Introduction

Climate change is a global problem. One practical strategy to help mitigate its effects is to remove carbon dioxide (CO2) and other greenhouse gases from the atmosphere and store them in soil as soil carbon. An associated policy strategy is to place a monetary value on newly stored soil carbon and allow trading of that commodity. Carbon markets allow those industries that emit carbon, such as manufacturing and airlines, to trade with those that store carbon or have relatively fewer carbon emissions, such as forestry and agriculture. These carbon markets allow farmers to generate additional revenue by adopting soil-management practices that store carbon in soil (Her et al. 2022). The stored carbon is traded as a carbon credit that is generated through a certification and verification process. Once generated, these carbon credits can be traded globally for greenhouse gas emissions reductions. As of 2023, carbon credit programs do not prohibit farmers from collecting payments from other incentive programs offered by the US Department of Agriculture (USDA) or other organizations if they enter the carbon market prior to collecting an incentive payment. Farmers must enroll in the carbon trading program before enrolling in other conservation programs to be eligible for carbon credit payments through carbon markets.

This publication is part of a larger body of work initiated by the UF/IFAS Extension Climate and Carbon Extension Educators that informs a general audience about climate issues and mitigation strategies. It was prepared to help Extension agents, farmers, and ranchers interested in carbon credit programs better understand the process of carbon credit trading, from credit generation to markets. Note that because carbon markets are relatively new, programs and prices are likely to change over time. This publication includes a list of resources for further information.

Carbon Markets

There are two types of carbon markets: mandatory (or compliance) and voluntary. Both schemes generate carbon offsets that are traded as carbon credits. Carbon offsets represent the amount of carbon sequestered or removed from the atmosphere. Carbon offsets are generated through climate-smart processes like agroforestry, no-till agriculture, and others (USDA-NRCS 2022; Medina-Irizarry et al. 2022). The offsetting process is defined by the people, place, and protocols and always involves procedures or methodologies for measuring the captured carbon (Kreye et al. 2023). Each metric ton (1,000 kg, or 2,205 lbs.) of offset CO2 or other greenhouse gases is worth one carbon credit. For example, holding one carbon credit gives the owner the right to emit one ton of CO2 into the atmosphere. The carbon credit can be sold to individuals or companies that need to reduce greenhouse gas emissions. A purchaser who buys a carbon credit gains ownership of one metric ton of CO2 equivalent (CO2e) removed from the atmosphere or prevented from entering the atmosphere by implementing an approved management practice. Companies and individuals can use carbon credits as units of exchange to offset their greenhouse gas emissions. In general, carbon credits are the units of exchange most commonly used to trade carbon offsets. Carbon credits have monetary value and are bought and sold in carbon markets.

Mandatory or Compliance Carbon Markets

Mandatory or compliance carbon markets are marketplaces that are required by law. Governments set limits on emissions and grant allowances in the form of carbon credits that represent large emitters’ right to generate CO2e. This policy allows these emitters to meet their legal climate goals. In general, the major buyers of carbon credits, such as oil refiners, large manufacturing industries, or natural gas plants, among others, are also major emitters of greenhouse gases. In mandatory carbon markets, prices are based on local economies and systems. Given that the demand for mandatory offset credits (allowances) is driven by regulatory obligations, their prices tend to be higher than prices for credits issued for the voluntary market (Broekhoff et al. 2019).

While there are no federal mandatory emission caps or programs in the United States, there are states or groups of states that mandate greenhouse gas emission limits for industries. Currently, there are two emissions trading systems in the United States: the Regional Greenhouse Gas Initiative (RGGI), which includes eleven Northeastern and Mid-Atlantic states, and the California Cap-and-Trade program). Trading allowances from a cap-and-trade system offer an alternative to carbon offset credits for claiming emission reductions.

Voluntary Carbon Markets

Some carbon markets in the United States allow companies and individuals who are large emitters or those interested in reducing their carbon footprint to purchase carbon offsets on a voluntary basis. Prices in the voluntary market can vary widely. Some of the key factors that influence the price of carbon credits in the voluntary market are the project type (i.e., the type of agricultural conservation practice that the farmer adopts to sequester carbon or reduce emissions), the project’s age (i.e., the length of the carbon contract), and the size of the transaction (i.e., the number of acres enrolled in the contract).

Additionality

Additionality is an important concept in carbon markets. It means that farmers must adopt practices that they would not have adopted if the carbon credit payments had not been offered (Broekhoff et al. 2019; Claassen et al. 2014). This is critical for carbon markets to measurably mitigate climate change. For the carbon market to be effective, it must incentivize additional carbon sequestration. Determining additionality can be subjective (Broekhoff et al. 2019) and proving that the sequestered carbon is “additional” and, therefore, eligible for trade on the market can be challenging. Other important concepts regarding carbon markets are permanence and leakage. Permanence refers to the longevity of the carbon benefits resulting from the project, while leakage refers to the carbon that was unintentionally leaked due to the project (Medina-Irizarry et al. 2022).

Carbon Credits Trading Process

Carbon trading involves three main phases: credit generation, verification and certification, and selling the credit. These phases are interconnected and can be summarized when describing carbon programs. In the sections that follow, we briefly describe the carbon program and add details about key players and conditions.

Phase 1: The Generation of Carbon Credits

Carbon Programs

At the center of the carbon credit generation process is the carbon program. A carbon program facilitates generation, verification and certification, and issuance of carbon credits to participating farmers. The key component of a carbon program is to design and develop carbon-credit-generation projects that result in certified tradable carbon credits. In addition to developing carbon credit projects, a carbon program could encompass verification, defining the marketplace, and establishing the registry. A carbon registry is a system used to generate, track, and manage carbon credits (Whiting 2023; Johnston 2022). For example, companies such as Agoro Carbon Alliance and Indigo are project developers that work with farmers and registries to generate and issue certified carbon credits, Gold Standard and Verra are carbon registries, and Nori is both a registry and a marketplace for trading carbon credits.

In conjunction with developing a project, the carbon program first verifies whether a particular agricultural practice sequesters carbon and then estimates the amount of carbon sequestered. This is done at the beginning of a farmer’s participation in the program to quantify the number of potential carbon credits that the farmer can generate. Once the project is in place, the carbon program usually uses accredited third-party verifiers to verify and calculate, at regular intervals, the amount of carbon sequestered through the farmer’s adoption of approved practices. This ensures that the amount of carbon sequestered meets the contractual agreement. Once a carbon credit is verified, it is registered in one of the interconnected registries and a unique serial number is issued for the credit. The carbon credit can then be sold at the marketplace.

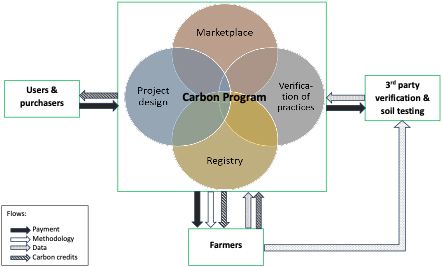

To illustrate the structure of the carbon credit generation process, we adapt the descriptions of ten carbon programs presented in Plastina (2022). Figure 1 summarizes the carbon-credit-generation process and shows the synergies among the different entities involved. The arrows in the figure represent primary transfers and their directions. In terms of flows of transfers, the farmer receives support with methodology from the carbon program, transfers data to both the carbon program and the third-party verifiers, and receives certified carbon credits that they can sell.

Credit: adapted from Plastina 2022

Program Eligibility

Generating carbon credits is a multistep process that starts with a contractual agreement (enrollment) with a carbon credit company or related entity. The agreement may stipulate that farmers will adopt (or terminate) certain activities on their farms to create carbon credits. For programs in the United States, requirements differ from one program to another in terms of the contract length, payments, payment processes, and eligible crops, among other factors. General requirements are that farmers must:

- be located in the United States;

- have the right to grow crops and implement practices on enrolled acres;

- have field(s) that are not currently enrolled in a carbon farming program; and

- be able to adopt practices that sequester or reduce carbon (e.g., cover cropping, crop rotation, agroforestry, among others).

However, even if all programs require additionality to generate credits, not all programs define additionality in the same way, and not all programs require that farmers change their production practices with respect to past practices on the same field. These nuances further speak to the subjective nature of additionality.

Regarding practice eligibility, there are several sustainable production practices that can qualify for carbon credits, such as cover crops, livestock grazing, crop rotation, no-till/strip-till, anaerobic digesters, nutrient management, buffer strips, and tree establishment, among others (Myers 2021). It is important to remember that carbon credits can either be created by a practice that reduces carbon emissions (like no-till practices that reduce the number of equipment passes in a field) or by a practice that enables long-term storage (or sequestration) of carbon, such as restoring marginal farmland to a prairie or a forest (Janzen, 2021).

Determining Carbon Credit Prices

Currently, the law of supply and demand is the primary driver in the voluntary carbon market, and the contracts vary by company and program. Payments are not awarded simply for engaging in a given practice but rather on a per-ton carbon-stored basis. The carbon storage potential may be estimated by taking field samples or using biophysical models ahead of time, or the stored carbon may be calculated throughout the length of the contract. Although some companies may have a price floor, carbon offset prices range from less than US$1 per ton to more than US$50 per ton (Second Nature 2021). Regarding payments, farmers can receive their compensation in the form of cash, cryptocurrency, or credits toward purchases (Sellers et al. 2021).

Phase 2: The Verification and Certification of the Carbon Credit

Verification

The verification phase refers to the process that a company uses to quantify soil carbon in a farmer’s operation. There are two aspects of verification:

- The first step is initial verification that a particular agricultural practice sequesters carbon and quantification of the amount of carbon that examiners predict will be sequestered. Verification and quantification are performed at the beginning of program participation, before the farmer adopts the climate-smart practice.

- The next step is collecting data from farm operations to verify that the new farm practices are, in fact, sequestering carbon. This step ensures the quality of the carbon credit generated and must be performed before the carbon credit can be issued and certified.

The carbon program uses a combination of site visits, models of soil dynamics, and remote sensing techniques to complete the initial verification and generation of carbon credits. Accredited third-party verifiers complete the post-participation verification and soil testing. In addition to data collection, the carbon credit company handles all administration activities needed to generate carbon credits. This helps to ensure that growers receive the appropriate monetary value determined by a reliable soil carbon verification process. Each company has its own accredited verification protocol that details its soil-sampling plan (e.g., the number of samples and where and when to take samples) (Sellars et al. 2021). Independent registries such as Verra, Gold Standard, Climate Action Reserve, and American Carbon Registry verify the processes to ensure projects follow strict protocols (Jennifer L. 2023). The Verified Carbon Standard by Verra and Gold Standard is the most widely used.

The effects of agricultural management practices on carbon sequestration vary substantially depending on soils, climates, and crops. Several tools are available to model or estimate carbon sequestration in agricultural soils (Melkani et al. forthcoming). Nayak et al. (2019) describe several methods used to quantify soil carbon, including spectroscopic methods, eddy covariance technique, Life Cycle Analysis (LCA), and others. It is not clear that these tools may be applied to Florida’s highly variable soil types.

Certification

Once soil carbon is quantified and verified, certification is needed to generate the carbon credits. The company that verifies the sequestered carbon or a third party will examine the carbon projects rigorously and provide a transparent report of the carbon the projects removed from the atmosphere. A certified carbon credit is registered with one of several interconnected registries, and a unique serial number is assigned to it. Climate Action Reserve, Gold Standard, and Verra are some examples of registries. CIBO and Nori are examples of companies that provide certification and are also registries and marketplaces. Other carbon programs like Agoro, Ecosystem Services Marketing Consortium (ESMC), Bayer, Nutrien, and Indigo get carbon credits certified by registries such as Gold Standard and Verra. The role of the certifier is to ensure that the farmer follows the accepted protocols to create the credit.

Potential Carbon Credit Programs in Florida

The global carbon market is relatively new to US farmers. At the time of this report (2023), we are unaware of any active programs for Florida specialty crop or livestock producers. With that said, with appropriate verification processes, the following companies advertise criteria that would make Florida producers eligible:

- Florida’s Sequestering Carbon and Protecting Florida Land Program offers cost share for conducting certain approved forest management practices that establish new forest stands. It is designed to assist non-industrial private landowners, county or local governments, and nonprofit organizations. The entities must own their own land, and preference is given to those with more than 20 acres. Funding opportunities for reforestation max out at 250 acres. The Florida Department of Agriculture and Consumer Services, Florida Forest Service, administers the program and is taking applications.

- CIBO Impact is a data platform that offers a carbon credit program for all US croplands. This program covers new no-till and low-till operations, cover crops, climate-wise nitrogen application, and carbon-sequestering changes in crop rotation practices. It offers a $20 incentive per carbon credit for the pilot program.

- Agoro Carbon Alliance, a subsidiary of the Norwegian fertilizer company Yara, was started by an input supply company covering corn-, soybean-, and wheat-growing areas, and other cash croplands of the continental United States. The program does not cover new practice costs, but it does offer a $10 incentive per acre if farmers enroll more than 2,560 acres 30 days after signing the contract.

- Ecosystem Services Market Consortium (ESMC) is a carbon and ecosystem services market entity that targets agricultural practices referenced in the USDA, Natural Resources Conservation Service conservation practice standards (see USDA-NRCS 2022 for practices). A full market was launched in May 2022.

- Nori is a carbon market entity covering row crop/hay/grass, seasonal cover crops, and orchard/vineyard. Farmers need to enroll at least 1,000 acres and are paid at the end of the month by Nori Carbon Removal Tons (NRT) tokens or cash when NRT are sold.

Readers can view the resources section below for more information about these programs.

Phase 3: Carbon Credit Selling and Payments to Farmers

Selling Carbon Credits

Carbon credits are designed to be purchased by carbon emitters to offset their emissions while maintaining overall emissions below certain thresholds or to reduce their overall carbon footprint (Plastina 2023). Carbon credit buyers might be large CO2 industry emitters that are required by law to reduce their carbon footprint (e.g., energy producers); multinational companies that want to reduce their carbon footprint; and environmentally responsible individuals or companies that are interested in being carbon neutral.

The Payment to Farmers

There is no universal price for carbon credits. The farmers’ contracts will stipulate how and when they are paid. Contracts vary widely, and payments may be in cash, cryptocurrency, or credits toward purchases (Sellers et al. 2021). Companies may offer a gradual payment, an upfront payment, or a lump sum to be paid later. Note that most programs do not pay growers for implementing practices. Rather, payments are for sequestered carbon from newly adopted conservation practices (Plastina 2023). While payment depends on the practice and the enterprise, it is unlikely that payments for sequestered carbon will cover the total cost of implementing the new practice. For example, Chakravarty and Wade (2023) find that cover crops in Florida citrus groves will cost over $100/acre to adopt. We are unaware of carbon credit programs that cover that cost. Programs like ESMC, Nori, CIBO, and Agoro do not cover the adoption cost of the new practice.

Discussion

Carbon markets have three main phases: the generation of carbon credits, verification and certification, and selling the carbon credits. For now, Florida farmers face major barriers to entering carbon markets. Most of these barriers have to do with the lack of a verification process that accounts for Florida’s unique soils and the cost of practice adoption. Little is known about how much carbon is sequestered using specific practices and crops. That stored carbon (and consequently the practices implemented to store the carbon) must be additional also means that producers who are already using climate-smart or conservation practices are likely ineligible to participate in the market. These farmers will have to adopt different practices or enroll land on which they have not yet adopted a climate-smart practice to be eligible. For other farmers, the cost of adoption will likely be higher than the credit payment they receive for any carbon they sequester. Nonetheless, carbon markets are growing, and major emitters are looking for new carbon offset opportunities. As a result, there are opportunities for new projects in Florida.

The Inflation Reduction Act of 2022, along with USDA-NRCS offers support for a wide range of agricultural climate-smart practices to help mitigate the effects of climate change. Its support for carbon sequestration efforts signals the federal government’s interest in enlisting the help of farmers to create climate change solutions. Entering carbon markets does not preclude farmers from enrolling in USDA-NRCS programs, and it is possible for farmers to get support for practice adoption and carbon credit payments if they enter the carbon payment program before enrolling in other conservation programs.

Carbon markets in the United States are voluntary, and as of writing, there is no universal price for the carbon stored on agricultural lands. Rather, prices are primarily driven by supply and demand, as with any other commodity. It is unlikely that the payment for carbon credits will cover the cost of practice adoption. However, one can also think of the total benefit as being more than the carbon payment, i.e., the total benefit from implementing the practice may include the carbon payment and co-benefits like the farm-level benefits from using regenerative practices (e.g., soil health or water quality benefits, or reductions in input costs), in addition to the social (or public) benefits associated with the practice. Therefore, generally, when total benefits and costs are considered, the practice may be worth adopting.

The current agricultural carbon credit market is not yet mature and is difficult to characterize because of the deviations in carbon credit programs’ rules, incentives, and penalties (Plastina 2023). Potential participants in this new and changing market should carefully review contracts (and may wish to seek legal assistance) to determine if a carbon credit program is the right fit for their enterprises. It is likely that the verification and additionality hurdles will be overcome as better carbon quantification methods and creative conservation policies are created. When the carbon market matures, savvy Florida farmers will be primed to take advantage of opportunities to participate.

Additional Resources

- Ask IFAS publication Capitalizing on Carbon.

- The Carbon Offset Guide: https://www.offsetguide.org/understanding-carbon-offsets/other-instruments-for-claiming-emission-reductions/allowances/

- Florida Department of Agriculture and Consumer Services Sequestering Carbon and Protecting Florida Land Program

- CIBO Impact’s Sustainability and Carbon Programs for Farmers

- Agoro Carbon Alliance carbon credit program

- Ecosystem Services Market Consortium

- NORI

- American Carbon Registry

- The Regional Greenhouse Gas Initiative (RGGI) https://www.rggi.org/program-overview-and-design/elements

- “Carbon Markets 101.” An article from Penn State Extension

- “Understanding Carbon Credits and Offsets.” An article from Penn State Extension

- “What are Carbon Credits? How Fighting Climate Change Became a Billion-Dollar Industry.” an article from NBC News

- The USDA’s Natural Resources Conservation Service provides this encyclopedic page on the Inflation Reduction Act

References

Broekhoff, D., M. Gillenwater, T. Colbert-Sangree, and P. Cage. 2019. “Securing Climate Benefit: A Guide to Using Carbon offsets.” Stockholm Environment Institute & Greenhouse Gas Management Institute. https://www.offsetguide.org/wp-content/uploads/2020/03/Carbon-Offset-Guide_3122020.pdf

Chakravarty, S., and T. Wade. 2023. Cost Analysis of Using Cover Crops in Citrus Production. HortTechnology, 33(3), 278-285. https://doi.org/10.21273/HORTTECH05126-22

Center for Climate and Energy Solutions (C2ES). 2013. Regional Greenhouse Gas Initiative. C2ES, Arlington, VA. https://www.c2es.org/document/regional-greenhouse-gas-initiative-rggi/

Her, Y. G., T. Wade, S. Boufous, J. Bhadha, and M. Andreu. 2022. “Florida’s Agricultural Carbon Economy as Climate Action: The Potential Role of Farmers and Ranchers: AE573/AE573, 5/2022.” EDIS 2022 (3). Gainesville, Florida. https://doi.org/10.32473/edis-AE573-2022

Janzen, T. 2021. “Creating Carbon Credits.” Janzen Ag Tech Blog, Janzen Ag Law, Indianapolis, IN. https://www.aglaw.us/janzenaglaw/2021/3/21/creating-carbon-credits

Jennifer L. 2023. “Who certifies carbon credits?” Carbon Credits (blog), carboncredits.com. https://carboncredits.com/who-certifies-carbon-credits/

Johnston, M. 2022. What is a Carbon Registry? Decode 6. https://decode6.org/articles/carbon-registry/

Kreye, M, K. Clay, S. Chizmar, L. Cooper, G. Diedrich, D. Gadoth-Goodman, R. Parajuli, and A. Sutton. 2023. “How a Forest Carbon Offset is Made and Sold.” Penn State University Extension. https://extension.psu.edu/how-a-forest-carbon-offset-is-made-and-sold

Medina-Irizarry, N. M., M. Andreu, and T. Cushing. 2022. “A Landowner’s Introduction to the Forest Carbon Market: FOR382/FR453, 3/2022.” EDIS 2022 (2). Gainesville, Florida. https://doi.org/10.32473/edis-fr453-2022

Melkani, S., N. Mamirakiza, S. Baker, and J. H. Bhadha in press. Forthcoming. “Current and Emerging Protocols for Quantifying Carbon Sequestration in Agricultural Soils.” EDIS Gainesville, Florida.

Myers, S. 2021. “Sustainability Markets, Part 1: Agricultural Ecosystem Credit Markets-The Primer.” Market Intel, March 2, 2021, American Farm Bureau Federation. https://www.fb.org/market-intel/sustainability-markets-part-1-agricultural-ecosystem-credit-markets-the-primer

Nayak, A. K., M. M. Rahman, R. Naidu, B. Dhal, C. K. Swain, A. D. Nayak, A. D., R. Tripathi et al. 2019. “Current and Emerging Methodologies for Estimating Carbon Sequestration in Agricultural Soils: A Review.” Science of the Total Environment 665:890–912. https://doi.org/10.1016/j.scitotenv.2019.02.125

Plastina, A. 2022. “How do data and payments flow through ag carbon programs?” Ag Decision Maker A1-77, Iowa State University Extension and Outreach, Ames, IA. https://www.extension.iastate.edu/agdm/crops/pdf/a1-77.pdf

Plastina, A. 2023. “How to Grow and Sell Carbon Credits in US Agriculture.” Ag Decision Maker A1-76, Iowa State University Extension and Outreach, Ames, IA. https://www.extension.iastate.edu/agdm/crops/pdf/a1-76.pdf

Second Nature. 2021. “Purchasing Carbon Offsets FAQs”. https://secondnature.org/climate-action-guidance/purchasing-carbon-offsets-faqs/#cost

Sellars, S., G. Schnitkey, C. Zulauf, K. Swanson, and N. Paulson. 2021. “What Questions Should Farmers Ask About Selling Carbon Credits?” farmdoc daily (11): 59, Department of Agriculture and Consumer Economics, University of Illinois, Urbana-Champaign. https://farmdocdaily.illinois.edu/2021/04/what-questions-should-farmers-ask-about-selling-carbon-credits.html

US Department of Agriculture Natural Resources Conservation Service (USDA-NRCS). 2022. Conservation Practice Standards Information. https://www.nrcs.usda.gov/wps/portal/nrcs/detailfull/national/technical/cp/ncps/?cid=nrcs143_026849#A

US Department of Agriculture. October 2023. Report to Congress: A General Assessment of the Role of Agriculture and Forestry in U.S. Carbon Markets. https://www.usda.gov/sites/default/files/documents/USDA-General-Assessment-of-the-Role-of-Agriculture-and-Forestry-in-US-Carbon-Markets.pdf

Whiting, T. 2023. “What’s the role of a carbon registry in the voluntary carbon market?” Lune (blog), Lune.co https://lune.co/blog/whats-the-role-of-a-carbon-registry-in-the-voluntary-carbon-market