This report is the second in a multi-part series based on the "Consumer Preferences for Florida-Grown Blueberries" study. The first report in this series is titled “Consumer Preferences for Florida-Grown Blueberries Part 1: Florida Fresh Blueberry Consumer Behavior—Insights on Shopping Locations, Frequency, and Spending” and is available on the EDIS Journal site. The main objective of this project is to support the marketability and competitiveness of Florida-grown fresh blueberries by analyzing consumers’ preferences for blueberry quality attributes. The target audiences include Florida blueberry growers, marketers, and retailers. By identifying the most influential labels and product attributes, we provide recommendations to refine packaging to meet consumer demand and improve market share.

This second report explores how Florida consumers perceive and respond to locally grown blueberries in the marketplace. First, we examine the importance of the Fresh From Florida® logo relative to other labels in consumers’ purchasing decisions. We also investigate consumers’ preferences and willingness to pay for Florida-grown blueberries. Next, we assess their knowledge of the local blueberry season and their experiences purchasing blueberries labeled Fresh From Florida®. Finally, we evaluate overall awareness of local brands among Florida consumers. Insights from this analysis will help Florida growers involved in the commercial blueberry industry make informed marketing decisions.

Method

We conducted an online survey of consumers in Florida, distributed over a two-week period in April 2024 through a reputable market research platform, Qualtrics. Respondents were screened based on the following criteria: (1) currently live in Florida; and (2) purchased fresh blueberries in the past six months. The survey participants were limited to Florida residents because Florida growers primarily target local markets. A total of 1,537 completed surveys were used in the analysis.

Who participated in the study?

In our study, the majority of respondents are between the ages of 55 and 74 (48.7%). Most hold a two-year or four-year college degree, and the sample includes more female respondents (56.2%) than male (43.6%). The most common racial group is White (84.8%), and the most frequently reported household income range is $50,000 to $99,999 (38.5%). See Table 1 for detailed demographic characteristics of the sample.

Table 1. Demographic characteristics of the sample (1,537 respondents).

Results

Importance of Local Food Labels in Purchasing Fresh Blueberries

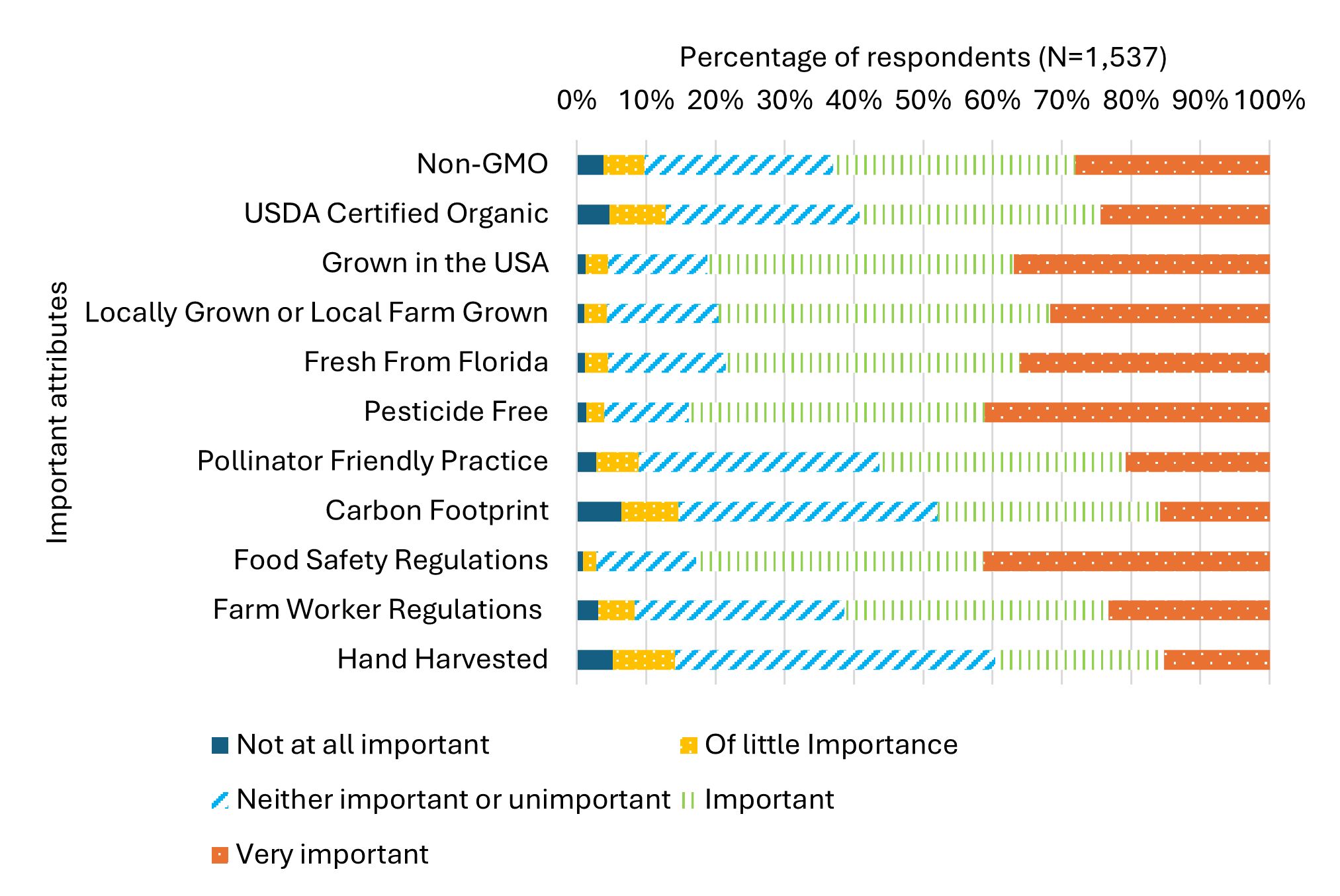

We analyze the relative importance of Fresh From Florida® labeling compared to other attributes when consumers purchase fresh blueberries. Respondents were asked to indicate the importance of each attribute on a five-point Likert scale, ranging from “very important” to “not at all important.” Results show that 36% of consumers rated Fresh From Florida® as “very important” to their purchasing decisions, while 5% rated it as “unimportant” (Figure 1).

When asked which attributes were “very important” in their blueberry purchases, 37% of respondents selected “Grown in the USA,” followed by 36% for “Fresh From Florida®,” and 32% for “‘Local brand.” This ranking highlights that while the Fresh From Florida® label is highly valued, consumers place slightly greater emphasis on broader national origin cues. These findings suggest that the Fresh From Florida® label resonates with many consumers, but communicating that Fresh From Florida® produce is also US-grown could reinforce its appeal. Additionally, pesticide-free and food safety regulations were rated as more important than other food labels. Interestingly, consumers rated Non-GMO labeling (28%) as more important than USDA Certified Organic (25%).

Credit: Authors’ survey data

Consumers’ Willingness to Pay for Locally Grown Fresh Blueberries

To conduct a more in-depth analysis of consumer preferences for Fresh From Florida®, we estimate consumers’ preferences and willingness to pay using the survey dataset. Our analysis revealed that Florida consumers are more likely to choose blueberries labeled with the Fresh From Florida® logo. Regression analysis showed that they are willing to pay an average premium of $2.16 per pint (11 oz) for this attribute. This result underscores the substantial economic value the Fresh From Florida® logo adds to locally grown blueberries, providing Florida producers with a competitive edge in the marketplace.

Perceptions of the Local Blueberry Harvest Season

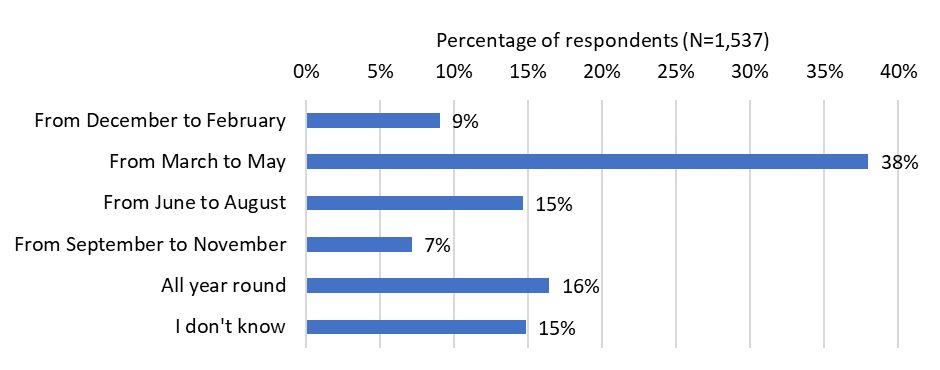

To better understand consumers’ awareness of seasonality, we explore their knowledge of Florida’s blueberry harvest season, which generally runs between March and May. Only 38% of blueberry consumers correctly identified the local harvest period, while 15% answered "I don't know," and 16% mistakenly believed that Florida blueberries are harvested year-round (Figure 2). Despite the high preference for locally grown blueberries, many consumers lack awareness of the state’s harvest season. This gap in knowledge may prevent them from seeking out Florida-grown blueberries during peak availability, highlighting an opportunity for producers to enhance consumer education through targeted marketing efforts.

Credit: Authors’ survey data

Experience in the Marketplace

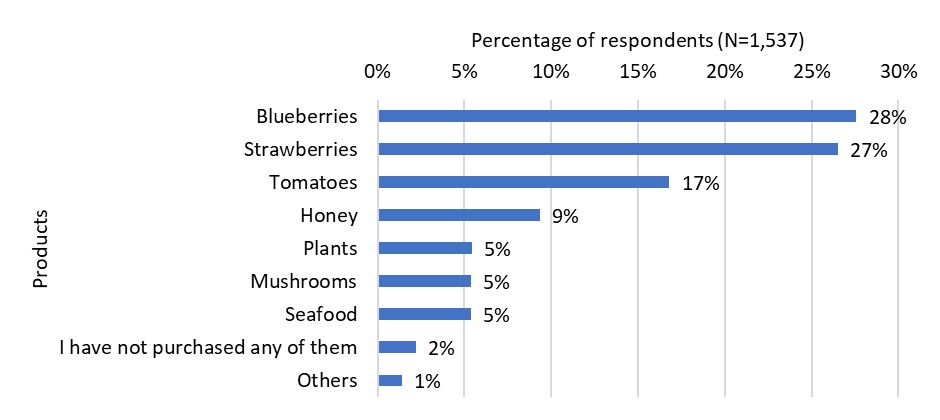

We examine consumers’ past experiences purchasing blueberries bearing the Fresh From Florida® logo. Participants were asked whether they had ever purchased any products featuring the Fresh From Florida® logo. Among respondents, 28% reported having purchased blueberries labeled with the Fresh From Florida® logo, the highest percentage among the listed products, including strawberries, tomatoes (17%), mushrooms, and honey (9%) (Figure 3), indicating stronger recognition or appeal for blueberries associated with the Fresh From Florida® attribute as compared to other commodities. Interestingly, products such as mushrooms, seafood, and houseplants showed much lower levels of the Fresh From Florida® logo association, suggesting an opportunity for expanded branding efforts in these categories. In the “others” category, oranges and orange juice were the most frequently mentioned products, reflecting the historical association of these products with Florida’s agriculture. These findings underscore the potential to build on the Fresh From Florida® logo’s established appeal for blueberries, while exploring strategies to enhance its recognition across other fresh produce categories. However, it is important to note that the blueberry-specific context of the survey may have influenced respondents’ recall or responses, potentially leading to higher reported familiarity with the Fresh From Florida® label on blueberries.

Credit: Authors’ survey data

Perception of Local Blueberry Brands

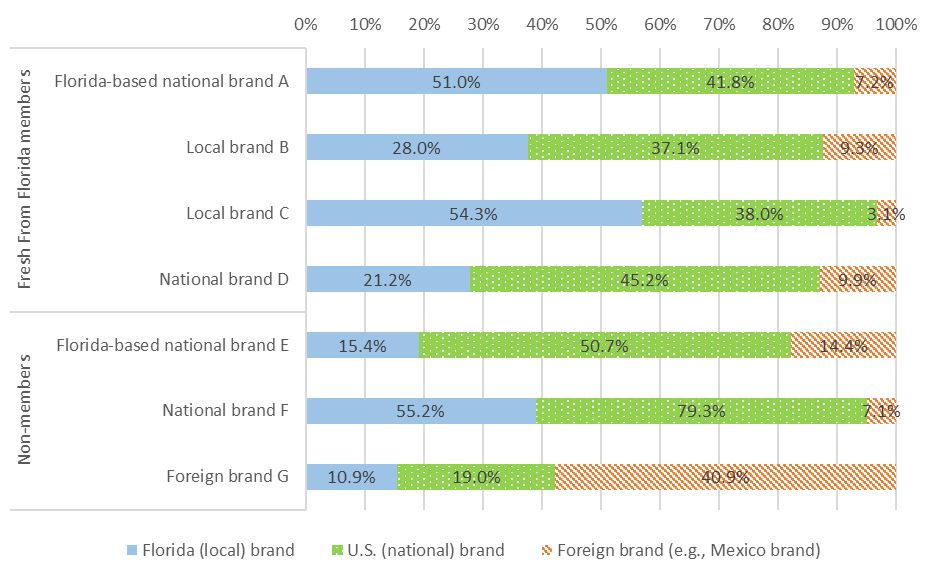

We examined whether consumers can recognize local fresh blueberry brands in the marketplace. We divided the brands into two categories: those that participated and those that did not participate in the Fresh From Florida® program. The main difference between these two categories is that participant brands use the Fresh From Florida® logo on their blueberry packaging. Consumers were asked to identify whether they perceived certain blueberry brands as local, national, foreign, or unfamiliar. In the survey, “local” was defined as referring to brands associated with Florida. We focused on the perceived origin of brands rather than their actual production sites or company headquarters.

Among consumers familiar with the brands (i.e., excluding those who answered "I don’t know"), the results show a relatively low recognition of local blueberry brands (Figure 4). Local brand C emerged as the most recognized local brand, followed closely by Florida-based national brand A, a participant in the Fresh From Florida® program. Florida-based national brand A is significantly more recognized as a local brand, compared to Florida-based national brand E, which does not use the Fresh From Florida® logo. National brand D using the Fresh From Florida® logo is less frequently recognized as a local brand than national brand F, which does not use Fresh From Florida® logo.

Interestingly, the result also suggests that national and foreign brands (e.g., National Brand D, National Brand F, and Foreign Brand G) were more consistently categorized, with a higher percentage of respondents accurately identifying their origin, regardless of their affiliation with the Fresh From Florida® program.

Credit: Authors’ survey data

Concluding Remarks

Our consumer survey results suggest a strong consumer preference for locally grown blueberries, as evidenced by the willingness to pay an average premium of $2.16 per pint for the Fresh From Florida® attribute. However, this preference is not fully leveraged due to gaps in consumer awareness of local (Florida) brand attributes and the blueberry harvest season in Florida. Specifically, the relatively low recognition of the local blueberry harvest season and limited experience with the Fresh From Florida® label may hinder consumer engagement and the full realization of their potential willingness to pay for locally grown blueberries. To capitalize on the demonstrated willingness to pay and increase market share for locally grown blueberries, targeted marketing strategies should focus on improving consumer awareness and enhancing the visibility of the Fresh From Florida® logo. Efforts could include campaigns to inform consumers about the local blueberry harvest season and the benefits of supporting local agriculture. Additionally, emphasizing the unique qualities of locally grown blueberries, such as freshness, and increasing the visibility of the Fresh From Florida® branding could strengthen consumer recognition and preference in the marketplace. Last but not least, combining the Fresh From Florida® branding with a broader “grown in the USA” message may further strengthen appeal by connecting with both local and national consumer values. These initiatives can help increase brand recognition, foster consumer loyalty, and secure a competitive edge for Florida-grown blueberries.