Credit: Lara Poirrier

Series Description

This series on military family readiness aims to provide valuable resources, information, and support to family service professionals and Extension agents who support military families navigating the unique challenges and opportunities that come with a military lifestyle. From relocations to retirement, each publication in this series will equip you with the knowledge and resources you need to engage with service members and to promote readiness, resilience, and overall military family well-being.

This publication is the fourth in the series on military family readiness.

Intended Audience

This publication is intended for family service providers, Extension agents and specialists, educators, and other professionals in the Military Family Readiness System.

Introduction

Higher education degrees, professional certifications, or other job credentials are an important financial goal for many Americans, including service members and their dependents. An investment of time and money in post-secondary education to improve human capital is a key determinant of future earning ability and lifestyle.

While educational costs have skyrocketed in recent years, there are various ways to save and borrow money, and educational benefit programs designed for military personnel, veterans, and their family members. This publication discusses:

- General information about education costs, savings plans, and payment methods

- Military-specific educational benefit programs

- Military-specific laws and policies affecting student loan repayment

- Five education planning tips for military families

- Education planning resources

General Information about Education Costs

According to a 2023 Education Data Initiative report, the average cost of college in the U.S. is $36,436 per student per year, including daily living expenses, books, and supplies. Costs vary considerably, however, with four-year schools costing more than two-year schools and private academic institutions costing more than public ones. With student loan interest added in over time, some bachelor’s degrees can cost over $250,000!

Annual costs by college type are shown in the tables below.

Table 1. Annual Cost of College, Public.

Table 2. Annual Cost of College, Private.

Trade schools vary in cost depending on the type of school and training discipline. Some programs charge higher tuition than others to cover the cost of expensive training materials (e.g., airplanes and simulators for aviation maintenance). One average cost estimate for trade school education in the early 2020s was $33,000.

In addition to cost, program completion time is another key factor to consider. Unlike four-year college degree programs, many trade school programs take two years or less to complete. This means less time out of the labor market with additional years of earnings and potential savings opportunities in early adulthood.

General Information about Education Savings Plans

Below are descriptions of four common savings vehicles for post-secondary education expenses.

Section 529 Plans

Named for a section of the IRS tax code, 529 plans are sponsored by state governments with plan features that vary from state to state. Substantial six-figure sums can be contributed. Earnings and withdrawals are tax-free when used for qualified educational expenses (tuition, fees, books, supplies, and room/board).

Coverdell Education Savings Accounts (ESA)

Like 529 plans, Coverdell ESAs provide tax-free investment growth and tax-free withdrawals if the funds are spent on qualified educational expenses. Designed for low-income savers, they have a $2,000 annual contribution limit with income phase-outs for higher earners. Account owners can select their own investments versus being constrained by choices available in state 529 plans.

Uniform Gifts to Minors (a.k.a., Custodial) Accounts

With custodial accounts, parents save money in a child’s name and the child gains control over the money at age 18 or 21 (depending on state law). Money held in custodial accounts can impact financial aid, and the account beneficiary cannot be changed as is the case with 529 plans and Coverdell ESAs.

Ordinary Taxable Accounts

These are savings accounts, typically held by parents, without any of the tax advantages and use restrictions of the accounts listed above. Parents can initially earmark the money for education but later use it for a different purpose.

General Information about Education Payment Methods

There are four ways that students (or their families) typically pay for post-secondary education.

- Out-of-pocket from current earnings and/or passive income

- Student loans (Federal Direct loans or private student loans) that must be repaid

- Scholarships and grants that typically do not have to be repaid

- Withdrawals from college savings accounts

Each payment method may be used alone or in combination with others.

Two categories of student loans are private loans and federal (government) loans. There are substantial differences between them, including interest rates charged, borrowing requirements, and loan repayment terms. As the name implies, private student loans are made by financial institutions or other non-federal government lenders. Specific loan terms vary among lenders.

There are two categories of federal student loans: need-based loans and non-need-based loans. Eligibility for need-based loans is largely determined by information submitted in the Free Application for Federal Student Aid (FAFSA) form. Two types of need-based loans are Federal Perkins Loans and Federal Direct Subsidized Loans. Subsidized loans pay a student’s loan interest while the student is in school and during grace and deferment periods. Annual and total loan limits apply.

Two types of non-need-based loans are Federal Direct Unsubsidized Loans and Federal Direct PLUS loans. With unsubsidized loans, interest accrues from the time that loan monies are disbursed. Thus, by the time a student graduates, or otherwise leaves school, the amount owed has increased. Federal Direct PLUS loans are made to parents of dependent undergraduate students or graduate/professional students.

There are several federal student loan repayment options, such as the standard repayment plan, the graduated repayment plan, the extended repayment plan, and income-driven repayment plans. There is also Public Service Loan Forgiveness (PSLF), which cancels loans after ten years of service for borrowers employed by qualifying government and non-profit organizations. Military service (i.e., months spent on active duty) counts toward PSLF, even during loan deferments.

For more information about the process of completing the Free Application for Federal Student Aid (FAFSA), student loan forbearance, and public service loan forgiveness, visit OneOp’s on-demand webinar on federal student aid.

Military-Specific Educational Benefit Programs

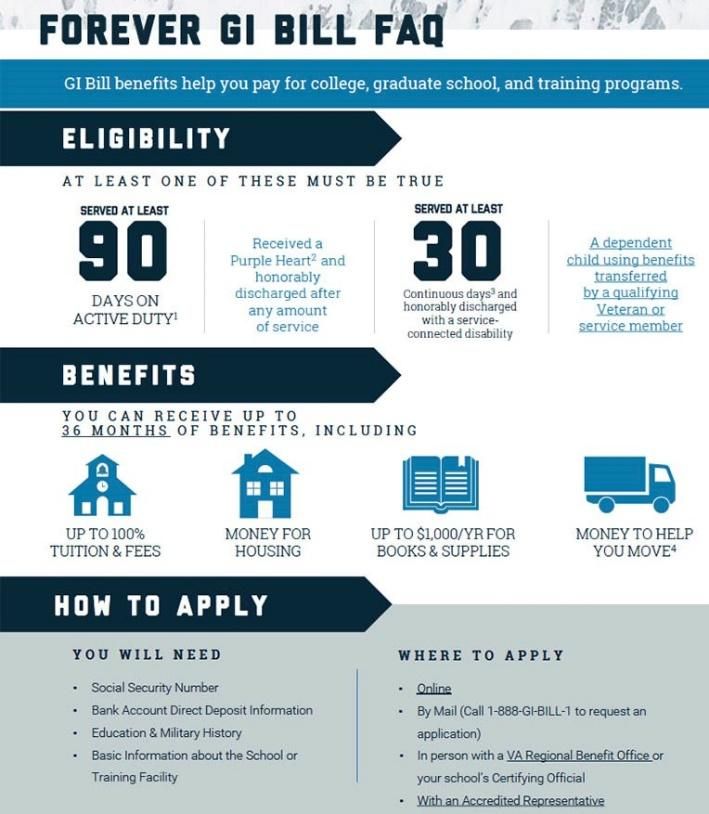

Since 1944, the GI Bill® has represented a strong commitment by the U.S. government to increase the human capital of service members and veterans through educational funding. On August 16, 2017, the Harry W. Colmery Veterans Educational Assistance Act of 2017 (a.k.a., the “Forever GI Bill”) was signed into law. It included the most comprehensive changes to GI Bill benefits since enactment of the Post-9/11 Veterans Educational Assistance Act in 2008 (i.e., the Post-9/11 GI Bill).

Forever GI Bill updates benefited both veterans and their families. There are many facets of this law that deal with deadlines to use benefits, benefit levels, housing allowances, and transfers of benefits to dependents. For example, there is more flexibility in the transfer of GI Bill benefits to dependents than there was previously.

In keeping with its name, the Forever GI Bill also eliminated the 15-year “use it or lose it” time limit that existed under previous Post-9/11 GI Bill rules. Service members who left active duty on or after January 1, 2013, can use their benefits at a time that is right for them or their family. There are also different service requirements for different benefit levels ranging from 50% GI Bill benefit (90 days to 6 months of service) to 100% GI Bill benefit (more than 36 months of service).

Forever GI Bill benefits also include a Monthly Housing Allowance (MHA) for students that is generally the same as the Basic Allowance for Housing (BAH) for a service member with dependents at E-5 rank. Like BAH, MHA is based on geographic location (according to the ZIP code of the school) and is adjusted annually.

Key features of the Forever GI Bill are shown in the U.S. Navy infographic below.

Credit: https://etoolbox.cnrc.navy.mil/infographics.html

Post-secondary education funding is a primary reason why many people become service members. In addition to post-military service Forever GI Bill benefits, the U.S. military offers branch-specific educational programs and allowances for service members to earn certifications and college credits or degrees while they are on active duty. Programs and covered benefits (e.g., tuition, books, study materials) vary by service branch and program. Limited funds are often first-come, first-served.

Military-Specific Laws and Policies Affecting Student Loan Repayment

While Forever GI benefits can cover many educational expenses, some service members and veterans must take out student loans, or they incurred student loan debt prior to entering military service. Below is a list of student loan benefits for members of the Armed Forces.

- Military service deferment: Service members can postpone loan repayment during certain periods of active duty (e.g., a war, military operation, or national emergency) and immediately following active duty service. Deferment request paperwork must be completed, along with a copy of military orders or a letter from the service member’s commanding officer (CO) describing the military assignment.

- Servicemembers Civil Relief Act (SCRA): The SCRA caps the interest rate on student loans received by service members prior to starting military service. The rate cap is 6% during periods of active duty and must be requested in writing with a letter to the loan servicer along with a copy of military orders or a letter from the service member’s CO describing the date that active duty service began.

- 0% interest: Service members do not have to pay interest for up to 60 months while serving in a combat zone that qualifies for special pay. Proof of deployment to a combat zone is required (e.g., military orders, a Leave and Earning Statement (LES) indicating receipt of hostile fire/imminent danger pay, or a CO’s certifying statement).

- Public Service Loan Forgiveness (PSLF): As noted above, military service counts as employment at a qualifying government or non-profit public service organization. Borrowers with Federal Direct loans must make 120 on-time qualifying payments after October 1, 2007, in a qualifying income-driven or standard loan repayment plan.

Five Education Planning Tips for Military Families

- Know the rules. Rules and process steps to access military education programs, Forever GI Bill benefits, PSLF student loan forgiveness, and student loan deferment are complex. Review the resources below and ask questions. Many schools have counselors with special training to assist service members and military veterans.

- File an early FAFSA. A FAFSA form is the starting point to obtain financial aid. The process begins with an FSA ID at www.studentaid.gov. Prepare the FAFSA prior to the earliest submission deadline so it is “good to go.” Some financial aid is awarded on a first-come, first-served basis, and states and colleges can run out of money early.

- Read the fine print. A good example is PSLF, where military service can count as public service employment. There must be 120 separate monthly student loan payments (but they do not have to be consecutive) and payments must be made in full within 15 days of the due date. Paying additional amounts or combining loan payments will not speed up loan forgiveness. Full-time employment is defined as the greater of 30 hours per week or the employer’s definition of full-time. Borrowers must also have a qualifying Federal Direct loan or Direct Consolidation loan.

- Take advantage of leniency provisions. There are process steps and paperwork involved to obtain a 6% SCRA interest rate cap or 0% interest while serving in a combat zone, or a student loan deferment for qualified military service. There are forms to fill out and documentation to attach. The advantages of “pushing through” and doing due diligence, however, are financial breathing room and not having to worry about monthly loan payments, especially during stressful deployment periods.

- Reach out for help. Free help is readily available at military installations to assist service members with education-related plans and decisions and student loan repayment. For example, personal financial managers can assist with student loan questions and monthly payment calculations, and military lawyers within the Judge Advocate General Corps (JAG) can assist with cases involving the SCRA. Additionally, many academic institutions have staff (or entire departments) who assist veterans with education planning and the use of military benefits.

Education Planning Resources and References

Consumer Financial Protection Bureau. (n.d.). Action Guide for Servicemembers with Student Loans. https://files.consumerfinance.gov/f/201210_cfpb_servicemember-student-loan-guide.pdf

Consumer Financial Protection Bureau. (2018). The Servicemembers Civil Relief Act (SCRA). https://files.consumerfinance.gov/f/documents/cfpb_servicemembers-civil-relief-act_factsheet.pdf

Federal Student Aid. (n.d.-a). Federal Student Aid. https://studentaid.gov/

Federal Student Aid. (n.d.-b). For Members of the U.S. Armed Forces. https://studentaid.gov/sites/default/files/military-student-loan-benefits.pdf

Federal Student Aid. (n.d.-c). Loan Simulator. https://studentaid.gov/loan-simulator/

Federal Student Aid. (n.d.-d). Public Service Loan Forgiveness. https://studentaid.gov/manage-loans/forgiveness-cancellation/public-service/questions

Hanson, M. (2023). Average Cost of College & Tuition. https://educationdata.org/average-cost-of-college

The Military Wallet. (2020). Military Education Benefits—A Guide to Education and Training Benefits. https://themilitarywallet.com/military-education-benefits/

U.S. Department of Defense, Office of Financial Readiness. (n.d.). Avoid These Costly Higher Education Traps. https://finred.usalearning.gov/assets/downloads/FINRED-HigherEdTraps-FS.pdf

U.S. Department of Veterans Affairs. (2023). About GI Bill Benefits. https://www.va.gov/education/about-gi-bill-benefits/

U.S. Department of Veterans Affairs. (2019). Forever GI Bill Changes. https://www.benefits.va.gov/GIBILL/docs/factsheets/FGIBChanges.pdf

U.S. Department of Veterans Affairs. (n.d.). Forever GI Bill Communications Toolkit. https://www.benefits.va.gov/gibill/docs/FGIB_comms_toolkit.pdf