Credit: U.S. Army photo by Kristen Wong. Image used with permission.

Series Description

This series on military family readiness aims to provide valuable resources, information, and support to family service professionals and Extension agents who support military families navigating the unique challenges and opportunities that come with a military lifestyle. From relocations to retirement, each publication in this series will equip you with the knowledge and resources you need to engage with service members and to promote readiness, resilience, and overall military family well-being.

Intended Audience

This publication is intended for family service providers, Extension agents and specialists, educators, and other professionals in the Military Family Readiness System.

Introduction

While the words “saving” and “investing” are often used interchangeably (e.g., saying “I’m saving for retirement” when you are really investing for a long-term goal), they are very different. Investors cannot expect to have characteristics of savings (e.g., low risk) in investment products, such as stock or growth mutual funds. Conversely, savers cannot expect the potential reward of long-term growth from a bank account.

People need to be both savers and investors. In fact, savings often provides an initial pool of money with which to start investing. For example, a mutual fund may require $1,000, $2,500, or $3,000 to open an investment account. This publication discusses:

- General information about saving money

- General information about investing

- Military-specific saving incentives

- Military-specific investments

- Military-specific investment fraud

- Five saving and investing tips for military families

- Saving and investing resources

General Information about Saving Money

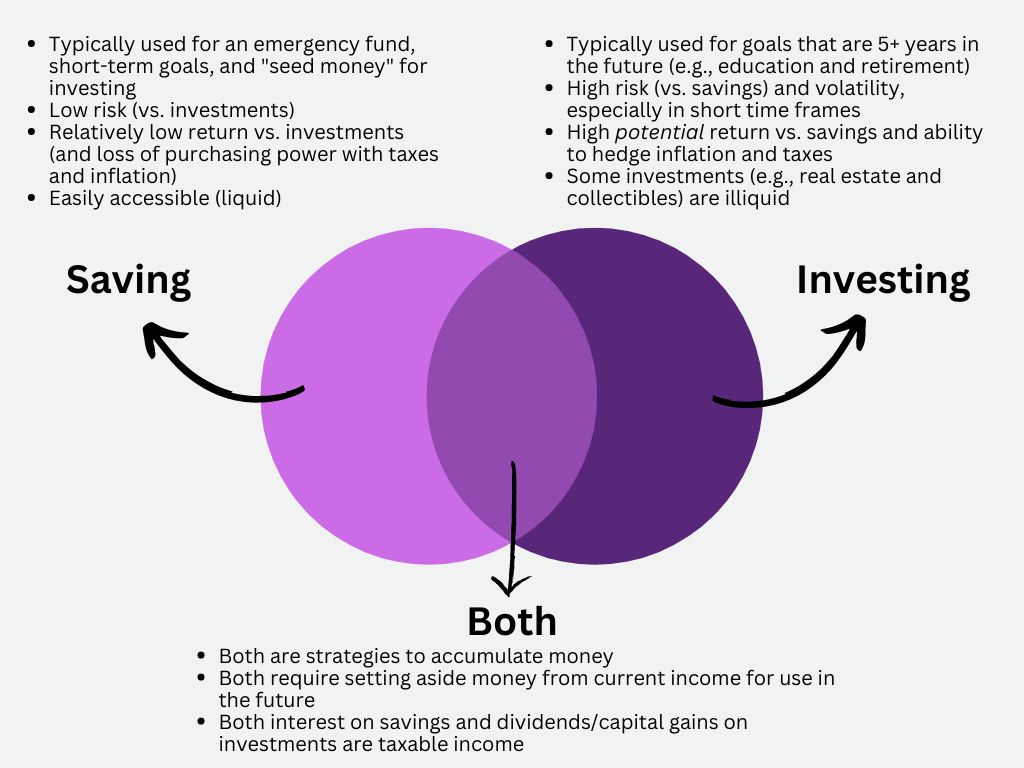

It generally takes more time to reach a financial goal with savings than with investments. The Venn Diagram below illustrates characteristics of saving versus investing and things that they have in common.

Credit: Kristen Jowers, UF/IFAS

While savings products generally underperform investments, savers should still try to earn the highest return possible. This generally involves online bank accounts where market competition often results in higher interest rates paid to savers (vs. “brick and mortar” banks/credit unions). A key metric in comparison shopping is annual percentage yield (APY), which is required to be disclosed in bank advertising. An account’s APY reflects its base interest rate and the frequency of compounding.

Five time-tested strategies can help increase savings:

- Save loose change: Put spare change in a jar and “cash out” when the jar is full.

- Level up: Move more money from checking to savings if you already do this.

- Finish a savings challenge: Follow savings challenge guidelines to reach a goal.

- Accelerate debt repayment: Reposition money to savings once debt is repaid.

- Live below your means: Track and then pare expenses to “find” money to save.

General Information about Investing

Investing comes with uncertainty about how much money investors will eventually make and volatility (i.e., fluctuation in the value of investments). It is typically done to fund long-term financial goals or provide a current income stream (e.g., bonds in retirement). A typical economic cycle lasts 4–5 years. The economy expands, reaches a peak, contracts, reaches a trough, and expands again. For this reason, it is generally not wise to invest in stocks or stock funds unless financial goals are 5+ years in the future.

Investors can be owners or loaners. With ownership investments (e.g., stock, stock funds, real estate, collectibles), investors own something. They have an ownership interest in a company (as a shareholder), a piece of property, or a valuable antique. With loanership investments, they lend money to a government entity (e.g., Treasury bonds), company (e.g., corporate bonds), or financial institution (e.g., certificates of deposit or CDs).

There are five important prerequisites for investing:

- An adequate emergency fund (at least three months’ expenses) so investments do not need to be sold at a loss to pay for car repairs or other unforeseen expenses.

- Adequate insurance to cover large financial risks including liability, disability, the destruction of a home, and the loss of a breadwinner’s income due to death.

- No or low consumer debt because the “return” on repaid debt (e.g., paying off an 18% APR credit card balance) is guaranteed and will probably exceed investment earnings.

- Clear and specific financial goals with a deadline date and an estimated cost. Financial goals determine the time frame for investing, which affects the choice of investments.

- An “investor’s mindset.” This means a willingness to accept the uncertainty that accompanies investing and not expecting a guaranteed, fixed return (like a bank CD).

Dollar-cost averaging is the practice of investing equal amounts of money (e.g., $50) at regular time intervals (e.g., monthly), regardless of market conditions. An example is the amount that service members contribute to their tax-deferred TSP plan each pay period. Dollar-cost averaging reduces average share costs over time as shown in Table 1.

Table 1. Dollar-cost averaging for eight months demonstrates the average cost per share when the total investment is divided by the shares purchased.

Military-Specific Saving Incentives

In this section, “saving” is defined in general terms as the act of setting aside current income for future use, regardless of where the money is placed. It describes several incentives to encourage service members to save money.

- Extra income: While military deployments are dangerous and stressful, they often result in extra income (pays and allowances) for service members, depending on the deployment location, length of deployment, and whether or not they have a family. Examples include hazardous duty pay, imminent danger pay, and family separation pay. Extra income provides an opportunity for increased savings.

- Savings Deposit Program (SDP): The SDP provides an opportunity for eligible service members deployed to designated combat zones to super-charge their savings. Service members can save up to $10,000 and earn a guaranteed 10% return for up to 90 days after they return from a combat zone. There is virtually no other investment that locks in a 10% return. Interest earned on SDP deposits is taxed in the year earned and reported on a 1099-INT form.

- Tax-free income: Eligible service members who serve in a combat zone can receive tax-free pay. “Entitlement to the compensation must have fully accrued in a month during which the member served in a designated combat zone or was hospitalized as a result of wounds, disease, or injury incurred while serving in a designated combat zone” (IRS, 2022). There is no required action for service members to receive tax-free pay. Each military branch will automatically certify their entitlement by excluding reportable income on their W-2 form for income taxes. Military pay earned while serving in a combat zone is, however, subject to Social Security and Medicare (FICA) taxes.

- Tax-free retirement income: Many military financial advisors recommend placing tax-free combat pay in a tax-free Roth individual retirement account (IRA). Doing so allows service members to deposit tax-free income while earning combat pay (vs. after-tax dollar deposits by civilians) and take tax-free qualified withdrawals in retirement. This is, essentially, a “double play.” This strategy was made possible by the 2006 HERO Act that allows service members with combat pay to use that income for deposits in IRAs.

- Thrift Savings Plan (TSP) match: Service members in the Blended Retirement System (BRS) are eligible for automatic and matching TSP contributions. These contributions are calculated as a percentage of base pay and do not include allowances (e.g., BAH or BAS). There are two types of TSP matching: an automatic contribution of 1% of base pay and matching government contributions, based on the amount that service members themselves contribute to their TSP account: a 100% match for the first 3% of pay and a 50% match for the next 2% of pay, as shown in Table 2.

Table 2. TSP contribution and government matching (as a percentage of base pay).

Between matching and automatic contributions, the maximum government match is 5% of base pay if service members themselves contribute at least 5% of base pay.

Military-Specific Investments

Like 401(k) plans in the private sector, the Thrift Savings Plan (TSP) is a defined contribution plan that allows service members (and federal government workers) to voluntarily set aside a percentage of their pay for financial security in later life.

The amount that accumulates depends on how much money is saved, how long the money has so it can grow, and the performance of selected TSP investments. There are two savings methods: traditional TSP (contributions of pre-tax dollars not yet taxed) and Roth TSP (contributions made with after-tax dollars). With the traditional TSP, taxes are owed when funds are withdrawn, while qualified Roth TSP withdrawals are tax-free.

Service members can contribute to one or both types of TSP plans up to the maximum annual limit, which is adjusted annually for inflation. A benefit of TSP investing is low administrative expenses vs. other types of tax-deferred (or taxable) accounts.

There are 15 investment funds to choose from in the TSP: ten lifecycle (L) funds and five individual TSP Investment funds. A key factor in service members’ fund selection is their investment risk tolerance. The University of Missouri has an empirically tested Investment Risk Tolerance Assessment tool that can be used to determine service members’ comfort level with different plan options.

Below are brief descriptions of each TSP investment fund.

- G Fund (Government Securities): The most conservative fund, G Fund, invests in nonmarketable U.S. Treasury securities only issued for the TSP. Its major risk is inflation (purchasing power) risk when investment returns are less than the inflation rate.

- F Fund (Fixed Income Index): The F Fund is an index fund that aims to match the return of the Bloomberg U.S. Aggregate Bond Index. It includes primarily U.S. government, mortgage-backed, and corporate bonds and is subject to credit, call, and inflation risk.

- C Fund (Large Company Stock Index): The C Fund is an index fund that aims to match the performance of the Standard and Poor’s (S&P) 500 index that tracks the 500 largest publicly traded U.S. companies. It is subject to market and inflation risk.

- S Fund (Small Company Stock Index): The S Fund is an index fund that aims to match the performance of the Dow Jones U.S. Completion TSM index that tracks companies not included in the C Fund. It, too, is subject to market and inflation risk.

- I Fund (International Stock Index): The I Fund invests in international stocks of more than 20 countries and aims to match the performance of the MSCI EAFE index. It has three primary sources of risk: market, inflation, and currency risk.

- L Fund (Lifecycle Funds): There are ten TSP L Funds that invest in the G, F, C, S, and I Funds in varying proportions. The target dates for these funds, which are designed to match workers’ planned retirement date, are 2065, 2060, 2055, 2050, 2045, 2040, 2035, 2030, 2025, and L Income. The funds automatically become more conservative over time.

Another option for TSP participants is the mutual fund window (MFW) that allows them to buy, sell, and exchange among thousands of mutual funds available. Participants’ initial transfer to the MFW must be $10,000 or more but may not be more than 25% of total TSP savings. Thus, participants must have at least $40,000 in their TSP account to ensure that the initial transfer is not more than 25% of TSP savings. Annual maintenance and administrative fees are charged for the MFW as well as fees for buy/sell trades.

Military-Specific Investment Fraud

Service members are frequent targets of investment fraud because many are young and financially inexperienced with a steady source of income that can be stolen. They may also fall prey to affinity fraud, where fraudsters exploit the sense of trust and friendship in groups of people with something in common and enlist respected leaders within a military community to unknowingly spread the word about fraudulent investments.

Fraudsters sometimes steal victims’ money by peddling worthless/nonexistent securities.

Below are five “red flags” of investment fraud.

- Future predictions: With the exception of bonds, investment returns are generally unpredictable, and the value of securities rises and falls with market trends. Beware of marketers who promise an investment’s future return.

- Quick cash: Scam artists often promise fast, low-risk payoffs and compare their returns to low rates available elsewhere. They imply that victims are “suckers” for earning low returns when they have a sure path to wealth in a short period of time.

- Obscure origins: Background information about the origin and performance of fraudulent investments is misleading or not provided because marketers do not want consumers to be able to assess their claims or search online for information.

- Immediate response: Requiring an immediate response and deposit of funds is another hallmark of investment fraud. Urgency is important to swindlers so they get victims’ money quickly before victims have time to become suspicious or contact others.

- Recovery attempts: When victims fall prey to a previous scam, they may get a call promising to recover the money they already lost. Of course, this “service” comes at a price. Be suspicious if people call and already know where you have invested before.

Five Saving and Investment Tips for Military Families

- Start small. Once a saving/investment account is open, small regular deposits will grow substantially over time. You can verify this with the DoD Compound Interest Calculator.

- Identify “nibblers.” “Nibblers” are relatively small budget expenses that add up over time. Think vending machine food, beverages, gambling, and more. To “find” money to save or invest, identify things you can live without and change spending habits.

- Set goals. Setting financial goals can provide motivation to reduce spending today so you can save or invest for a secure future tomorrow. Be specific with a date and dollar cost. An example of a fully fleshed out goal is, “Save $10,000 for a used car in four years.”

- Take “free money” from reliable sources. Employer retirement savings matching, such as the government match for the TSP, is “free money” that should not be missed. Take maximum advantage of investment opportunities (e.g., retirement savings plans) that your employer offers.

- Be skeptical. It is easy for fraudsters to make messages look credible. Think twice before investing money in anything you learn about on the Internet. Request more information and always exercise caution if something sounds too good to be true.

Saving and Investing Resources and References

Extension Foundation. (2023). Investing for Your Future. https://personal-finance.extension.org/investing-for-your-future/

GovInfo. (n.d.). Heroes Earned Retirement Opportunities Act. https://www.govinfo.gov/app/details/PLAW-109publ227

IRS. (2023). Armed Forces’ Tax Guide. https://www.irs.gov/forms-pubs/about-publication-3

IRS. (2022). Tax Exclusion for Combat Service. https://www.irs.gov/individuals/military/tax-exclusion-for-combat-service

OneOp. (2022). Thrift Savings Plan Updates for 2022. https://oneop.org/wp-content/uploads/2022/06/PF_TSP_081622F.pdf

Thrift Savings Plan. (n.d.-a). Expenses and Fees. https://www.tsp.gov/tsp-basics/expenses-and-fees/

Thrift Savings Plan. (n.d.-b). Lifecycle Funds. https://www.tsp.gov/funds-lifecycle/

Thrift Savings Plan. (n.d.-c). Mutual Fund Window. https://www.tsp.gov/mutual-fund-window/

Thrift Savings Plan. (n.d.-d). TSP Investment Options. https://www.tsp.gov/investment-options/

U.S. Army. (2023). Special Pay. https://myarmybenefits.us.army.mil/Benefit-Library/Federal-Benefits/Special-Pay

U.S. Securities and Exchange Commission. (2023). Saving and Investing for Military Personnel. https://www.sec.gov/securities-topics/military-investment-options