Abstract

To gain insights into US consumers’ food-related perspectives, we examined their food and beverage preferences and consumption patterns in parallel with those identified in 2017. Using a nationwide sample of 6,412 primary food shoppers in 2018, we assessed consumer perspectives regarding food shopping outlets, responses to food price increases, grocery expenditures, food-related attitudes, food and beverage consumption patterns, and nutritional perceptions. Last, we compared consumer trends in 2018 with those in 2017 to identify any changes over time. Our study offers insights into shifting consumer preferences and consumption patterns, helping stakeholders make informed product development, marketing, and policy decisions.

Introduction

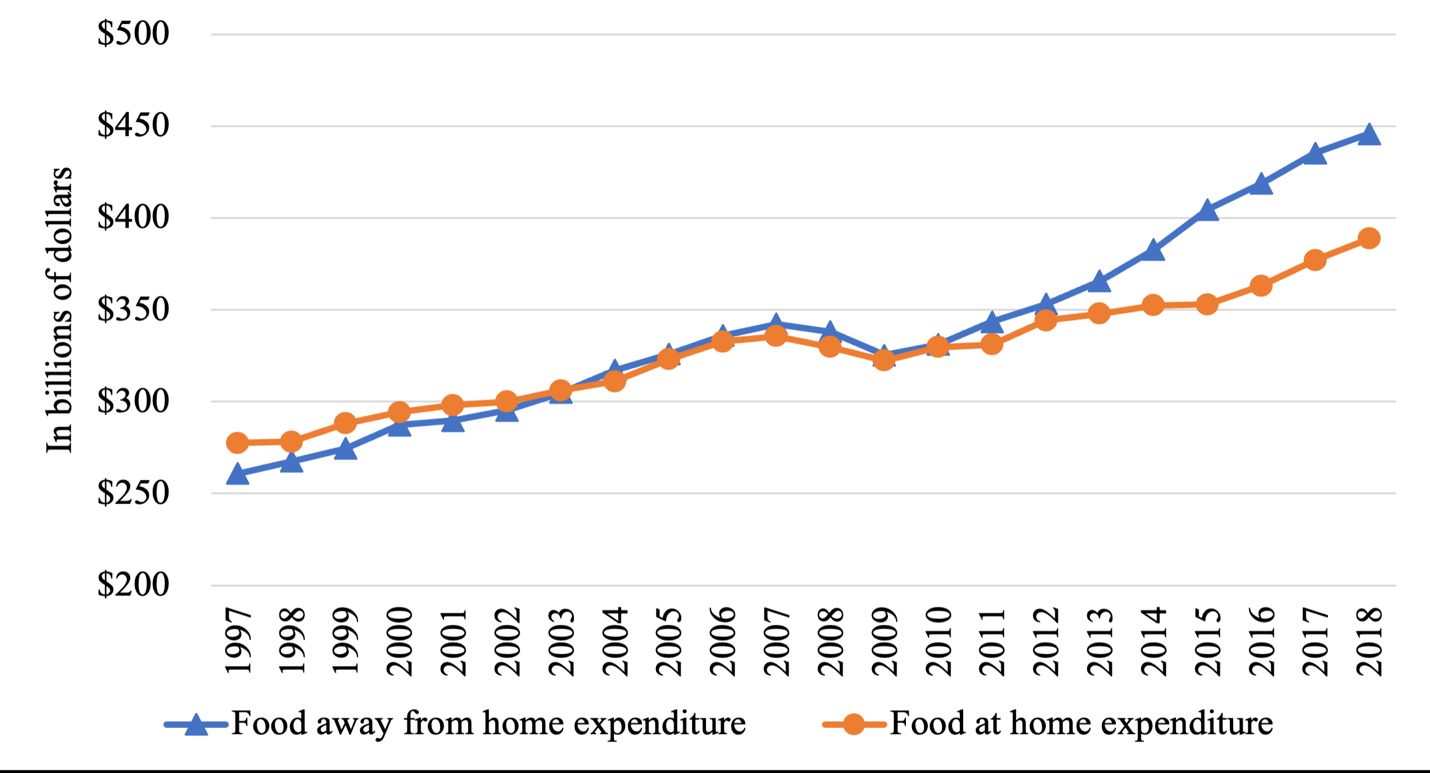

The food expenditure data provided by the US Department of Agriculture shows that households contribute to 84% of the total food expenditures, while businesses and government each account for 9% and 7%, respectively (Elitzak and Okrent 2018). The average US consumer spends approximately 10% of their disposable personal income (DPI) on food, and it has been relatively consistent at that level after 2004 (Okrent et al. 2018). While the DPI allocated to food remains stable, there is a notable shift in consumer spending patterns. Over time, the expenditures from both food-away-from-home (FAFH) (e.g., full- and quick-service restaurants) and food-at-home (FAH) sectors (e.g., grocery stores) have shown a growing trend (Figure 1). The gap between FAFH and FAH expenditures has widened in recent years due to more pronounced growth in FAFH spending.

Following the 2017 food shopper trends (Chen and House 2022), this study provides an overview of how US consumers perceive and behave related to food purchases and consumption in 2018. Moreover, this study is part of a series of studies examining consumer food shopping and consumption behavior since 2017, providing insights into evolving consumer preferences and dynamics in the food sector on a yearly basis. These insights serve as a valuable baseline for understanding recent shifts in consumer preferences and behaviors, such as the impacts of the COVID-19 pandemic and inflation. Our findings are essential for food system stakeholders, including policymakers, marketers, managers, and consumers, to make informed strategic decisions in response to evolving food consumption patterns.

Credit: USDA’s Food Expenditure Series, available at ers.usda.gov

Data and Methods

The Florida Agricultural Market Research Center (FAMRC) in the Department of Food and Resource Economics at the University of Florida has been administering a monthly survey to examine US consumers’ food and beverage consumption patterns since July 2016. The survey is hosted on Qualtrics and disseminated to a consumer panel through a third-party panel company, Toluna. The panel is demographically and geographically balanced to represent the US population. Approximately 500 responses from primary grocery shoppers are collected each month. In this study, primary grocery shoppers are individuals aged 18 or older and are responsible for at least 50% of grocery shopping in households. To ensure data quality, two attention check screeners are applied to detect if participants read the questions carefully (Jones et al. 2015). Our data are collected at the beginning of each month, reflecting consumer trends in the previous month. Therefore, this study uses data collected from February 2018 through January 2019, reflecting consumer perceptions and shopping behaviors from January 2018 to December 2018. Observations with missing values or identical values on attitudinal questions were excluded, resulting in a sample of 6,412 responses.

Consumer Demographics

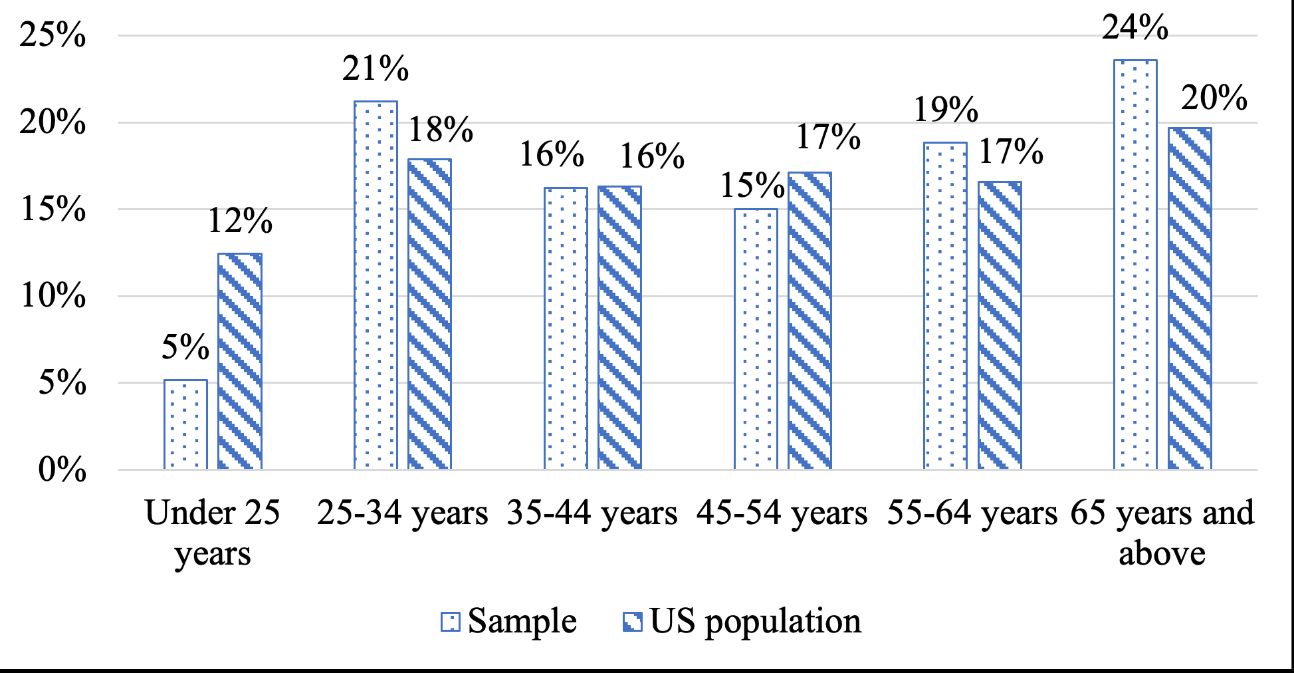

A majority of the respondents (79%) indicated that they are primarily responsible for grocery shopping, whereas the rest shared food shopping responsibility equally with other family members. A significant portion of the respondents were female (62%), college-educated (60%), and with a household income above $50,000 (61%). The average household had 2.6 members, with 13%, 18%, and 17% of the households having children in the age groups of under six years, between 6–12 years, and between 13–17 years, respectively. The sample consists of six age groups aligned with US census categorizations (see Figure 2), with the majority—over 70%—falling within the 25- to 65-year age range, adjusted for the sampling criteria that we target food shoppers above 18 years of age.

Credit: The United States Census Bureau’s American Community Survey S0101/Age and Sex, available at data.census.gov. Survey data calculated by authors and the US Census Bureau, 2018

Grocery Spending

In a typical week in 2018, the average household in our sample spent $136 on groceries, comparable to $137 in 2017 (Chen and House 2022). When comparing households from different income groups, we found that high-income ($100,000 or more), middle-income ($50,000–$99,999), and low-income (under $50,000) households’ weekly grocery expenditures were $182, $142, and $107, respectively. In 2018, per capita weekly food spending averaged $52, on par with $55 in 2017. For this analysis, households with six or more members, comprising 3% of the sample, were assumed to have exactly six members.

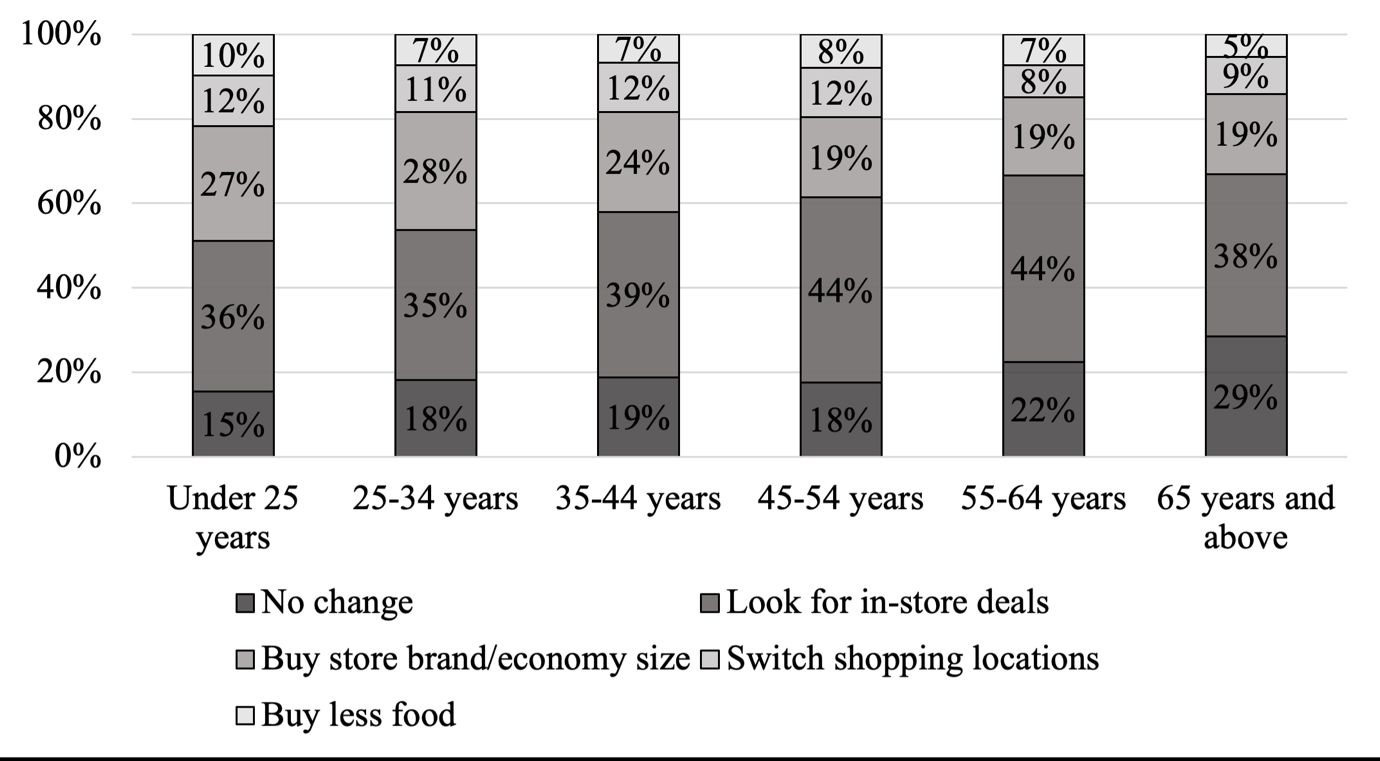

Price plays a significant role in shaping consumer spending behavior, especially in food choices (Devine and Marion 1979). Additionally, demographic characteristics, such as age, income, and family size, also play a role in identifying food consumption patterns (MacNell 2018; Robinson and Smith 2002). As shown in Figure 3, over 70% of participants across all age groups adopt different strategies to cope with food price increases; however, those aged 55 and above are more likely to maintain their shopping habits. Younger consumers under 45 prefer cost-saving measures, such as purchasing store brands, buying bulk, and switching shopping venues, echoing Chen and House’s 2017 findings. Despite minor shifts, consumer responses to food price increases remain similar when comparing data from 2017 and 2018. These minor shifts are observed, for example, in the share of consumers opting to “buy less food” (7% in 2018 and 6% in 2017); “switch shopping locations” (10% in 2018 and 9% in 2017); “purchase store brands or economy sizes” (22% in 2018 and 20% in 2017); and “look for in-store deals” (40% in 2018 and 44% in 2017). In both years, approximately 21% of consumers did not change their shopping habits.

Credit: Survey data calculated by authors

Food Shopping Outlets

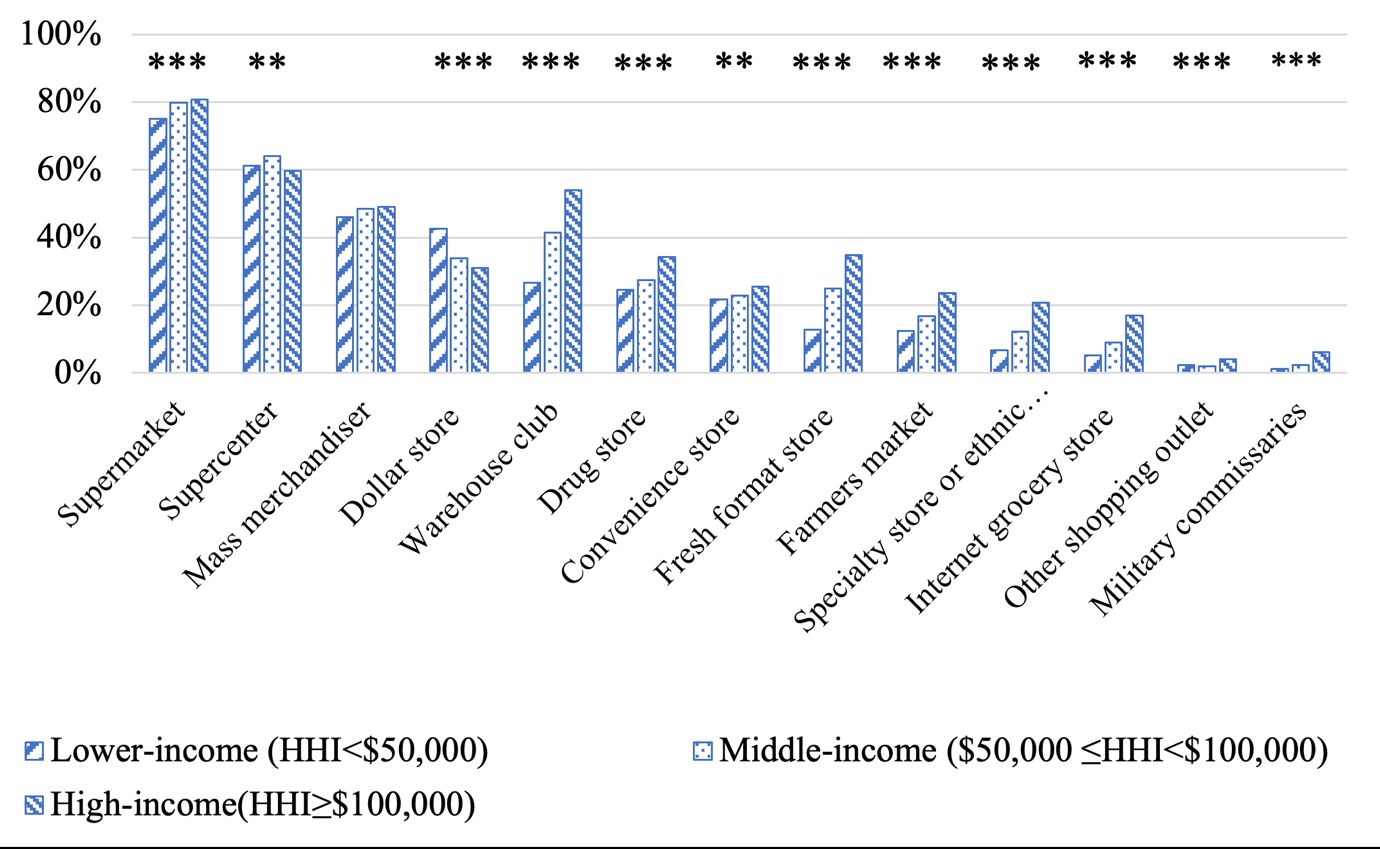

Understanding where consumers shop for food is critical to both marketers and policymakers in terms of devising promotional campaigns (e.g., promoting healthy eating). In this study, respondents were asked to select all formats of food outlets that they had visited in the past 30 days. The food outlets include supermarkets or grocery stores, supercenters, mass merchandisers, warehouse clubs, dollar stores, drug stores, fresh stores, convenience stores, farmers’ markets, specialty stores (e.g., ethnic stores), internet grocery stores, military commissaries, and others. Results show that, in 2018, an average consumer visited 3.8 different outlets monthly. This is similar to the 3.7 visits observed in 2017. Additionally, the diversity of food outlets, defined as the total number of different store formats visited in a month, varies across income groups. Specifically, consumers from low-income, middle-income, and high-income households visited an average of 3.4, 3.8, and 4.4 stores in different formats, respectively. This result is similar to 2017, where consumers from low-income, middle-income, and high-income households visited an average of 3.2, 3.7, and 4.3 stores, respectively.

A statistically significant relationship between household income level and food outlet choice was found (p<0.01 using a chi-square test), except for mass merchandisers. The chi-square test is a statistical method used to determine whether there is a meaningful association between two categorical variables—in this case, income level and choice of food outlet. Similar to the patterns in 2017 (Chen and House 2022), our results show that supermarkets, supercenters, and mass merchandisers were the most popular food shopping outlets among consumers in 2018 (Figure 4). Compared to low- and middle-income families, high-income consumers were more likely to visit various stores to complete their food shopping tasks, including warehouse clubs, fresh stores, farmers’ markets, specialty and ethnic food stores, and internet grocery stores. A year-over-year comparison indicates that the overall popularity of certain food outlets is steady, with supermarkets retaining a high patronage rate of approximately 79% in both years, specialty stores at 13%, online grocery stores at 10%, and other retail outlets holding at 3%. Some shifts are identified for other food outlets. Compared to 2017, the 2018 data indicated a slight uptick in the popularity of mass merchandisers (from 43% to 48%) and dollar stores (from 32% to 36%). A marginal rise was seen for supercenters (from 61% to 62%), fresh stores (from 23% to 24%), convenience stores (from 22% to 23%), and farmers’ markets (from 17% to 18%). In contrast, military commissaries experienced a slight decrease in patronage (from 4% to 3%).

Credit: Survey data calculated by authors. Note: *** and ** indicate significance at the 0.1% and 1% levels, respectively, under the chi-square test.

Food and Beverage Purchase Patterns

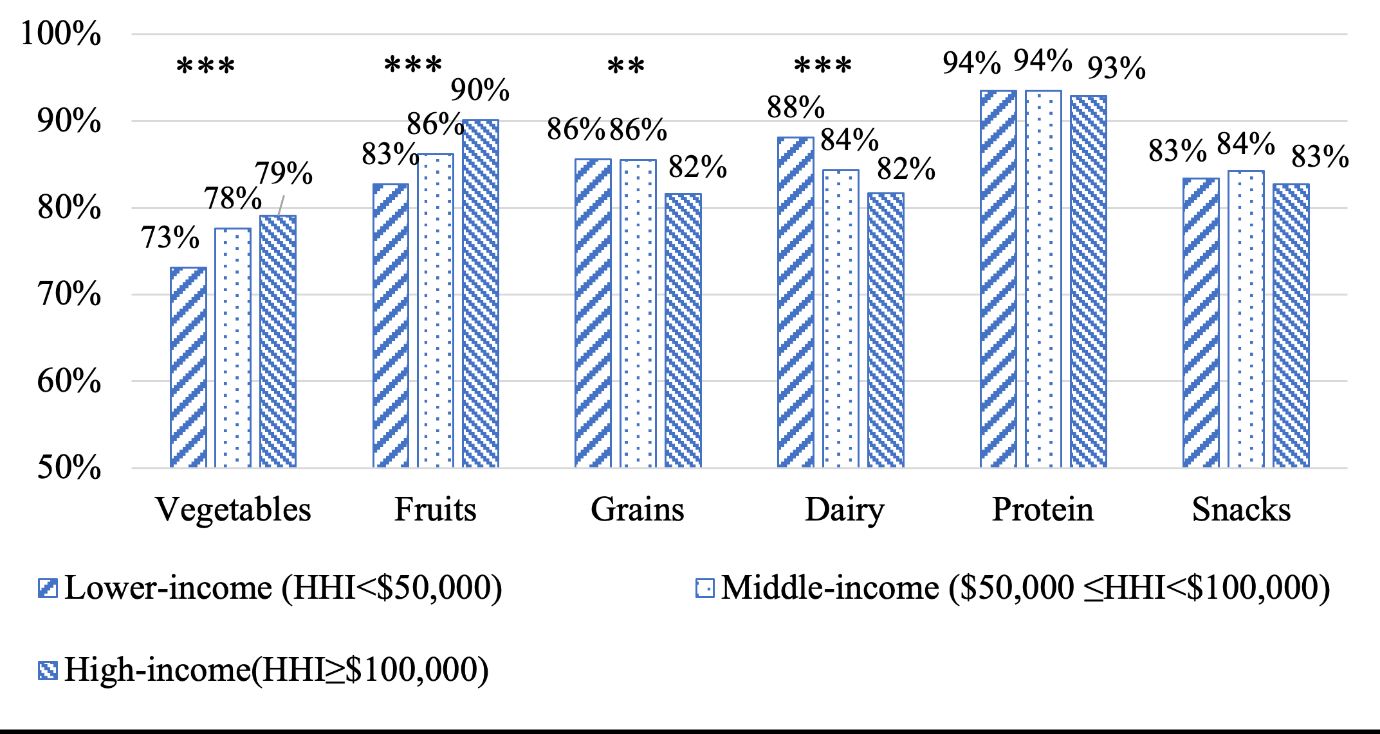

To better understand food consumption patterns, respondents were asked to indicate the food categories they had purchased in the past 30 days. This study focuses on 10 common food categories classified into six food groups: vegetables, fruits, grains, dairy, protein, and snacks (including candy and salted snacks). Note that we focused only on animal protein at the time of the study, and the category of snacks was added in addition to the 2017 study. Plant-based proteins such as legumes, nuts, seeds, and soy products were added to the survey in November 2020. Among the six food groups, protein foods were the most purchased, whereas vegetables were the least purchased (Figure 5). Overall, the purchase patterns for the five food groups were similar to those in 2017 (Chen and House 2022), especially for protein foods (93%) and dairy (85%). Slight decreases were observed for groups such as vegetables (77% in 2018, down from 78% in 2017); grains (84% in 2018, down from 85% in 2017); and fruit (84% in 2018, down from 87% in 2017). In addition, a cross-tabulation analysis (chi-square test) showed a significant relationship between household income levels and consumption of four food groups: vegetables, fruits, grains, and dairy products (p<0.05). This indicates that the consumption of the four food groups varies across household income levels. For example, high-income households were more likely to purchase fruits and vegetables relative to low- and middle-income families, whereas low-income households are more likely to purchase dairy products (Figure 5).

Following Chen and House (2022), the dietary diversity index (DDI) was calculated to quantify the extent of variety in the consumption of different types of foods. The index represents the sum of food categories selected in the survey, covering 10 common food categories: grains, fresh fruits, beef, pork, poultry, eggs, seafood, fresh vegetables, dairy, and fruit juice. Mirroring the findings from 2017, the average American household’s DDI in 2018 was 7.0, meaning that the average household purchased foods from seven of the 10 categories listed above. This consistency suggests a stable degree of dietary diversity year-over-year.

Credit: Survey data calculated by authors. Note: *** and ** indicate significance at the 0.1% and 1%, respectively, under the chi-square test.

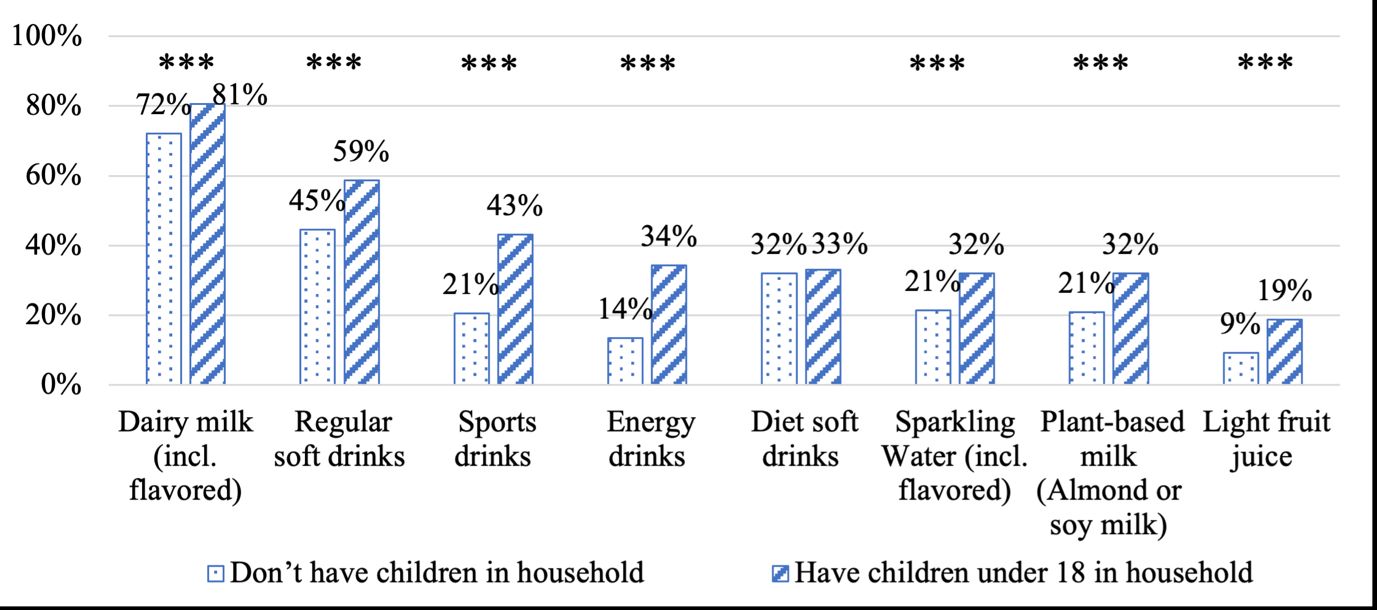

Consumers’ beverage choices are summarized in Figure 6. Data show that dairy milk, regular soft drinks, and sports drinks were the most preferred beverages in 2018, consistent with 2017. Overall, in 2018, the shares of consumers who indicated that they had purchased the beverages presented in the survey were slightly higher than those in 2017 across all categories (Chen and House 2022). For example, on average, slight increases were observed in the consumption of regular soft drinks (from 49% to 52% between 2017 and 2018), sports drinks (from 29% to 32%), energy drinks (from 22% to 24%), and sparkling water (from 24% to 27%). The chi-square analysis indicates a significant difference (p<0.01) in beverage choices across all categories (except for diet soft drinks) between families with children under 18 years of age and families without children (Figure 6). Specifically, families with young children reported a 34% likelihood of consuming energy drinks and sports drinks, more than double the rate of families without children at 14%. Notably, this disparity has diminished relative to 2017, due to more families without children reported consuming such beverages in 2018.

Credit: Survey data calculated by authors. Note: *** indicates significance at the 0.1% level under the chi-square test.

General Food Attitudes and Nutrition Perceptions

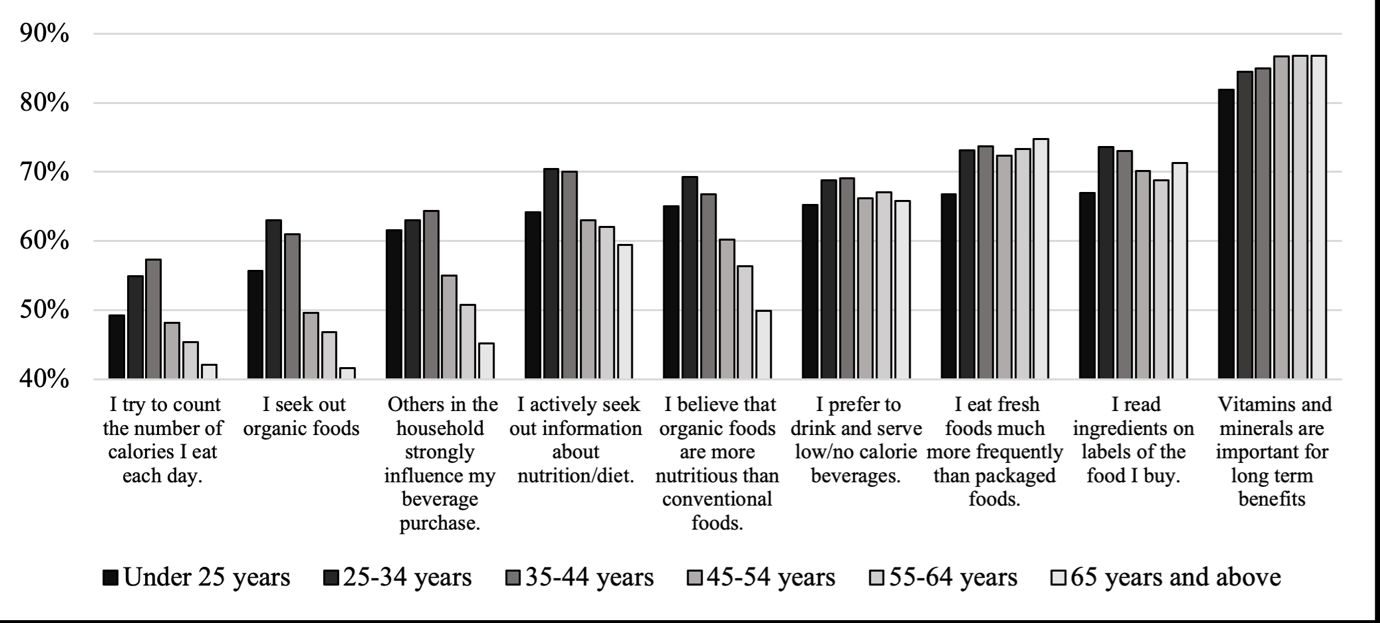

To gain insights into consumers’ general attitudes about food, respondents were asked to rate how much they agreed or disagreed with nine food-related statements (Figure 7). The agreement was measured using a seven-point Likert scale with “1” indicating strongly disagree and “7” indicating strongly agree. Consumer ratings above the value of “4” were interpreted as indicative of agreement. Similar to the findings from the 2017 study (Chen and House 2022), consumers had the highest agreement (85%) with the statement “vitamins and minerals are important for long-term health benefits.”

More than 70% of the respondents indicated that they ate fresh food more frequently than packaged food and read the ingredients on the food labels. Respondents who tried to count daily calorie intake accounted for approximately half of the sample (48%), an increase from 2017 (32%). About two-thirds of the respondents preferred low-calorie beverages and actively sought out information about nutrition and diet. Half of the respondents (51%) actively sought organic food, and, among them, approximately 85% reported that they believed organic food is more nutritious than conventional food. These findings mark an increase from the 2017 results (Chen and House 2022), where a smaller proportion, approximately 37%, actively sought organic food. Last, 55% of the respondents indicated that their beverage purchases were strongly influenced by other household members, marking an increase from 47% in 2017.

Consumers’ attitudes towards food also vary across different age groups (Figure 7). Respondents aged between 25–44 had the highest level of agreement with most of the food attitude statements, whereas those over 65 years old generally showed a lower level of agreement, especially regarding seeking organic foods and counting calories. Older individuals (above 65 years) showed the highest level of agreement regarding the importance of vitamins and minerals for long-term health benefits, and preferred fresh foods over packaged options.

Credit: Survey data calculated by authors

Credit: Survey data calculated by authors. Note: *** indicated significance at the 0.1% level using the Kruskal-Wallis test.

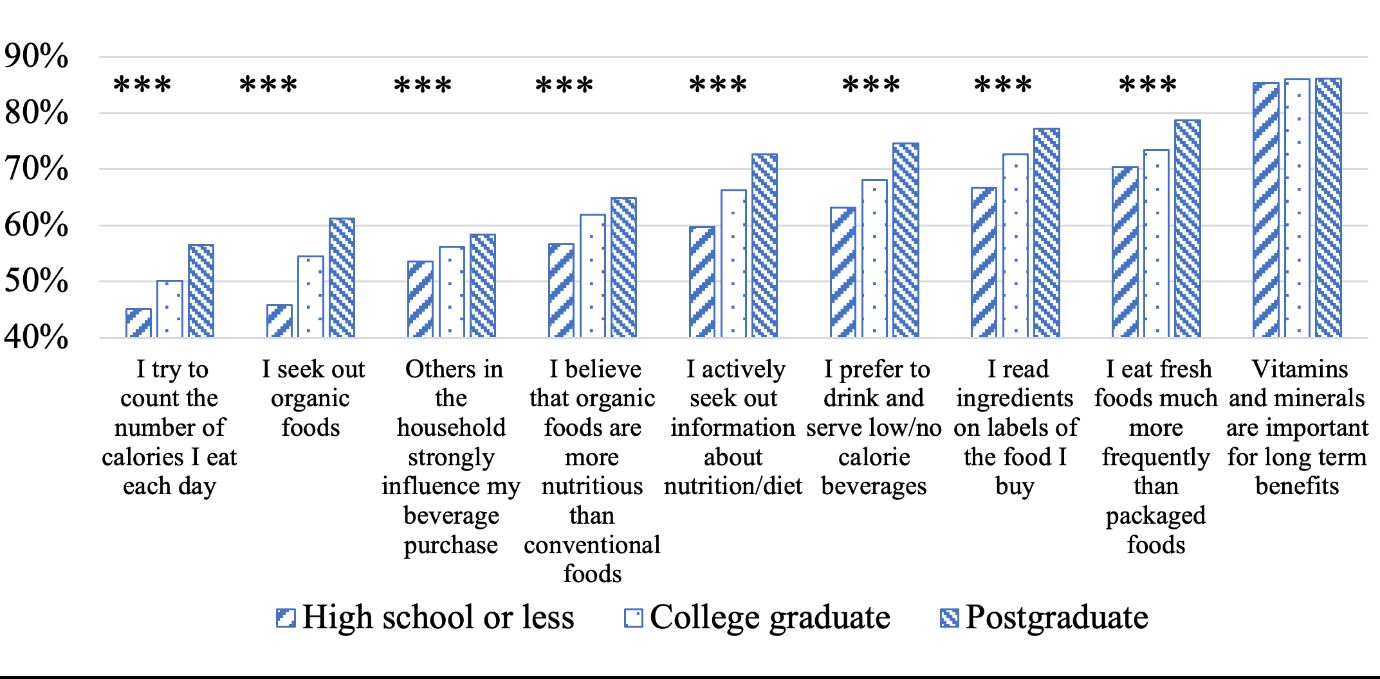

The Kruskal-Wallis test revealed significant differences in food attitudes across education levels for all statements except the one regarding the importance of vitamins and minerals for long-term benefits (Figure 8). The Kruskal-Wallis test is a non-parametric statistical test used to assess whether there are significant differences in responses (in this case, food attitudes) across multiple independent groups (in this case, education levels). Respondents with a higher level of educational attainment (i.e., postgraduate degrees) expressed stronger agreement with the food-related statements discussed above, while those with lower levels of educational attainment showed lower levels of agreement in general. Overall, the respondents had the highest level of agreement regarding the importance of vitamins and minerals for long-term health benefits, regardless of their educational attainment.

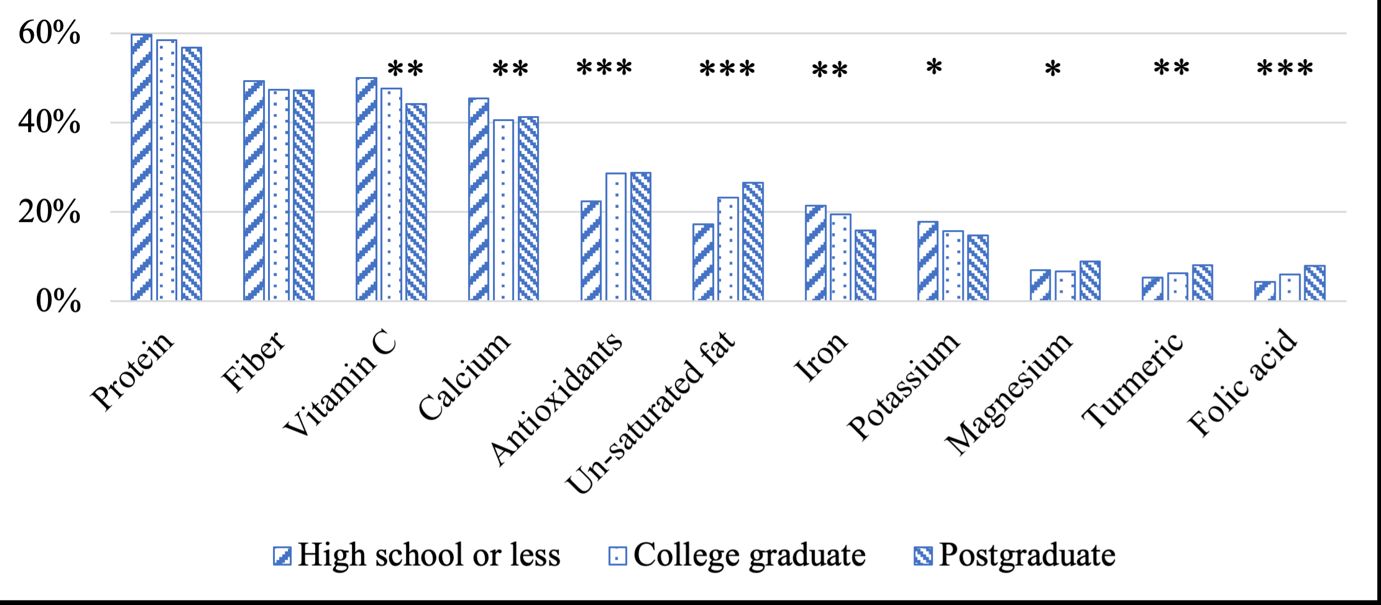

Respondents were tasked to indicate three characteristics that they tried to include in their diets. Results show that protein remained the most preferred nutritional characteristic, followed by fiber, vitamin C, and calcium, which was selected by more than a third of the respondents (Figure 9). Magnesium, folic acid, and turmeric were considered low priority among consumers (below 10%). Overall, the preference for nutritional characteristics such as vitamin C (47%), antioxidants (27%), and iron (19%) remains consistent with those observed in 2017 by Chen and House (2022). Minor shifts in consumer selections were observed when comparing data from 2017 and 2018. In 2018, more consumers selected protein (58% in 2018 and 57% in 2017); potassium (16% in 2018 and 15% in 2017); and magnesium (8% in 2018 and 7% in 2017). By contrast, in 2018, fewer consumers selected fiber (48% in 2018 and 50% in 2017); calcium (42% in 2018 and 44% in 2017); and unsaturated fat (22% in 2018 and 24% in 2017).

Among nutritional characteristics consumers tried to include in their diets, consumer responses to unsaturated fat indicated the greatest variations between educational attainment levels, which is validated by the chi-square test. For example, compared to high school graduates, respondents with a postgraduate degree were 1.5 times more likely to include unsaturated fats in their diets.

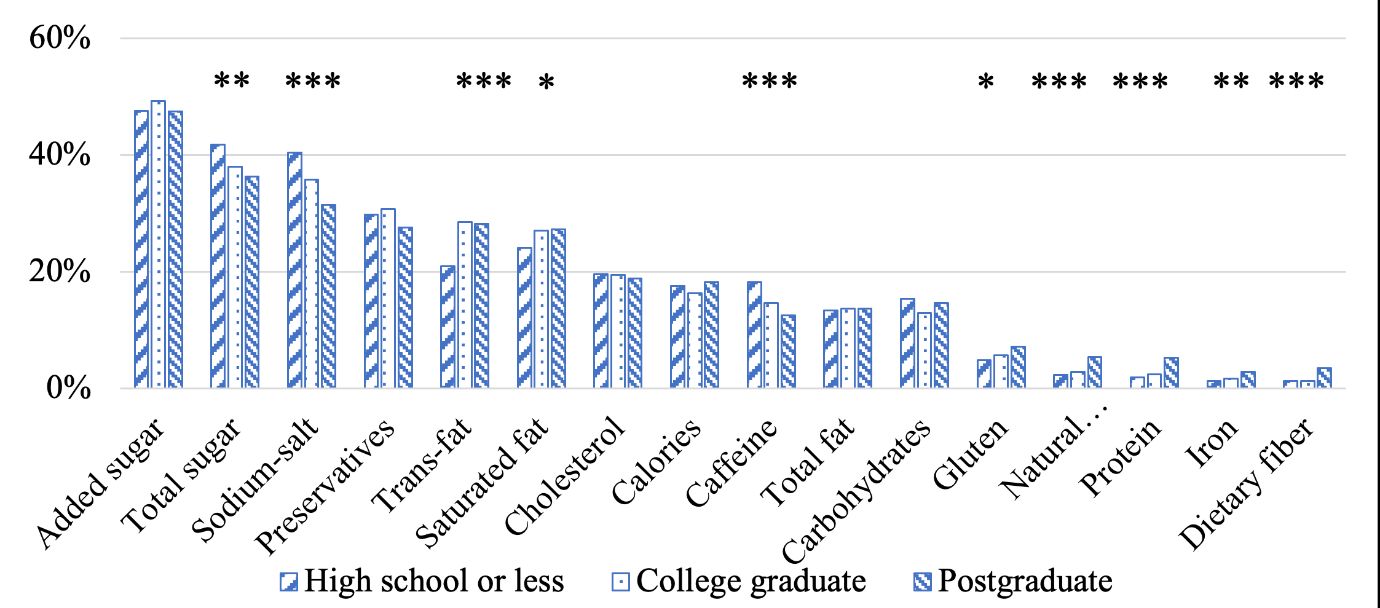

When asked which beverage characteristics respondents considered the worst for their health, added sugar, total sugar, preservatives, trans-fat, and saturated fats were the top five choices (Figure 10). Overall, consumer selections of these nutritional characteristics in 2018 were similar to those in 2017 (Chen and House 2022). For example, similar consumer preferences were observed for sodium (36% in 2018 and 37% in 2017), total sugar (39% in 2018 and 37% in 2017), trans-fat (26% in 2018 and 28% in 2017), and calories (17% in 2018 and 18% in 2017). Furthermore, the chi-square tests revealed a significant relationship (p<0.05) between education attainment and perception of beverage characteristics (Figure 9). For instance, high school graduates were more likely to indicate sodium as the worst beverage characteristic than college graduates or postgraduates.

Credit: Survey data calculated by authors

Credit: Survey data calculated by authors

Conclusion

Using food shopper trends in 2017 (Chen and House 2022) as a baseline, this study provides an updated overview of US food consumers in 2018. Based on a nationwide sample of 6,412 US food consumers, we examined how consumers think and behave around foods and beverages. In 2018, an average consumer spent $136 per week on groceries, and their primary shopping outlets were supermarkets and supercenters. Consumers from higher income brackets were more likely to visit non-traditional food outlets such as warehouse clubs, fresh stores, drug stores, convenience stores, and farmers’ markets. We find that consumers from different age groups cope with food price increases differently. For instance, individuals aged above 65 were less likely to change shopping behaviors, whereas younger consumers tended to employ different cost-saving strategies, such as looking for in-store deals, buying bulk, or switching to store brands. In addition, people aged between 25–44 were more involved with food, tended to count daily calorie intake, sought out food information, and preferred organic foods. Finally, consumer perceptions of nutritional characteristics differ by educational attainment. Overall, while the 2018 food trends show considerable similarities to those observed in 2017, there are some year-on-year variations, such as changing food attitudes toward organic food and calorie counting. The observed shifts indicate a potentially continued trend toward healthy eating and preferences for environmental friendliness. This information is valuable for food producers, marketers, and policymakers to develop marketing strategies and policies that not only align with shifting consumer preferences but also address broader public health objectives. Moreover, these insights underscore the importance of a continuous and timely examination of food shopper trends to ensure responsiveness to market dynamics and societal needs.

References

Chen, L. A., and L. House. 2022. “US Food Shopper Trends in 2017: FE1126, 12/2022.” EDIS 2022 (6). Gainesville, FL. https://doi.org/10.32473/edis-FE1126-2022

Devine, D. G., and B. W. Marion. 1979. “The Influence of Consumer Price Information on Retail Pricing and Consumer Behavior.” American Journal of Agricultural Economics 61 (2): 228–37. https://doi.org/10.2307/1239727

Elitzak, H., and A. Okrent. 2018. “USDA ERS—New U.S. Food Expenditure Estimates Find Food-Away-From-Home Spending Is Higher Than Previous Estimates.” Amber Waves United States Department of Agriculture. https://www.ers.usda.gov/amber-waves/2018/november/new-u-s-food-expenditure-estimates-find-food-away-from-home-spending-is-higher-than-previous-estimates

Jones, M. S., L. A. House, and Z. Gao. 2015. “Respondent Screening and Revealed Preference Axioms: Testing Quarantining Methods for Enhanced Data Quality in Web Panel Surveys.” Public Opinion Quarterly 79 (3): 687–709. https://doi.org/10.1093/poq/nfv015

MacNell, L. 2018. “A Geo-Ethnographic Analysis of Low-Income Rural and Urban Women’s Food Shopping Behaviors.” Appetite 128 (1):311–20. https://doi.org/10.1016/j.appet.2018.05.147

Okrent, A. M., H. Elitzak, T. Park, and S. Rehkamp. 2018. “Measuring the Value of the U.S. Food System: Revisions to the Food Expenditure Series.” United States Department of Agriculture. https://www.ers.usda.gov/publications/pub-details?pubid=90154

Robinson, R., and C. Smith. 2002. “Psychosocial and Demographic Variables Associated with Consumer Intention to Purchase Sustainably Produced Foods as Defined by the Midwest Food Alliance.” Journal of Nutrition Education and Behavior 34 (6): 316–25. https://doi.org/10.1016/S1499-4046(06)60114-0

Tables

This section provides matching data tables for the figures in this publication.

Table 1. Food-away-from-home (FAFH) and food-at-home (FAH) expenditures in constant dollars (with taxes and tips for all purchasers), 1997–2018. (See Figure 1.)

Table 2. Composition of the sample by age groups, 2018. (See Figure 2.)

Table 3. Consumers’ responses to food price increases by age groups, 2018. (See Figure 3.)

Table 4. Food outlet choices by different household income (HHI) levels, 2018. (See Figure 4.)

Table 5. Consumer purchase of the six food groups by income level, 2018. (See Figure 5.)

Table 6. Beverages purchased in the past 30 days, 2018. (See Figure 6.)

Table 7. General food attitudes by age groups, 2018. (See Figure 7.)

Table 8. General food attitudes by education, 2018. (See Figure 8.)

Table 9. Characteristics consumers try to include in their diets, 2018. (See Figure 9.)

Table 10. Beverage characteristics considered the worst for health, 2018. (See Figure 10.)