Credit: U.S. Coast Guard photo by Petty Officer 2nd Class Patrick Kelley. Image used with permission.

Series Description

This series on military family readiness aims to provide valuable resources, information, and support to family service professionals and Extension agents who support military families navigating the unique challenges and opportunities that come with a military lifestyle. From relocations to retirement, each publication in this series will equip you with the knowledge and resources you need to engage with service members and to promote readiness, resilience, and overall military family well-being.

This publication is the second in the series on military family readiness. For the rest of the publications in the series, visit Ask IFAS.

Intended Audience

This publication is primarily intended for family service providers, Extension agents and specialists, educators, and other professionals in the Military Family Readiness System.

Introduction

The military retirement system provides a sense of financial security and stability for retired service members, ensuring a steady income during their post-military life. Overall, military retirement offers valuable benefits to honor and support those who have dedicated their careers to serving in the United States Armed Forces.

There is a range of benefits to support service members and their families as they transition from a career in the military to civilian life. Retirement benefits for military personnel include a monthly monetary benefit, access to healthcare through TRICARE, transition assistance programs, and commissary and exchange privileges. This publication discusses:

- Different military retirement systems, including the current Blended Retirement System (BRS)

- The military transition and retirement planning process

- Military retirement pay and taxes

- Military retirement pay and divorce

- Military retirement survivor benefits

- Retirement planning resources

Military Retirement

In 2018, the military retirement system underwent changes, including the introduction of the Uniformed Blended Retirement System, similar to a 401(k) in the private sector, which combined a traditional pension, or defined benefit plan, with a defined contribution plan called the Thrift Savings Plan (TSP). For more information about recent changes to the TSP, consult OneOp’s on-demand webinar, Thrift Savings Plan Updates for 2022.

In addition to the Blended Retirement System (BRS), there are three other retirement plan options available for active-duty and reserve service members with a date of entry into military service (DIEMS) before January 1, 2018. In each plan, retirement compensation is calculated based on the length of service and the service member’s pay. Table 1 outlines the four retirement plan options and the criteria a service member must meet to gain access to each plan.

Table 1. Retirement plan options.

Preparing Service Members for Retirement

Typical active-duty service members will become eligible for retirement after they accumulate 20 years of service. However, service members should not wait 20 years to start planning. Retirement planning should begin when service members start their service. By prioritizing retirement planning early on in their careers, service members can plan for a variety of situations, such as paying off debt, adjusting to changes in cost of living, and reviewing investment options.

The Department of Defense’s guide for managing one’s transition suggests specific preparation activities that should take place in the two years prior to retirement, which means that you could be working alongside service members in this preparation and transition stage in the years leading up to their retirement. The Office of Financial Readiness has made a checklist for service members at this stage, including creating or updating an estate plan, creating a transition spending plan, and examining life insurance options for veterans.

Military Retirement Pay and Taxes

Retirement income serves as a foundation for a stable and secure post-military life.

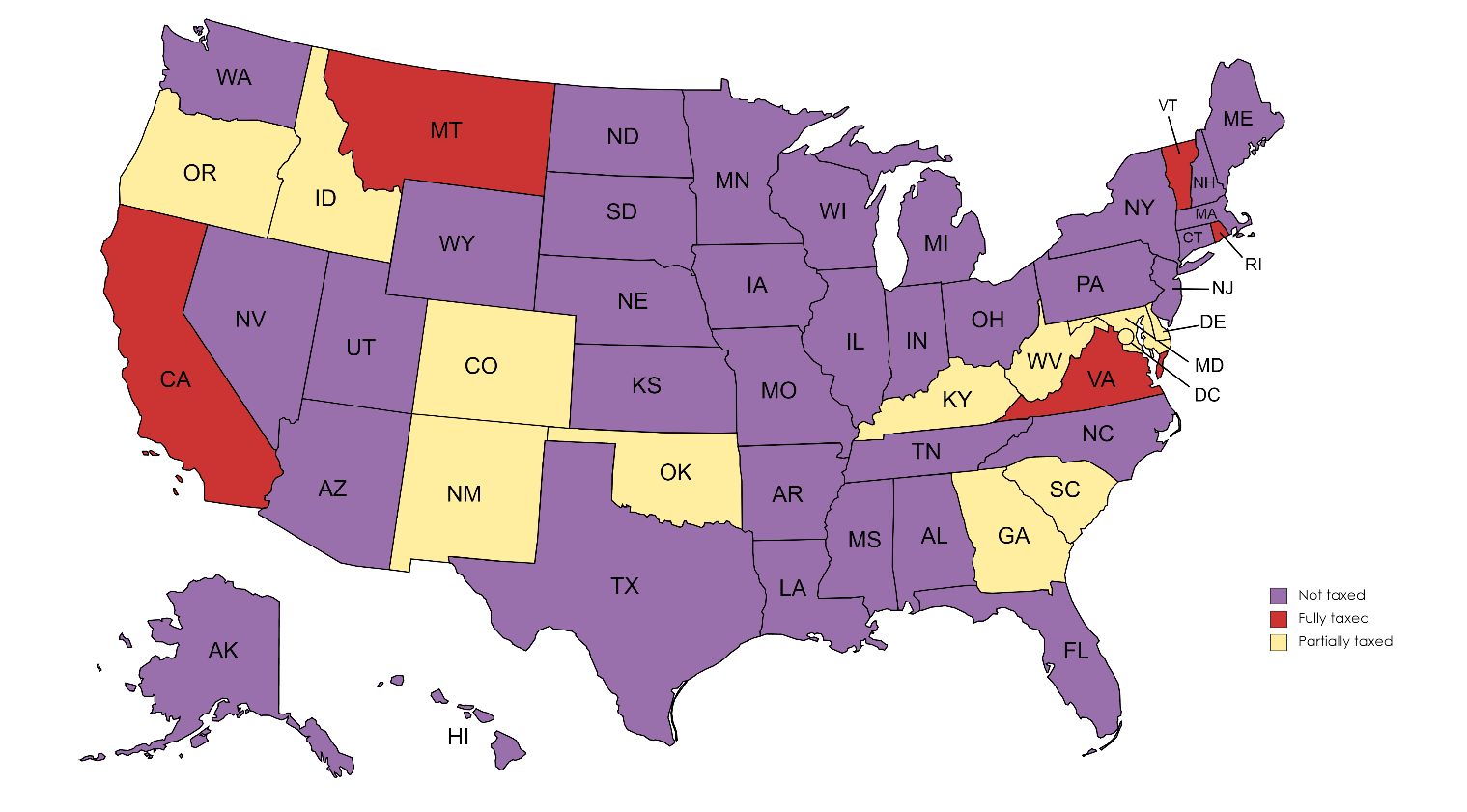

One important consideration for military retirement planning is taxes. Tax implications could impact the military retirees in your service network. Federal income taxes are paid on all retired military compensation in every state. However, state income tax varies by state of residence. For example, Florida does not have a state income tax, including distributions from the Thrift Savings Plan. The lack of state income tax makes Florida an attractive location for active-duty service members, reserve service members, and military retirees. In addition to not taxing military pensions, Florida has other benefits for military retirees, including property tax exemptions. Several other states have no state income taxes, or no state income tax on retirement pay. If you are located outside of Florida, check the map below to identify tax obligations for your state.

Credit: Kristen Jowers, UF/IFAS

According to the Internal Revenue Service (2020), some income is not subject to taxation. Examples are veterans’ benefits and disability pay for military service-connected incidents. Some retirees confuse military retirement pay, which is taxable, with Veterans Affairs (VA) Disability Compensation, which is nontaxable. A military retiree whose spouse also works or a military retiree who earns income from both military retirement and civilian employment should consider planning for a change in their tax bracket and adjust withholdings accordingly so they can avoid a surprising tax bill.

Military Retirement Pay and Divorce

As a service provider, it is important for you to understand the impact of a service member’s divorce on retired pay, because you may need to provide support to the service member, their former spouse, or both. According to the Defense Finance and Accounting Service (2019) and the Uniformed Services Former Spouses’ Protection Act (USFSPA), a court order is needed for a former spouse to receive a portion of the retiree’s pay. Additionally, the marriage must last a minimum of 10 years. At least 10 years of marriage must overlap 10 years of service, also known as the 10/10 Rule. Additionally, the National Defense Authorization Act of 2017 ratified the way that the USFSPA interprets disposable income. The law applies to divorces granted after December 23, 2016, and it uses the date of divorce to calculate a share of retired pay in a calculation of the service member’s pay grade and years of service at the time of the court order.

For more detailed information on retirement pay calculation, medical/disability retirement, and divorce implications for military retirees, view OneOp’s on-demand webinar, Retirement Benefit Basics for Active Duty, Guard, and Reserve Components.

Military Retirement Survivor Benefits: SBP and RCSBP

An important and time-sensitive aspect of retirement planning unique to the military community is the Department of Defense Survivor Benefit Plan (SBP) and the Reserve Component Survivor Benefit Plan (RCSBP). Military retirement pay stops with the death of a retiree. Therefore, it is important for service members to understand the actions they can take to continue providing support even after their deaths. The SBP and RCSBP allow retirees to provide a portion of their retired pay to eligible survivors, including spouses, former spouses, and children. Both the SBP and RCSBP are paid as a monthly annuity to eligible survivors. The designation must be made prior to retirement or within 90 days of receipt of Notification of Eligibility (NOE) for Retired Pay (20 Year Letter). Service members must elect an eligible survivor at retirement or risk forfeiting the opportunity.

For more information about the SBP and the RCSBP, read the OneOp blog, 9 Things You Should Know About the DoD Survivor Benefit Plan, and watch the on-demand webinar, Retirement Benefit Basics: The DoD Survivor Benefit Plan.

Post-Military Life

Service providers may help service members to successfully navigate the transition from uniformed services to civilian life. Retirement from the military opens opportunities for second careers, entrepreneurship, or further education. Plan to connect the military retiree clients in your service network with employment and education resources from branch-specific transition assistance programs.

Since 2018, retired service members can still utilize Military OneSource for 365 days after their date of separation. Military OneSource offers services such as, “help with relocation, tax support, financial planning, health and wellness coaching, as well as confidential non-medical counseling and specialty consultations for spouse employment, education, adoption, elder care, special needs and much more” (United States Department of Defense, 2018). This is a resource that your clients can use throughout their service that can provide a continuity of care through the first year of their transition to post-military, civilian life.

Veteran Resources

According to the Department of Veteran Affairs’ veteran population by state map, these eight states have the largest veteran populations in the United States: Florida, North Carolina, Virginia, Pennsylvania, Ohio, New York, California, and Texas. Given the vast retired-military population in Florida and beyond, having knowledge of the resources available to veterans is useful for Extension agents and specialists, educators, and family service providers.

As the service members you work with transition into retirement, connect them to resources curated for veterans. Veterans have access to VA benefits such as:

References

Defense Finance and Accounting Service. (2019). Uniformed Services Former Spouses' Protection Act Legal Overview. https://www.dfas.mil/garnishment/usfspa/legal/

Internal Revenue Service. (2020). Federal Income Tax Withholding after Leaving the Military. Lifecycle Series. Publication 4782, Catalog Number 53298M. https://www.irs.gov/pub/irs-pdf/p4782.pdf

United States Department of Defense. (n.d.). Military Compensation. https://militarypay.defense.gov/Pay/Retirement/

United States Department of Defense. (2018). Military OneSource is now available to veterans and their families for a full year after separating from the military. https://www.defense.gov/News/Releases/Release/Article/1600957/military-onesource-is-now-available-to-veterans-and-their-families-for-a-full-y/