Credit: G. Anthonie Riis

Series Description

This series on military family readiness aims to provide valuable resources, information, and support to family service professionals and Extension agents who support military families navigating the unique challenges and opportunities that come with a military lifestyle. From relocations to retirement, each publication in this series will equip you with the knowledge and resources you need to engage with service members and to promote readiness, resilience, and overall military family well-being.

This publication is the third in the series on military family readiness.

Intended Audience

This publication is intended for family service providers, Extension agents and specialists, educators, and other professionals in the Military Family Readiness System.

Introduction

Debt repayment is a major expense for many U.S. families. Interest is the cost of borrowed money and it is expensive, especially over time. Examples include a credit card balance that revolves monthly for years or a seven- (or eight-) year car loan.

Some people spend a day’s take-home pay (or more) each week repaying car loans, credit card bills, and other debt. Not only is this expensive, but payments are unavailable for other expenses, including savings. This publication discusses:

- General information about credit and debt repayment

- General information about credit reports and scores

- Military-specific credit-related challenges

- Military-specific credit-related laws and support services

- Five credit management tips for military families

- Credit education resources

General Information about Credit and Debt Repayment

Credit is the present use of future income. In return, interest is assessed, which means people pay back more than the original cost of whatever they borrowed money for. Advantages of credit include the immediate ability to buy things (e.g., sale items) and make reservations (e.g., hotels). Borrowing money and making timely payments also help to establish a positive credit history.

A major disadvantage of credit, in addition to interest, is ease of overspending. This can lead to serious problems, such as “perma-debt” (a permanent credit card balance), collections, wage garnishment, and bankruptcy. Studies show people spend more with credit than with cash. Debt is an outstanding balance owed. It ties up future income with payments often lasting longer than the items the borrowed money purchased.

There are two types of credit: open-end (a.k.a., revolving) and closed-end. With open-end credit, money can be borrowed on a continuous basis up to a specified amount. Examples are credit cards and home equity lines of credit. Closed-end credit is used for one-time purchases and has a fixed number of regular payments. Examples include car loans and mortgages. Borrowers must typically secure the loan by pledging the asset for which money was borrowed (e.g., car) as collateral.

Regardless of credit type, there is one key concept. The longer money is borrowed (e.g., seven vs. four years) and the higher the interest rate charged (e.g., 18% vs. 14%), the more costly the borrowed money will be. A key factor to consider when shopping for credit is the annual percentage rate (APR), which is the total cost of credit expressed on an annual basis. APRs must be disclosed on all credit card and loan applications.

Table 1 illustrates the cost of repaying a $15,000 car loan with different assumptions for loan terms and APRs.

Table 1. Cost of repaying a $15,000 car loan with different assumptions for loan terms and APRs. Credit: Derived from the amortizing loan calculator from the Office of Financial Readiness.

General Information about Credit Reports and Scores

A credit report is a summary of someone’s bill-paying history. It is prepared by credit reporting agencies (credit bureaus) and used for business decisions by entities such as creditors and insurance companies. The three major credit bureaus are Equifax, Experian, and TransUnion. Credit experts recommend checking credit reports annually to identify inaccurate information and evidence of identity theft.

There are four main parts to a credit report: identifying personal information (e.g., address and Social Security number); public record information (e.g., foreclosures and bankruptcy); credit history information (list of creditors and timeliness of payments); and credit inquiries. The latter includes inquiries made as a result of credit applications and for promotional marketing purposes by creditors. The Consumer Financial Protection Bureau credit report review checklist can be used to review credit reports.

Credit scores are derived from data contained within credit reports. Fair Isaac Corporation scores (FICO scores), the most common, are a three-digit number ranging from 300 to 850. Calculated by statistical analysis, they measure the risk that borrowers will become delinquent or default. The higher the credit score number (e.g., 780 vs. 620), the better.

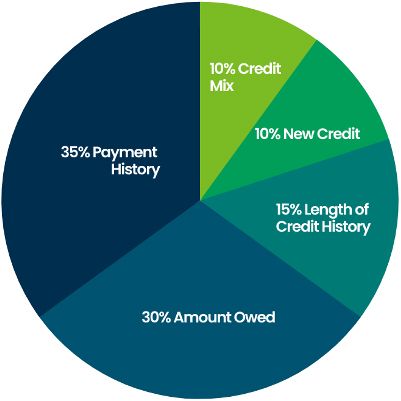

Figure 2 illustrates how a FICO credit score is determined. The most important factor is bill payment history, which is weighted at 35%. Other key factors are amounts owed, i.e., the proportion of outstanding debt to available credit limits (30%); the length of a person’s credit history (15%); the number of recent new credit inquiries (10%); and the mix of types of credit used (e.g., credit cards, auto loan, mortgage, etc.) (10%).

Credit: Kristen Jowers

Credit reports are like report cards in schools and credit scores are like numerical GPAs. Both provide “snapshots” of credit history at a point in time. Borrowers are constantly being “graded.” Paying bills on time and not becoming overextended are the two best ways to improve a credit report and raise a credit score.

Some consumers may receive their credit score from a creditor when an application for credit is denied, or when going through the mortgage approval process. Some banks and creditors may voluntarily provide credit scores free of charge to attract and retain customers. Under the Fair and Accurate Credit Transactions Act (FACTA), Americans can request one free credit report every 12 months from each “big three” credit bureau.

Military-Specific Credit-Related Challenges

Service members are prime marketing targets for credit offers ranging from mainstream credit card applications to predatory payday and car title loans. One reason is that many service members are young (sometimes still in their teens) and financially illiterate and/or inexperienced. Another reason is they have steady paychecks. Creditors know they can seek enforced allotments from service members’ pay if debt payments are not made.

Service members are also an easy group to target, with predatory lenders and other vendors (e.g., pawn shops, casinos, used car dealers, etc.) setting up shop near the gates of military installations. Double-digit interest rates for car loans are not uncommon. Overextended credit and unpaid debt can also jeopardize the security clearances that are necessary for service members to do their jobs.

In addition, credit is an important cash management tool during permanent change of station (PCS) moves and other necessary travel when upfront payments are needed, expenses are not covered by government allowances, or reimbursement is delayed. There is also the challenge of managing money when service members are always on the move. Creditors need to be promptly notified of address changes.

Service members may experience difficulty finding employment for their spouse, a loss of social support services (e. g., child care), and/or an increase in local living costs (e.g., rent and auto insurance) after PCS moves. Changes like these put pressure on family budgets, resulting in credit being used to pay for essential living expenses. One survey found that 27% of service members had more than $10,000 in credit card debt and more than one-third struggled to pay monthly bills.

A sobering report from the Consumer Financial Protection Bureau found that service members’ credit challenges get worse upon separation from active duty. A sizable fraction of these service members went delinquent on debt or had severe derogatory marks appear in their credit history in the six months following separation. Service members were most likely to default on installment loans if they had one at the time of separation. Post-military income, disability, and employment were likely contributing factors.

Military-Specific Credit-Related Laws

Two federal laws that directly affect credit purchases made by service members are the Servicemembers Civil Relief Act (SCRA) and the Military Lending Act (MLA).

SCRA

Originally passed in 2003 and amended in 2023, the SCRA is a federal law that provides protections for service members as they enter active duty military service. Its purpose is to ease legal and financial burdens caused by active duty service and it covers all military service branches (Air Force, Army, Coast Guard, Marines, and Navy), Reserve members, and activated National Guard/Air National Guard members.

The SCRA covers issues such as rental agreements, installment contracts, and credit card and loan interest rates. The SCRA also reduces interest rates on pre-service loans (i.e., debt incurred prior to a person’s entry into active duty military service) to a maximum of 6%. This interest rate reduction can be requested any time while serving on active duty and last for up to 180 days after release from active duty.

Specific provisions of the SCRA include the following.

- Pre-service loans: To invoke the SCRA, service members with pre-service debt (e.g., car loan, student loan, credit card) must notify their lender(s) in writing and include a copy of their military orders to active duty service or a letter from their commanding officer (CO) that describes the date that active duty service began.

- Default judgments: There are legal protections for service members who are sued while on active duty, including protection from a default judgment in a civil action when they are unable to appear and defend themselves.

- Repossession: Creditors are prohibited from repossessing personal property, including a car, without a court order if the property was purchased or leased (or a deposit or payment was made) before active duty service.

- Leases: Service members have the right to terminate residential leases signed prior to active duty service or if they receive PCS or deployment orders. Written notice of termination and a copy of orders or a CO letter must be provided. A similar process may be used for auto leases, depending on lease contract terms.

MLA

The 2006 Military Lending Act (MLA) is different from the SCRA in that it applies to certain loans made after a service member is on active duty rather than to pre-service loans. The MLA caps the interest rate and fees creditors can charge covered borrowers to 36%, which is called the military annual percentage rate (MAPR).

Like the SCRA, the MLA is a federal law that covers active duty members of the U.S. Armed Forces and those on active Guard or Reserve duty. Its purpose is to cap interest rates on many loans and to prohibit creditors from forcing service members, as well as spouses and certain dependents, to waive certain consumer rights.

The MLA covers consumer credit products offered to active duty service members and covered dependents including payday loans, deposit advance products, tax refund anticipation loans, and vehicle title loans. It also covers some overdraft lines of credit and installment loans, certain student loans, and credit cards. The MLA does not cover residential mortgages, loans used to buy a motor vehicle when the loan is secured by the vehicle being purchased, or personal property when the loan is secured by the personal property being purchased (i.e., appliances or jewelry).

Specific provisions of the MLA include the following.

- MAPR calculation: When calculating loan charges to make sure they do not exceed the MAPR, the following costs are included: finance charges, credit insurance premiums, and add-on credit-related products and fees.

- No mandatory allotments: Creditors cannot require service members to create a military allotment (i.e., an automatic amount of money taken from service members’ paychecks) to pay back a loan.

- No mandatory waivers: Creditors cannot require service members to submit to mandatory arbitration or give up certain rights they have under federal or state laws (e.g., the SCRA).

- No prepayment penalty: Creditors cannot charge a penalty fee (e.g., a percentage of the remaining loan balance) if service members pay back part or all of a loan early.

Active Duty Alerts

Due to their mobility, youth, and/or financial management inexperience, service members are targets for identity theft and other fraud. Amendments to the Fair Credit Reporting Act provide an opportunity for service members to reduce their risk of becoming a fraud victim while deployed.

An active duty alert, like a general fraud alert, is designed to make it harder for fraudsters to open unauthorized credit accounts in a victim’s name. It is free, lasts for one year, and can be renewed for the length of a service member’s deployment.

An active duty alert can be placed with any of the “big three” credit bureaus (i.e., Equifax, Experian, and TransUnion). Once it is established, the credit bureau with which it is housed must notify the remaining two credit bureaus to also place an alert, thereby avoiding the hassle of having to contact all three.

Military-Specific Credit-Related Support Services

Military families can turn to several support services for assistance with credit- and debt-related questions and issues.

- Free FICO scores: Access to free credit scores is available for active duty service members through installation military financial educators and counselors called PFMs (see below). This service is provided with support by SaveandInvest.org.

- Military legal assistance: Legal assistance staff are available at military installations, including military lawyers who are part of the Judge Advocate General Corps (a.k.a., JAG). They often assist with cases involving the Servicemembers Civil Relief Act (SCRA).

- Military OneSource: Military OneSource has many personal finance resources for service members including a credit card payoff calculator and a debt elimination calculator. It also provides free financial counseling services in person and via telephone or video conferencing.

- Personal financial managers (PFMs): PFMs are professionals located at military installations who provide financial counseling and financial education services to service members and their families.

Five Credit Management Tips for Military Families

- Know the limit. Borrowers should commit no more than 10% to 15% of monthly take-home (net) pay to total monthly debt repayments for consumer debt including student loans, credit card debt, payday loans, and auto loans (e.g., $250 to $375 with $2,500 of net pay). Consumer debt including mortgage debt should be less than 36% of monthly income.

- Avoid negative equity. Two key steps are borrowing as little as possible by making the largest possible down payment (e.g., as you might for a car) and shortening the loan term. These steps can help you to avoid owing more than the car is worth.

- Shop around. Comparison shopping for credit can uncover differences in costs and product features. This includes following the “Rule of Three” (comparing at least three vendors for APR, fees, etc.) and negotiating terms with existing creditors.

- Accelerate debt repayment. There are two ways to add more money to existing monthly debt payments: avalanche (focus on repaying debt with highest interest rate first) and snowball (focus on repaying debt with smallest balance first).

- Monitor credit history. Free credit reports and scores are available to service members for regular review. Paying credit card bills promptly establishes a positive credit history and reduces the average daily balance on which interest is charged.

Credit Education Resources and References

Consumer Financial Protection Bureau. (2020). Debt and Delinquency after Military Service. https://files.consumerfinance.gov/f/documents/cfpb_debt-and-delinquency-after-military-service_report_2020-11.pdf

Consumer Financial Protection Bureau. (n.d.). Servicemembers Civil Relief Act and Military Lending Act Provisions. https://files.consumerfinance.gov/f/documents/cfpb_ymyg-servicemembers-handout_scra-and-mla-protections.pdf

DoD Office of Financial Readiness. (n.d.). Amortizing Loan Calculator. https://finred.usalearning.gov/ToolsAndAddRes/Calculators/Loan/calculator/Amortizing-Loan

Military.com. (2012). More military families struggle with debt. https://www.military.com/money/personal-finance/more-military-families-struggle-with-debt.html

Military OneSource. (n.d.). Active-Duty Alert. https://www.militaryonesource.mil/resources/gov/active-duty-alert/

Utah State University. (n.d.). PowerPay. https://extension.usu.edu/powerpay/