Even though there are many estate-planning tools, a will is considered to be the cornerstone of most estate plans. A will is a written legal document that takes effect at death. It is used to administer the estate, including transferring property ownership and making provisions for the care of minor or dependent children.

States differ on the requirements of a valid will. For instance, some states require two witnesses and some states require three. The state in which you reside—your domicile—will determine the validity of your will. If you live in a different state than where your will was prepared, you may want to have it reviewed by an attorney in your current state of residence to make sure it is valid.

A properly drawn will simplifies the administration of an estate, minimizes costs, and minimizes family conflict over property distribution. Your estate is everything you own. It includes your home, automobile, jewelry, bank accounts, investments, retirement plans, furnishings, and other belongings. Your estate will include probate and non-probate property. Non-probate property is distributed according to deed, title, or contract. Probate property is distributed according to your will or according to state law if there is no will.

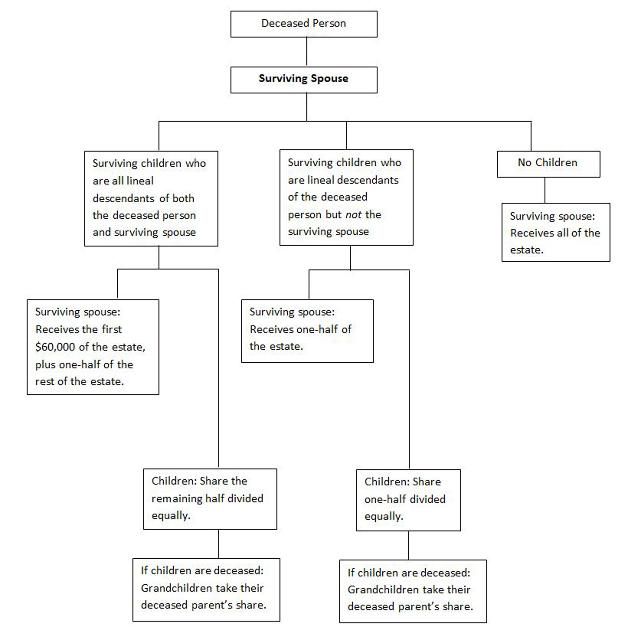

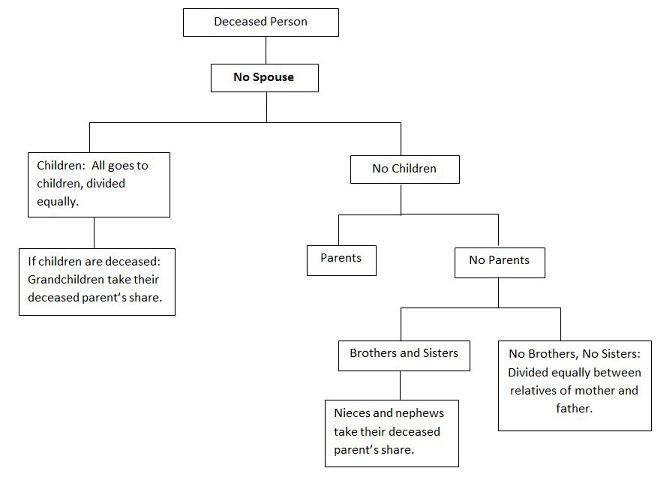

The following figures outline the distribution based on your family situation if you die intestate (without a will) in Florida.

At your death, the non-probate property that you own will go directly to the person(s) (beneficiary) indicated in a deed, title, or contract that you have prepared during your lifetime. It is important to keep your beneficiary information up-to-date. For example, if you have a child or divorce you may want to update your beneficiary information. This property does not go through probate, the court procedure used to change title to property. You cannot transfer this property by a will.

Examples of non-probate property include the following:

-

Real estate that you and your spouse own as tenants by the entirety. At the death of one owner, the property goes to the surviving spouse.

-

Property you own with one or more persons as joint tenancy with rights of survivorship.

-

Bank accounts that say the account is payable to either individual or the survivor.

-

Insurance policies payable to a named beneficiary.

-

Retirement accounts such as a 401(k) or 403(b) payable to a named beneficiary.

-

Property in a trust is non-probate if the trust agreement indicates how the trust property is to pass at the death of the trustor.

Probate property is all the property that you own that does not, by the way it is titled, have survivorship rights.

Examples are as follows:

-

Property you own as tenants in common.

-

Property you own by yourself (sole ownership).

Probate property is the property transferred by your will, or if there is no will by state law.

Florida law requires a probate proceeding upon the death of an individual if the individual owns any assets. The probate proceeding is the law's way of assembling the decedent's assets, paying debts and taxes, and passing title to the decedent's beneficiaries.

Preparing Your Will

It is advisable to have an attorney competent in developing and executing estate plans prepare your will. The Florida Bar certifies attorneys for five years in Wills, Trusts and Estates, upon completion of an application, a rigorous written exam, and satisfactory professional ethics record. Even though not all good attorneys are board-certified you can be assured that a Bar-certified attorney has a good reputation and a proven level of expertise.

For your will to be valid in the state of Florida:

-

The testator (person writing the will) must be at least 18 years of age or an emancipated minor.

-

The testator must be of sound mind at the time the will was signed (that is he/she knew what he/she was doing, i.e., making his/her will, what property was owned, and who the relatives and potential heirs were.)

-

The will must be in writing (it does not have to be typed).

-

The will must be signed and dated in the presence of at least two witnesses.

-

The two witnesses must sign in the presence of each other and the testator.

You can minimize attorney fees by preparing the following information and providing it to the attorney:

-

List of your goals and objectives for your family and your business.

-

List of your family members, names, addresses, ages, and Social Security numbers.

-

List of the people to be included in your will. (If you are eliminating a family member from your will, give reasons why.) In Florida you cannot disinherit your spouse without having a valid prenuptial or postnuptial. Additionally, Florida gives the surviving spouse a choice of either his or her share under the terms of the will or 30% of the decedent's estate, less any valid claims against the estate, real property located outside of Florida, state and federal taxes, and administration expenses. The surviving spouse, therefore, is always entitled to at least 30% of the decedent's net estate. This is known as an elective share.

-

The financial condition of your estate.

a. Provide a net worth statement (Identify all property both probate and non-probate [Include the value of the property and indebtedness against the property.]).

b. Your own personal wishes (who you want to inherit and what you want each person to receive).

For example, you should have in mind ideas about the following:

-

If you have minor children, who do you want to be the children's guardian?

-

Ideas about the management of property being left to a minor child.

-

Ideas about the financial needs of those people for whom you are responsible.

-

Your personal representative and a contingent personal representative (person who administers your estate at your death). Some states call this person an executor or executrix.

Once you have made your will, be sure to sign it and keep it up-to-date. Review it on a regular basis and change it as the law changes or family and financial situation change.

Last but Not Least: Self-proving Wills

After you have written your will you may notice that you are required to sign twice. Your attorney is trying to make things easier for you. The first signature indicates that you are the person making the will, and your signature is evidence that this will expresses your wishes. The second time you sign, you are signing a provision that makes the will self-proving. A self-proving will can be admitted to probate without further evidence that it is eligible to be probated. No witnesses are required to offer testimony.

Sign only one copy of your will. You may want to have extra-unsigned copies of your will available to you so that it can be reviewed periodically.

Where to Keep Your Will

A secure place to store your will is in a safe deposit box. In the past, some authorities advised against this because of the difficulty of gaining access to the box after the death of the owner. This difficulty has been substantially improved under current Florida law. Some people may prefer to leave their will with their attorney or to store it in a locked file cabinet or safe at home. The important thing is to store your will where it is easy for someone to locate when you die and where it will not be lost or accidentally destroyed.

Periodically review your will to ensure that it reflects your wishes. Review your will whenever your family situation changes, such as marriage, divorce, death of family members, birth or adoption of children, children reaching adulthood, or substantial change in the value of your estate.

You may change your will any time before your death, but you must follow correct procedures. Never change it by crossing out portions on the original document. In some cases you may change your will by adding a codicil. A codicil allows a person to modify provisions in his or her will without drafting an entirely new will. In other cases, you might need to write a new will.

You may revoke your will any time before death. It is revoked when you destroy the will with the intent to revoke it. It may also be revoked by executing a new will that expressly revokes any prior will.

Disclaimer

This publication is not intended to be a substitute for legal advice. Rather, it is designed to create an awareness of the need for estate planning and to help families become better acquainted with some of the devices involved. Further changes in laws cannot be predicted, and statements in this publication are based solely upon the laws in force on the date of publication.

Acknowledgment

Many thanks to attorney Richard M. White, Jr., Florida Bar Certified in Wills, Trusts and Estates, Gainesville, Florida, for reviewing this publication for accuracy.

References

Berteau, John T. 1998. Estate Planning in Florida 2nd Edition. Sarasota, Florida: Pineapple Press, Inc.

Florida State Statutes Chapter 732 and 733. Accessed March 5, 2012. http://www.leg.state.fl.us/Statutes/index.cfm?Mode=View%20Statutes&Submenu=1&Tab=statutes.

Garman, Thomas E., and Raymond E. Forgue. 2006. Personal Finance 8th Edition. New York: Houghton Mifflin Co.

Pohl, Esq., Amelia E. 1999. When Someone Dies in Florida. Boca Raton, Florida: Eagle Publishing Co.