Blueberries have become increasingly popular, with per-capita consumption in the United States increasing tenfold over the last two decades, driven by growing demand for fresh and healthy produce (Hammami et al. 2024). In line with the trend, fresh blueberries have become one of Florida’s fastest-growing agricultural products (FDACS 2021). This growth aligns with a broader trend of growing consumer interest in local foods across the United States (Warwick et al. 2014; Wu and Guan 2021). Florida blueberry producers are capitalizing on this demand by marketing their products with distinctive branding, particularly the Fresh From Florida® logo.

Fresh From Florida® is a unique state branding initiative created by the Florida Department of Agriculture and Consumer Services (FDACS). It is designed to advertise food products grown in Florida by distinguishing them from out-of-state or imported alternatives, potentially influencing consumer awareness and purchasing decisions. Florida agricultural producers can participate in this program by paying a fee, which grants them the ability to use the initiative’s logo on their product packaging. Participating producers can increase product visibility and benefit from state-sponsored marketing campaigns.

Despite growing demand, the Florida blueberry market has faced increasing competition from imports, particularly from Mexico and Peru (Hammami et al. 2024). Although state production has successfully met demand, increasing imports from foreign countries and other US states underscores the need for Florida farmers to examine and reassess marketing strategies. Therefore, improving our understanding of marketing campaign effects is necessary to help local growers differentiate Florida-grown fresh blueberries in an increasingly competitive marketplace. Moreover, it is essential to investigate consumers’ purchasing preferences and awareness of locally grown fresh blueberries to enhance local blueberry consumption. Lastly, identifying additional labels that can add value to the existing ones is crucial for strengthening the competitive advantage of Florida-grown blueberries and attracting more consumers. Enhancing understanding of the importance of these factors will help Florida blueberry growers and marketers to strengthen their position in the marketplace.

In an effort to learn how best to support the marketability and competitiveness of Florida-grown fresh blueberries, UF/IFAS economists conducted a study entitled “Consumer Preferences for Florida-Grown Blueberries.” The study analyzes consumers’ purchasing behavior and preferences for various blueberry attributes, providing insights to help growers, marketers, and retailers refine packaging and marketing strategies. Specifically, the study aims to (1) understand consumers' perceptions of locally grown blueberries, (2) identify value-adding labels for blueberry packaging, and (3) examine consumers' preferences and willingness to pay for specific product attributes.

This report is the first in a multi-part series based on the study. It summarizes results from a survey of Florida fresh blueberry consumers. The objective of this report is to understand consumer purchasing behavior and the factors influencing consumers’ choices regarding what, where, when, and how much they buy. We present findings on the types of blueberries purchased, shopping locations, purchase frequency, and the price paid per pint of fresh blueberries. The next report in this series will explore how Florida consumers perceive and respond to locally grown blueberries in the marketplace.

Method

We conducted an online survey of consumers in Florida, distributed over a two-week period in April 2024 through a reputable market research platform, Qualtrics. Respondents were screened based on the following criteria: (1) currently live in Florida and (2) purchased fresh blueberries in the past six months. The survey respondents were limited to Florida residents because Florida growers primarily target local markets. In fact, according to a Florida Department of Agriculture and Consumer Services (FDACS) report, Florida exported $36 million worth of blueberries overseas in 2022 (FDACS 2023). Based on our calculations using values from FDACS and the United States Department of Agriculture National Agricultural Statistics Service (USDA NASS), we estimate that more than half of Florida-grown blueberries are consumed domestically. For example, in 2022, 35% of Florida's blueberries were exported, with 33% going to Canada and 2% to Mexico or other destinations, while the remaining 65% were consumed domestically. A total of 1,537 respondents were used in the analysis.

Who participated in the study?

Table 1. Demographic characteristics of the sample (1,537 respondents).

Results

Forms of Blueberries Purchased by Survey Respondents

We limited the sample to respondents who indicated they had purchased fresh blueberries in the past six months, which explains the high percentage of fresh blueberry purchases (70% of respondents) (Table 2). In addition to fresh blueberries, the blueberry consumers also purchased frozen blueberries (19%) or processed blueberries (3%). Respondents who purchase three types of blueberries, fresh, processed, and frozen, account for 8.2%. These findings suggest that most blueberry consumers prefer purchasing fresh blueberries over other types.

Table 2. Percentages of blueberry types purchased (N=1,537 respondents).

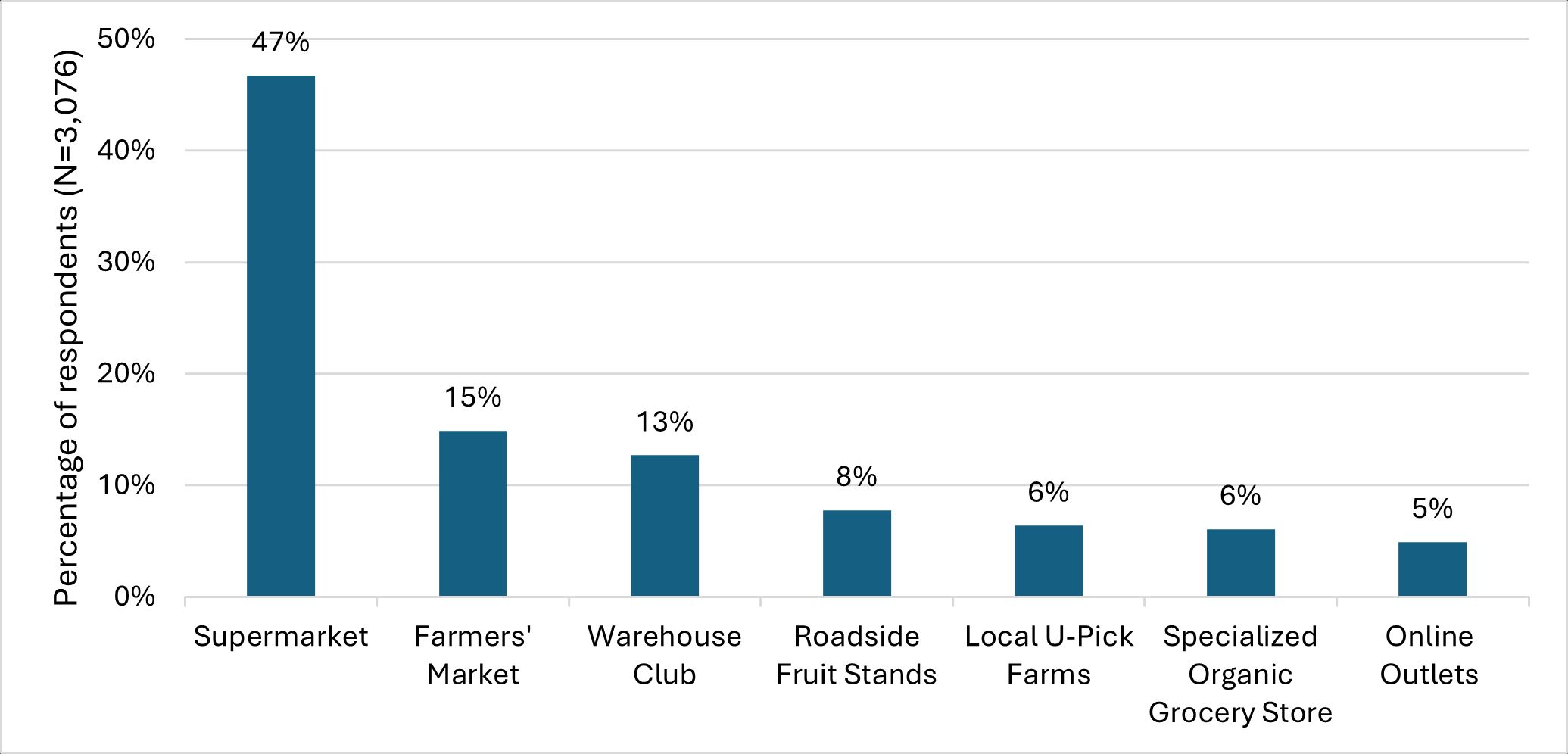

Purchase Locations for Fresh Blueberries among Survey Respondents

Respondents were asked to select all the locations where they purchase fresh blueberries. Most indicated that they usually purchase fresh blueberries from supermarkets (47% of respondents) (Figure 1). Following that, 15% of fresh blueberry consumers reported purchasing them from farmers’ markets and 13% from warehouse clubs. Only 5% of consumers reported buying blueberries from online outlets. This finding highlights the dominant role of traditional retail channels, such as supermarkets, in fresh blueberry purchases, while alternative outlets like farmers' markets and warehouse clubs play smaller but notable roles in providing locations to source Florida blueberries.

Credit: Authors’ survey data

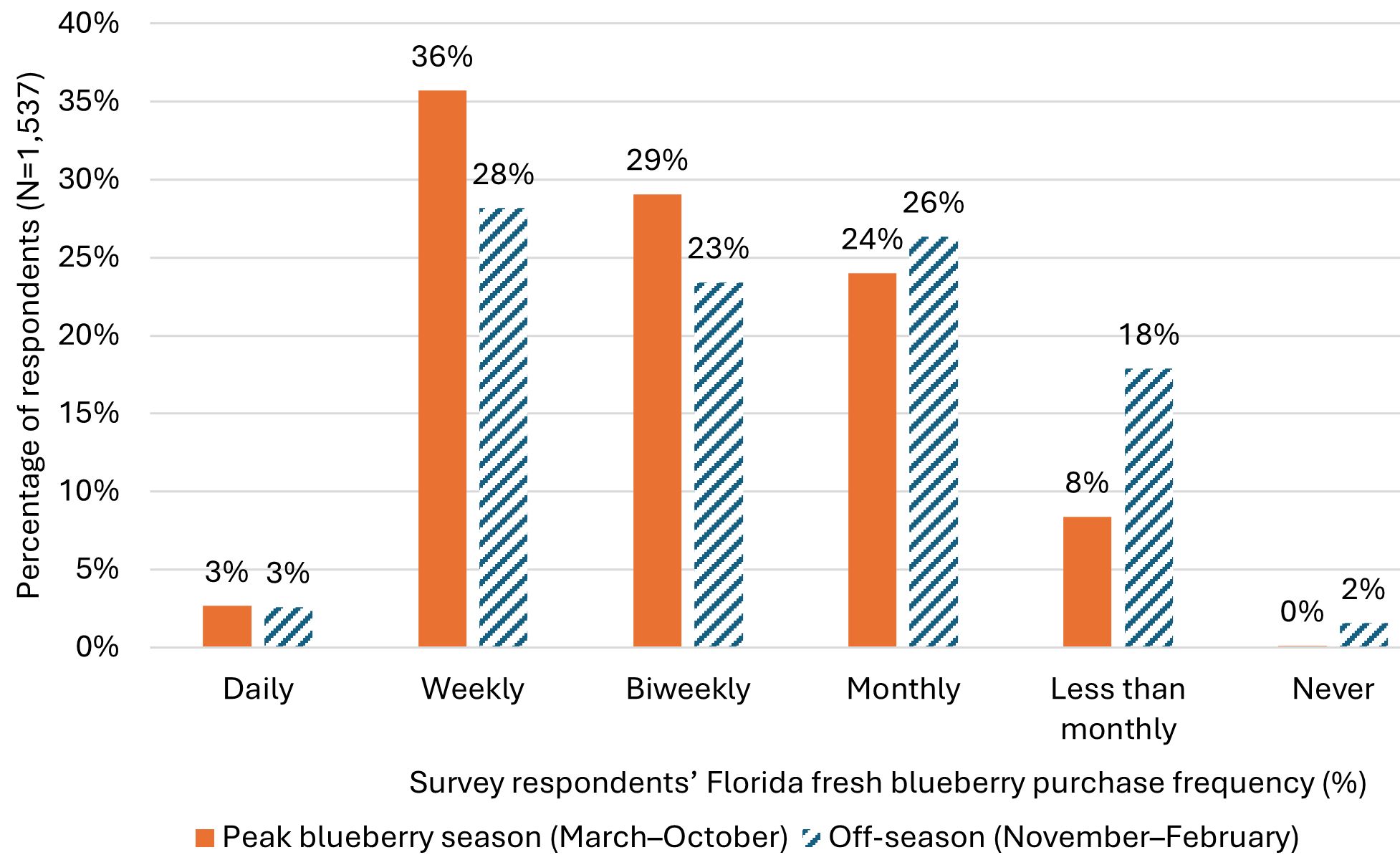

Seasonal Frequency of Fresh Blueberry Purchases among Survey Respondents

The frequency of fresh blueberry purchases during the domestic peak season (March–October) and the off-season (November–February) is reported in Figure 2. During the peak season, most respondents (36%) purchased fresh blueberries weekly, compared to 28% during the off-season. In contrast, during the off-season, 18% of participants purchased fresh blueberries less than monthly. Also, monthly purchases are slightly higher during the off-season (26%) than in the peak season (24%), while the percentage of respondents who buy blueberries daily remains relatively consistent across both seasons. The figure also shows that no respondents reported "never" purchasing fresh blueberries during the peak season, while 2% of respondents indicated they "never" purchased fresh blueberries during the off-season. This finding highlights the seasonal difference in fresh blueberry purchasing behavior, with higher purchase frequency observed during the peak season. Also, it suggests that demand remains steady for some year-round consumers.

Credit: Authors’ survey data

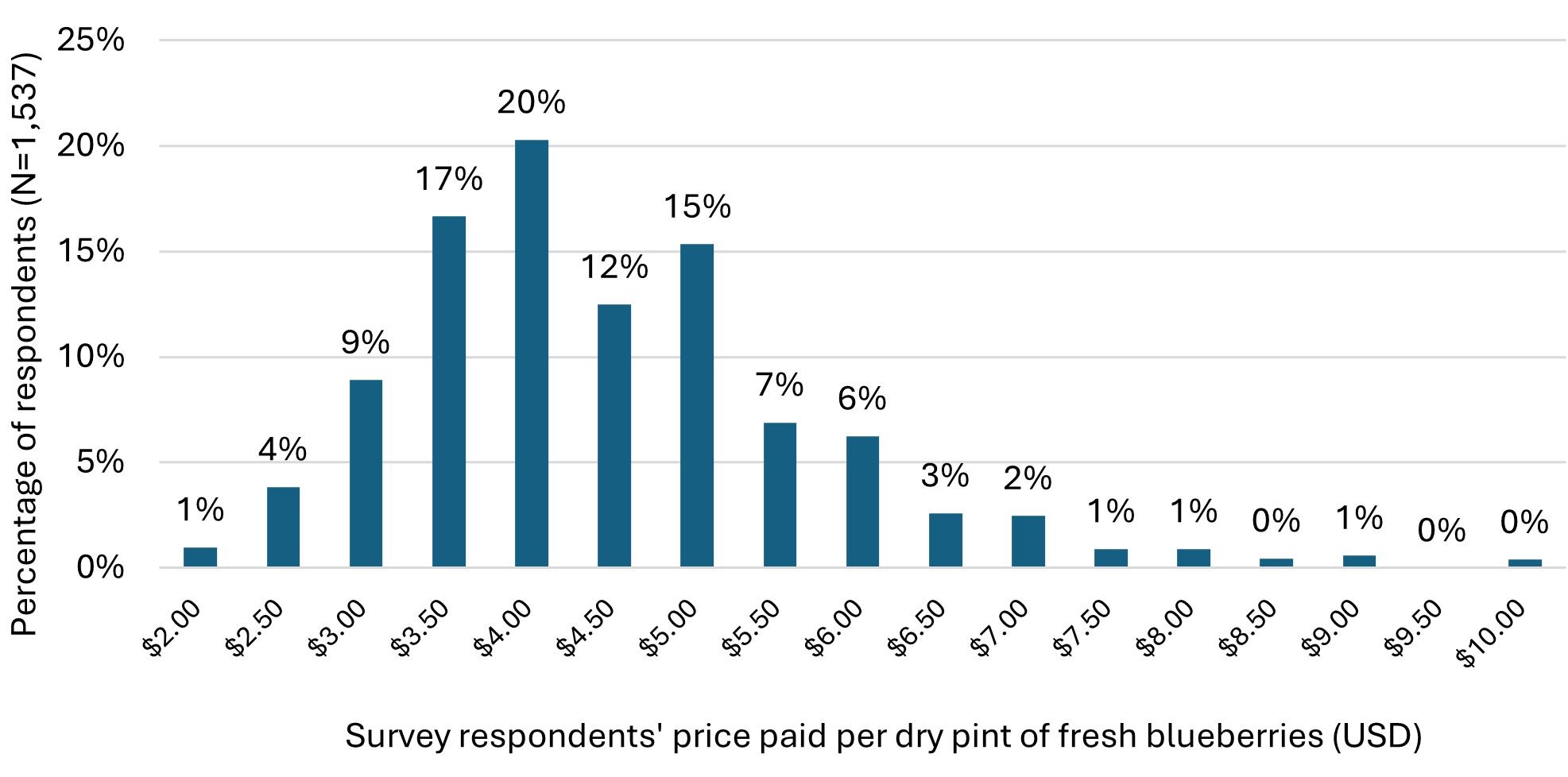

Fresh Blueberry Spending Patterns among Survey Respondents

Respondents were asked to indicate the price they paid for one dry pint of fresh blueberries (Figure 3). Most respondents (20%) report spending $4.00 per pint, followed by 17% who spend $3.50 and 15% who spend $5.00. The figure suggests that most respondents pay between $3.50 and $5.00 per pint of fresh blueberries, indicating a relatively narrow and consistent price range for this product. Notably, very few respondents reported spending below $3.00 or above $6.00. This finding might be related to consumers’ willingness to pay within the $3.50 to $5.00 range for one dry pint of fresh blueberries.

Credit: Authors’ survey data

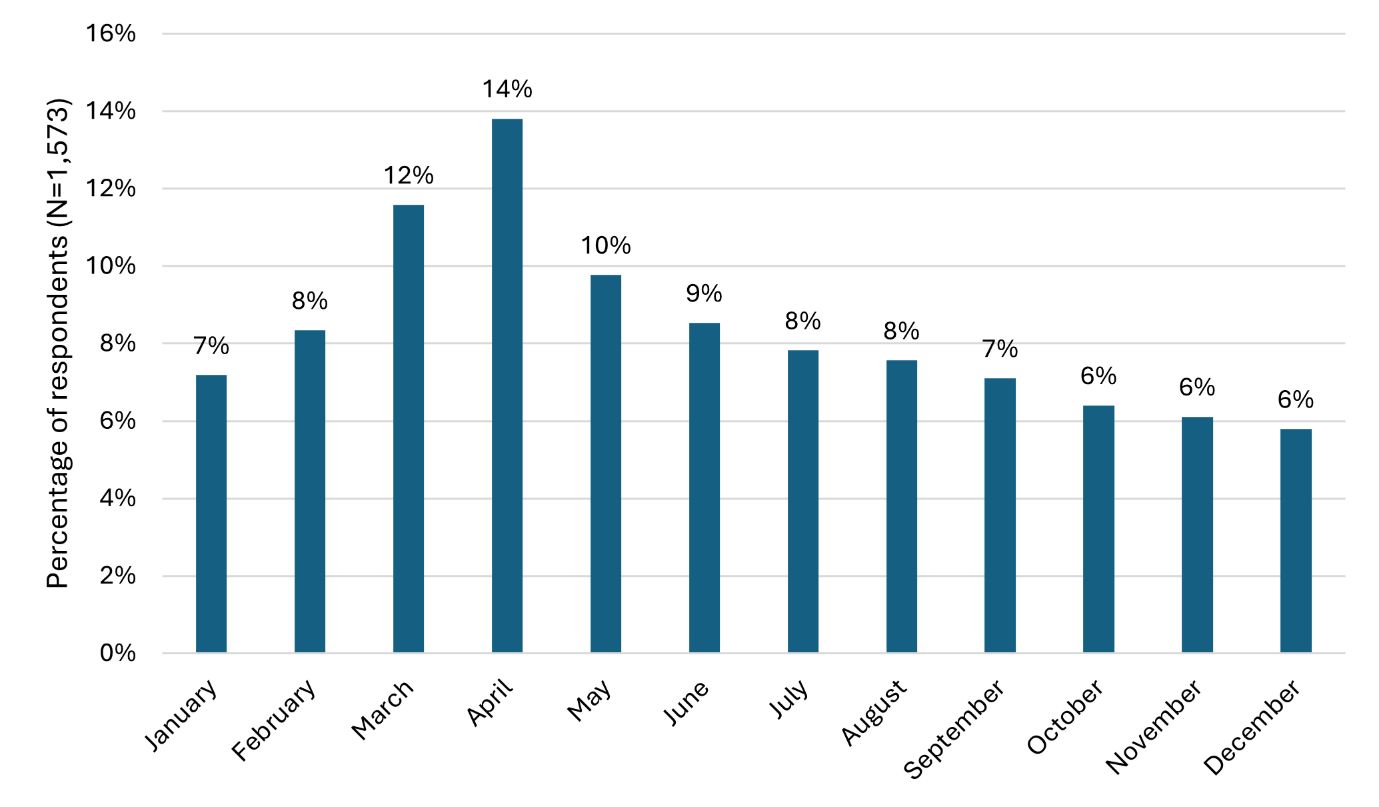

Following the price question, respondents were asked to select the months in which they pay the reported price (with multiple choices). The results, as shown in Figure 4, indicate that purchases were mostly made between March and May, with April being the peak month (14%) followed by March (12%) and May (10%). This trend aligns with the peak harvest season for fresh blueberries in Florida, when supply is abundant. Fewer respondents reported the price based on their December purchases (6%), reflecting lower purchasing activity during the winter months.

Credit: Authors’ survey data

Concluding Remarks

Forms of Blueberries Purchased by Survey Respondents

This study examines the purchasing behavior of Florida consumers for fresh blueberries, focusing on shopping location, purchasing frequency, and spending patterns. The findings reveal that most blueberry consumers purchase fresh blueberries both during the peak season and the off-season, primarily choosing fresh blueberries over frozen or processed alternatives. Supermarkets emerged as the primary purchase outlet, indicating a strong reliance on traditional retail channels. This finding aligns with Marques et al. (2021), who also found that consumers primarily purchase fresh fruits from chain stores. These results suggest that marketing efforts targeting supermarkets as the primary channel could enhance visibility and accessibility of Florida-grown fresh blueberries.

During the peak season, most consumers purchase blueberries weekly; however, this frequency drops during the off-season, with more consumers buying less than monthly. Few respondents report zero purchase of blueberries during the off-season, suggesting that seasonal availability and preferences significantly influence their purchasing decisions. These insights highlight the importance of maximizing in-season promotion efforts, especially in supermarkets, to capture high-frequency shoppers while demand is at its peak. Finally, most respondents spend between $3.50 and $5.00 per pint of fresh blueberries, indicating a range that reflects notable variation in consumer price expectations.

The next report in this series will explore consumers’ perceptions of local foods and local brands, as well as their willingness to pay for the state logo, Fresh From Florida®, providing further insights to inform labeling and marketing strategies in the Florida blueberry market.

References

Florida Department of Agriculture and Consumer Services (FDACS). 2021. Florida Agriculture by the Numbers. Available at https://www.fdacs.gov/Agriculture-Industry/Florida-Agriculture-Overview-and-Statistics. Accessed June 2024.

Florida Department of Agriculture and Consumer Services (FDACS). 2023. Florida Agriculture Export Report.

Hammami, A. Malek, Zhengfei Guan, and Xiurui Cui. 2024. “Foreign Competition Reshaping the Landscape of the U.S. Blueberry Market.” Choices. 2024. Quarter 3. https://www.choicesmagazine.org/choices-magazine/submitted-articles/foreign-competition-reshaping-the-landscape-of-the-us-blueberry-market

Marques, Juliano Martins Ramalho, Ariana P. Torres, Bridget K. Behe, Petrus Langenhoven, and Luiz Henrique de Barros Vilas Boas. 2021. “Exploring Consumers’ Preferred Purchase Location for Fresh Fruits.” HortTechnology 31 (5): 595–606. https://doi.org/10.21273/HORTTECH04865-21

USDA National Agricultural Statistics Service (USDA-NASS). 2024. Florida Agricultural Overview. Available at https://www.nass.usda.gov/Statistics_by_State/Florida/index.php.

Warwick, Caroline, Valentina Castano, Meredith M Oglesby, Olivia K. Doyle, Lauri M Baker, and Joy N. Rumble. 2014. “Talking Local: Florida Consumers’ Reasons for Purchasing Local Food: AEC511 WC176, 8 2014.” EDIS 2014 (9). Gainesville, FL. https://doi.org/10.32473/edis-wc176-2014

Wu, Feng, and Zhengfei Guan. 2021. “An Overview of the Mexican Blueberry Industry: FE1106, 12 2021.” EDIS 2021 (6). Gainesville, FL. https://doi.org/10.32473/edis-fe1106-2021