Introduction

The hard clam industry is a true success story for commercial aquaculture in Florida. From a cottage industry borne of reductions in commercial wild clam harvests in the Indian River Lagoon during the late 1980s, hard clam aquaculture has now developed into an industry that is rivaled by no other aquaculture food product in Florida. As one of the top two sources of cultured hard clams in the United States, the Florida industry uses over 1,500 acres of leased, submerged land cultivated by over 300 growers; supports approximately ten certified hatcheries; provides the product to about 50 certified wholesale dealers; and has created a network of associated supportive businesses, including seed suppliers, bag manufacturers, equipment and boat dealers, and other service-related businesses. The presence of this profitable industry in Florida's coastal communities has created other benefits, such as helping to strengthen local and regional resolve to preserve coastal water quality. Although successful by virtually any metric, the risks and uncertainty associated with commercial hard clam culture has led to the evaluation of programs that help mitigate risk, such as the former pilot Cultivated Clam Crop Insurance Program administered by USDA Risk Management Agency. All of this alludes to the economic importance of the hard clam culture industry which, through the cultivation process and sales of products, generates local income and taxes, creates jobs and businesses, and draws new money into the local economy, as cultured hard clams are sold to non-residents and buyers outside the region and state.

Findings from a recent survey and analysis by the University of Florida provide an estimate of the impact of the hard clam industry to the Florida economy. The following discussion provides an overview of this most recent study, as well as comparisons to two previous studies that provided estimates of the contribution of this relatively new industry to sales, incomes, jobs, and taxes within the coastal communities where the industry is located (Philippakos et al. 2001; Adams et al. 2009).

Economic Impact Study for 2012 Business Year

This study of the economic contribution associated with the Florida hard clam industry was conducted during fall 2013. A survey instrument was developed and sent to all certified shellfish dealers in Florida who handled cultured hard clams in 2012. The survey was designed to assess the economic activities associated with the handling and distribution of cultured hard clams by certified shellfish wholesale dealers (all harvested molluscan shellfish in Florida must be sold directly to state-certified dealers). Surveying the dealers allows the assessment of economic activities from the sale of clams to the dealers and the sale of clams by the dealers. Thus, the survey was not sent to growers, unless a grower was also a dealer. The survey instrument solicited information about the location of dealer activities within Florida, the number of clams sold, the total sales value, and the source (by type of seller and region of the state) of the clams purchased by the dealer. In addition, the survey solicited information on the destination of clam sales, as well as the distribution of those sales by type of buyer and the respective prices received. The authors can be contacted for a copy of the survey instrument.

Descriptive Findings from the Survey Sample

The survey solicited information from certified shellfish wholesale dealers about business activities associated with the procuring, handling, and selling of cultured hard clams in 2012. A list of certified dealers was obtained from the Division of Aquaculture of the Florida Department of Agriculture and Consumer Services. All dealers were provided a survey questionnaire to complete. Of the 79 certified firms, only 47 handled cultured clams during 2012; the remaining firms dealt solely in oyster sales. Of those 47 firms, 39 provided usable responses, while 8 firms did not respond. Unfortunately, a group of firms in one region of the state failed to provide responses even though multiple attempts were made to contact those non-reporting firms. The responses by the cooperating firms, however, provided for an 83 percent overall response rate. Due to confidentiality issues resulting from the location of the non-reporting firms, the survey findings could not be reported on a regional basis, as has been done in previous studies.

With regard to the following discussion of survey findings, most growers only produce clams and do not operate as a dealer. However, about half of the 47 certified dealers surveyed were also growers. These "grower dealers" obtain clams from both their own production and other growers. Key findings from the 2012 survey respondents are listed below.

Total number of clams sold by growers to dealers: 126.6 million clams

Of the total number of clams obtained by dealers, 51.5 percent were purchased from growers, while 48.5 percent were obtained from the dealers' own production. In addition, 14.7 million clams were purchased from other dealers; however, this amount was omitted to avoid double counting. This number is reasonably consistent with a recent National Agricultural Statistics Service (2013) report that 136 million clams were sold by Florida clam growers during 2012.

Total value of sales by clam growers to dealers: $12.3 million

Although the survey did not attempt to solicit grower prices across the range of clam sizes, the average price paid to growers for each clam was assumed to be $0.09. The recent National Agriculture Statistics Survey (2013) reported sales of $11.6 million by Florida growers during 2012.

Total value of sales by dealers: $19.5 million

The total value of sales by dealers was aggregated across all types of buyers and destination of sales (in-state vs out-of-state).

Destination of dealer sales volume and value (in-state vs out-of-state)

Of the total sales volume (number of clams) by dealers, 49.6 percent went to buyers within Florida, while 50.4 percent went to buyers outside of Florida. Of the total sales value (clam sales revenues) by dealers, 45.7 percent was associated with in-state sales, while 54.3 percent was associated with out-of-state sales.

Disposition of dealer sales (value) across type and location of buyers

Wholesale buyers accounted for 29 percent of in-state dealer sales, 35 percent of out-of-state dealer sales, and 64 percent of total dealer sales. Restaurant buyers accounted for 7 percent of in-state dealer sales, 8 percent of out-of-state dealer sales, and 15 percent of total dealer sales. Retail buyers accounted for 9 percent of in-state dealer sales, 11 percent of out-of-state dealer sales, and 15 percent of total dealer sales. Consumers accounted for 1 percent of in-state dealer sales, 0 percent of out-of-state dealer sales, and 1 percent of total dealer sales.

Average per-clam price paid to dealer by type of buyer

On average, wholesale buyers paid $0.13 per clam, restaurant buyers paid $0.14 per clam, retail buyers paid $0.16 per clam, and consumers paid $0.19.

Economic Impact Findings

The data describing the sales patterns (in-state and out-of-state) were used to develop estimates of the economic impacts of clam sales on the Florida economy. The total economic impacts of cultured hard clams were estimated using a regional economic model for the state of Florida constructed with the Impact Analysis for Planning (IMPLAN) software (v.3) and associated 2012 regional data licensed from the IMPLAN Group LLC, Inc. IMPLAN is an input-output analysis/social accounting matrix (I-O/SAM) modeling system, which is a standard technique for estimating the broad economic impacts resulting from changes in specific economic activities in a regional economy (Miernyk 1965; Miller and Blair 2009). IMPLAN models provide estimates of impacts on the regional economy from changes in final demand or purchases for final use, changes in earnings, or changes in employment. Final demand represents the value of goods and services produced and sold to final users (households or institutions), which result in changes in industry purchases of goods and services from their input industries in the local economy, and changes in employee spending.

The secondary economic effects of given changes in output or employment are estimated by economic multipliers that represent the activity generated from intermediate purchases through the industry supply chain (indirect effects) and activity generated from employee household spending (induced effects). Spending that occurs outside the region under study represents a "leakage" of money that has no economic impact to the region. Economic impacts are assessed through several measures either in the form of dollars or jobs. Industry output is the dollar value of goods and services produced or sold, and it is equivalent to sales revenues plus changes in business inventories. Value added is a combined measure of various types of income, including labor income, other property income, indirect business taxes, and capital consumption or depreciation, and it is comparable to Gross Domestic Product (GDP). Labor income represents gross earnings by employees and business owners, including wages, salaries, and payroll benefits. Other property income is income from investments such as corporate dividends, royalties, property rentals, or interest on loans. Indirect business taxes include property, excise, and sales taxes, but exclude income taxes. Employment represents full-time and part-time jobs (not full-time equivalents).

Parameters in the IMPLAN software and databases are derived from state and federal government statistics. Regional data are available for all US states and counties. These data describe 440 industry sectors classified by the North American Industry Classification System (NAICS) and an additional 25 institutional sectors. Information is provided on industry output (revenues), employment, labor and property income, personal and business taxes, household and institutional commodity demand, inter-regional commodity trade (imports, exports), transfer payments (e.g., welfare and retirement pensions), personal savings, and capital investments.

The economic impact metrics pertaining to commercial hard clam culture suggest an industry that generates significant, positive economic consequences for the Florida economy (Table 1). The hard clam culture industry supports 543 jobs, including employment in all of the various businesses involved in the growing, processing, selling, and distributing of clams, and in providing the myriad of inputs necessary for the hard clam industry. The industry generates $14.7 million in labor income for the jobs created. As the hard clams make their way from the production site to the final buyer, $21.9 million in added value is generated. The added value is created through the process of washing, sorting, bagging, tagging, handling, shipping, storing, marketing, and other activities that result in a marketing margin for the product as it completes the journey from the water to the final consumer. The sale of hard clams also generates tax revenues, which are contained within the value added estimate. During 2012, hard clam sales generated $1.4 million in state/local tax revenues and $2.7 million in federal taxes. Finally, the industry output, or gross revenue impact, is estimated to be $38.7 million. This economic impact estimate shows the economic importance of the cultured hard clam industry to the coastal communities in which the industry resides, as well as to the statewide economy of Florida. Note that this analysis assumed that only direct impacts applied to in-state sales, since purchases of clams by Florida residents may substitute for other consumer spending.

How the Economic Impacts Changed Over Time

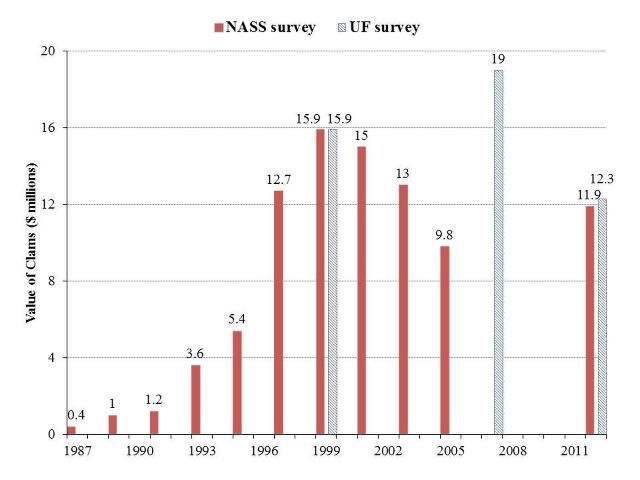

This report represents the third assessment of the economic impacts associated with the commercial hard clam culture industry in Florida—the previous studies being conducted for the calendar years 1999 and 2007. As expected, the resulting nominal economic impact estimates have changed with time (Table 2). The industry was characterized by a strong upward trend in production during the 1987 to 1999 period, with 1999 being a peak production year (Figure 1). However, production exhibited a declining trend after 1999, leading into 2004 and 2005, when major hurricanes hit the Gulf region. Although hard clam production was impacted by these storm events, the industry recovered and exhibited record numbers of harvested clams by 2007. As a result, economic output increased by 59 percent from 1999 to 2007. However, the output impact estimates for 2007 ($53.9 million) and 2012 ($38.7 million) indicate a 28-percent decline during this period. Note that this change can only be interpreted as a point-to-point decline because semi-annual surveys by the USDA, National Agricultural Statistics Service, which had been conducted between 1987 and 2005, were not conducted between 2005 and 2012. Thus, data are unavailable to describe the trend that might have existed during the 2005 to 2012 time period.

Although the industry recovered from the storm events of the 2004 and 2005 hurricane seasons, additional events may have contributed to a decline in the performance of the hard clam culture industry. The economic recession that began in 2007 and continued into 2012 generated a significant weakness in both regional and national markets for seafood products, resulting in depressed prices and declining sales. As disposable income declined, consumers opted for less expensive meat products, such as pork and chicken. The market for molluscan shellfish was not immune to these negative impacts. In addition, the 2010 Deepwater Horizon oil spill further weakened consumer demand for Gulf of Mexico seafood in general, as unfounded concerns regarding contamination influenced consumer perceptions. The oil spill caused many Florida hard clam growers to delay summer and fall plantings during 2010 because landfall of oil on the Gulf coast of Florida was anticipated. Although oil did not reach any of the shellfish harvesting areas on the west coast of Florida, the decision by growers to delay plantings resulted in reduced production during 2011/12. Full recovery of the industry from these key events is yet to be realized.

Given the circumstances discussed above, the total output impact associated with the cultured hard clam industry declined from $53.9 million in 2007 to $38.7 million in 2012. This decline was a result of changes in several business metrics. Hard clam production declined by 33 percent, while the average (nominal) price received by growers fell by 10 percent. These changes resulted in a 35 percent decline of grower sales. Dealer sales declined by 27 percent, as the total number of clams to be sold declined and the average (nominal) price received by dealers declined by 7 percent. While the average price paid by out-of-state markets remained steady, the share of total sales to out-of-state buyers (a key source of economic impact) declined by only 8 percent. In addition, the average prices paid by restaurant and retail buyers declined by 22 percent and 11 percent, respectively. Finally, while prices paid by other wholesale buyers (the most important market for Florida hard clam dealers) increased by only 8 percent, market share associated with wholesale buyers increased by only 5 percent, not enough to offset the declines endured by the other market sectors. Although the number of jobs attributed to the commercial hard clam culture industry decreased between 2007 and 2012, with about 60 jobs lost, the industry continues to provide full-time and part-time employment opportunities, and it remains an important source of income for harvesters, dealers, and associated supportive businesses (hatcheries, bag suppliers, equipment suppliers, etc.) found within the coastal communities where clam culture occurs.

Conclusions

The commercial hard clam industry produces the most important aquaculture food product in Florida. The industry has only existed since the late 1980s, but during that short time Florida's hard clam industry has grown from a small, cottage industry to one of the two largest providers of cultured hard clams (the hard clam culture industry in Virginia being the other major supplier). The industry is a source of employment, business taxes, and economic impact to a number of the state's coastal communities, as well as the overall economy of Florida. Although the hard clam industry has endured challenging events, such as the 2004 and 2005 hurricane seasons, the 2007–2012 recession, and the 2010 Deepwater Horizon oil spill, the industry exhibits a resiliency that allows for recovery and continued future market expansion. While the economic contributions associated with the industry declined between 2007 and 2012, the total economic impact and associated employment estimates provide evidence of the importance of the hard clam culture industry to the Florida economy. With strengthening and growth of the domestic seafood market and a continued vigilance by resource managers in Florida to ensure the existence of high-quality coastal waters, the commercial hard clam industry will likely continue to grow and prosper into the foreseeable future.

References

Adams, C.M., A. Hodges, and T. Stevens. 2009. Estimating the Economic Impact for the Commercial Hard Clam Culture Industry on the Economy of Florida. Project Final Report (UF Project #00073946) submitted to Florida Department of Agriculture and Consumer Services, Division of Aquaculture, Tallahassee, FL.

IMPLAN Group, Inc. 2013. IMPLAN social accounting and impact analysis software (version 3), and 2012 regional data file for Florida. Hendersonville, NC. Web resources available at https://implan.com.

Miernyk, W.H. 1965. The Elements of Input-output Analysis. Made available on the web book of regional science at https://researchrepository.wvu.edu/rri-web-book/6/.

Miller, R.E. and P.D. Blair. 2009. Input-Output Analysis: Foundations and Extensions, second edition. Cambridge,UK: Cambridge University Press.

National Agricultural Statistics Service. 2013. Aquaculture. National Agricultural Statistics Service, United States Department of Agriculture, Washington, D.C. https://www.nass.usda.gov/Statistics_by_State/Florida/Publications/Aquaculture/Aquaculture2013-FDA.pdf.

Philippakos, E., C.M. Adams, A. Hodges, D. Mulkey, D. Comer and L. Sturmer. 2001. Economic Impact of the Florida Cultured Hard Clam Industry. Florida Sea Grant Report SGR-123. University of Florida, Florida Sea Grant College Program, Gainesville, FL.