Credit: Cristina Carrizosa, UF/IFAS

Introduction

Rising consumer interest in locally sourced, sustainably produced products presents an opportunity for breweries to differentiate their brand in an increasingly competitive market, as well as for local growers to supply those ingredients. Our report explores Florida consumers’ preferences and the premiums that Florida consumers are willing to pay for beer made with local ingredients and sustainability certification. We also examine how the premiums vary across Florida’s largest metro areas: Miami, Tampa, Orlando, and Jacksonville. This information can inform growers of potential market opportunities and brewers of product differentiation strategies. The report is the second in a series that seeks to provide Florida breweries with state-specific, data-driven marketing information to help grow their consumer base. We provide a list of key insights for breweries, growers, and Extension agents at the end. Our first report on consumer purchasing and consumption habits on the Ask IFAS website (edis.ifas.ufl.edu) is Tapping into Florida’s Craft Beer Market: A Brewer’s Guide to Consumer Purchasing and Consumption Habits in the Sunshine State (Hambaryan et al. 2025).

Local Ingredients and Sustainability Certification

A growing consumer interest in locally sourced agricultural products has prompted breweries nationwide to experiment with local ingredients—from hops to grains to fruits—to differentiate their products. However, the extent to which Florida beer consumers value these attributes is uncertain. We investigate preferences for Florida-grown hops and blueberries and quantify the premium that Floridians may be willing to pay for these ingredients in beer. Hops are grown predominantly in the Pacific Northwest and were selected as an essential ingredient in beer, providing much of the flavor and aroma. Although not yet grown commercially in the state, recent research describes successful production systems for growing hops in Florida (Agehara et al. 2021; Acosta-Rangel, Agehara, and Rechcigl 2024; Gallardo, Agehara, and Rechcigl 2025) and limited quantities can be obtained directly from UF/IFAS (reach out to your local UF/IFAS Extension office for assistance: https://sfyl.ifas.ufl.edu/find-your-local-office/). We also chose blueberries to compare the premium of an essential ingredient (hops) with that of a secondary ingredient that is sometimes added for flavor.

Research also suggests that some beer consumers value a brand’s commitment to sustainability (Staples et al. 2020), opening up another potential avenue for differentiation. We investigate whether Florida consumers hold similar preferences for sustainability by asking if they would pay a premium for beer produced by a certified B-Corp. Some breweries, such as North Coast Brewing Company, actively promote being a certified B-Corp, which is a designation awarded to businesses that meet high standards of social and environmental performance, transparency, and accountability. High profile certified B-Corps include Patagonia®, Ben & Jerry’s®, and New Belgium Brewing Company®.

Survey of Florida Beer Consumers

We conducted an online market research study of consumers between July and October of 2023. The survey contained a choice experiment that presented a series of hypothetical purchasing scenarios to consumers who were asked to choose their preferred Florida craft beer six-pack from three randomized options or select “none.” Each option varied in price, the origin of the ingredients in the beer, and whether the beer was made by a certified B-corp. For the statewide and metro area results, we analyzed responses using a random parameter logit model, which allows us to estimate individual preferences for each of the attributes listed above. Based on these preferences, we calculated the premium—that is, the additional amount of money that the average consumer would be willing to pay—for beer when specific attributes are present. For the metro area results, the limited sample size necessitated a slightly different approach. For these areas, we calculated the simple average of the individual willingness to pay for each attribute within each geographic area.

An important caveat when interpreting our results: because the premiums are estimates taken from a sample of the population, they are only meant to provide a general idea of the premium that the average Florida beer consumer would pay. The exact premiums for an individual consumer or for a segment of consumers, such as millennials or frequent craft beer drinkers, will likely be different than the ones presented here.

We break down the demographics of our sample in Table 1 and compare our sample to the overall population in the state of Florida. Comparatively, our consumers are more likely to be women. The difference may be in part because our survey targeted the primary shopper for contacted households, and primary shoppers are more likely to be female. In addition to the gender difference, our consumers are considerably older, wealthier, and more likely to hold a college degree than the average Floridian.

Table 1. Sample composition vs. population of Florida.

Note: Categories may not sum to 100% due to rounding.

Statewide Results

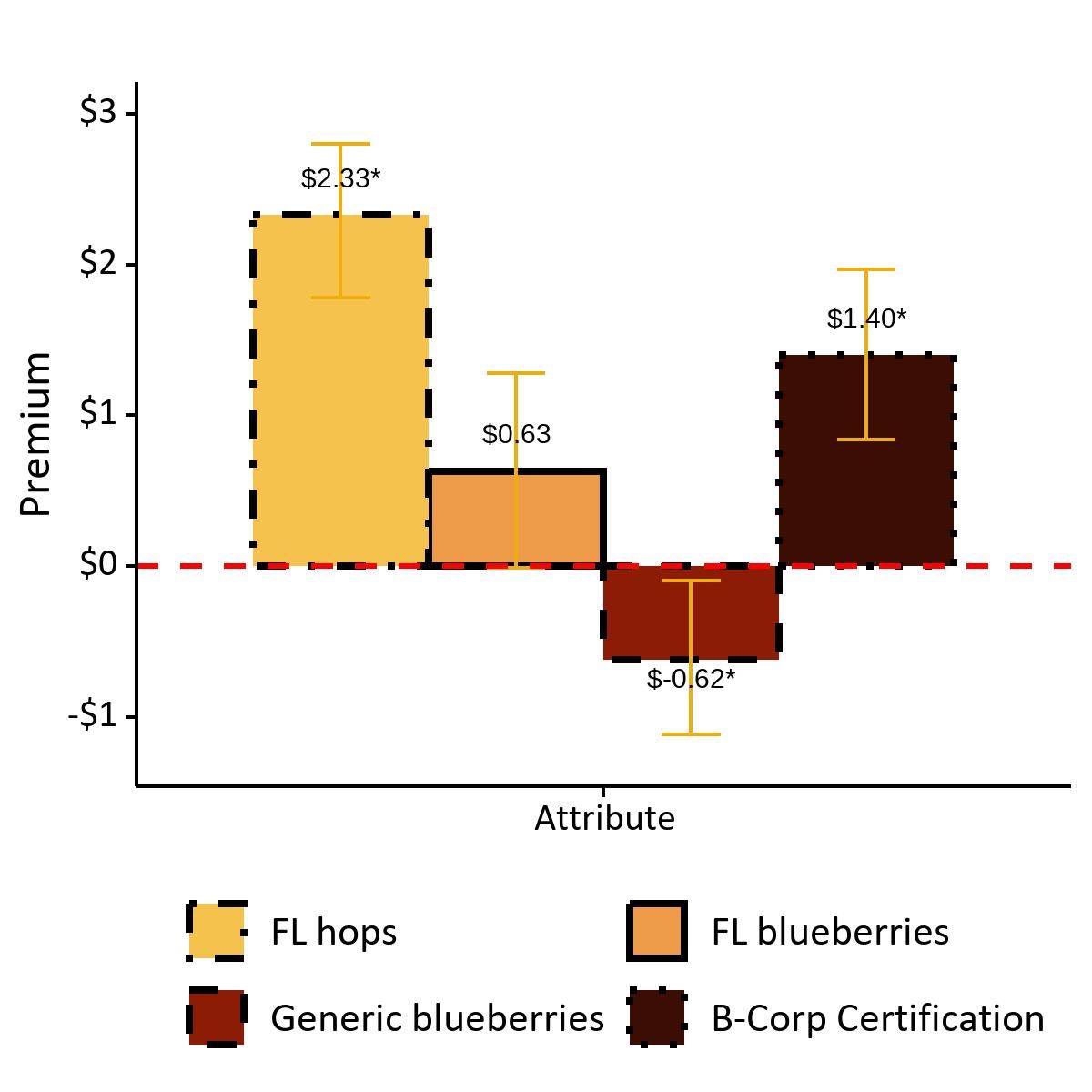

Our statewide results, shown in Figure 2, indicate that the average Florida beer consumer prefers beer that is made with local ingredients and produced by a certified B-Corp, and is willing to pay a substantial premium on a six-pack of craft beer with these attributes. Florida hops were associated with the highest average premium at $2.33, while Florida blueberries commanded a somewhat lower average premium of $0.63. However, based on our 95% confidence interval, this premium for Florida blueberries is not statistically significant, meaning that we can't be sure the extra amount people are willing to pay isn't just random variation in the data. Consumers may place a higher value on hops due to it being a well-known and widely recognized essential ingredient as opposed to a fruit occasionally added for flavor. Despite a smaller premium compared to hops, locally grown blueberries were distinctly preferred over a generic alternative. In fact, the negative and significant premium indicates that the average Florida beer consumer prefers beer without any blueberries over beer made with generic fruit, implying that breweries should carefully consider their target market when adding non-local fruit given the additional production costs and lack of appeal to the average beer consumer. Regarding B-Corp certification, the $1.40 average premium indicates that a commitment to sustainability resonates strongly with consumers in Florida.

Credit: Nathan Palardy, UF/IFAS

Results by Metro Area

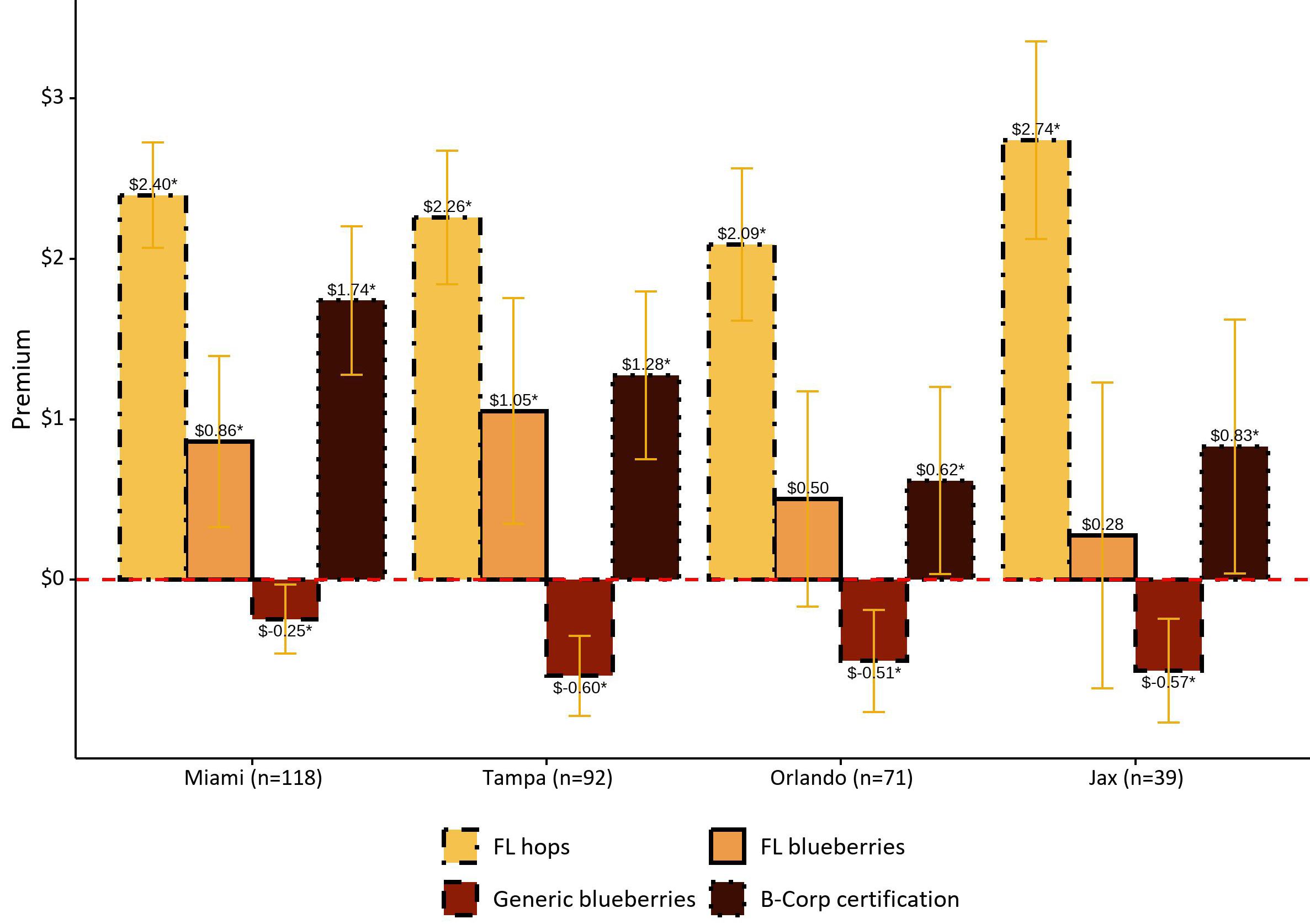

Where possible, we provide metro-specific results to help breweries evaluate their local market or potential new markets to expand distribution. We found that, although the average of the individual premiums for each attribute varied across metro areas, consumers consistently valued Florida hops and B-Corp certification the most. Florida hops were especially appealing to beer consumers in Jacksonville where the average premium was $2.74. The premium for B-Corp certification exhibited a little more variation, with Miami consumers willing to pay $1.74 compared to $0.62 in Orlando. Our results for Florida blueberries suggest that breweries may want to strategically choose markets where they introduce beer made with local fruit. Tampa and Miami were most receptive of Florida blueberries, and willing to pay an average premium of $1.05 and $0.86, respectively. However, we did not find a significant premium for Florida blueberries in Orlando or Jacksonville. As might be expected from the statewide results, no metro area had a positive premium for beer made with generic blueberries.

Credit: Nathan Palardy, UF/IFAS

Key Insights for Breweries and Growers

This is the second installment in a series focusing on providing evidence-based market analysis to help breweries and growers to leverage their strengths. It offers strategies to market products based on insights into consumption patterns and purchase preferences in Florida. Overall, both breweries and growers can leverage local sourcing and sustainability to appeal to Florida’s craft beer consumers and optimize their market strategies.

For Breweries

- Local ingredients appeal to Florida beer consumers. Consumers in the Sunshine State are willing to pay more on average for a six-pack of Florida craft beer made with Florida-grown hops ($2.33) and Florida blueberries ($0.63). The premium indicates that marketing materials highlighting local ingredients, especially hops, are likely to resonate with consumers and that there is room to offset the higher costs of these ingredients by adjusting prices.

- Sustainability sells. Consumers value a commitment to sustainability and, statewide, were willing to pay an average premium of $1.40 for beer produced by a certified B-Corp. Informing consumers about your brand’s commitment to sustainability can serve as an effective differentiation strategy.

- Metro markets differ. The premium for local ingredients varies by region:

- Jacksonville consumers exhibit the highest willingness to pay for Florida hops at $2.74.

- Tampa and Miami consumers were more receptive to Florida blueberries, with willingness to pay at $1.05 and $0.86, respectively.

- Orlando and Jacksonville consumers demonstrated a slightly lower willingness to pay for sustainability certification and showed no significant premium for Florida blueberries.

- Breweries can leverage this information to pilot test products tailored to the specific tastes and preferences of each metro area.

- Ingredient sourcing is key. Generic blueberries did not add value and may even deter some Florida consumers. Breweries may want to prioritize local ingredients to align with consumer preferences.

- Find local partners. Breweries that wish to connect with a Florida grower to purchase ingredients can reach out to their local UF/IFAS Extension office for assistance. The list of offices can be found here: https://sfyl.ifas.ufl.edu/find-your-local-office/.

For Growers

- Develop targeted supply chains. Understanding consumer preferences in different markets can help growers develop strategic partnerships with breweries to maximize profitability.

- Monitor the nascent market for Florida hops. Despite hops not yet being commercially grown in Florida, the high average premium suggests strong potential demand.

- Be aware of the selective market for fruit additions. While local blueberries are preferred over generic ones, demand varies by metro area. Growers should collaborate with breweries in regions where consumers value them most (e.g., Tampa or Miami for blueberries).

- Form sustainability partnerships. Breweries prioritizing sustainability certifications may be interested in sourcing from growers who use sustainable farming practices.

- Network with breweries. Growers can market their products to breweries directly by reaching out to the Florida Brewers Guild or attending trade conferences like the Florida Brewers Conference (https://floridabrewers.org/).

References

Acosta-Rangel, Aleyda, Shinsuke Agehara, and Jack Rechcigl. 2024. “Double-Season Production of Hops (Humulus Lupulus L.) with Photoperiod Manipulation in a Subtropical Climate.” Scientia Horticulturae 332 (June): 113177. https://doi.org/10.1016/j.scienta.2024.113177

Agehara, Shinsuke, Mariel Gallardo, Aleyda Acosta-Rangel, et al. 2021. “Crop Management Practices and Labor Inputs for Hop Production in Florida: HS1409, 3/2021.” EDIS 2021 (2). Gainesville, FL. https://doi.org/10.32473/edis-hs1409-2021

Gallardo, Mariel, Shinsuke Agehara, and Jack Rechcigl. 2025. “Optimization of Trellis Design and Height for Double-Season Hop (Humulus Lupulus L.) Production in a Subtropical Climate: Growth, Morphology, Yield, and Cone Quality during Establishment Years.” European Journal of Agronomy 162 (January): 127415. https://doi.org/10.1016/j.eja.2024.127415

Hambaryan, Meri, Glory Orivri, Nathan Palardy, John Lai, and Bachir Kassas. 2025. “Tapping into Florida’s Craft Beer Market: A Brewer’s Guide to Consumer Purchasing and Consumption Habits in the Sunshine State: FE1160, 12/2024.” EDIS 2025 (1). Gainesville, FL. https://doi.org/10.32473/edis-fe1160-2024

Staples, Aaron J., Carson J. Reeling, Nicole J. Olynk Widmar, and Jayson L. Lusk. 2020. “Consumer Willingness to Pay for Sustainability Attributes in Beer: A Choice Experiment Using Eco-Labels.” Agribusiness 36 (4): 591–612. https://doi.org/10.1002/agr.21655