs include applications of N-P-K (nitrogen, phosphate, potash). Fertilization costs (materials only) are estimated at $213.20/acre/year.

Labor costs: These include application costs for agricultural inputs (fertilizers) and costs incurred for agricultural activities (planting, harvest, and post-harvest.) Labor costs (hired labor only) are estimated at $4,669/acre/year.

Interest in capital: This is the cost of borrowing money or the opportunity cost for using equity. A rate of 6.25% was considered in the given analysis. Interest on operating capital is estimated at $791.46/acre/year.

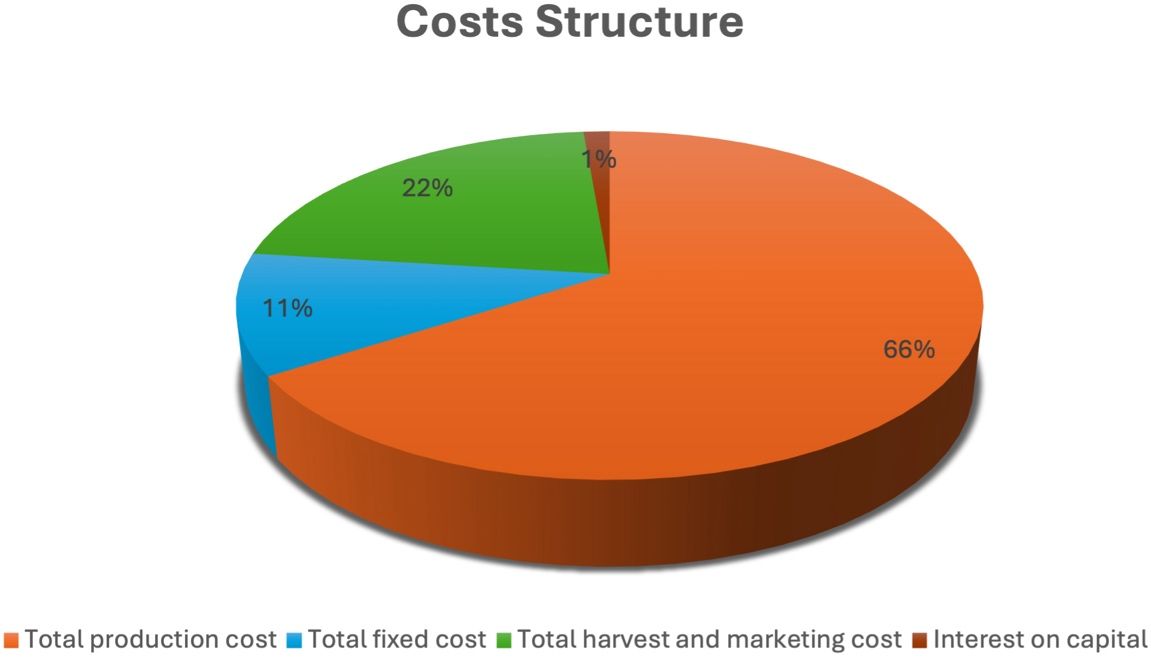

Harvesting and marketing costs: Hemp must be harvested by hand. Harvesting and marketing costs represent 22% of the total cost.

Variable costs: These costs amount to $13,564.76/acre/year. These costs include operating costs and harvesting and marketing costs. This is the total of costs directly related to production.

Fixed costs: This amount constitutes the indirect costs that are incurred regardless of the level of production. It includes cash overhead costs (e.g., insurance and taxes), non-cash overhead costs (e.g., land rent), and other overhead costs (e.g., machinery use, electricity, telephone, computer, and other miscellaneous office expenses). Total fixed costs are estimated at $1,721.18/acre/year, representing 11% of the total costs.

Total costs: Variable costs (costs for hired labor, irrigation, fertilization, and pest control) account for 66% of the total cost. Fixed or overhead costs constitute 11% of the total cost. Harvest and marketing costs are 22% of the total cost. Finally, interest on capital represents 1% of the total cost (Figure 2).

Credit: Andres Bejarano Loor, UF/IFAS Tropical Research and Education Center

Returns and Profitability Analysis

The total cost to produce and market one acre of hemp for CBD is estimated at $15,175/acre/year. Based on an average marketable yield of 15,200 pounds %CBD/acre (1,520 pounds of plant dry matter with projected 10% CBD oil content) and the average estimated price of $1.00/pound %CBD oil, total income would be $15,200/acre/year. Table 1 shows a net return of $24.07/acre/year. Net return is obtained by subtracting the total cost from the total revenue and is used to measure the long-term profitability of the farming operation.

When subtracting total variable cost (operating cost plus harvesting and marketing cost) from total revenue, we obtain a gross return of $1,745.25/acre/year, or in other words, a gross margin of 11.5% ($1,745.25/$15,200). The gross margin provides a useful indicator of short-term profitability. A positive gross return implies that all variable costs are covered by the income generated and those additional funds can be utilized to cover some or all the remaining fixed costs. Gross margin represents the monetary amount the producer retains after production costs. A gross margin of 11.5% means for every dollar of revenue, $0.11 is retained by the producer and $0.89 is dedicated to production.

A negative gross return implies that a business is not viable in the short term, and changes are needed to continue operating. Many growers are only concerned with the gross margin. However, while the gross margin provides an indication of return to the grower, it does not include fixed costs and, hence, is not a true indicator of the long-term feasibility of the business. Both net return and gross margin should be calculated to measure profitability and sustainability.

Net return is obtained by subtracting the fixed costs from the gross margin and is used to measure the long-term profitability of the farming operation.

Sensitivity Analysis

Table 2 presents a sensitivity analysis of the gross margin, which considers the short-term economic viability of a hemp farm for CBD based on variable yield and price. Under the best-case scenario, where the price increases by 250% and yields are assumed to increase by 10%, gross return margin would increase from $1,745/acre to $45,065/acre. Under the worst-case scenario, where the price decreases by 50% and yield decreases by 10%, gross return would decrease from $1,745/acre to -$6,615/acre. Price changes (keeping the production constant) have the same level of impact on gross margin as quantity changes (keeping the price constant).

Table 2. Sensitivity analysis of the annual per acre gross margin for hemp (CBD) in Florida where negative returns are in orange and bolded.

Table 3 presents a similar analysis based on annual net returns per acre, which considers long-term economic viability. Under the best-case scenario, where the price increases by 250% and yield is assumed to increase by 10%, net return would increase from $24/acre to $43,344/acre. Under the worst-case scenario, where the price decreases by 50% and yield decreases by 10%, net return results in a loss of $8,336/acre. Other combinations of prices and yields and their impact on net return are also depicted in Table 3. The information presented in Table 2 and Table 3 can be interpreted in a similar manner. However, it should be considered that at a broader industry level, any significant increase in production would decrease the price received by the growers.

Table 3. Sensitivity analyses of per acre annual net returns for hemp (CBD) in Florida where negative returns are in orange and bolded.

Conclusions

The net return of a CBD hemp farm in Florida is estimated to be approximately $24/acre. This return makes this crop not as attractive as other crops, although there have been times where pricing was exceptionally favorable. In addition, UF/IFAS does not recommend plant species with high invasive potential in Florida’s natural areas, including hemp (https://assessment.ifas.ufl.edu/assessments/).

Hemp flower and high-CBD extracts can be processed into multiple products with potential markets that retain interest for growers with small acreage most often in controlled indoor settings. Yet, further increase in hemp production in Florida may result in continued market saturation and reduced prices. Hemp market opportunities seem attractive due to assumed product versatility and health benefits, but a producer should identify an available market ahead of production. The primary barriers to hemp for CBD production in Florida are the low net return and limited access to buyers/processors in the region. Note that, to minimize the loss in the first production cycle, it is recommended to start with a small area. If you are new in the industry, starting with a small area will help you to become accustomed to managing your cultivar and adapting the processes to your specific production targets.

References

Florida Department of Agriculture and Consumer Services (FDACS). 2021a. “Hemp Cultivation Licensing.” https://www.fdacs.gov/Cannabis-Hemp/Hemp-CBD-in-Florida/Hemp-Cultivation-Licensing

Florida Department of Agriculture and Consumer Services (FDACS). 2021b. “Hemp Food Establishment Permit.” https://www.fdacs.gov/Business-Services/Food/Food-Establishments/Hemp-Food-Establishment-Permit

Grinspoon, P. 2021. “Cannabidiol (CBD): What We Know and What We Don’t.” Harvard Health. https://www.health.harvard.edu/blog/cannabidiol-cbd-what-we-know-and-what-we-dont-2018082414476

Hemp Benchmarks Editors. 2020. “2020 CBD Biomass Production Estimate.” https://cutt.ly/KWAMhav

Johnson, R. 2019. “Hemp-Derived Cannabidiol (CBD) and Related Hemp Extracts.” https://fas.org/sgp/crs/misc/IF10391.pdf

Morgan, K. L., T. Wade, K. Athearn, C. Prevatt, A. Singerman, E. Evans, T. Blare, H. Khachatryan, and Z. Guan. 2022. “An Introduction to Florida Commodity Enterprise Budgets: A Tool to Improve Farm Business Planning: FE1109.” EDIS 2022 (1). https://edis.ifas.ufl.edu/publication/FE1109

Oregon State University. 2021. “Enterprise Budget: Hemp, CBD Oil, Mechanical Harvest, Willamette Valley.” https://agsci.oregonstate.edu/sites/agscid7/files/oaeb/pdf/aeb0065.pdf

Smith, H. 2019. “Is it legal to smoke hemp where I live?” Green Unicorn Farms. https://greenunicornfarms.com/blog/hemp-legalities-by-state/

World Health Organization. 2018. “CANNABIDIOL (CBD) Critical Review Report.” Expert Committee on Drug Dependence. https://cdn.who.int/media/docs/default-source/controlled-substances/whocbdreportmay2018-2.pdf?sfvrsn=f78db177_2