Credit: U.S. Marine Corps photo by Lance Cpl. Alex Fairchild

Series Description

This series on military family readiness aims to provide valuable resources, information, and support to family service professionals and Extension agents who support military families navigating the unique challenges and opportunities that come with a military lifestyle. From relocations to retirement, each publication in this series will equip you with the knowledge and resources you need to engage with service members and to promote readiness, resilience, and overall military family well-being.

This publication is the fifth in the series on military family readiness.

Intended Audience

This publication is intended for family service providers, Extension agents and specialists, educators, and other professionals in the Military Family Readiness System.

Introduction

Understanding the basics of income taxes is important. The taxes that Americans pay contribute to Social Security, Medicare, interstate highways, federal/state government agencies, and the military.

Taxes are based on location (i.e., where people live and work), income, expenses, deductions, family size, and other factors, including military service. Taxes require good records because taxpayers are responsible for the accuracy of data on their return, regardless of who prepares it (i.e., the individuals themselves, or a paid preparer). This publication discusses:

- General information about income tax terminology

- General information about income tax rules, rates, and refunds

- Military-specific income tax challenges

- Military-specific income tax regulations

- Five income tax planning tips for military families

- Income tax resources

General Information about Income Tax Terminology

Income tax is paid at the federal level. States and cities also have the option to charge income tax. When new employees start a job, including military service, they complete a W-4 Form (a.k.a., Employee’s Withholding Certificate) that determines the amount of money deducted from their paycheck.

W-4 Forms take into account workers’ income and tax filing status (e.g., single, married filing jointly, married filing separately). Employees can also request to have additional taxes withheld from their paycheck to cover taxes on other taxable income sources such as capital gains, investments, and self-employment income from a side job. Those who file jointly with their spouse may need to have extra withholding; their employer will not know about the other spouse’s paycheck, and taxes may not be withheld at the correct amount.

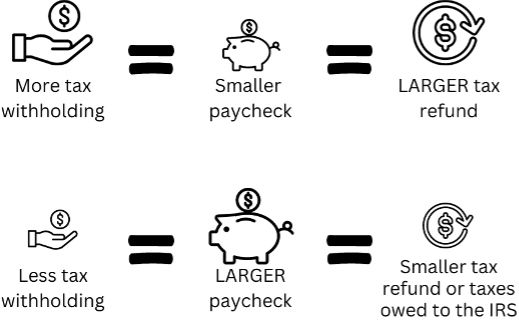

Tax withholding can essentially be explained this way: More tax withholding means a smaller paycheck and larger tax refund. Less tax withholding means a larger paycheck and smaller refund (or taxes owed to the IRS).

Credit: Kristen Jowers

More money taken out does not always lead to a refund. Sometimes a worker will ask for additional withholding, so they do not owe too much and incur an underpayment penalty. No one wants to pay more tax than they must. Taking advantage of available strategies to reduce taxes to their lowest legal level is called tax avoidance. Engaging in fraudulent activities (e.g., understating income/overstating deductions) is called tax evasion and is a crime punishable by fines and imprisonment.

Income taxes are an example of a progressive tax. This means that taxpayers pay a higher percentage of their income in taxes as their income rises. Federal income tax rates are set by Congress and change periodically. Conversely, regressive taxes such as sales and excise taxes tax a lower percentage of income as taxpayers’ income rises.

A tax deduction is a legitimate expense that reduces the amount of taxable income. About 90% of taxpayers currently take the standard deduction, which is a specific amount allowed by the tax code each year. The remainder take itemized deductions if their deductions total more than the standardized amount. Good records and receipts are a must! A tax credit is a dollar-for-dollar reduction in the amount of taxes owed. There are various types of tax credits available (e.g., adoption credit, child tax credit, child and dependent care tax credit, and earned income tax credit). Some tax credits are refundable, and others are nonrefundable. For refundable tax credits, if the taxpayer’s tax bill is less than the amount of a refundable credit, then they can receive the difference back as a refund. For nonrefundable tax credits, once the tax bill is zero, then the taxpayer will not receive the leftover credit amount back.

General Information about Income Tax Rules, Rates, and Refunds

Tax forms (a.k.a., returns) and payments are due by April 15 each year, but the official tax filing deadline can be adjusted by several days for weekend dates and holidays. Returns filed in April are for income earned in the previous calendar year.

The basic federal income tax form is the 1040 Form. Schedules are forms that are attached to the 1040 to show specific expenses, deductions, or income. For example, Schedule B is used to list interest and ordinary dividends received.

Employers must send employees a W-2 Form by January 31 to report income and federal and/or state tax withholding from the previous calendar year. W-2 Forms also show taxes withheld for Social Security and Medicare (a.k.a., FICA tax). W-2 Forms may be mailed or made available to employees online.

A 1099 is a form that is provided for non-employee income. There are various types of 1099 Forms. For example, banks and credit unions will send a 1099-INT to show the amount of interest earned. Investment firms will provide a 1099-DIV to show dividends and capital gains earned. Taxpayers who earn over $600 in a year as an independent contractor should receive a 1099-NEC. If someone receives a distribution from a pension, annuity, or IRA, they will receive a 1099-R Form.

Federal income tax rates were most recently changed on January 1, 2018. There are currently seven marginal tax rates: 10%, 12%, 22%, 24%, 33%, 35%, and 37%. Many people refer to these as “tax brackets.” These percentages are the tax rate on the last dollar of taxable income (i.e., gross income minus adjustments and deductions). The income ranges for each tax bracket change annually with inflation. “Annual Limits Relating to Financial Planning” in the Tax Resources below provides a comprehensive list of income tax and other financial information that changes annually with inflation indexing.

When taxpayers get a refund, they are getting their own money back without interest. Some people like a big tax refund because they see it as a means of forced savings. A potential downside, however, is income tax identity theft. Victims must often wait months for their cases to be resolved by the IRS so they can collect their refund. If they change their W-4 Form and receive more money throughout the year in their paycheck, there will be less money held up if they become victims of fraud.

Military-Specific Income Tax Challenges

A wide range of unique issues affect tax filing for military families, including:

- Moving expenses for permanent change of station (PCS) relocations

- Sale of a primary residence or “accidental landlording” following a PCS move

- Travel required for Reserve duty

- Tax-exempt and taxable allowances (i.e., need-specific payments in military pay)

- Tax-free “combat pay” for service in designated combat zones

- Certain tax-filing extensions

- Legal residency rules for state income tax filing (service members and spouses)

- State tax rules for taxation of military retirement benefits

- The opportunity to make tax-deductible pre-tax dollar (i.e., money that has not yet been taxed) contributions to the traditional Thrift Savings Plan (TSP)

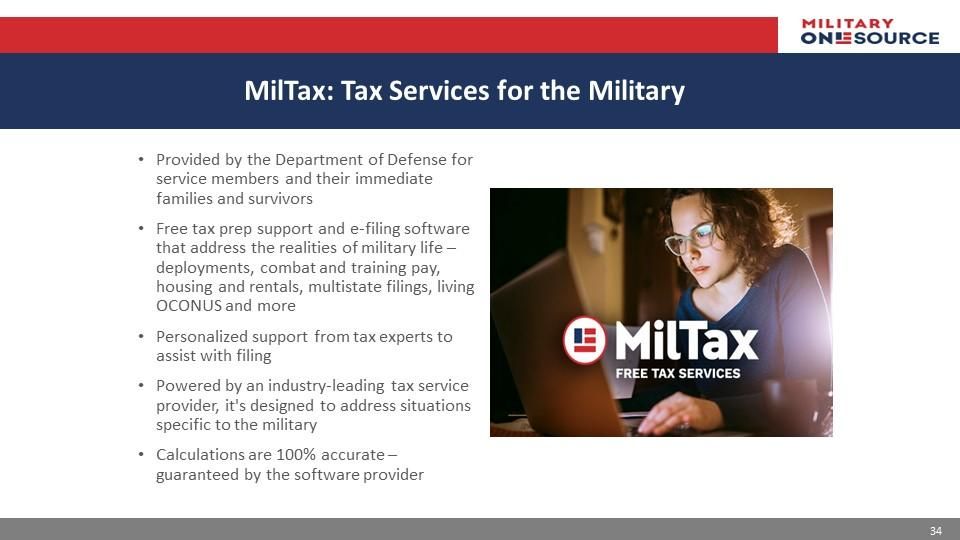

A complete description of military-specific tax rules can be found in IRS Publication 3, Armed Forces Tax Guide. The IRS website also contains military tax tips and links to resources such as MilTax, a Department of Defense and Military OneSource program that provides free tax return preparation and e-filing for service members and some veterans, with no income limit. More details about MilTax services are shown below.

Credit: https://www.militaryonesource.mil/financial-legal/taxes/miltax-military-tax-services/

Military-Specific Income Tax Regulations

- Extensions for tax filing: Service members serving in a combat zone during tax filing season can receive automatic extensions of time to file their tax return and pay any tax that is due. The length of the extension is the period of service in the combat zone plus up to 180 days after the last day in the combat zone. Extensions apply for all types of income (e.g., unearned investment income as well as military pay).

- Military retirement pay: Military retirement pay is taxable at the federal level as ordinary income (i.e., at one of the marginal tax rates based on taxable income). State income taxes can fall into one of four categories: 1. No state income tax (nine states; see below); 2. State income tax but no tax on military retirement benefits (25 states); 3. Partial state income tax on military retirement benefits (nine states); and 4. Full state income tax and little or no tax benefits for military retirement income (seven states: California, Georgia, Montana, Rhode Island, Utah, Vermont, and Virginia).

- Military spouse income: The Military Spouses Residency Relief Act (MSRRA) allows qualified spouses to declare the same state of residency as their spouse and only pay tax on income in their state of legal residency. Specific conditions apply (e.g., the service member is living in a state that is not their resident state as per military orders; the spouse must be in that same state solely to live with the service member). MSRRA is especially attractive when the state of residence is one of the nine states without a state income tax (i.e., Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming; New Hampshire taxes only dividends and interest income).

- Moving expenses: Military families are entitled to deduct nonreimbursable moving expenses resulting from military orders for a permanent change of station (PCS). Covered expenses include the transportation of household goods and personal effects and traveling expenses, including lodging. Meals are not deductible. Moving expenses are reported on Schedule 1 of the 1040 Form as an adjustment to income.

- National Guard and Reserve training expenses: Nonreimbursable travel expenses (i.e., lodging, meals, transportation) for drills and meetings that require an overnight stay more than 100 miles from home may be deducted as an “above the line” deduction (i.e., deduction from gross income to determine adjusted gross income). Deductions are limited to rates (e.g., mileage) authorized for federal employees.

- Sale of a principal residence: To qualify for the capital gains exclusion for homeowners ($250,000 for single taxpayers and $500,000 for married filing jointly), civilian homeowners must have owned and used a house as their main home for at least two years out of the five years prior to its date of sale. Military families can use a test period of up to ten years. Specific qualified official extended duty rules apply.

- Tax forgiveness: Survivors of a service member killed in action while deployed in a combat zone (or later from injuries sustained in a combat zone) can request forgiveness of the service member’s tax debt (or a refund if taxes were already paid) with a special request to the Internal Revenue Service (IRS).

- Tax-free allowances: Military pays (basic pay, special pay, incentive pay) are taxable on federal income tax returns as ordinary income. Most allowances are tax-free (a.k.a., tax-exempt), including the Basic Allowance for Housing (BAH) and the Basic Allowance for Subsistence (BAS). Since BAH and BAS average over 30% of service members’ total regular pay, the tax savings are significant.

- Taxable allowance: An exception to tax-free allowances is CONUS COLA, which is taxable. CONUS COLA is a supplemental allowance designed to help offset high living expenses for service members assigned to expensive geographical locations in the continental United States.

- Tax-free combat pay: Income earned during a period of service in a Department of Defense-designated combat zone (or in direct support of combat zone military operations) is generally excluded from federal income tax. It is, however, subject to Social Security and Medicare (FICA) tax. This exclusion includes other types of pay (in addition to basic pay) earned during this time, including re-enlistment bonuses. Exclusions from taxable income will be indicated on service members’ W-2 Form and can provide significant tax savings. For example, a six-month deployment for a junior enlisted service member could mean excluding $14,000 of basic pay from taxable income. In the 12% federal income tax bracket, this would save almost $1,700 in federal income tax ($14,000 x .12 = $1,680).

- Tax-free death benefit: The $100,000 death gratuity, payable to eligible survivors of deceased service members, is not taxable for deaths occurring after September 10, 2001. This payment is the same for all survivors regardless of cause of death.

- Tax preparation services: As noted above, MilTax is a free tax resource for military families and qualifying veterans and family members. There are no income limits.

- Thrift Savings Plan contributions: Traditional TSP contributions (deposits) are made pre-tax and are not included in taxable income for the year that they are made, which lowers current taxable income. Contributions and earnings are taxed upon withdrawal, typically in later life. Roth TSP deposits are made with after-tax dollars (i.e., money that has already been taxed) and are tax-free upon withdrawal if the account has been open at least five years and the owner is at least 59.5 years of age.

Five Income Tax Planning Tips for Military Families

- Use tax refunds wisely. Smart uses of an income tax refund include: paying off high-interest debt (e.g., credit card balances); building an emergency fund for unexpected expenses; saving for retirement (e.g., Roth or traditional IRA); saving for other financial goals (e.g., car, education, house); making home improvements; investing in education (e.g., college courses, certifications, and other professional development); starting a “side hustle” business; donating to qualified charities; upgrading old equipment (e.g., home appliances and computer); and investing in self-care and well-being (e.g., gym or spa membership, therapy sessions, hobbies).

- Adjust tax withholding as needed. As noted above, many factors affect the tax returns of military families. For example, combat pay is generally excluded from taxable income, thereby reducing tax liability, and moving expenses may be tax-deductible. Prepare a mock-up tax return that projects the tax impact of military-related (and other; e.g., birth or adoption of a child) changes, and use the online IRS Tax Withholding Estimator to determine accurate tax withholding. For example, determine the tax savings from six months of tax-free income.

- Keep good records. Good record-keeping can help ensure accurate tax reporting and potentially maximize deductions. Important records to keep include copies of Form W-2 and Form W-4, deployment orders, bank statements and Form 1099-INT for interest, investment company statements and Form 1099-DIV for dividends and capital gains, receipts for deductible moving expenses, and the final Leave and Earnings statement (LES) of the year that summarizes all payroll deductions.

- Take advantage of free and reliable help. Free tax preparation services are available through MilTax from Military OneSource and the IRS Volunteer Income Tax Assistance (VITA) program, which can be found at many large military installations. These services can help to ensure timely and accurate filing and potentially identify tax-saving deductions, credits, and strategies to minimize tax liability. Several commercial tax preparation firms also provide free or low-cost tax filing for military families.

- Stay informed. Tax laws change regularly, and tax bracket income ranges, standard deduction amounts, and maximum contributions for the TSP and IRAs are adjusted annually for inflation. To stay up to date with tax law changes that affect military families, review IRS resources specifically designed for military families such as Publication 3 (Armed Forces’ Tax Guide).

Income Tax Resources and References

College for Financial Planning. (2023). 2023 Annual Limits Relating to Financial Planning. https://static.twentyoverten.com/5d252702a03bfb38f263a72e/pTFWSI9m-g/2023-Annual-Limits.pdf

Internal Revenue Service. (2023a). Armed Forces’ Tax Guide. https://www.irs.gov/pub/irs-pdf/p3.pdf

Internal Revenue Service. (2023b). Military Family Tax Benefits. https://www.irs.gov/newsroom/military-family-tax-benefits

Internal Revenue Service. (2023c). Tax Withholding Estimator. https://www.irs.gov/individuals/tax-withholding-estimator

Intuit Turbotax. (2023). States That Don’t Tax Military Retirement. https://turbotax.intuit.com/tax-tips/military/states-that-dont-tax-military-retirement/L6oKaePdA

Military OneSource. (n.d.). MilTax: Free Software and Support. https://www.militaryonesource.mil/financial-legal/taxes/miltax-military-tax-services/

Rutgers Cooperative Extension. (2023). Tax Information. https://njaes.rutgers.edu/money/tax-info/