Buying insurance can be baffling. And no wonder! As prices rise, people become more concerned about getting value for their dollar. Deciding what insurance you need and comparing different policies has become even more difficult. And adding to the already complex problem are the many new kinds of policies being offered today.

Whether you are buying long-term care, disability, health, life, liability, automotive, or property insurance, you need to understand all aspects of insurance. You need to be informed in order to protect the resources and assests you and your family depend on.

What is insurance?

Insurance is a transfer of risk to a third party for a fee. In essence, it is "a device by means of which one party through a contract, called a policy, for a consideration, called a premium, undertakes to assume for another party certain types of risk or loss." Actually, insurance is the sharing of potential economic loss. Families can choose to pay a certain loss of a premium so that the insurer will bear the majority of the burden should a loss occur. Thus, a number of people pool their money to help the few people who suffer a loss covered by that contract. Insurance can only be purchased against losses that are estimable. Often insurance may involve additional cost sharing of the loss, such as a deductible, co-insurance, or co-payment.

Why buy insurance?

If you can't afford the costs that result from accidents, thefts, or man-made and natural disasters, you buy insurance so other people can share the cost of your loss. In other words, the money the insurance company gets from other people's premiums is used to help pay for your loss.

Before you can buy an insurance policy, you must have an insurable interest. That is, the loss you are insuring against must be an economic loss for you or your family. For example, you cannot buy insurance on someone else's automobile unless you would suffer a loss if it were destroyed. Nor can you buy insurance on someone's life unless you would suffer an economic loss if he or she died.

Questions to Consider

1. What risks do you and members of your family face?

Here are some risks that many Floridians face:

-

Health-related risk. When someone in the family becomes sick or disabled, medical bills must be paid.

-

Job-related risk. If a breadwinner loses his or her job, for either a short time or permanently, living expenses must still be met.

-

Death of a breadwinner. For some time we have realized that the family would suffer an economic loss if a breadwinner dies. But we have finally recognized there would also be an economic loss if a homemaker were to die because of the many essential family services provided.

-

Lawsuits for damages. Accidents caused by carelessness or neglect can involve you or your family in a lawsuit.

-

Property lost or destroyed. Your property can be lost, stolen, or destroyed by accidents, nature, or violence.

2. What events could cause these losses or additional costs?

Check the ones that could happen to you:

-

Work or leisure activities could increase the chance of accidents.

-

Other people's neglect may increase the chance of health-related problems.

-

Health problems may be inherited.

-

Job loss could result from changes in health, the economy, job skills, new technology, or for other reasons.

-

Death may come from a disease or accident.

-

Lawsuits for damages result primarily from accidents that are related to property you own.

-

Theft, accidents, and acts of nature are a major cause of property loss.

3. How should you handle each risk?

There are three ways to handle these risks. Most people use a combination of these ways:

-

Be careful to prevent the loss. For example, give up high-risk activities.

-

Keep the risk (self-insure). Set aside some savings to cover losses.

-

Transfer the risk to someone else. You transfer risks when you pay taxes for fire and police protection. You also transfer risks to insurance companies when you buy insurance policies.

Making A Plan

After considering the risks and causes that could affect you and your family, you need to write out your plan for handling each one.

-

Start a prevention program. Schedule regular checkups for your family and your property. Practice good health and safety habits and use common sense.

-

Save money to cover the risks that you plan to self-insure against. Put this money in a special fund so it can be earning for you until you need it.

-

Buy insurance to cover those risks you decide to transfer to insurance companies. But first, shop around for an insurance agent you trust. Compare policies offered by different companies. Check on the insurance company's reputation and financial situation.

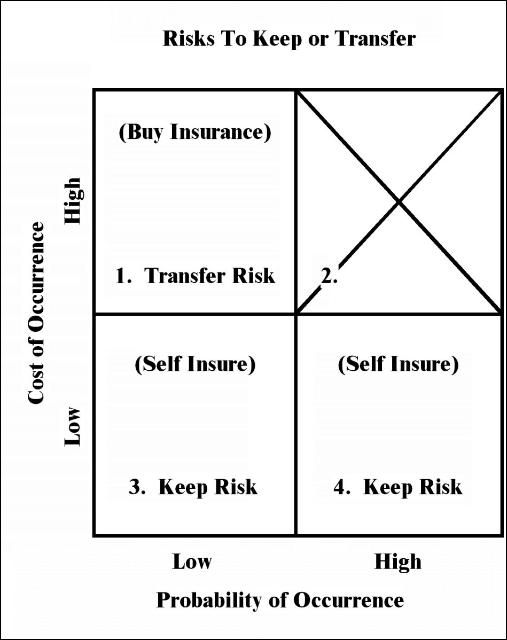

The following chart will help you set your insurance priorities. It will help you decide which risks you should keep or self-insure against and which risks you should transfer to insurance companies.

BLOCK 1—If the probability of the event is low but the cost is high, transfer the risk. Buy insurance.

Example: The probability of your house burning down is not very high. But, if it were to burn down, your loss would be great.

BLOCK 2—If the probability of the event is high and the cost of the event is high, no one would sell you insurance anyway. Or, the cost would be too high for most people to pay.

Example: If you had surgery for cancer last year and you try to buy health or life insurance, you would find it very difficult to buy complete health coverage and almost impossible to buy life insurance. Insurance companies will view this situation as a sure loss.

BLOCK 3—If the probability of the event is low, and the cost is low, keep the risk. Don't buy insurance.

Example: Buying insurance to cover the loss of your eyeglasses, hub caps, or damage to your child's tree house is probably an unwise expense.

BLOCK 4—If the probability of the event is high but the cost is low, keep the risk. Don't buy insurance.

Example: A special insurance policy to cover visits to the doctor's office is probably unwise. You likely will go to the doctor's office once or twice during the year. But most people can pay these expenses from savings. A better use of health dollars would be a major medical or catastrophic insurance policy that covers the large expenses for any health problem. You may, however, receive this coverage as a part of a benefit package where you work.

Buying insurance to cover risks in blocks 3 and 4 would probably cost you more money than paying the expenses out-of-pocket. These incidents don't cost much when they occur.

Only you can decide how much insurance to buy and how much you can afford to set aside for self-insurance. Study your risks and the methods of handling them.

Reference

Turner, Josephine. 1984. Protecting Dollars: Buying Insurance. Extension circular HE577, Alabama Cooperative Extension System, Auburn University, AL 36849.